Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsUS consumers going big as full-size SUVs gain share

As US auto sales recover to pre-pandemic levels, full-size SUVs are racking up notable gains.

When vehicle inventories skidded during the pandemic and semiconductor crisis, automakers switched focus to concentrating on high-profit segments. In the case of the Detroit 3, that meant large SUVs, which saw substantial share gains. Now as manufacturing and inventories return in earnest, will that share growth be sustainable and translate into big volume gains as well?

"We're now in the fourth year after the initial pandemic lockdown, and now those consumers are coming to the surface with a desire to travel on the road," said Tom Libby, associate director for loyalty solutions and industry analysis at S&P Global Mobility.

S&P Global Mobility projects US retail sales at 15.4 million units this year, up from 13.9 million units in 2022. From that total, registration data show total full-size utilities leaping to 3.5% cumulative year-to-date share through June, compared to a 1.9% level 10 years ago and 2.6% in 2019. Mainstream full-size SUV share has risen from 1.2% a decade ago to 2.3% this year, while luxury models' share has bumped up from 0.7% to 1.2%.

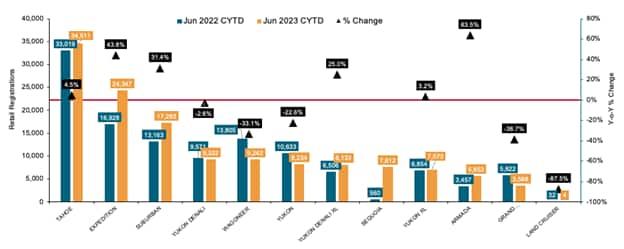

FULL-SIZE MAINSTREAM SPORT-UTILITY SHARES

Source: S&P Global Mobility retail

registration data CYTD June 2023 vs 2022 ©2023 S&P Global

Mobility

Source: S&P Global Mobility retail

registration data CYTD June 2023 vs 2022 ©2023 S&P Global

Mobility

In year-over-year registrations for mainstream models, sharp increases have been posted by the Ford Expedition, up 43.8% to 24,347 units year-to-date through 1H 2023, and the Chevrolet Suburban, up 31.4% to 17,293 units. The segment leader, the Chevrolet Tahoe, rose 4.5% to 34,511 retail registrations.

Not that everyone is seeing success. The Jeep Wagoneer is down 33.1%, and the Grand Wagoneer has fallen 38.7%, while GMC's Yukon has slipped by 22.6%.

However, the overall range of General Motors' full-size SUV lineup - Chevrolet's Tahoe and Suburban, and GMC's Yukon, Yukon XL, Yukon Denali, and Yukon XL Denali - give GM a vast array of competitive full-size models, Libby said.

"They have a real strength in those higher-end models," Libby said. "No one offers that kind of breadth in utility vehicles."

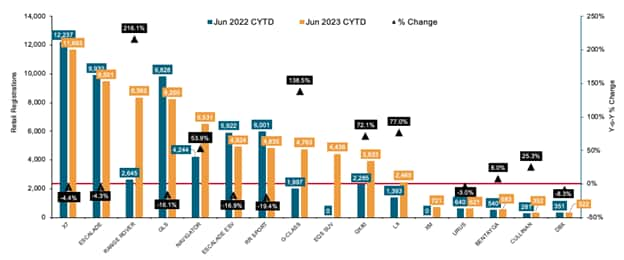

In the luxury space, a newcomer appears to have gained substantial traction, Libby says. The electric Mercedes-Benz EQS registered 4,436 units through June, following its late-2022 launch. And while some of those sales likely came from Mercedes' own GLS - which has taken a 16.1% hit to 8,250 units - overall Mercedes-Benz full-size SUV sales have grown.

The rival BMW X7, however, has seen sales drop 4.4% to 11,693 units. Meanwhile, the Land Rover Range Rover flagship has seized on strong owner loyalty with its recent redesign to see its 1H 2023 registrations leap to third place among big luxury SUVs.

FULL-SIZE LUXURY SPORT-UTILITY SHARES

Source: S&P Global Mobility retail

registration data CYTD June 2023 vs 2022 ©2023 S&P Global

Mobility

Source: S&P Global Mobility retail

registration data CYTD June 2023 vs 2022 ©2023 S&P Global

Mobility

LIGHT VEHICLE SALES FORECASTING

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

POLK AUTOMOTIVE AUDIENCES: CONSUMER MARKETING ANALYTICS

AUTOMOTIVE LOYALTY RATES STALL DESPITE VOLUME INCREASES

SEPTEMBER AUTO INVENTORY TRENDS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.