Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 09, 2025

The Surge in ADR Securities Lending Revenues: A Closer Look at May's $68 Million Boom.

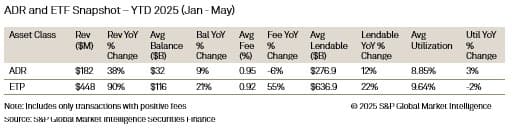

In May 2025, ADR securities lending revenues increased 137% year-on-year, with year-to-date totals reaching $182 million.

American Depositary Receipts (ADRs) are financial instruments that allow U.S. investors to buy shares in foreign companies without dealing with the complexities of foreign stock exchanges. Each ADR represents a specific number of shares in a foreign company, and these receipts trade on U.S. exchanges like stocks. This structure provides investors with an opportunity to diversify their portfolios and gain exposure to international markets, while the foreign companies benefit from increased visibility and access to U.S. capital.

In May 2025, the revenues generated from ADR securities lending skyrocketed to an impressive $68 million, marking a staggering 137% increase year-on-year and a remarkable 79% increase month-on-month. This surge highlights the growing interest and activity in ADRs, particularly among international investors looking to capitalize on the unique arbitrage opportunities they present.

Common Arbitrage Strategies Involving ADRs

ADRs are often employed in various arbitrage strategies, which involve taking advantage of price discrepancies between the ADRs and their underlying foreign shares. One popular strategy is the conversion arbitrage, where traders buy the underlying shares in the foreign market while simultaneously selling the ADRs in the U.S. This strategy aims to profit from the price difference between the two markets. Another common strategy is statistical arbitrage, which uses quantitative methods to identify mispriced ADRs relative to their underlying shares, allowing traders to exploit temporary inefficiencies.

Spotlight on Top ADR Revenue Generators

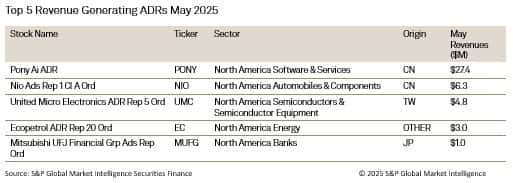

In May, five ADRs accounted for over 60% of the monthly securities lending revenues. Notably, Pony AI (PONY), a Chinese company specializing in self-driving car technology, emerged as a significant contributor. Recently exiting its lock-up period, Pony AI saw an increase in the free float of its shares. However, the profitability of the company remains in question due to the capital-intensive nature of the autonomous vehicle industry, making it a focal point for arbitrage opportunities.

Another major player is Nio Inc. (NIO), which designs and manufactures smart electric vehicles. Nio has been expanding its offerings with various power solutions and services, including home charging and battery-swapping technologies. On March 27, the company announced a proposal to offer up to 118.8 million shares outside the U.S., which could lead to significant share dilution and downward pressure on prices. This situation presents a ripe opportunity for short sellers to capitalize on potential price fluctuations.

United Microelectronics Corporation (UMC) has also been a prominent ADR in the lending market, especially amid the ongoing tariffs and trade war rhetoric affecting the semiconductor industry. The volatility surrounding UMC's stock has made it an attractive target for investors looking to exploit short-term price movements.

Additionally, Ecopetrol (EC), Colombia's national oil company, and Mitsubishi UFJ Financial Group (MUFG) have entered the top revenue-generating table for ADRs. The oil and financial sectors are known for their sensitivity to global economic conditions, making their ADRs attractive for arbitrage strategies as investors seek to hedge against various market risks.

ADR Performance in the Securities Lending Market in 2025

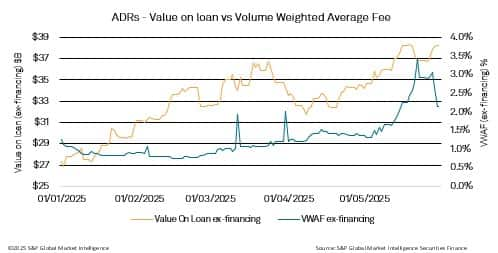

Throughout 2025, ADRs have been performing exceptionally well in the securities lending market. As of the end of May, year-to-date revenues reached $182 million, reflecting a substantial increase of $50 million compared to the same period in 2024. May also saw an average fee of 2.13%, marking the highest monthly fee in over 12 months. Additionally, average balances reached $36.7 billion in May, approaching a multi-year high, which pushed average utilization over 10% for the first time in many months.

Exchange-Traded Funds (ETFs) have also been experiencing recent highs in securities lending revenues, showcasing some similarities with ADRs. Both instruments provide easy access to investments in foreign companies, offering investors a streamlined way to diversify their portfolios. Additionally, both ADRs and ETFs benefit from cost and trading efficiencies, as they allow for simplified transactions and reduced administrative burdens. They are also utilized in price discovery strategies, enabling investors to identify market trends and make informed trading decisions.

The robust performance of ADRs in the securities lending market throughout 2025, alongside the rising popularity of ETFs, underscores the growing demand for innovative investment vehicles that facilitate exposure to international markets. As investors continue to seek out opportunities in a dynamic global landscape, both ADRs and ETFs stand poised to play a crucial role in shaping the future of investment strategies.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-surge-in-adr-securities-lending-revenues-a-closer-look-at-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-surge-in-adr-securities-lending-revenues-a-closer-look-at-.html&text=The+Surge+in+ADR+Securities+Lending+Revenues%3a+A+Closer+Look+at+May%27s+%2468+Million+Boom.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-surge-in-adr-securities-lending-revenues-a-closer-look-at-.html","enabled":true},{"name":"email","url":"?subject=The Surge in ADR Securities Lending Revenues: A Closer Look at May's $68 Million Boom. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-surge-in-adr-securities-lending-revenues-a-closer-look-at-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Surge+in+ADR+Securities+Lending+Revenues%3a+A+Closer+Look+at+May%27s+%2468+Million+Boom.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-surge-in-adr-securities-lending-revenues-a-closer-look-at-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}