Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsUS vehicle inventory reaches post-pandemic high in September

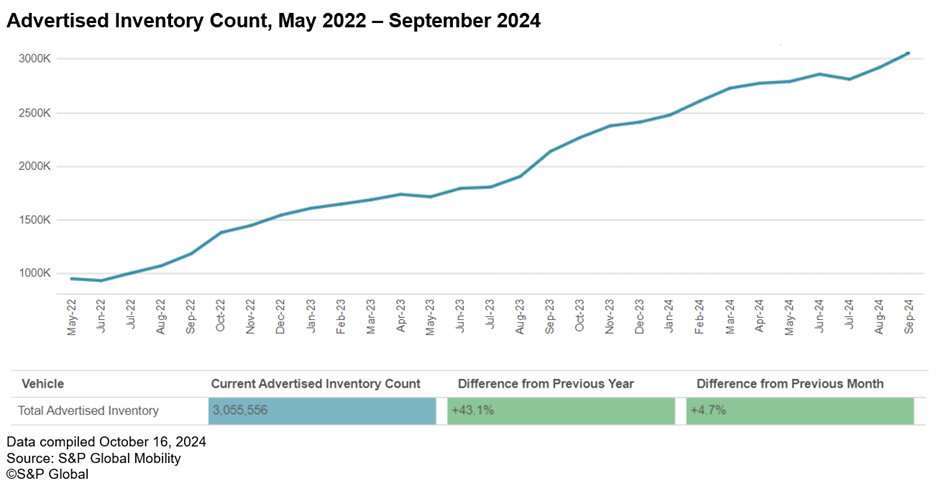

Advertised vehicle inventory in the US soared to 3.056 million units in September 2024—marking a significant 4.7% increase from the previous month and breaking the three-million mark for the first time in our dataset. This surge aligns with a broader trend we've observed over the past two years, where inventory levels consistently rise in the fall.

The vehicle inventory rise appears across most OEMs and segments, with some exceptions. Stellantis brands are down vs. last month (Jeep -4.1%, RAM -1.4%, Dodge -9.1%) and a couple of premium brands have decreased as well (Audi -7.8%, Cadillac -1.6%, Lincoln -0.8%)

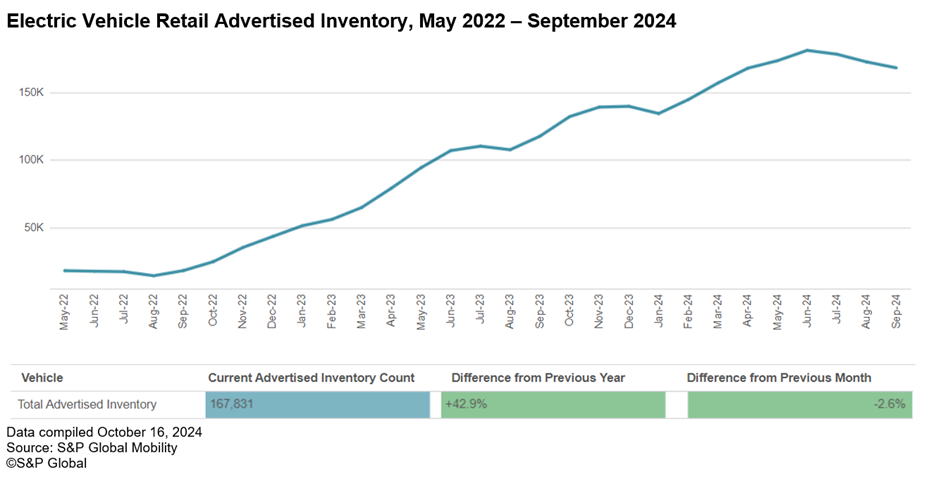

Interestingly, while overall inventory has been growing, electric vehicle inventory has decreased and is down 2.6% vs. August. This has reversed a trend that we had seen in previous months where EV inventory was growing more than the industry as a whole.

