Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsJuly 2024 auto sales to realize bounce from June impacts

Given the shift of delayed new vehicle purchases which stemmed from the dealer management software cyberattack, the pace of US auto sales in July 2024 is expected to realize a notable boost.

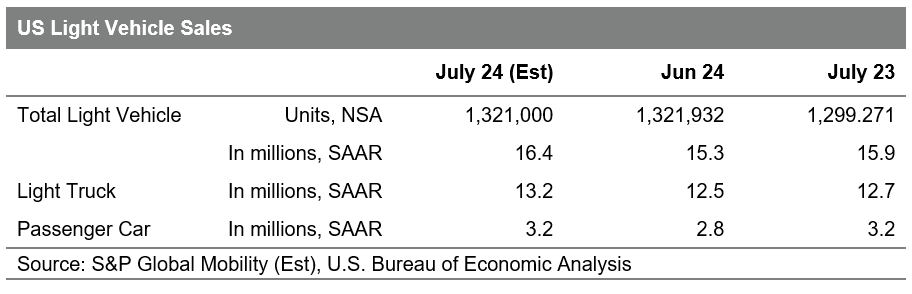

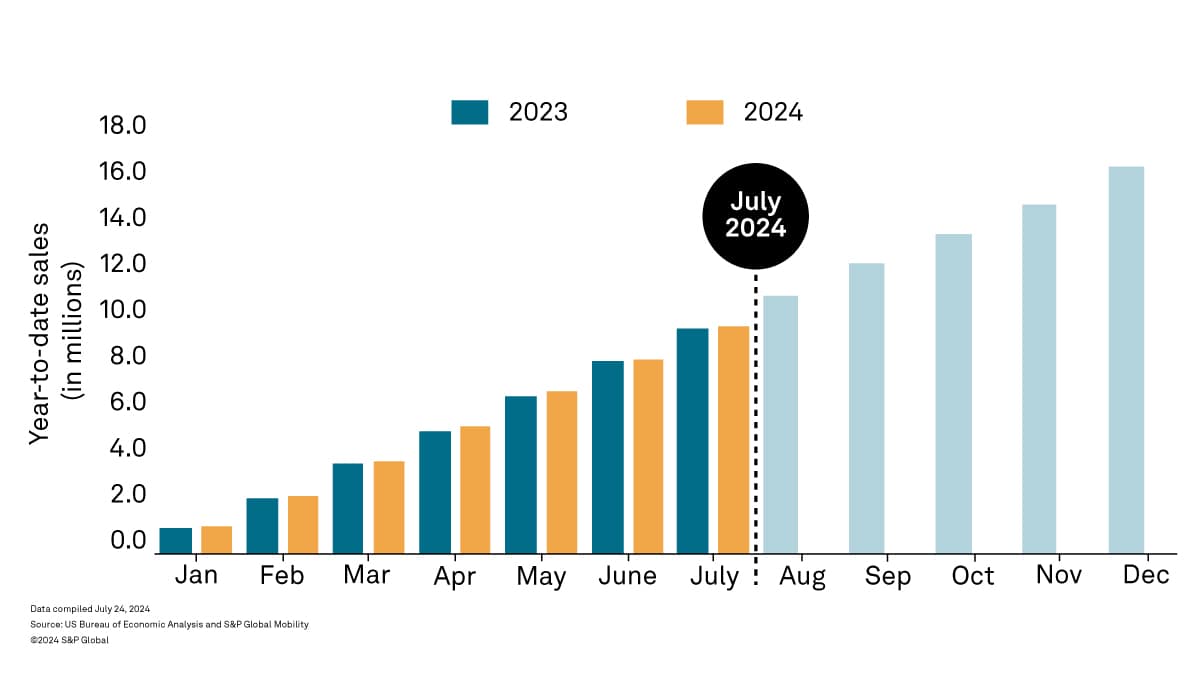

S&P Global Mobility projects US sales volume for new auto sales in July 2024 will reach 1.32 million units, up approximately 1% year over year. This volume would translate to an estimated sales pace of 16.4 million units (seasonally adjusted annual rate: SAAR), which would be the highest monthly mark for this metric since May 2021.

"As a result of delayed transactions from the June auto dealer cyberattacks, even with one less selling day than June 2024, auto sales volume in July is expected to essentially match the month-prior result," said Chris Hopson, principal analyst at S&P Global Mobility.

