Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 04, 2025

European Corporate Bond ETFs Experience a Surge in July Flows.

European corporate bond ETFs see surge in July flows amid market resilience.

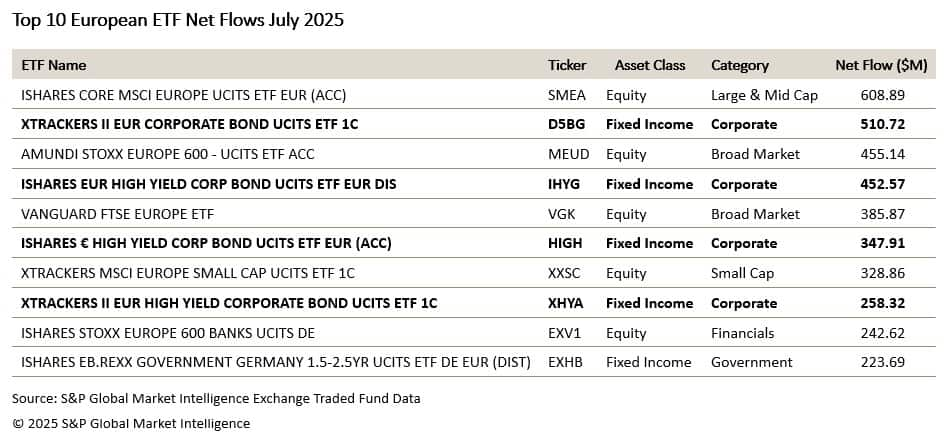

In July 2025, European-based corporate bond exchange-traded funds (ETFs) experienced significant inflows, reflecting a broader trend of investor confidence. Across the top ten ETF flows, Corporate Bond funds attracted over $1.5 billion in new investments alone, marking a decisive pivot towards fixed income as investors reassess their portfolios in light of shifting market dynamics.

The XTRACKERS II EUR Corporate Bond UCITS ETF and the ISHARES EUR High Yield Corp Bond UCITS ETF led the charge, collectively attracting nearly $1 billion in July. The prominent inflows into corporate bond ETFs, particularly those focused on high yield, underscore a strategic shift among investors seeking yield in an environment marked by low interest rates and economic uncertainty.

The backdrop of lower interest rates, as central banks like the European Central Bank have maintained accommodative monetary policies, has created a favourable environment for fixed income investments. This is particularly relevant as investors seek stability and yield amid ongoing geopolitical tensions and economic volatility. The recent performance of corporate bonds reflects a broader sentiment that, despite the potential for growth in equities, the fixed income market offers a safer harbour amidst uncertainty.

Lower interest rates and plans for significant defence spending in Europe have bolstered stocks, yet investors are increasingly cautious, prompting a pivot towards fixed income assets. The performance of shorter-dated government bonds has been strong, boosted by central bank interest-rate cuts as inflation has eased further. This easing inflation, coupled with the expectation of continued monetary support, has made corporate bonds an attractive investment option. As investors anticipate further rate cuts, the demand for fixed income securities, particularly those with higher yields, is likely to persist.

The inflows into high yield corporate bond ETFs also suggest a growing appetite for risk among investors. With yields on government bonds remaining low, many are turning to high yield corporate bonds as a means to enhance returns. The shift towards European markets is particularly notable, as investors are slowing their purchases of US assets amid concerns that tariffs and tax cuts will impact earnings. This repositioning not only reflects a search for yield but also a strategic move towards markets perceived as offering more favourable conditions for investment.

The ongoing rebound in mergers and acquisitions (M&A) activity adds another layer of appeal to corporate bonds. The significant inflows into corporate bond ETFs can be interpreted as a response to anticipated corporate profitability that often accompanies M&A activity. As companies seek to finance acquisitions or expand operations, the demand for corporate bonds is likely to increase, further driving investor interest.

The economic landscape in Europe has shown resilience, with corporate bonds benefiting from a favourable credit environment. Investors have been encouraged by data indicating that US stocks are finishing the first half of the year at record highs, buoyed by optimism surrounding trade talks and the potential for economic growth. This positive sentiment has spilled over into European markets, where lower interest rates and increased defence spending have bolstered stock performance.

Importantly, the narrowing spreads observed in the corporate bond market are indicative of improving credit quality and investor confidence. As risk premiums tighten, the market is signalling a more favourable outlook for corporate issuers, which can further entice investors to allocate capital to corporate bonds. The spread between corporate bonds and government bonds has been contracting, suggesting that investors are increasingly willing to take on credit risk in pursuit of yield. This trend is particularly relevant as the market grapples with the dual pressures of geopolitical tensions and the ongoing impact of monetary policy.

The performance of technology companies has also played a crucial role in driving the S&P 500 and other indices to record highs. As these companies continue to thrive, the corporate bond market stands to benefit from increased corporate profitability and investment. The shift in sentiment towards corporate bonds reflects a broader understanding of the need for diversification in investment portfolios, particularly as market participants seek to balance risk and return in an evolving financial landscape.

The significant inflows into European corporate bond ETFs in July illustrate a strategic pivot among investors towards fixed income assets in a challenging economic environment. The combination of low interest rates, easing inflation, and a robust M&A landscape has created a fertile ground for corporate bonds, particularly high yield offerings. As the market continues to navigate geopolitical tensions and economic uncertainties, the resilience of corporate bonds will likely remain a focal point for investors seeking stability and yield. With accommodative monetary policy expected to persist, the trend towards corporate bond ETFs may continue, reinforcing the role of fixed income in diversified investment portfolios. The July flows into corporate bond ETFs not only highlight changing investor sentiment but also signal a broader strategic shift as market participants seek to balance risk and return in an evolving financial landscape.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-corporate-bond-etfs-experience-a-surge-in-july-flows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-corporate-bond-etfs-experience-a-surge-in-july-flows.html&text=European+Corporate+Bond+ETFs+Experience+a+Surge+in+July+Flows.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-corporate-bond-etfs-experience-a-surge-in-july-flows.html","enabled":true},{"name":"email","url":"?subject=European Corporate Bond ETFs Experience a Surge in July Flows. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-corporate-bond-etfs-experience-a-surge-in-july-flows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+Corporate+Bond+ETFs+Experience+a+Surge+in+July+Flows.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-corporate-bond-etfs-experience-a-surge-in-july-flows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}