Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAutomotive Industry in India Defies Global Disruptions

Despite infrastructure and manufacturing challenges that could temper the pace of electric vehicle (EV) adoption, India's large domestic automotive market, low existing EV penetration rates, and increasing production capacity make it an attractive destination for automakers and suppliers.

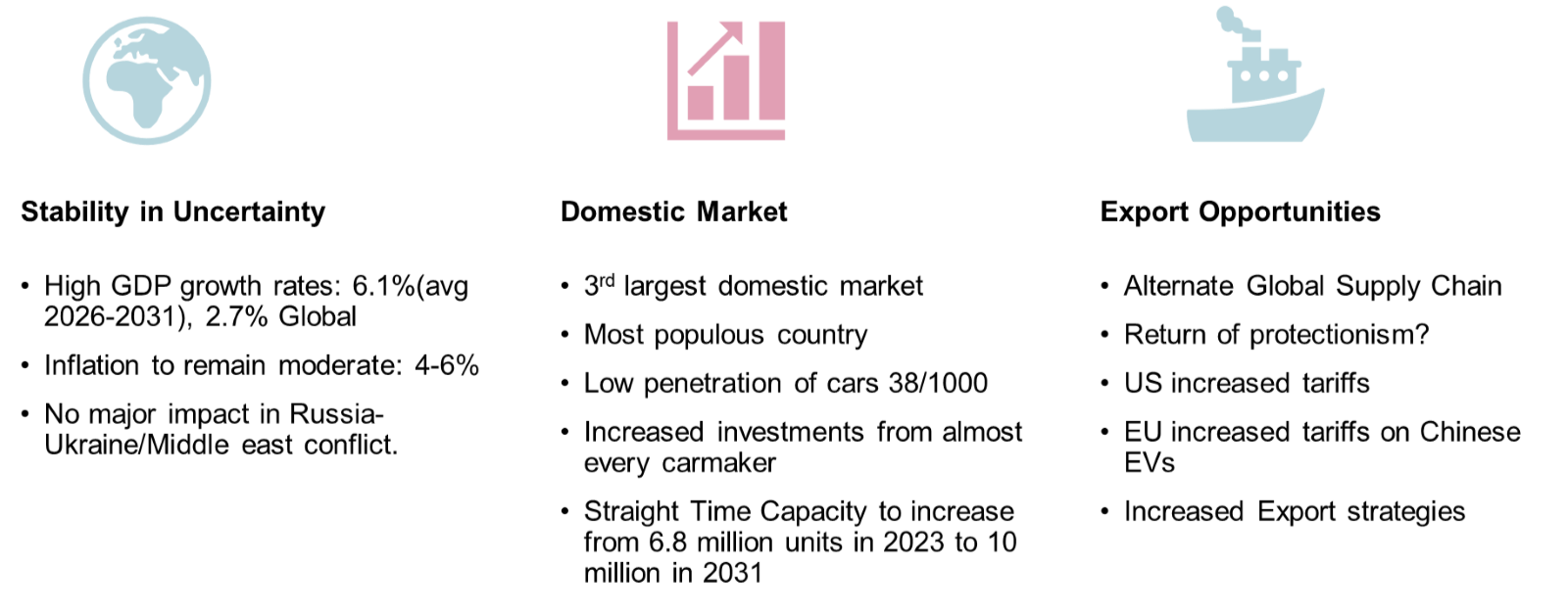

If Tata Motors' and Mahindra's success in navigating the pandemic and semiconductor shortages is any indication, India is expected to become a major player in global light vehicle production. Furthermore, with global supply chain disruptions and the return of protectionism, India's position as an export base for mature markets is becoming increasingly viable.