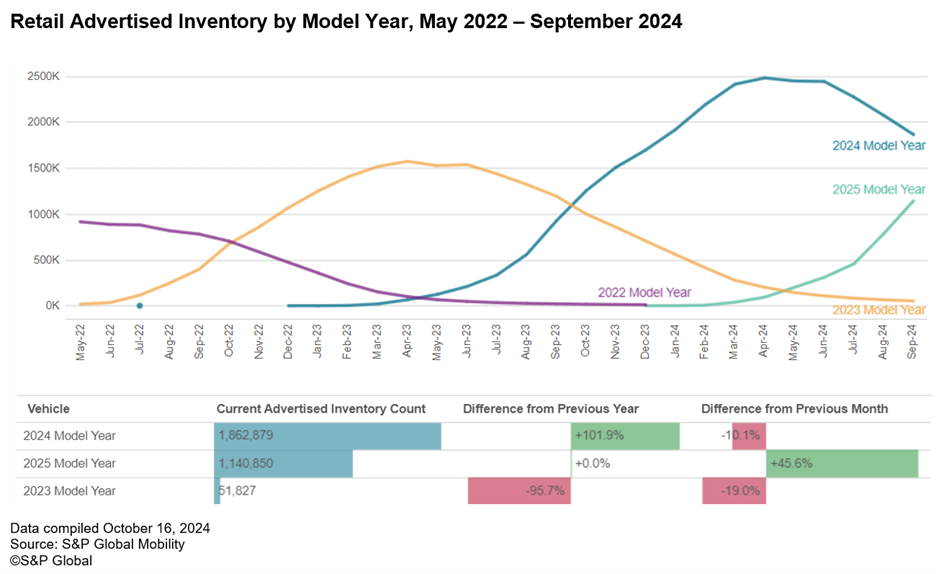

The model year detail helps to explain much of the overall industry-level results. The roll-out of the 2025 model year continues to accelerate and is up 45.6% vs. the end of August. Meanwhile, 2024 and 2023 model year inventories have decreased by 10.1% and 19.0%, respectively.

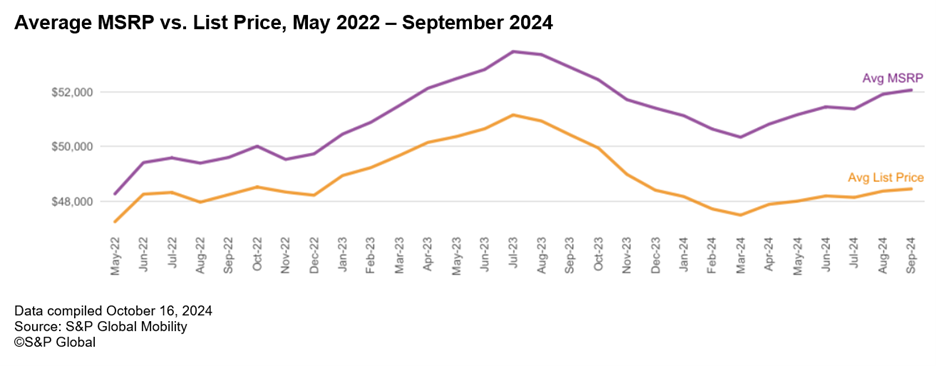

Prices also continue to rise, with the average MSRP standing at $52,066 at the end of September, up 3.3% compared to March 2024. The average dealer list price has increased to $48,460, an increase of 2% vs. March.

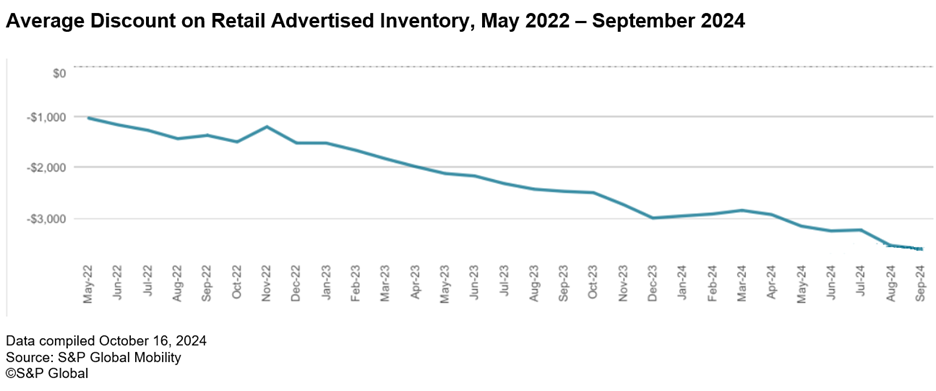

This gap can be seen through

the increase in the average listed discount, which has reached

$3,606 at the end of September. This is an increase of 21.2% since

March.

This gap can be seen through

the increase in the average listed discount, which has reached

$3,606 at the end of September. This is an increase of 21.2% since

March.

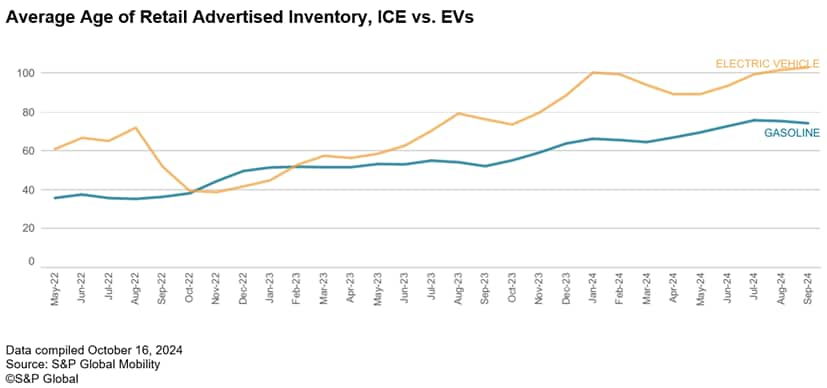

The average age of advertised inventory decreased slightly to 79 days in September but is up from 56 days last September. In the following chart, we can see that gasoline vehicles have been advertised for 74 days on average, while electric vehicles are aging at a greater rate and now have been listed for 103 days on average.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.