Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 04, 2025

Securities finance June, Q2 &H1 Snapshot 2025

June, Q2 and H1 revenues all increase year-on-year

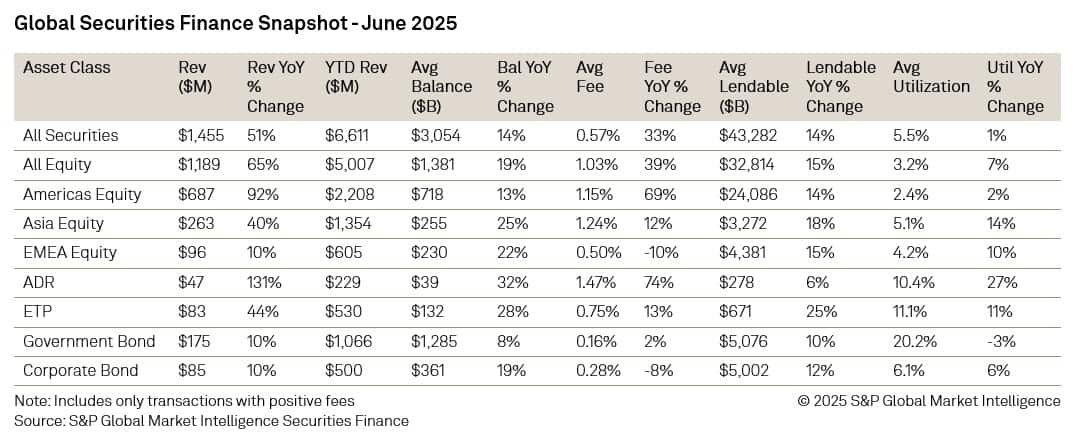

- June revenues $1,455M (+51% YoY)

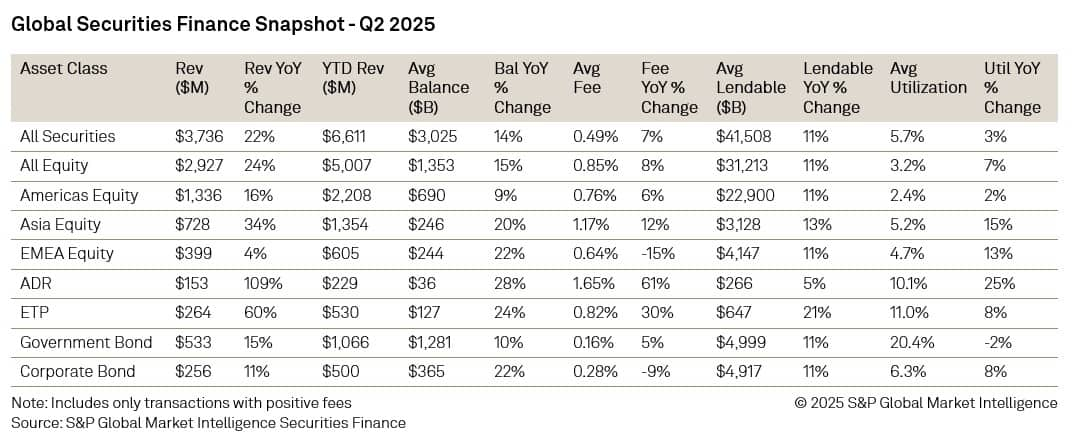

- Q2 revenues $3,736M (+22% YoY)

- H1 revenues $6,611M (+14% YoY)

- Asian equity revenues, ADRs and ETFs all perform well during Q2 and H1

- Americas equities jump +92% YoY during June as Coreweave Inc (CRWV) generates $266M

Securities lending activity recorded robust revenues of $1,455 million for the month, reflecting a substantial year-on-year increase of 51%. This growth trajectory was largely supported by the performance of Asian equities, exchange-traded funds (ETFs), and American Depositary Receipts (ADRs), which collectively contributed to enhanced returns. Notably, North American equities experienced remarkable expansion in June, driven predominantly by Corewave Inc (CRWV), which generated an impressive $266 million in revenues. This surge followed a significant appreciation in the company's valuation, which escalated from its initial public offering (IPO) price of $40 in March to surpass $170 in June, accounting for nearly 40% of total North American equity revenues.

In the APAC region, South Korean equities demonstrated exceptional performance, with revenues skyrocketing 520% year-on-year to reach $54 million, supported by an average fee of 2.38%. Hong Kong and Malaysia also exhibited strong results, with revenues of $56 million (up 68% YoY) and $4 million (up 66% YoY), respectively, as lending balances continued to rise across both markets.

In the EMEA region, equity revenues increased by 10% compared to June 2024, totalling $96 million. Several countries showcased significant year-on-year growth, including Turkey (+433%), Poland (+88%), Greece (+63%), and Spain (+67%). However, average fees across the region experienced a decline as seasonal trading patterns began to normalize.

Exchange-traded funds have increasingly solidified their position within the securities financing markets, generating monthly revenues of $83 million, comparable to the total revenues produced by the entire EMEA region. Year-on-year measurements indicate continued growth in revenues, balances, and average fees for this asset class.

Fixed income asset classes also demonstrated strong performance in June, with government bond lendable surpassing $5 trillion in value for the first time this year. Corporate bonds achieved their third-highest monthly revenues of the year, although balances experienced a slight decline of 2% month-on-month.

In the securities lending markets, total revenues climbed to $3,736 million, reflecting a robust year-on-year growth of 22%. All asset classes reported positive growth during this period, driven by heightened market volatility that spurred increased borrowing activity. Notably, exchange-traded funds (ETFs) emerged as the standout asset class, with revenues surging by 60% to $264 million. Similarly, American Depositary Receipts (ADRs) experienced remarkable growth, with revenues expanding by 109% to $153 million in Q2. Both asset classes capitalized on the elevated levels of market volatility and the ongoing uncertainties stemming from President Trump's revised international trade policies.

Asian equities also had a strong quarter, particularly following the lifting of the short-selling ban in South Korea. Demand for microprocessor and semiconductor stocks, which could be affected by U.S. trade policy, contributed to rising revenues and average fees. Malaysia continued to establish itself as a focal point for lenders and borrowers, with both revenues and average fees showing consistent growth.

In the fixed income markets, revenues remained robust, with corporate bond revenues increasing both year-on-year and quarter-on-quarter, totalling $256.4 million for the quarter. The demand for Asian government bonds remained strong, with revenues, average fees, and balances all on the rise. Specifically, revenues across this asset class increased by 15% year-on-year, generating $533 million.

SAVE THE DATE

Q2 Securities Finance Market Review

Our regular Q2 Webinar will be taking place on July 17th3PM UK / 10AM EST. During the webinar we will be sharing the most recent Q2 data, and we will have a guest speaker, Justin Aldridge, Senior Vice President and Head of Agency Lending at Fidelity Agency Lending.

To register, please click HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june-q2-h1-snapshot-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june-q2-h1-snapshot-2025.html&text=Securities+finance+June%2c+Q2+%26H1+Snapshot+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june-q2-h1-snapshot-2025.html","enabled":true},{"name":"email","url":"?subject=Securities finance June, Q2 &H1 Snapshot 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june-q2-h1-snapshot-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+finance+June%2c+Q2+%26H1+Snapshot+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june-q2-h1-snapshot-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}