Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 28, 2025

The Tug of War: Short Interest vs. R2K Growth.

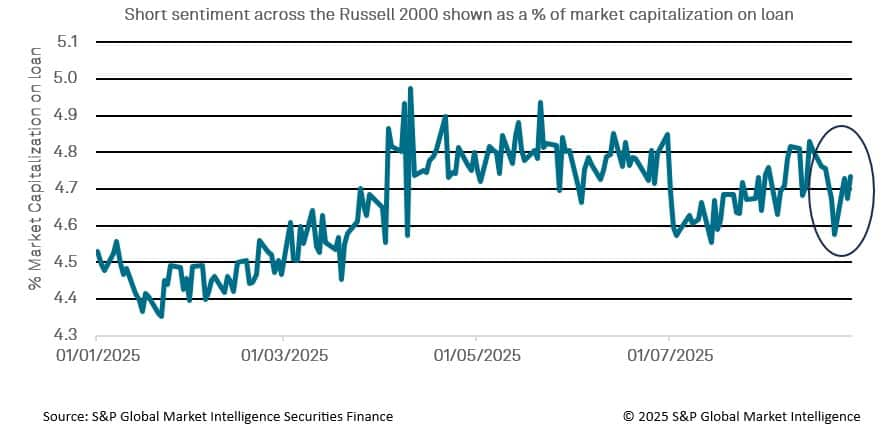

Recent shifts in U.S. interest rate expectations have influenced short sentiment throughout the Russell 2000 Index.

Recent statements from the Federal Reserve have prompted discussions about potential changes to the future path of US interest rates. Historically, adjustments in monetary policy have coincided with movements in the small-cap sector, impacting stocks represented by the Russell 2000 Index.

A significant moment regarding interest rate changes occurred during Federal Reserve Chair Jerome Powell's address at the annual Jackson Hole symposium. His remarks, coupled with a recent labour market report, have heightened interest in futures markets regarding potential rate changes. This has contributed to a market rally, with futures reflecting a 75% probability of a rate cut at the upcoming September Fed meeting.

The Russell 2000 Index, which tracks the performance of small-cap stocks, has responded to these developments with an increase. Since the beginning of August, the index has increased 7.3%, marking its best month relative to the S&P 500 since July 2024. This growth is linked to expectations of looser monetary policy, which may benefit regional banks and industrial companies that comprise a significant portion of the index.

However, alongside this positive sentiment, there has been a notable rise in short interest, with currently 4.73% of market capitalization on loan, up from 4.58% as of August 22. This increase in short interest reflects a level of scepticism among certain investors regarding the sustainability of the small-cap rally. The rise in short positions suggests that while some investors anticipate gains from the Russell 2000 due to potential interest rate cuts, others are positioning themselves defensively in light of possible market corrections.

This situation prompts an examination of the relationship between short interest and the performance of small-cap stocks in the context of changing interest rates. Historically, lower interest rates have been associated with improved performance for small-cap stocks, primarily due to reduced borrowing costs that enhance profitability for smaller companies often reliant on debt for expansion. When the Fed cuts rates, it typically leads to increased consumer spending and business investment, fostering an economic environment conducive to growth for small-cap companies.

Moreover, as interest rates decline, small-cap stock valuations often rise. Investors tend to take more risks in a low-rate environment, leading to increased capital inflows into small-cap equities. This trend has been reflected in the Russell 2000's recent performance, which has outpaced larger counterparts amid expectations of monetary easing.

However, the concurrent rise in short interest indicates that some investors are adopting a cautious approach. Concerns regarding the sustainability of upward momentum may arise from economic uncertainties or specific sector challenges. The increase in short positions could signal a belief among some investors that current valuations may not be entirely justified.

The relationship between rising short interest and the growth of the Russell 2000 Index is shaped by the Federal Reserve's monetary policy. While the potential for rate cuts may suggest a favourable outlook for small-cap stocks, the increase in short interest highlights scepticism among certain investors. As the market adjusts to these dynamics, the performance of the Russell 2000 may depend on the balance between investor optimism influenced by lower rates and the caution reflected in rising short positions.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-tug-of-war-short-interest-vs-r2k-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-tug-of-war-short-interest-vs-r2k-growth.html&text=The+Tug+of+War%3a+Short+Interest+vs.+R2K+Growth.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-tug-of-war-short-interest-vs-r2k-growth.html","enabled":true},{"name":"email","url":"?subject=The Tug of War: Short Interest vs. R2K Growth. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-tug-of-war-short-interest-vs-r2k-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Tug+of+War%3a+Short+Interest+vs.+R2K+Growth.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-tug-of-war-short-interest-vs-r2k-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}