Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsCannibalization Risks Remain for Incremental Gasoline Models

In this first article of a three-part series, we examine vehicle brand cannibalization with a focus on incremental gasoline models. The next articles will explore hybrid models and electric vehicles.

The debut of a new vehicle model often generates excitement as automakers eagerly anticipate its market reception. Incremental gasoline model launches play a crucial role in driving business for brands, even as hybrid and electric vehicles rise in popularity.

Incremental models are introduced into a brand's portfolio without replacing an existing vehicle and they may even enter segments where the brand already has other models.

However, a significant challenge with these launches is the risk of cannibalization, where the majority of the new model's sales come from existing customers rather than attracting buyers from competitors. Understanding this dynamic is essential for brands aiming to maximize the impact of their incremental offerings.

Product Cannibalization

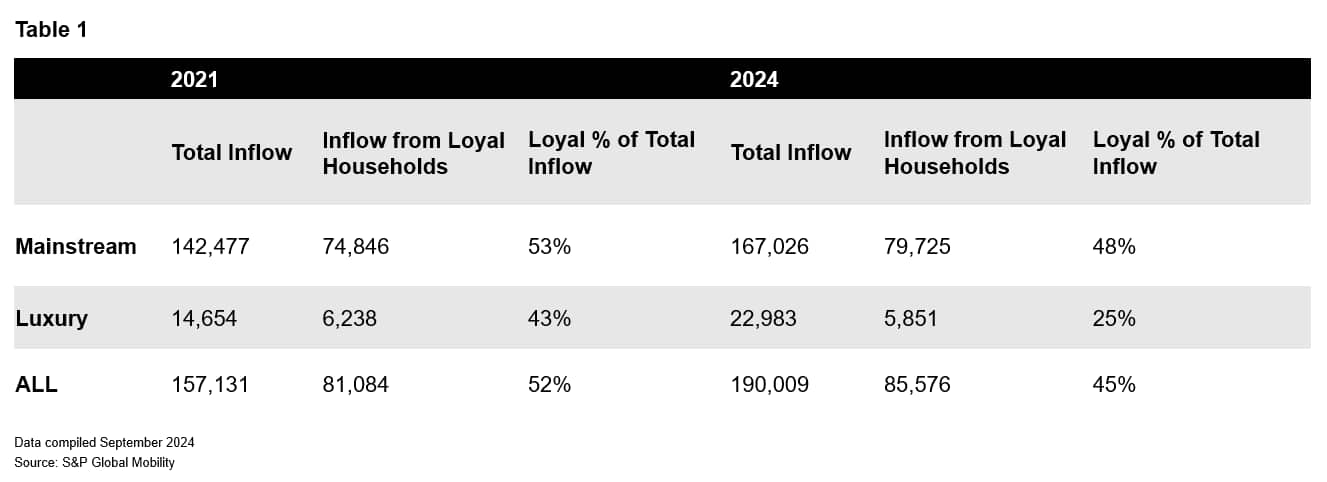

Cannibalization occurs when a new model draws a significant portion of its early buyers from within the brand. Loyal customers eagerly upgrade, leaving the new model struggling to attract conquest buyers. A 2021 analysis revealed that 52% of a new model's early inflow came from households from the same brand. Although this figure has decreased in 2024, it remains substantial.

For mainstream models examined in our 2024 study, 48% of the total inflow in the first six months came from brand-loyal households, while luxury models saw only 25% from within the same brand. In the 6 to 12 months post-launch, these figures remained stable: 47% for mainstream models and 25% for luxury models.

Adjacent Model Cannibalization

Another significant aspect of product cannibalization is the impact on adjacent models within the brand's lineup. Incremental models often take buyers away from similarly sized or priced vehicles, creating an internal shift that may cannibalize sales of existing models.

