Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 15, 2025

US ETF Flows in June: A Month of Improving Market Sentiment.

In June 2025, diverging patterns in US ETF flows emerged.

June 2025 proved to be an influential month for exchange-traded funds (ETFs) in the United States. The month's activity showcased investor sentiment that was characterized by substantial inflows into equity-focused funds alongside significant outflows from certain bond and sector-specific ETFs. Analyzing the month's top performers reveals valuable insights into the changing landscape of investment strategies. The examination of ETF data often provides a clearer understanding of the trends shaping investor behavior and the decision-making that is taking place in today's dynamic market environment.

Top Inflows: A Vote of Confidence for Equities

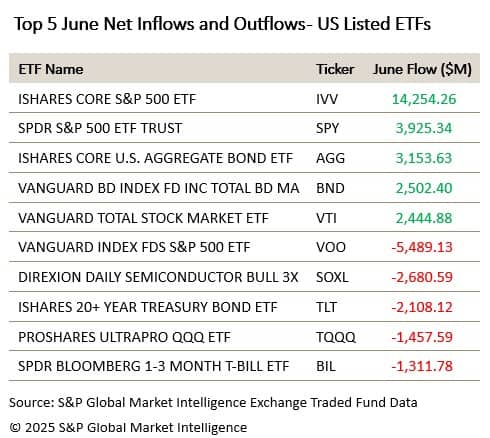

Leading the charge in inflows was the iShares Core S&P 500 ETF (IVV), which attracted a staggering $14.25 billion. This remarkable influx signals a robust investor confidence in the U.S. equity market, particularly within the S&P 500, which has long been regarded as a bellwether for overall market health.

Following IVV, the SPDR S&P 500 ETF Trust (SPY) experienced inflows of $3.93 billion. As one of the most recognized ETFs in the market, SPY's enduring popularity highlights the trend among institutional investors who favor established funds that offer dependable exposure to large-cap U.S. equities.

In the bond market, the iShares Core U.S. Aggregate Bond ETF (AGG) attracted $3.15 billion. Despite a general decline in fixed-income inflows during the month, this performance suggests that investors are still seeking stability and income amid a backdrop of tariff uncertainty. Similarly, the Vanguard Bond Index Fund Inc Total Bond Market (BND) drew $2.50 billion, reinforcing the notion that some investors remain committed to the bond market as a safe haven.

Lastly, the Vanguard Total Stock Market ETF (VTI) rounded out the top five inflows with $2.44 billion, reflecting a growing interest in the broader U.S. stock market beyond the confines of the S&P 500.

Five Largest Outflows: A Shift in Strategy

On the flip side, the month saw significant outflows from several key ETFs. The Vanguard Index Funds S&P 500 ETF (VOO) experienced the largest outflow, with a staggering $5.49 billion. Known as a vehicle used by retail investors, thanks to the low fee, this decline may signal a pivotal shift in investor behavior, as retail investors appear to be reallocating their portfolios in search of greater geographic diversification. After recently hitting a new all-time high, investors in the S&P500 may now be shifting their focus to opportunities in international markets instead. One place where retail investors appear to be showing interest is in European ETFs. During June, the Wisdom Tree European Defence UCITS ETF - EUR ACC (WDEF) noted inflows of $21.3 billion while the Vanguard FTSE Europe ETF (VGK) experienced inflows of $6.7 billion.

The outflows from VOO may also indicate a broader market rotation, as investors shift their focus towards sectors and assets believed to offer better short-term growth potential or risk diversification. In June, the Vanguard Growth ETF (VUG) attracted nearly $1 billion, while the Vanguard Total Stock Market ETF (VTI) garnered $2.4 billion in inflows. Such strategic repositioning highlights a dynamic market landscape where adaptability is essential for navigating changing investment opportunities.

The semiconductor sector, known for its volatility, was not spared, as the Direxion Daily Semiconductor Bull 3X (SOXL) faced outflows of $2.68 billion. This trend may be attributed to ongoing supply chain disruptions, tariff uncertainties and geopolitical tensions that have created unease among investors in this sector.

The iShares 20+ Year Treasury Bond ETF (TLT) recorded outflows of $2.11 billion, suggesting a waning appetite for long-term treasury bonds. Higher for longer interest rates and inflation concerns following the announcement of further trade tariffs, may be prompting investors to reassess their positions in this traditionally stable asset class. Similarly, the ProShares UltraPro QQQ ETF (TQQQ), which provides leveraged exposure to the Nasdaq-100, saw outflows of $1.46 billion, reflecting a cautious sentiment as investors reevaluate their stakes in high-growth tech stocks.

Lastly, the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) experienced outflows of $1.31 billion, indicating a potential shift in strategy among investors moving away from short-term treasury bonds in light of changing economic conditions.

An Improvement in Investor Sentiment

During June, the significant inflows into equity-focused funds, particularly the iShares Core S&P 500 ETF (IVV) and SPDR S&P 500 ETF Trust (SPY), underscored robust investor confidence in the U.S. equity market. This positive sentiment is further bolstered by a decline in short interest, evidenced by a reduction in the percentage of market capitalization on loan across the SPDR S&P 500 ETF Trust (SPY). Short interest fell from a peak of 3.5% on 19th June to just under 2.2% on 30th June. The same was also true for The Vanguard Index Funds S&P 500 ETF (VOO) and the Vanguard Total Stock Market ETF (VTI). Such decreases indicate that fewer investors are betting against these funds, reflecting an increasing optimism about future market performance.

In summary, June 2025 showcased a mixed sentiment among investors, characterized by strong preferences for equities and selective bond investments while steering clear of sectors with higher volatility and interest rate sensitivity. As the market continues to evolve, these trends will be crucial for understanding the shifting landscape of ETF investments in the months to come. Investors are likely to remain vigilant, adapting their strategies to navigate the complexities of an ever-changing financial environment.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-etf-flows-in-june-a-month-of-improving-market-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-etf-flows-in-june-a-month-of-improving-market-sentiment.html&text=US+ETF+Flows+in+June%3a+A+Month+of+Improving+Market+Sentiment.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-etf-flows-in-june-a-month-of-improving-market-sentiment.html","enabled":true},{"name":"email","url":"?subject=US ETF Flows in June: A Month of Improving Market Sentiment. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-etf-flows-in-june-a-month-of-improving-market-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+ETF+Flows+in+June%3a+A+Month+of+Improving+Market+Sentiment.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-etf-flows-in-june-a-month-of-improving-market-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}