Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFuel for Thought: Battery Industry Blues: Consequences of the EV Slowdown

Listen to the Fuel for Thought podcast.

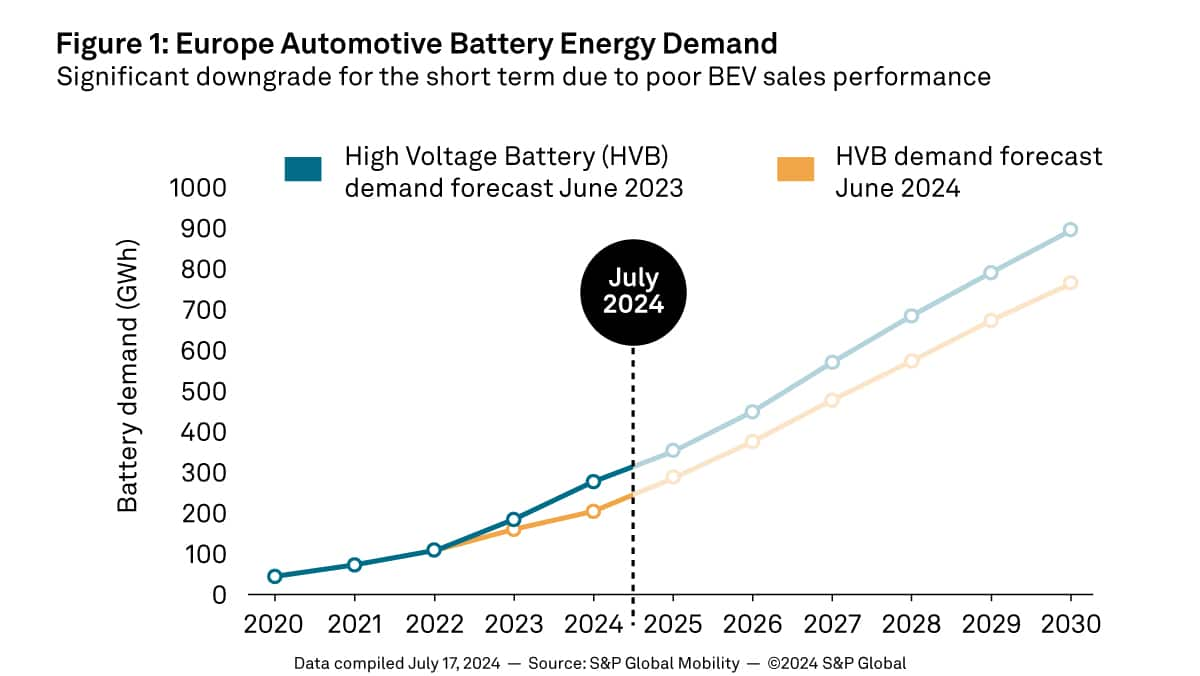

With a slowdown in enthusiasm for battery electric vehicles, the battery industry is wrestling with a combination of oversupply, underutilization of capacity and lower return on investments.

Since the second half of last year, the electric vehicle segment is facing strong headwinds, much to the surprise of many, as EVs have been witnessing a strong demand in the last few years in several markets around the world. The ambitious zero-emission vehicle (ZEV) sales targets by both governments and automakers painted a rosy picture about the EV industry and how quickly it is expected to evolve.

As the novelty of EVs fades, the last several months have brought forth the realization that there are still fundamental issues that persist and need to be addressed for EVs to be a widely accepted solution. Some of these issues are the lack of EV charging infrastructure, long charging times and the high initial cost of EV acquisition. Most of these challenges are not short-term and will require years, if not decades to be fully solved.

