Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 03, 2025

Securities Finance August Snapshot 2025

August revenues remain elevated as market moves generate strong returns.

Market revenues increase by 45% YoY

Asian equity revenues soar as Hong Kong and South Korea produce strong returns

Lendable and balances hit new highs

Corporate Action related trades (CRWV and PSKY) generate a combined $245M

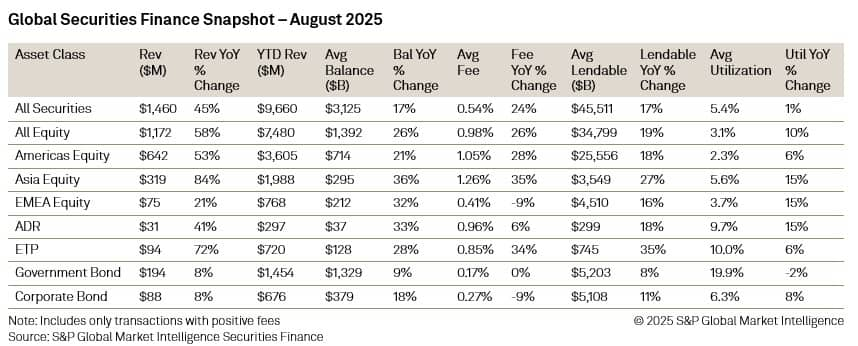

In the securities lending markets, revenues experienced remarkable growth following a strong July, reaching a total of $1.46 billion for the month. All securities balances rose by 17% year-on-year, while average fees increased by 24%, reaching an average of 0.54%. This marks the third consecutive month in which the average fee has exceeded 50 basis points. The value of lendable inventory continued to expand throughout the month, driven by record-high market valuations, culminating in a new record of $46 trillion set on August 25th.

Regionally, both Asia and North America maintained their dominance in market activity, showcasing impressive year-on-year revenue increases. The top revenue-generating stocks for the month were both U.S. equities, as corporate action-related trades continued to present lucrative opportunities for lenders. Coreweave Inc (CRWV) generated $136.6 million, while Paramount Skydance Corp (PSKY) contributed $108.8 million.

In Asia, Hong Kong-listed equities led demand, generating significantly higher revenues compared to its market peers. Notable stocks such as Guotai Junan International Holdings Ltd (1788), Contemporary Amperex Technology Co Ltd (3750), and Laopu Gold Co Ltd (6181) were all in high demand. Other countries in the region reported strong returns, with South Korean equities generating $67 million, a staggering 848% increase year-on-year. Malaysia saw revenues rise by 77% year-on-year to $6 million, while Taiwan experienced a decline, with revenues dropping 11% to $61 million as average fees fell by 12%.

European equity revenues performed well, increasing by 21% year-on-year to $75 million. Notably, Germany, Sweden, the UK, and France each contributed circa $10 million during the month.

Fixed income assets continued to offer stable revenue streams to lenders, with an 8% increase in revenues across both corporate and government bonds. Balances in this sector also continued to grow throughout the month.

August proved to be a strong month for the securities lending markets, characterized by robust revenues and rising average fees. The combination of market volatility and record valuations created a favourable environment for both lenders and borrowers. As summer comes to an end in the northern hemisphere and investors return from their summer breaks, September is poised to bring further volatility and opportunities for additional revenue growth.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-august-snapshot-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-august-snapshot-2025.html&text=Securities+Finance+August+Snapshot+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-august-snapshot-2025.html","enabled":true},{"name":"email","url":"?subject=Securities Finance August Snapshot 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-august-snapshot-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+August+Snapshot+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-august-snapshot-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}