Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsDon’t count out hybrids just yet

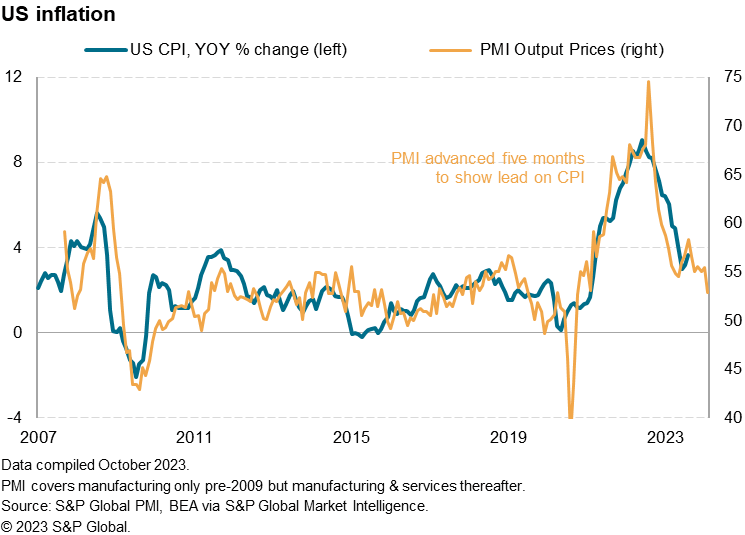

While the auto industry obsesses over consumer acceptance of electric vehicles, an interesting side development has occurred: Sales of hybrid gas-electric vehicles have soared, both to individuals and to fleets.

In August, full hybrid and plug-in hybrid electric vehicles (PHEVs) accounted for 9.7% of total registrations in the US market — nearly triple its pre-pandemic share and continuing a steady rise in consumer interest in hybrid vehicles over the past three years. Counting just retail registrations, hybrids have accounted for more than 10% of the market in two of the past three months.

Hybrid Share of Total Registrations & Fleet Share of Hybrid

Filter: Hybrid (all hybrids) fuel type only

Note: Fleet defined as total new registrations less retail

registrations

Source: S&P Global Mobility new light vehicle

registrations, January 2020-August 2023

©2023 S&P Global Mobility

This surge may be attributed to the slower-than-expected adoption of electric vehicles - at least those that aren't Teslas - as hybrids are seen by consumers as a pragmatic half-step toward a more fuel-efficient vehicle without committing entirely to battery electric propulsion and charging.

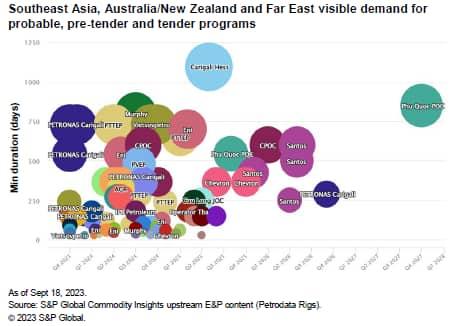

Adding to the momentum are an increasing number of ICE-vehicle households returning to market, and choosing a hybrid as their next vehicle, as seen in the chart below:

Gasoline return-to-market loyalty by fuel type

The percentage of return-to-market gasoline households migrating to hybrids has climbed 3.4 percentage points (PP) (61%) in one year.

Source: S&P Global Mobility gasoline return to market

loyalty by fuel type

©2023 S&P Global Mobility

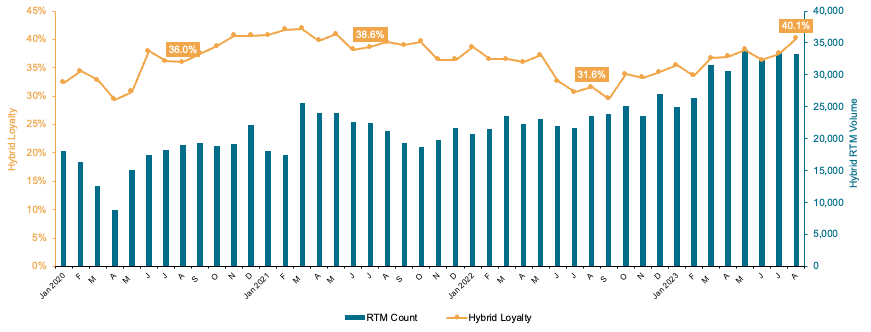

What's more, those hybrid-vehicle owners who are returning to market are also showing increased loyalty to the hybrid fuel type:

