Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 04, 2025

Securities Finance July Snapshot 2025

July revenues explode as market valuations and market risk remain elevated.

Market revenues surpass $1.5B, YoY growth of 53%

US specials revenues increase 100% YoY

Market valuations and balances hit new highs

ETFs continue to soar as YoY revenues grow 86%

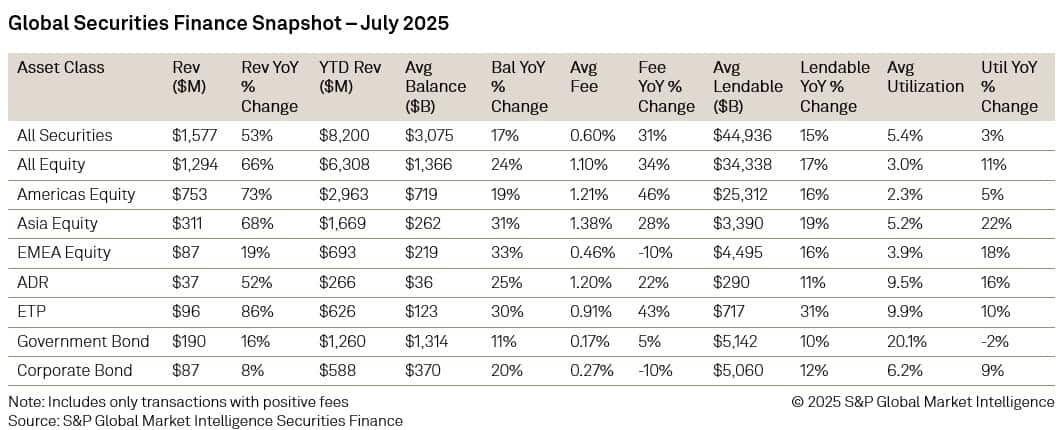

In the securities lending markets, revenues soared to an impressive $1.577 billion in July, reflecting a remarkable 53% increase compared to the previous year. All asset classes contributed to this growth, with equities leading the way, posting a 66% year-on-year rise and generating revenues of $1.294 billion. Special revenues saw significant gains across all regions, with US equities achieving a staggering 100% increase year-on-year, and specials activity accounting for 83% of total revenues. Coreweave Inc (CRWV) remained a strong performer for shareholders, generating over $308 million during the month.

In Asian equities, Hong Kong regained its position as the top revenue-generating market, raking in $94 million, which represents an extraordinary 216% increase year-on-year. Companies such as Guotai Junan International Holdings Ltd (1788) and Contemporary Amperex Technology Co Ltd (3750) were key contributors, with a combined revenue of $32.6 million. Balances in the province surged by 107% year-on-year, while average fees climbed 52%, reaching an average of 2.16%.

Exchange-traded products and depositary receipts also reported robust revenues throughout the month, driven by the ongoing buzz around AI and cryptocurrency stocks. The rising price of Bitcoin bolstered the popularity of leveraged ETFs, alongside increasing valuations seen in the technology sector. Although depositary receipt revenues have declined from their peak in May, July still saw a year-on-year growth of over 52%.

In the fixed income space, both government and corporate bonds continued their strong performance from earlier in the year. Balances across both asset classes increased, and revenues demonstrated year-on-year growth.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2025.html&text=Securities+Finance+July+Snapshot+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2025.html","enabled":true},{"name":"email","url":"?subject=Securities Finance July Snapshot 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+July+Snapshot+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}