Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsBriefCASE: Chinese suppliers gain strong foothold in global lidar market

Knowledge of lidar for the lay person is likely to be limited to

two things. One, Elon Musk doesn't like them. Two, companies

providing lidar were key players in the Special Purpose Acquisition

Companies (SPAC) fad of a few years ago. While the SPAC lidar

companies generated plenty of noise, they've yet to make

significant inroads into the automotive lidar market.

Specialist suppliers from mainland China dominate the lidar market.

Their dominance is a by-product of the rapid advancements in

advanced driver assistance systems (ADAS) and robo-taxi

applications in the Chinese market, supported by benevolent

government policy and subsidies. In terms of volume, the country

accounted for more than 80% of global lidar sales in 2023,

according to S&P Global Mobility data. Having found a large

customer base in their domestic market, the Chinese lidar suppliers

are actively looking to expand their presence in international

markets to stay on a strong growth trajectory.

Market share of Chinese suppliers

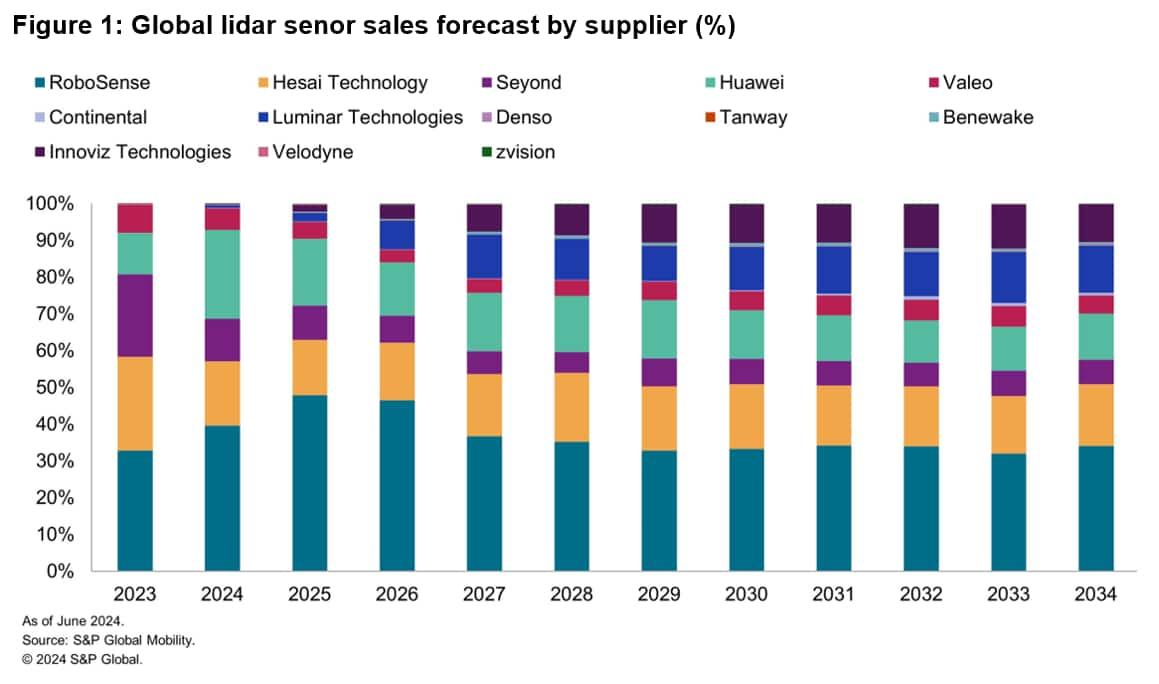

The aforementioned factors have created a congenial economic environment for Chinese lidar suppliers to innovate and grow. In terms of sales volume, mainland China is now home to some of the biggest lidar sensor suppliers in the world. In 2023, China-based RoboSense, Hesai Technology and Huawei accounted for over 65% of global lidar sales (see Figure 1). The only other non-Chinese supplier that has over 20% market share is US-based Seyond (formerly Innovusion).

Making lidar technology more affordable and accessible seems to be

a core strategy of the Chinese suppliers. They are strategically

reducing costs and elevating system performance and dependability,

aiming to democratize lidar technology for broader market

penetration. In the mechanical scanning lidar market, Hesai and

Huawei together have a share of over 50% with the other half of the

global demand majorly served by suppliers such as Seyond (33%),

Valeo (11%) and others.

Things get more interesting in the micro-electromechanical systems

(MEMS) lidar market, where RoboSense is the largest supplier in the

world with around 97% market share in 2023. Hesai Technology also

has presence in MEMS lidars with around 3% share, which is expected

to grow in the future, according to S&P Global Mobility's

analysts. The MEMS lidar market is experiencing rapid growth due to

its compact size and lower cost compared with mechanical scanning

lidars, making it highly suitable for mass-market automotive

applications.

Focus on maintaining the lead

Hesai and RoboSense have reported strong lidar sales in the

first quarter of 2024. RoboSense's ADAS lidars sales reached

approximately 116,200 units during the quarter, representing a 542%

year-over-year increase. As of May, RoboSense established

cooperation with 22 global automotive original equipment

manufacturers and tier 1 suppliers and obtained design wins for 71

vehicle models, 25 of which are under production and some more will

start production this year, according to the company.

Hesai reported ADAS lidar shipments of 52,462 units in the first

quarter, representing an increase of 86.1% year over year. The

company has recently secured orders from two global automotive OEMs

to provide ADAS lidars for their upcoming series production

programs. Including the latest deals, Hesai has now secured design

wins with four prominent global OEMs. So far, Hesai has secured

ADAS design wins with 18 OEMs and tier 1 suppliers globally across

70 vehicle models.

Market share forecast

The rise of domestic suppliers in mainland China facilitating

development and integration of cost-effective lidar solutions will

continue to accelerate the technology's adoption in a wide range of

vehicles from mainland Chinese OEMs. This trend will ensure Chinese

suppliers will maintain a strong position in the global lidar

market even 10 years from now.

And what about the lidar companies that went public via SPACs?

Their time to shine is coming. The likes of Luminar, Innoviz and

Velodyne are expected to gain market share as we move through the

decade and as North American and European markets follow the

>L2+ lead of mainland China, driven by evolving regulatory

environment and rising consumer demand.

Luminar, which has partnerships with Volvo Cars and Mercedes-Benz,

and Innoviz, which is collaborating with BMW and Volkswagen, expect

new rules in the United States

mandating higher-speed automatic emergency braking (AEB) on all

passenger cars to create demand for long-range lidars. Luminar also

has Tesla in its customer list. The US automaker was Luminar's

largest lidar customer in the first quarter, but it's not clear if

the companies have yet entered any long-term agreement. All in all,

these companies are making progress, but are not expected to

dethrone the Chinese suppliers anytime soon.

Read the autonomy sensors report.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.