Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsJune 2024 auto sales advance again in the US

June 2024 auto sales are expected to maintain pace with the previous month result and translate to one of the stronger seasonally adjusted results since 2021.

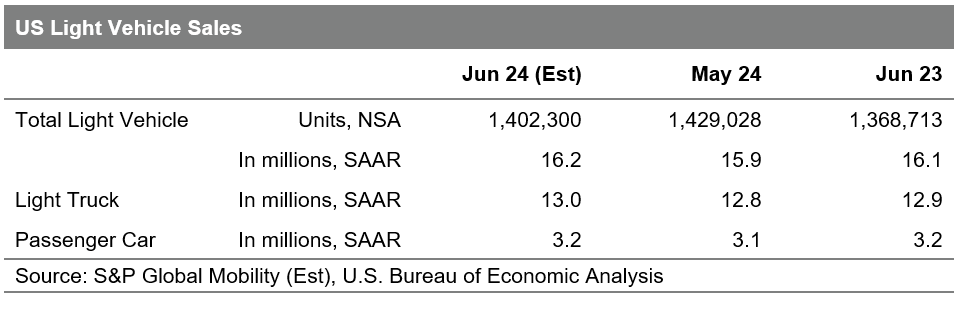

S&P Global Mobility projects new light vehicle sales volume in June 2024 to reach 1.40 million units, up approximately 1% year over year. This volume would translate to an estimated sales pace of 16.2 million units (seasonally adjusted annual rate: SAAR), which would be the highest monthly mark for this metric since May 2021.

While recent events such as the dealer management software cyberattack and stop-sale announcement on certain Toyota and Lexus vehicles could hamper some of the progress realized earlier in the month, June 2024 auto sales are expected to follow up the notable May advance with another solid result.

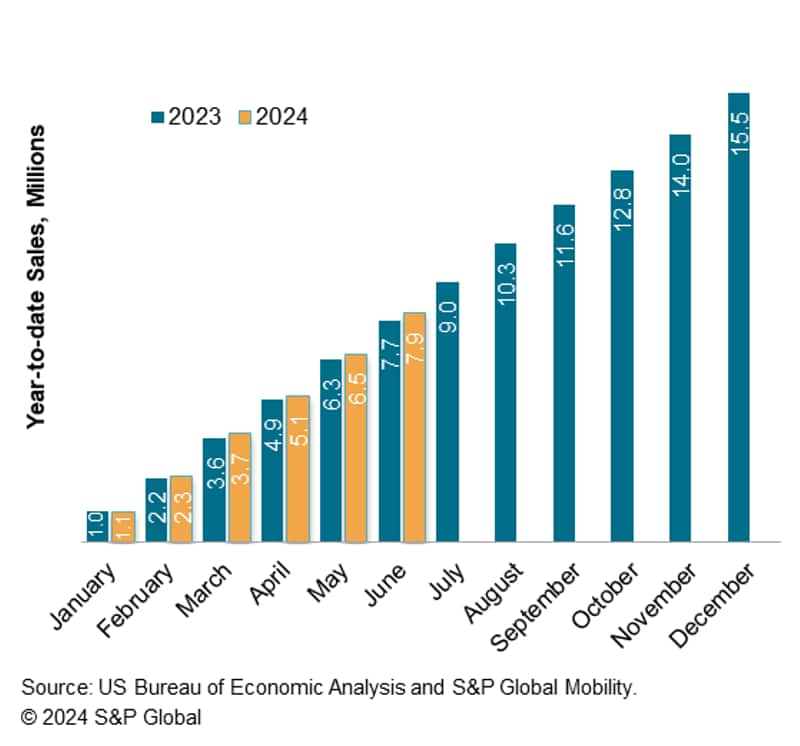

"June auto sales are expected to sustain the recent progress in the market," said Chris Hopson, principal analyst at S&P Global Mobility. "Supported by growing incentive and inventory levels, the monthly sales pace will have advanced every month in the second quarter and the estimated 16.0 million-unit SAAR average projected for the period would be the highest quarterly mark since Q2 2021. Mixed signals regarding the outlook for the second half of the year remain entrenched though, as new vehicle affordability concerns remain prevalent, and inventories are not expected to advance as strongly as they have done over the past 12 months."

According to Matt Trommer, associate director, S&P Global Mobility, "Analysis of May retail advertised inventory data in the US finds that inventory is still on the rise, with electric vehicle (EV) inventory growing faster than the overall industry. Available retail advertised inventory at the end of May continued to grow, reaching 2.79 million vehicles, up 0.4% compared to April and 61% over last May. This is the 12th consecutive month of increases (22 of the last 23 months have grown vs. the prior month), but the rate of increase is the lowest since May 2023."

Mixed signals continue to prevail within the new vehicle demand environment, and we do not expect sales volumes over the next several months to dynamically change from the current trend. S&P Global Mobility projects calendar year 2024 new vehicle sales volume to reach approximately 16.0 million units, growth of over 2%, or an incremental 374,000 units, from the 2023 level.

US Light Vehicle Sales June 2024

US Light Vehicle Sales Comparisons

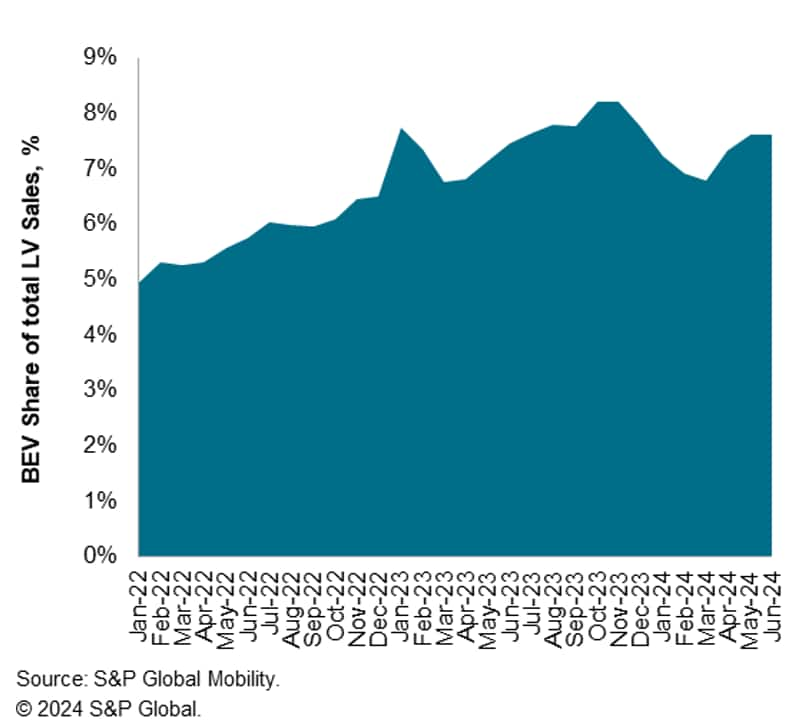

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. June battery electric vehicle (BEV) sales share is expected to reach 7.5%, similar to the month prior reading and continued advancement from the Q1 2024 results. BEV share is expected to advance over the next several periods, assisted by the the roll outs of vehicles such as the Chevrolet Equinox EV, Honda Prologue and Fiat 500e, all scheduled for launch over the next few months, followed by new BEVs such as the Jeep Wagoneer S and Volkswagen ID. Buzz slated for release in the second half of 2024.

US Battery Electric Vehicle Sales Share

Learn more about the Light Vehicle Sales Forecast.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.