Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsStartups and slowdowns in EV and battery plans

Over the past few weeks, BEV assembly and battery plants have opened, started construction, and been delayed, as the global industry adjusts to an inconsistent demand path.

The S&P Global Mobility AutoIntelligence service provides daily analysis of global automotive news and events, providing our clients timely context and impact analysis for navigating the fast-moving industry. Behind the Headlines offers a bi-weekly dive into the most recent top stories.

New BEV battery capacity comes online in Asia-Pacific

Inconsistent demand growth for battery electric vehicles (BEVs) in 2024 is increasingly expected to continue in 2025. As automakers balance capital expenditure and consumer demand, a number of battery projects are being delayed and revised, while others are moving full steam ahead.

On the BEV battery side, a plant between Hyundai Motor and LG Energy Solution (LGES) has started production in Indonesia. It is the first battery cell plant in the country, with annual capacity of 10 GWh of battery cells and supported by a US$1.1 billion investment announced in 2021.

On the vehicle assembly side, GAC Aion, a new energy vehicle subsidiary of GAC Group, has inaugurated a new plant in Thailand. That plant has annual capacity of 50,000 units and saw US$65 million invested. The GAC Aion plant is the second of its kind to be opened in Thailand this month; BYD's plant opened in early July with capacity for 150,000 new-energy vehicles each year.

VinFast has also started construction on a new plant in Indonesia, aimed at building right-hand drive versions of the VF 3, VF 5, VF 6 and VF 7 vehicles for the Indonesian market; this plant is planned to have 50,000-unit annual capacity.

In North America, battery projects are delayed and revised

Meanwhile, on the other side of the world, Ford and GM have slowed ramp-up of their BEV production capacity increases. This slowdown is having an impact on North American manufacturing investments, while VinFast is finding that breaking into the US is more difficult than expected.

After GM's CEO confirmed the company will not reach the target for 1 million units of installed BEV capacity in 2026, LGES indicated it will slow construction on a new battery cell plant in Michigan. LGES said that it will adjust the speed of its overall investments and is looking for ways to ensure its plants are flexible, comments which suggest other changes could be made. The GM-LGES Michigan plant is an Ultium Cells LLC joint venture with GM, the third between the two in the US.

Ford has also announced another shift in its North American manufacturing plans. Instead of producing the planned three-row BEV utilities for the Ford and Lincoln brands at its Oakville, Ontario (Canada), plant, Ford will start building the current-generation F-Series Super Duty truck there in 2025. As soon as 2026, the next generation will be produced there as well. Ford committed to electrified solutions for the next Super Duty, though stopped short of committing to BEV production at Oakville.

Announcing global sales of 21,747 vehicles in the second quarter of 2024, VinFast reduced its guidance for 2024 full-year sales from 100,000 units to only 80,000 units. VinFast also delayed its first US BEV plant to 2028; this is the second delay for a plant which was initially meant to see production start in July 2024.

Turkey gets BYD investment and creates potential hedge against EU tariffs

Turkey's government announced that it will not impose tariffs on Chinese automakers who invest locally, after imposing a 40% tariff on mainland Chinese passenger car imports. US presidential candidate and former President Donald Trump has said that he might consider a similar policy if he wins the US election in November 2024.

In early July BYD reached an agreement with Turkey to invest US$1 billion into vehicle production there. SAIC is also said to be in discussions to begin production in Turkey, while Chery said in an earlier statement, "We are working intensively on the feasibility analysis of factory construction in Turkey and production in Turkey together with the relevant Ministries. We are striving to be able to produce in Turkey as soon as possible." Any facility constructed in Turkey could potentially circumvent tariffs imposed by European Union member states.