Hybrid return-to-market volume and loyalty

August 2023 hybrid loyalty of 40.1% is highest since May 2021, and up 8.5 PP (27%) from a year ago

Source: S&P Global Mobility hybrid return to market

loyalty by fuel type

©2023 S&P Global Mobility

Toyota has continued to dominate the hybrid segment throughout 2023, capturing 36% of personal hybrid registrations and 40% of total hybrid fleet volume through August. This underlines Toyota's strong position and success in the hybrid sector that it established two decades ago with the Prius' Hybrid Synergy Drive, which it then added throughout its lineup.

| TOP-SELLING HYBRID BRANDS | HYBRID PERSONAL REGISTRATIONS |

| TOYOTA | 277,017 |

| HONDA | 180,208 |

| KIA | 59,903 |

| HYUNDAI | 57,028 |

| FORD | 55,694 |

| JEEP | 53,047 |

| LEXUS | 47,382 |

| BMW | 13,517 |

| VOLVO | 12,285 |

| CHRYSLER | 5,678 |

Source: S&P Global Mobility, new personal light vehicle

registrations, Hybrid (all hybrids) fuel type only, January-August

2023

©2023 S&P Global Mobility

Hybrid registrations in the fleet category have emerged as a driving force behind this trend, with 13.3% of hybrid registrations coming from fleet from January to August 2023, and 14.2% in July alone, representing the highest rate in more than three years. As hybrid prices become comparable to internal combustion engine (ICE) models, fleet operators are recognizing the advantages of integrating hybrids into their portfolios to meet sustainability goals and reduce fuel costs, especially for high-mileage operations. This strategic move also allows automakers to manage inventory effectively and helps to ensure emissions regulations are met.

Toyota, Ford, Jeep, and Chrysler collectively commanded 80% of hybrid fleet volume so far in 2023. The Toyota Sienna and Chrysler Pacifica minivans led the pack with 12.2% and 9.7% market share respectively, followed closely by Toyota RAV4 and Jeep Wrangler.

| Hybrid Make/Model | YTD Fleet Registrations |

| TOYOTA SIENNA | 14,440 |

| CHRYSLER PACIFICA | 11,570 |

| TOYOTA RAV4 | 10,024 |

| JEEP WRANGLER | 9,476 |

| FORD F SERIES | 7,423 |

| FORD ESCAPE | 5,194 |

| FORD EXPLORER | 4,922 |

| FORD MAVERICK | 4,511 |

| TOYOTA PRIUS | 4,444 |

| JEEP GRAND CHEROKEE | 4,035 |

| TOYOTA HIGHLANDER | 3,715 |

| TOYOTA COROLLA | 3,461 |

| HONDA CR-V | 3,318 |

| TOYOTA CAMRY | 3,293 |

| HONDA ACCORD | 3,285 |

| TOYOTA TUNDRA | 2,651 |

| TOYOTA SEQUOIA | 2,529 |

| HYUNDAI TUCSON | 2,326 |

| LEXUS RX | 1,854 |

| TOYOTA VENZA | 1,727 |

Source: S&P Global Mobility, new fleet light vehicle

registrations, Hybrid (all hybrids) fuel type only, January-August

2023

Note: Fleet defined as total new registrations less retail

registrations

©2023 S&P Global Mobility

However, a notable distinction appears when examining domestic brands: they rely more heavily on fleet sales to drive their hybrid volume. For instance, 67% of the Chrysler Pacifica's more than 17,000 total PHEV registrations year-to-date came from fleet acquisitions. Similarly, 86% of Ford Explorer Hybrid registrations were fleet driven. Overall, 29% of domestic hybrid registrations came from fleet. In contrast, European and Asian brands relied on fleet for 12% and 10% of their hybrid registrations, respectively.

The resurgence of hybrid vehicles in the market offers consumers and fleet operators a practical and environmentally conscious alternative, bridging the gap between traditional internal combustion engines and fully electric models. The collaborative effort between OEMs and fleet operators is not only a strategic business move but also further reinforces the viability of hybrids as a sustainable choice towards a greener future for mobility. Each OEM, however, employs the fleet strategy uniquely, reflecting their differing approaches to aligning with market demands and sustainability goals.

DOES THE AUTO INDUSTRY HAVE AN EV LOYALTY PROBLEM?

LIGHT VEHICLE POWERTRAIN FORECASTS

LOYALTY AND CONQUEST ANALYTICS

3-CYLINDER ENGINE INSTALLATIONS RISING IN US, THOUGH 4-CYLINDERS STILL RULE

THE EVOLUTION OF THE EV CONSUMER

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

-

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.