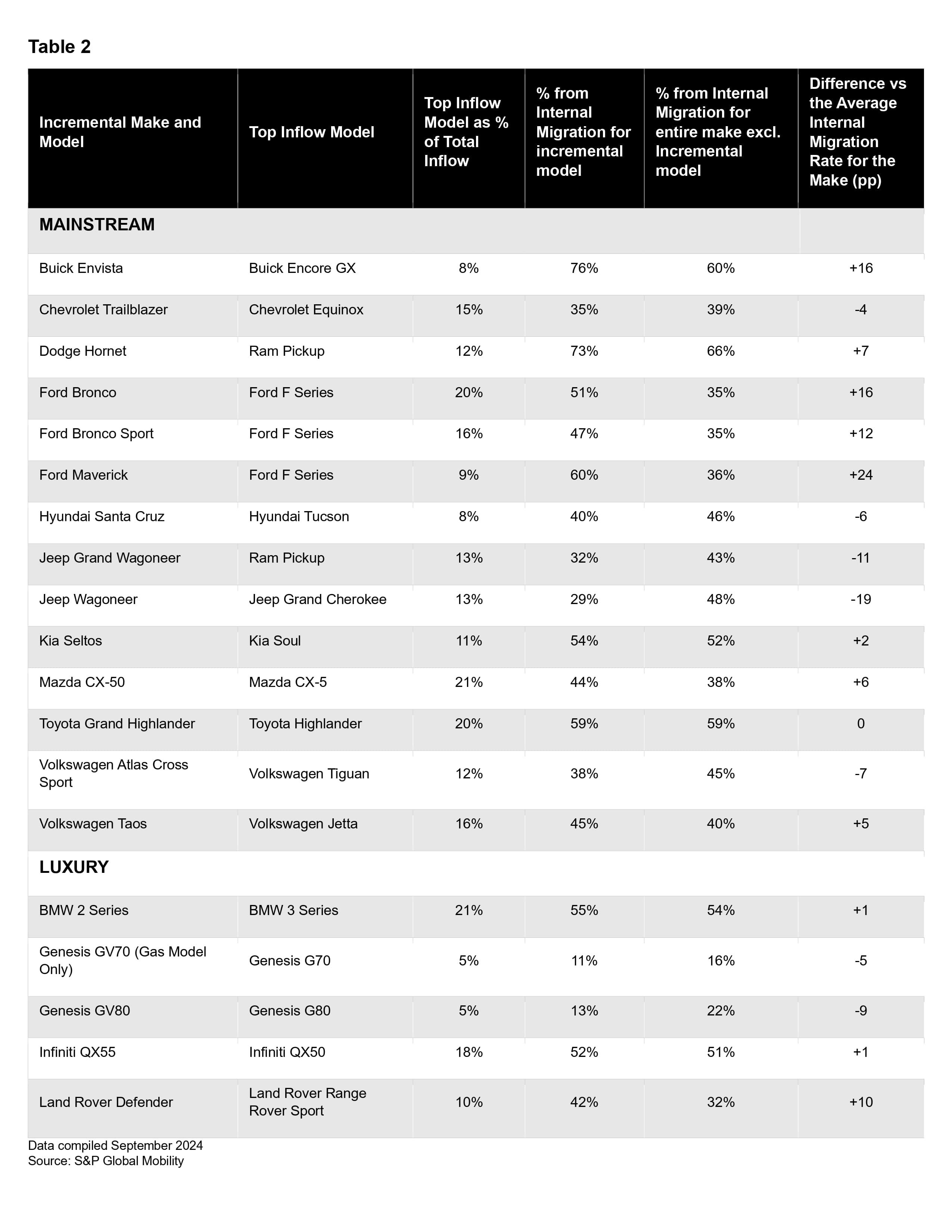

Table 2 highlights several incremental gasoline models launched since 2020 and identifies the top inflow models (those from which the new model draws most of its early buyers). The data shows that adjacent models — those closest in size, price, or body style — are often the most impacted.

For every incremental gasoline model listed, the highest level of inflow came from existing vehicles within the same brand. For example, 20% of the total inflow for the Toyota Grand Highlander came from the Toyota Highlander, its closest sibling model. Similarly, the Mazda CX-50 pulled 21% of its early inflow from the CX-5, reflecting how closely linked these vehicles are in the marketplace.

Looking Forward

Automakers must effectively balance retaining loyal customers while attracting new buyers through incremental models. By benchmarking the performance of their incremental models against industry metrics, brands can assess whether their innovations are successfully drawing in new customers. It is essential to analyze how consumer preferences shift across gasoline, hybrid, and electric vehicles, as this understanding will empower brands to adapt their strategies. By leveraging these insights, automakers can not only enhance their market position but also ensure they remain competitive in an ever-evolving landscape.

Demo Our Loyalty Analytics Tool.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.