"When averaged together, the two-month SAAR level of June and July would be very similar to the respective readings of April (15.8M) and May (15.9M), which were progressing mildly as rising inventory and incentive levels continue to help alleviate some new vehicle affordability pinch points," he added. "Mixed signals regarding the outlook for the second half of the year remain entrenched though, as new vehicle affordability concerns remain prevalent, and inventories are not expected to advance as strongly as they have done over the past 12 months."

On the supply side of the equation, with pockets of automakers reaching inventory saturation points given the current pace of sales, there are expected to be some interesting dynamics in the short-term production outlook. "Some automakers are struggling to balance their sales, production, inventory and incentive targets as the market returns to more normal dynamics than what occurred from 2020-2023," said Joe Langley, associate director at S&P Global Mobility. "Our North American light vehicle production outlook for the remainder of this year has been scaled back as automakers attempt to manage these factors."

According to Matt Trommer, associate director, S&P Global Mobility, "Analysis of June retail advertised inventory data in the US finds that inventory continues to rise. Available retail advertised inventory at the end of June continued to grow, up 1.8% compared to May and 57% over last June."

US Light Vehicle Sales July 2024

US Light Vehicle Sales Comparisons

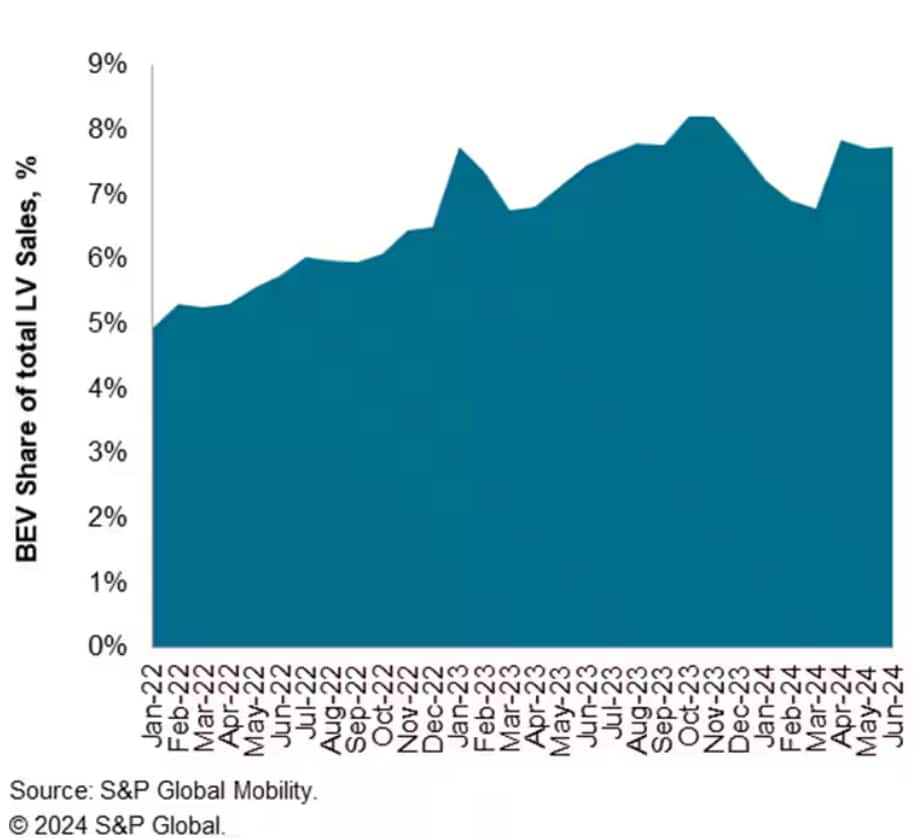

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. July BEV share is expected to reach 7.8%, similar to the month prior reading and continued advancement from the Q1 2024 results. BEV share is expected to progress over the next several months, assisted by the the roll outs of vehicles such as the Chevrolet Equinox EV and Honda Prologue, followed by new BEVs such as the Jeep Wagoneer S and Volkswagen ID. Buzz slated for release in the second half of 2024.

US Battery Electric Vehicle Sales Share

Get a free preview of our Light Vehicle Sales Forecast.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.