Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 05, 2025

Securities Finance May Snapshot 2025

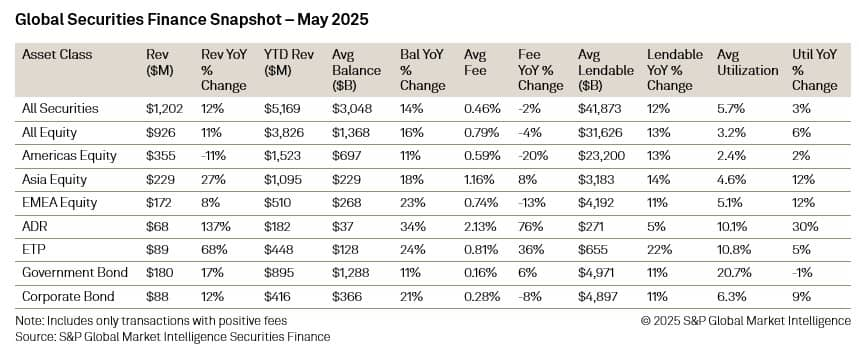

In the securities lending markets, revenues reached $1,202M, marking a 12% year-on-year increase. Balances continued to rise year-on-year as market valuations recovered from the turbulence experienced during April. Average balances reached a recent high during May, surpassing $3T for the first time in seventeen months. Average fees also increased during the month as seasonal activity across the EMEA region helped to push fees higher.

Americas equities revenues continued to experience year-on-year decreases whilst Asian and European markets showed further growth. Average fees across Americas equities increased month-on-month, gaining 4bps when compared with April (59bps average in May). Balances across the asset class exploded reaching one of their highest monthly averages for over two years ($697B).

Asian equities remained popular during May despite monthly revenues falling when compared with both April ($236M) and March ($263M). Average fees climbed to their highest level (116bps) of 2025 however, as the revival of securities lending activity seen across South Korea helped to push the metric higher.

ETFs and ADRs also continued to generate strong returns with revenues, average fees and balances all showing double-digit year-on-year growth. Pony Ai (PONY) generated $27.4 million during the month as the company became a victim of the escalating global trade tensions.

Both government and corporate bonds fared well during May with revenues and balances continuing to grow year-on-year. Both asset classes benefited from the volatility seen in yields during the month as government borrowing and the question of "neutral" interest rates continued to dominate the financial press.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2025.html&text=Securities+Finance+May+Snapshot+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2025.html","enabled":true},{"name":"email","url":"?subject=Securities Finance May Snapshot 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+May+Snapshot+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}