Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 17, 2025

Yielding Returns: How Rising JGB Yields Are Shaping Borrowing Trends.

The Japanese government bond market is seeing a surge in borrowing activity as JGB yields near all-time highs.

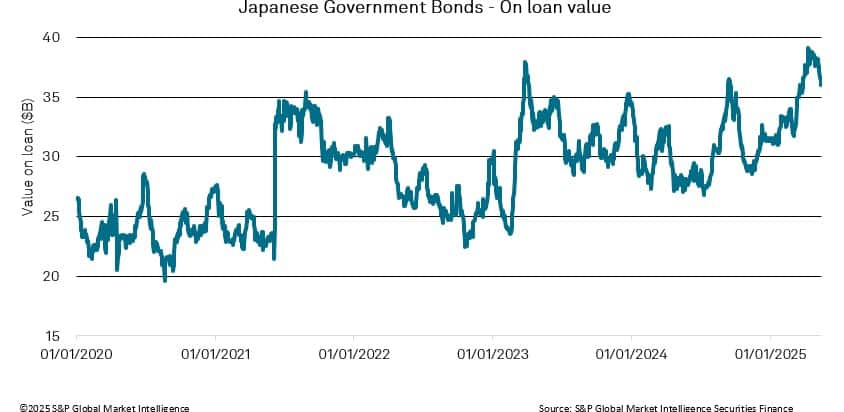

The Japanese government bond (JGB) market, valued at approximately $7.8 trillion, is experiencing a significant increase in borrowing activity, reaching its highest value on loan since 2020. This surge is primarily driven by a rapid shift in yields, particularly in longer-maturity bonds, where 30-year yields are nearing record highs.

Recent increases in yields reflect a broader market shift as investors respond to changing economic conditions and monetary policy. A critical factor in this trend has been the BoJ's decision to scale back its bond purchases. By reducing its presence in the market, the central bank has inadvertently allowed yields to rise as bond prices fall. This inverse relationship between price and yield has created an environment where market speculators are closely monitoring pricing dynamics for potential short-selling opportunities, anticipating further declines in bond prices as yields continue to rise.

The steepening yield curve indicates a changing landscape in Japan's monetary and fiscal environment. As yields rise, the government faces higher servicing costs on its substantial debt load, which currently exceeds 250% of GDP. This situation poses significant challenges, as increased servicing costs can strain public finances, limiting the government's ability to invest in growth-promoting initiatives. Additionally, the risk of a trade war complicates matters further, as it can hinder economic growth and exacerbate Japan's debt burden. The combination of rising yields and economic uncertainties may lead to a decline in investor sentiment.

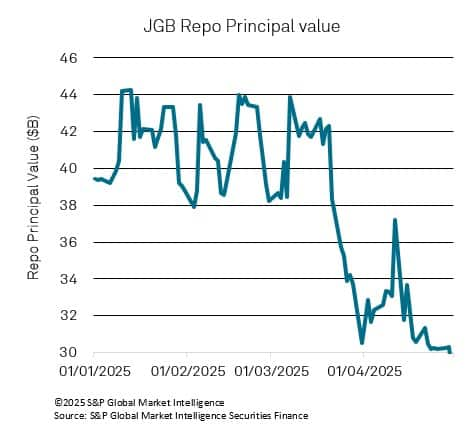

In contrast to the rise in securities lending balances, repo balances have been in decline since the beginning of the year, experiencing a significant drop following the announcement of US tariffs, which triggered a sell-off in financial markets and heightened economic uncertainty. As investors anticipated further increases in yields and potential declines in JGB prices, demand for government bonds weakened, leading to reduced repo transactions. This decline in investor sentiment, driven by concerns over rising servicing costs and the broader implications of trade tensions, has caused market participants to become more risk-averse. Additionally, increased market volatility has prompted a cautious approach, with many opting to hold cash or invest in safer assets rather than engage in repo financing, further contributing to the downward trend in repo balances.

The implications of this borrowing surge in the securities lending market extend beyond the bond market itself. As yields rise, the cost of financing for the government escalates, potentially leading to significant changes in fiscal policy. Higher borrowing costs may compel the government to reassess its spending priorities, particularly in an uncertain economic climate. Furthermore, the BoJ may need to reevaluate its monetary policy framework to address the challenges posed by rising yields and the evolving dynamics of the JGB market. The increase in securities lending balances reflects a strategic shift among investors, as they seek to capitalize on the changing landscape.

In this context, investors are increasingly exploring various securities lending strategies to optimize their positions in the JGB market. Borrowing JGBs to sell them short allows investors to capitalize on anticipated declines in bond prices as yields continue to rise. Additionally, collateralized lending arrangements enable investors to lend their JGB holdings to other market participants in exchange for cash or securities, providing liquidity while allowing borrowers to take advantage of higher yields.

The increase in borrowing of Japanese government bonds marks a significant shift in the market landscape, driven by rising yields and changing investor behaviour. As the BoJ reduces its bond purchases and local investors withdraw from the market, the dynamics of the JGB market are evolving, prompting market participants to watch pricing closely for new opportunities.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyielding-returns-how-rising-jgb-yields-are-shaping-borrowing-t.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyielding-returns-how-rising-jgb-yields-are-shaping-borrowing-t.html&text=Yielding+Returns%3a+How+Rising+JGB+Yields+Are+Shaping+Borrowing+Trends.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyielding-returns-how-rising-jgb-yields-are-shaping-borrowing-t.html","enabled":true},{"name":"email","url":"?subject=Yielding Returns: How Rising JGB Yields Are Shaping Borrowing Trends. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyielding-returns-how-rising-jgb-yields-are-shaping-borrowing-t.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yielding+Returns%3a+How+Rising+JGB+Yields+Are+Shaping+Borrowing+Trends.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fyielding-returns-how-rising-jgb-yields-are-shaping-borrowing-t.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}