Potential of India Automotive Industry to Bridge Gaps in Global Supply Chain

Source: S&P Global Mobility Light

Vehicle Production Forecast

Source: S&P Global Mobility Light

Vehicle Production Forecast

The Resilience of India Automotive Industry

While major markets like mainland China, the United States, and Germany grappled with production setbacks during disruptions caused by COVID-19 and semiconductor shortages, automotive industry in India showed resilience. Indian automotive OEMs demonstrated a stronger capability to secure semiconductor supplies despite having lower purchasing power compared to global car manufacturers and offering fewer features in their vehicles.

India's high GDP growth rate, which is further projected to remain over 6% between 2026 and 2031, significantly higher than the global average of 2.7%. India's domestic automotive market is a significant draw for global automakers. As the 3rd largest market in light vehicle sales and the 4th largest in light vehicle production, India's low car penetration rate of just 38 vehicles per 1,000 people presents a massive opportunity for the automotive industry of India. According to S&P Global Mobility Light Vehicle Production Forecasts, production capacity is expected to rise from 6.8 million units in 2023 to 10 million by 2031, further solidifying India's role in the global automotive landscape.

Concurrently, the US and EU's increased tariffs on Chinese EVs have created a void that India is well-positioned to fill. With its stable supply chain, light vehicle production growth in India is expected to maintain a steady pace. S&P Global Mobility projects a growth rate of 4 percent for 2024, with longer-term expectations of growth stabilizing between 4% and 6% annually through 2031.

A significant driver of this growth is the anticipated increase in exports from major manufacturers like Maruti Suzuki and Hyundai, which may benefit from the growing demand for affordable vehicles in emerging markets.

Suzuki, for example, aims to ramp up production to 4 million units by 2031, with a focus on hybrids and EVs.

