Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 27, 2025

DRIPs Dry Up: Canada’s Securities Lending Landscape.

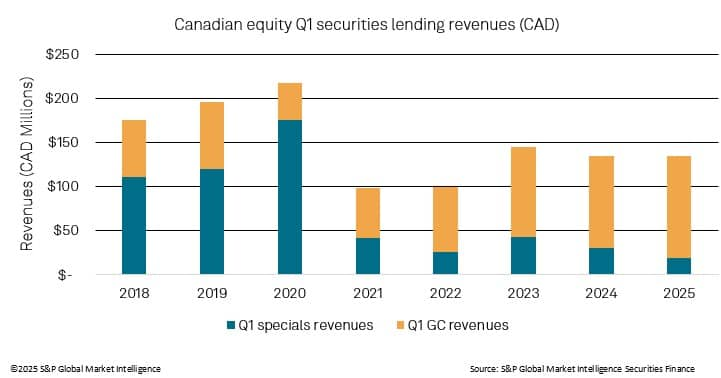

Canada's securities lending equity market has seen declining revenues since 2020.

Since 2020, the Canadian securities lending market has undergone significant structural and revenue-related changes. These changes are primarily the result of macroeconomic shifts such as high inflation and rising interest rates following the COVID-19 pandemic, alongside evolving investor behaviour and global trade tensions—particularly the imposition of U.S. tariffs. The impact has reverberated across various facets of the market, including Dividend Reinvestment Plans (DRIPs) and short-selling activity creating a new paradigm for securities lending participants in Canada.

Post-Pandemic Pressures: Inflation and Interest Rates Reshape Market Dynamics

The Canadian economy experienced a sharp inflationary surge post-pandemic, reaching a 39-year high of 8.1% in June 2022. To combat this, the Bank of Canada began aggressively raising interest rates, culminating in a peak of 5% by mid-2023. These rate hikes, while necessary to control inflation, had far-reaching consequences across financial markets, including securities lending.

Higher interest rates typically increase the return on cash collateral, a key revenue stream in securities lending. However, they also tend to reduce market volatility and suppress speculative activity—two major drivers of "specials" revenues (securities loaned at high fees, often exceeding 500 basis points). As a result, Canadian equity securities lending revenues have experienced a steady decline since 2020. In particular, high-fee special trades have become less frequent, while general collateral (GC) lending, where securities are borrowed at much lower fees, has become a larger share of total revenue.

A Decline in DRIPs and Its Broader Implications

High inflation and elevated interest rates in Canada over the past few years have contributed to a decline in the number of companies offering Dividend Reinvestment Plans (DRIPs). As borrowing costs rise, companies face tighter financial conditions and are more cautious with capital allocation, often opting to preserve cash rather than issue discounted shares through DRIPs. This shift has implications for the broader equity market. DRIP dividends in Canada have historically driven demand for equities, particularly among securities lending participants. Many Canadian firms offer DRIP shares at discounts of up to 5%, creating arbitrage opportunities: investors can short the stock before the dividend record date, borrow shares to cover the position, and then repurchase them at a lower effective cost due to the DRIP discount. This activity temporarily increases the demand to borrow shares, pushing up loan fees and generating profitable "specials" for lenders. With fewer DRIP programs available, these arbitrage opportunities diminish, reducing both the demand for borrowing and the secondary market activity that supports Canadian equity valuations.

Q1 Revenue Composition in 2025

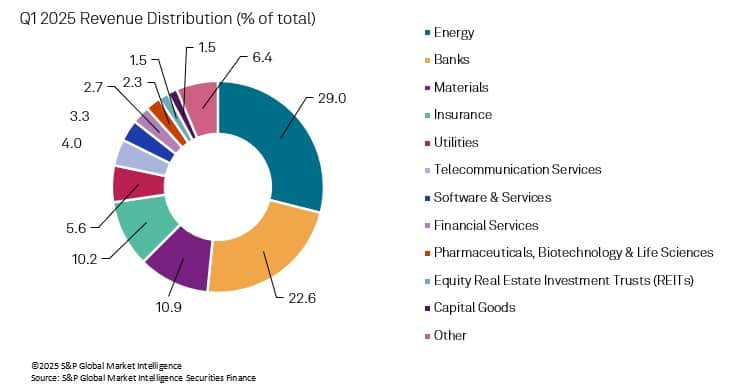

While the number of drips and/or the size of the discounts offered may have declined, the highest revenues still stemmed from sectors linked to drip activity. Equity market revenues have remained muted compared to previous years, in part due to macroeconomic uncertainty stemming from U.S. tariffs on Canadian exports, particularly in sectors like steel, aluminum, and automotive. These trade tensions have cast a shadow over the broader market and reduced appetite for risk.

A closer look at Q1 2025 revenue composition reveals a concentration of earnings across four sectors:

- Energy: 29%

- Banks: 23%

- Materials: 11%

- Insurance: 10%

In Q1, drip sectors continued to dominate revenues, accounting for over 70% of securities lending revenues. This trend reflects a risk-averse environment, where lending demand has concentrated on large-cap, liquid names—particularly those with a blend of institutional ownership and stable dividend payouts.