S&P Global Mobility sees BEV production reaching 59% of light-vehicle production — in 2036

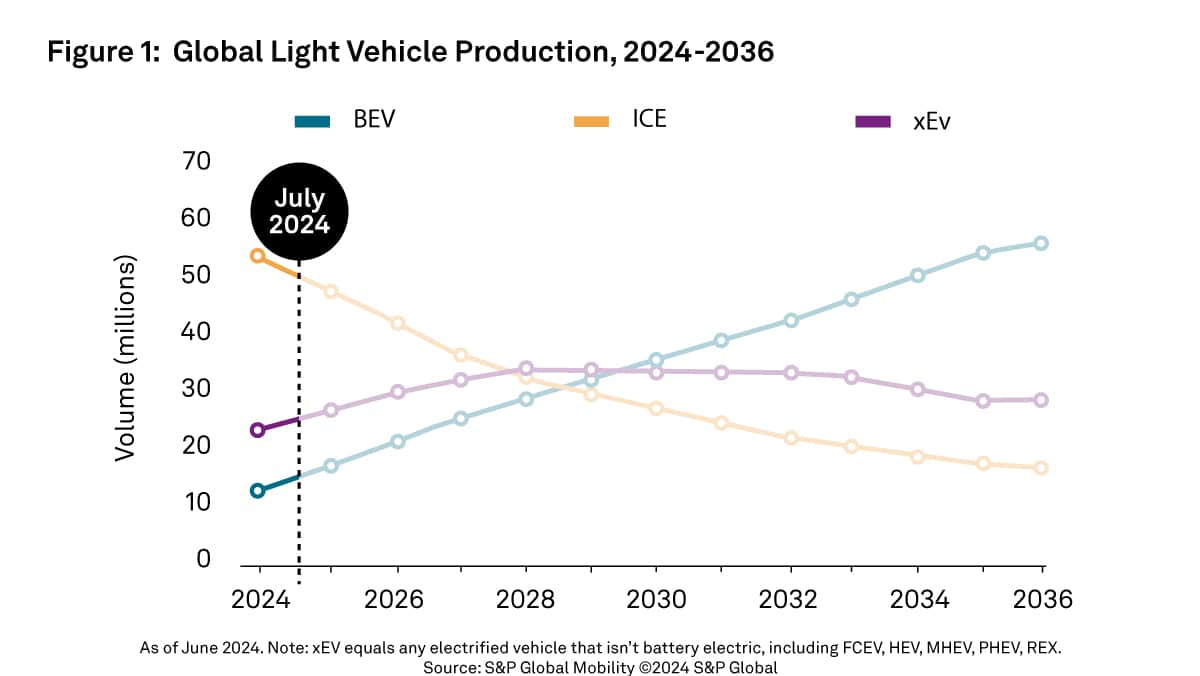

The S&P Global Mobility June 2024 light vehicle production forecast sees production of BEVs continuing at a fairly aggressive upward slope, even with consumer hesitation in 2024. Global light-vehicle BEV production is expected to overtake internal combustion engine (ICE) production in 2029.

By 2036, we see global BEV production at just 59% of all light-vehicle production. However, we also see the potential for Germany with 97% of its light-vehicle production having shifted to BEVs by then.

In Mainland China, which will continue to be the highest-volume producer of BEVs, only about 64% of light-vehicle production is forecast to be BEVs by 2036. Mainland China's drive toward new energy vehicles (NEV) as opposed to a laser-focus on BEVs leaves more room for solutions like plug-in hybrid (PHEV) and range-extended electric (REX) vehicle solutions; those are forecast to see, roughly, respective 17% and 7% of mainland China light-vehicle production in 2036.

The US is expected to be the third-highest BEV producer in 2036; we forecast that 75% of light-vehicle production could be BEVs by that year. Indonesia and Thailand are long-standing vehicle-producing countries, with opportunity for both the home market and for exports. Still, a BEV transition is expected to take a little longer there; in 2036, we forecast Thailand BEV production at about 50% of the country's output. In Indonesia we see BEV output reaching 26% of production.

Though at this point, a shift to BEV-dominant vehicle production and sales is assumed to be a "when" rather than an "if" question, we will continue to see OEMs and suppliers revising immediate plans as they balance the need to have capacity to support the shift, while not having too much too soon.

Get Free Trial of AutoIntelligence.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.