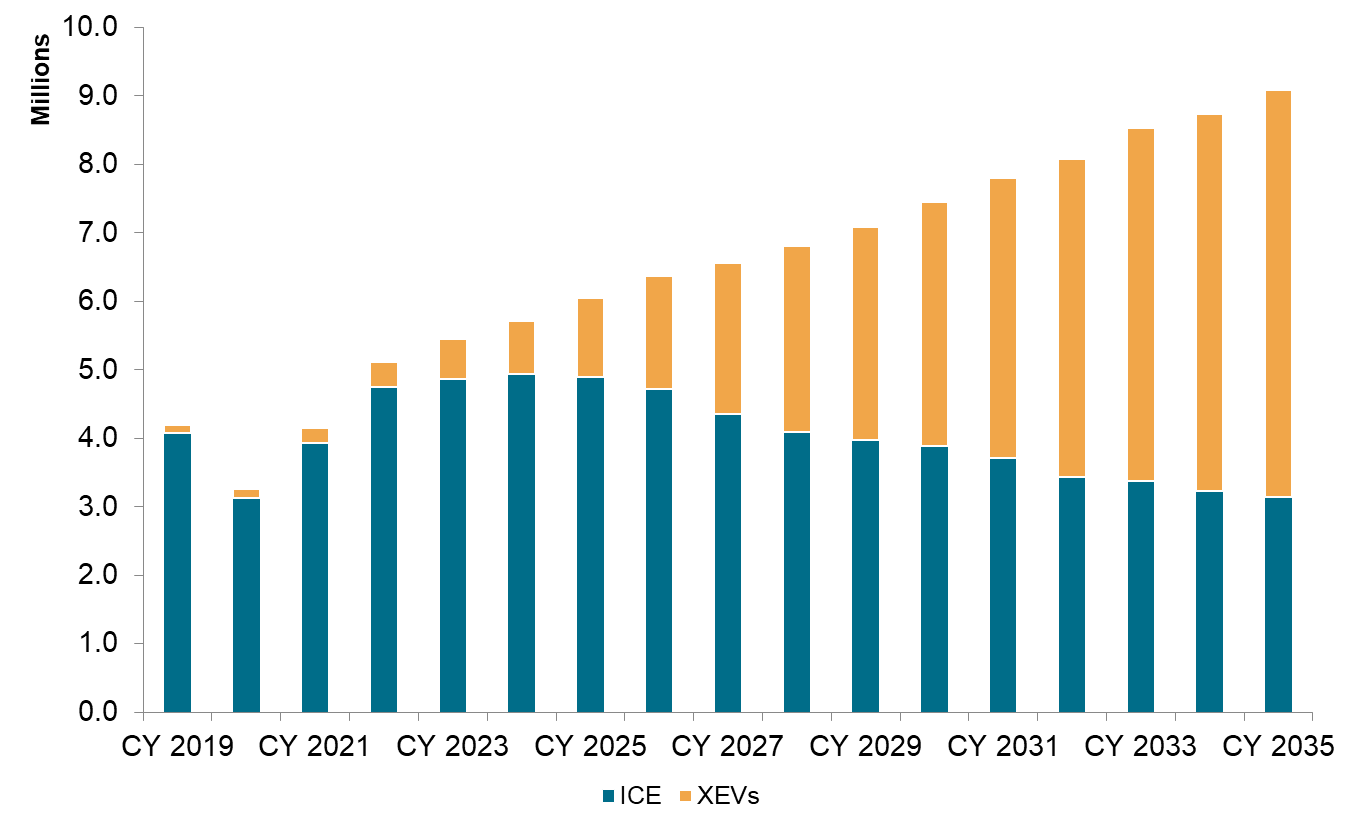

India Light Vehicle Production, xEV vs. ICE

Data compiled: 8th July 2024.

Source: S&P Global Mobility.

XEVs = Mild Hybrid electric vehicle (MHEV)+ Hybrid

electric vehicle(HEV)+Plug in Hybrid vehicle (PHEV)+Range extender

electric vehicle (REX)+Battery Electric Vehicle (BEV)

Transition of India Automotive Industry to Clean Technologies

India's automotive landscape is also shifting towards EVs. The share of internal combustion engine (ICE) vehicles produced in India is projected to decrease dramatically, from 97% in 2019 to around 35% by 2035. The implementation of stricter emission standards like the Bharat Stage 6 (BS6) and upcoming BS 7 norms have pushed manufacturers to innovate and transition towards cleaner technologies.

India automotive market is also witnessing a corresponding rise in the adoption of low emission vehicles like xEVs. Demand for hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs) is expected to grow substantially, with a notable increase in hybrid, range extender vehicles and plug-in hybrid vehicles in the short term.

However, the current state of infrastructure, particularly the availability of charging stations and the overall EV ecosystem in India automotive industry, could temper the pace of EV adoption. Consumers and automakers are still somewhat cautious in the current EV landscape. There is a noted delay in adopting new models and platforms due to uncertainty surrounding regulatory conditions, like the aforementioned BS7 emission norms.

High costs associated with early-stage EV manufacturing have also led to rising vehicle prices, raising concerns about affordability among first-time buyers. The increase in discounts for ICE vehicles amid consumer trepidation and high inventory levels could further slow the rate of adoption in the immediate future.

Even with these mid-term pressures, the trend is unmistakable. Vehicle manufacturers in India are increasingly adopting multi-energy platforms that can support both internal combustion engine (ICE) vehicles and EVs. Over the next few years, these platforms are expected to increase in the market, setting the stage for the eventual rise of dedicated EV platforms. Overall, the long-term outlook for EVs in India is positive. As infrastructure improves and consumer concerns are addressed, EV adoption is likely to accelerate, according to S&P Global Mobility forecasts.

As India automotive industry is in the midst of a technological revolution, there is also a heightened emphasis on supply chain management. Innovations like ADAS (Advanced Driver Assistance Systems), software-defined vehicles, and AI (Artificial Intelligence) are becoming standard features, which require OEMs to integrate these components into their supply chain.

This article is part of a series featuring highlights from S&P Global Mobility's 2024 Solutions Webinar Series. The webinar, India's Light Vehicle Production Outlook and Tata Motors' Supply Chain Resiliance, occurred on July 16, 2024.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.