The TSX60 and Market Uncertainty: The Role of Tariffs

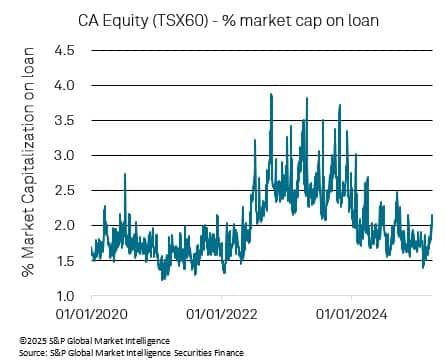

The introduction of U.S. tariffs has created a considerable degree of uncertainty within Canadian markets, particularly impacting the TSX60. Investor sentiment has worsened due to concerns over slowed economic growth and reduced export competitiveness. In this climate of protectionism and policy unpredictability, short-selling activity decreased as market participants take a cautious, wait-and-see stance.

As this uncertainty persists, any recent uptick in the percentage of market capitalization on loan across Canadian equities is likely attributable to hedging strategies employed by investors looking to mitigate potential risks. The ramifications of tariffs have also varied by sector; for example, energy and telecommunications companies are grappling with heightened costs and pricing pressures. Although the energy sector contributes significantly to lending revenues, it too faces market volatility, resulting in fluctuating loan balances and fees. Additionally, while currency fluctuations, particularly a weaker Canadian dollar, have somewhat bolstered the attractiveness of Canadian exports in USD terms, this has not sufficiently alleviated the overarching caution among investors.

Short-Selling Dynamics: Shorts are out of the money

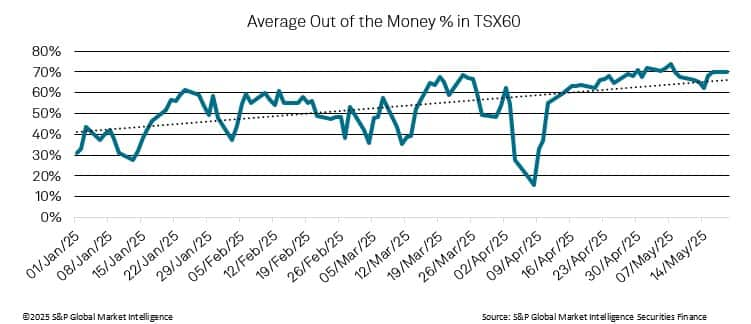

Rising equity market values during the early months of 2025 led to a sharp drop in the percentage of short positions that were "out of the money" (i.e., currently unprofitable). At the height of the tariff concerns, this figure dropped to just 16%, its lowest level of the year, as falling stock prices made many short positions profitable.

However, with the market showing signs of stabilization and recovery, this metric has begun to normalize, following an upward trend. As of May 2025, the percentage of shorts out of the money has risen back to 70%, indicating that a majority of short positions are now under water, potentially limiting further downside risk and suppressing further shorting activity across the TSX60 index.

Looking Ahead: A More Optimistic Outlook?

Despite recent headwinds, there are reasons for cautious optimism in the Canadian securities lending market. The Bank of Canada has begun lowering its policy rate, most recently to 2.75%, with expectations of further cuts throughout 2025. This pivot toward growth-oriented monetary policy marks a significant shift from the inflation-fighting stance of the past two years.

Key Forecasts and Potential Impacts:

- Interest rates may decrease by an additional 75 bps by year-end, easing borrowing costs and boosting equity valuations.

- Lower rates are likely to support equity market sentiment, potentially encouraging renewed short-selling activity and volatility—both of which are positive for lending revenues.

- Sector rotation into rate-sensitive sectors such as financials and real estate could drive demand for securities lending activity in these areas, diversifying revenue sources.

- A revival of DRIP participation may occur if inflation stabilizes and interest rates decline, reopening opportunities for high fee lending opportunities around dividend events.

Furthermore, the Canadian market has demonstrated resilience, particularly in its foundational sectors—banks, energy, and materials. If economic momentum builds and investor confidence improves, we could see a return of specials activity and a modest rebound in securities lending profitability.

With falling interest rates on the horizon and sectoral strength continuing in key industries, there is potential for a rebound in activity. A more favourable economic environment could reinvigorate both DRIP participation and short-selling demand, setting the stage for a renewed era of opportunity in Canadian securities lending.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdrips-dry-up-canadas-securities-lending-landscape-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdrips-dry-up-canadas-securities-lending-landscape-.html&text=DRIPs+Dry+Up%3a+Canada%e2%80%99s+Securities+Lending+Landscape.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdrips-dry-up-canadas-securities-lending-landscape-.html","enabled":true},{"name":"email","url":"?subject=DRIPs Dry Up: Canada’s Securities Lending Landscape. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdrips-dry-up-canadas-securities-lending-landscape-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=DRIPs+Dry+Up%3a+Canada%e2%80%99s+Securities+Lending+Landscape.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdrips-dry-up-canadas-securities-lending-landscape-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}