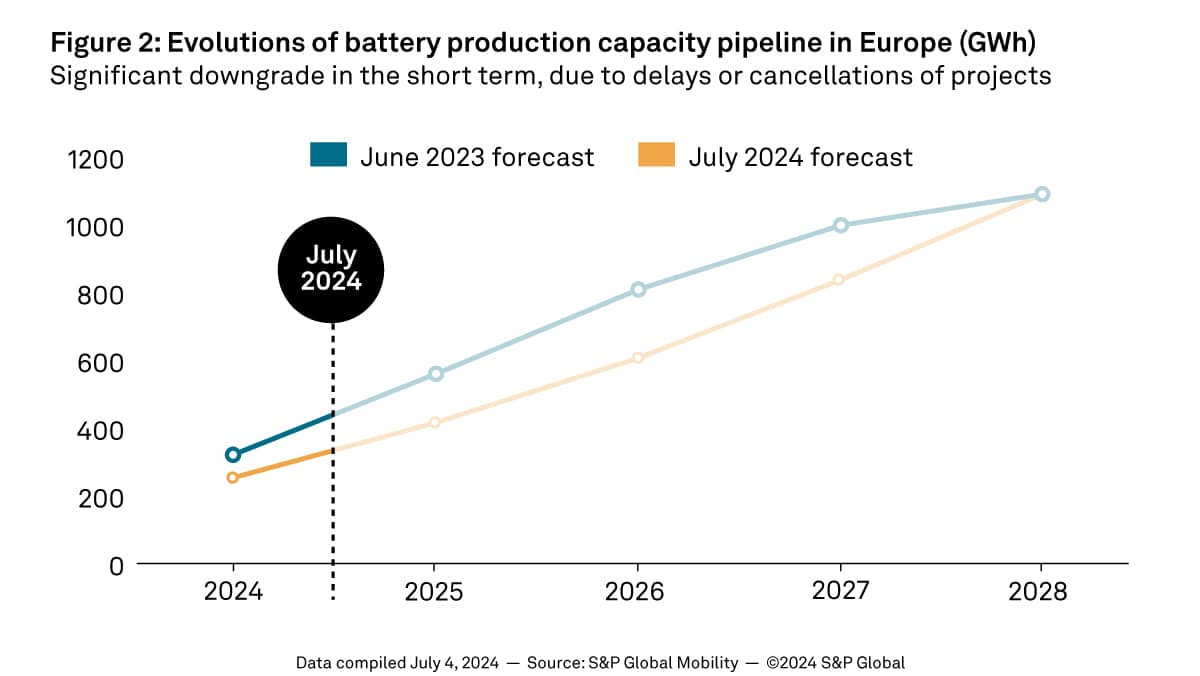

What all the noise around EVs has led to is a massive investment from many stakeholders in the EV ecosystem, right from material sourcing to setting up significant manufacturing capacity for batteries. The faster-than-realized uptake of EVs was expected to propel the demand for EV batteries which necessitated a capacity expansion to be able to able to meet the demand.

However, with the EV slowdown, the industry is now looking at a case of oversupply, underutilization of the capacity and lower return on investments.

Curtailing investments

From what has transpired in the industry in the last few months, the OEMs and battery players have watered down their ambitions. This has led to several reports and official announcements of pulling back or postponement of investments in battery projects in markets which were seen as the biggest growth centers for battery electric vehicles (BEVs).

Most recently, it was reported that Automotive Cells Company (ACC), a joint venture by Stellantis, Total and Mercedes-Benz, has decided to apply brakes on two of its upcoming EV battery plants in Europe. The two plants are located in Kaiserslautern, Germany, and in Termoli, Italy. Both plants were expected to have a production capacity of 40 GWh each in 2030.

ACC also has a plant in Douvrin, France which is already in production and is expected to start battery cell supply later this year. Together, ACC had announced an investment of $7.6 billion in the three plants. In light of the EV slowdown, the three partners are expected to review their battery investment plans by the end of the year or early next year.

In fact, Mercedes-Benz has also announced a delay in its electrification plans, pushing back its goal of 50% electrified vehicle sales by five years. In 2021, Mercedes-Benz had said that it will have 50% electrified vehicle sales (BEVs and hybrids) by 2025, which is now expected to be reached in 2030.

Earlier in May, mainland Chinese cell maker Svolt also announced that it is dropping plans to set up a plant in Germany. In 2022, Svolt had said that it will set up a 16 GWh cell plant in Lauchhammer, Brandenburg to cater to European demand. The plant was scheduled to start production in 2025. The tariff of mainland Chinese players in Europe also played a role in Svolt taking this decision.

Volkswagen too has said that it will hold back from taking a decision on its fourth battery plant in Europe. The automaker was aiming to set up a new battery plant in Eastern Europe and was looking at Czech Republic, Hungary, Poland or Slovakia as possible locations.

"Most of the European cell manufacturing projects are currently facing challenges due to the recent slowdown in battery-electric vehicle (BEV) sales. The investments made in new projects, or the expansion of existing facilities were based on the expectation of continued astronomical growth rates in recent years. However, the poor performance of BEV sales in 2024 has resulted in a surplus of unused capacities for cell makers. The significant price gap between European batteries, which primarily rely on NCM technology, and LFP cells from China further complicates the situation for European cell makers, especially as car manufacturers strive to introduce affordable electric vehicles," said Ali Adim, Manager, Technical Research, S&P Global Mobility.

Europe is not the only region where an EV investment slowdown is being witnessed. Several reports suggest that OEMs and battery players are also delaying their investments in North America.

American automaker Ford also brought its battery investments plans back to review board. Last November, Ford announced scaling back of its Michigan plant in the US.

"While we remain bullish on our long-term strategy for electric vehicles, we are re-timing and resizing some investments. As stated previously, we have been evaluating BlueOval Battery Park Michigan in Marshall. We are pleased to confirm we are moving ahead with the Marshall project, consistent with the Ford+ plan for growth and value creation. However, we are right sizing as we balance investment, growth, and profitability. The facility will now create more than 1,700 good-paying American jobs to produce a planned capacity of approximately 20 GWh," Ford said in a statement in November 2023.

BlueOval Battery Park Michigan is a $3.5 billion investment by Ford Motor Company which will produce lithium iron phosphate (LFP) batteries that will power a variety of Ford's next-generation EV passenger vehicles and pickups. Previously, the plant was set to manufacture 35GWh of batteries and employ 2,500 people.

There also have been reports that Panasonic, one of the biggest cell manufacturers in the United States, may also delay investing in additional capacity of battery plants in North America. Panasonic was reportedly planning to set up a third plant in the US. However, the delay in investment may have put the plans for the third plant in a limbo. "There's a need to control the speed of investment depending on the speed at which EVs spread," Yuki Kusumi, Panasonic group's chief executive, was quoted as saying.

There have also been reports that suggest Northvolt may delay setting up its plant in Montreal, Canada, which was expected to become operational by 2026.

Northvolt recently hit another roadblock when BMW, one of its biggest customers, reportedly cancelled its €2 billion order for EV lithium-ion battery cells. The supply of the cells, which were to be produced in Europe at the Northvolt gigafactory at Skellefteå in northern Sweden, was scheduled to start in 2024. Although production delays were cited as one of the reasons for cancellation, BMW may also be reviewing its cell demand, given the slowdown in EV sales.

EV demand falling has also led to a significant drop in the prices of critical battery raw materials such as nickel cobalt and lithium. According to S&P Global, Prices for lithium, nickel and cobalt sharply decreased in 2023 and are expected to decline further in 2024.

High voltage battery forecast data.

By Srikant Jayanthan, Senior Research Analyst II, S&P Global Mobility

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.