Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 26, 2025

The Rise of Active ETFs in a Bull market.

Active ETFs are thriving in a bull market, is this proof that investors still value the human touch?

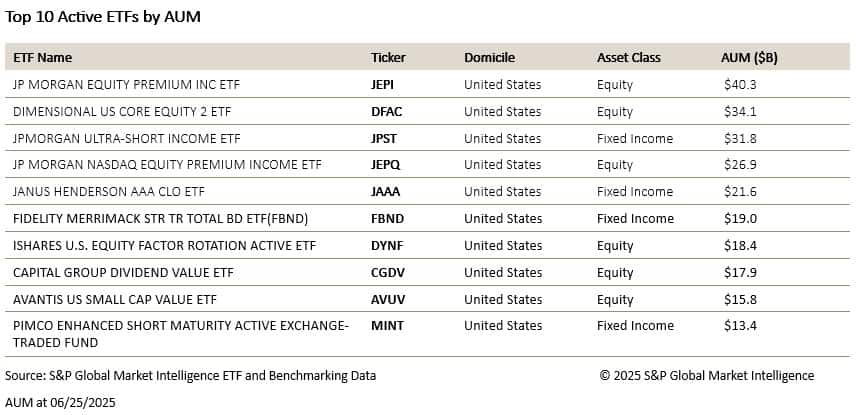

In recent years, actively managed exchange-traded funds (ETFs) have experienced remarkable growth, even as major market indices have reached unprecedented heights. This seemingly counterintuitive trend reveals a significant evolution in investor preferences and market dynamics. With current assets under management (AUM) for actively managed ETFs reaching $1.423 trillion according to S&P Global Market Intelligence data, these investment vehicles have firmly established themselves as a major force in the financial landscape.

The active ETF market has shown impressive diversification across asset classes, with approximately $780 billion allocated to equity-based funds and $457 billion in fixed income funds. This distribution highlights investors' desire for professional management across multiple sectors, even during periods of broad market strength.

Several factors have contributed to this surge in popularity despite all-time market highs. While passive index funds have performed well during the extended bull market, many investors have grown concerned about elevated valuations and increased market volatility. Active ETFs offer the potential for downside protection through tactical asset allocation and security selection, attributes particularly appealing to investors who fear a market correction after prolonged gains. Higher yields observed across actively managed ETFs, generated from writing options on high momentum/high volatility stocks or dividend-paying stocks, have also contributed to the increase in assets under management (AUM) for this asset class. Active managers can also adjust portfolio exposures, reduce concentration in overvalued sectors, and potentially identify undervalued opportunities even within broadly expensive markets. This flexibility represents a compelling value proposition during periods of economic uncertainty and changing monetary policy.

Active ETFs combine the benefits of professional management with the structural advantages of the ETF wrapper. These include greater tax efficiency, lower expense ratios compared to mutual funds, intraday liquidity, and improved transparency. These features have attracted investors who previously avoided active management due to the high costs and operational inefficiencies of traditional mutual funds. The ETF structure has effectively democratized access to sophisticated investment strategies that were once available only to institutional investors or high-net-worth individuals. This accessibility has expanded the potential market for active management significantly.

The substantial allocation to fixed income active ETFs ($457 billion) is particularly noteworthy. In the current interest rate environment, passive bond index funds face inherent limitations. Bond indices are weighted toward the most indebted issuers, and traditional passive approaches lack the flexibility to navigate changing interest rate environments. Active fixed income managers can adjust duration, credit quality, and sector exposures based on their economic outlook which is a crucial advantage when interest rates are volatile. They can also capitalize on pricing inefficiencies in less liquid segments of the bond market, potentially generating alpha that passive strategies cannot capture.

For actively managed fixed income ETFs, dividend forecasting has emerged as an essential component of risk management and performance optimization. Accurate dividend projections enable portfolio managers to enhance hedging strategies by anticipating income streams with greater precision, allowing them to implement more effective approaches to protect against interest rate and credit risks. This capability is particularly valuable in volatile markets where traditional correlation patterns may break down. Reliable dividend forecasts also allow for more efficient cash management and reinvestment planning, potentially enhancing overall fund performance through optimized liquidity positioning. Understanding the expected income component of returns helps managers make more informed decisions about credit and duration risks necessary to achieve target yields.

S&P Global Market Intelligence has positioned itself as a leader in this space, offering comprehensive dividend forecasting services that leverage advanced analytics and extensive market data. These tools provide active ETF managers with actionable insights that can translate into competitive advantages in portfolio construction and risk management.

The continued expansion of active ETFs suggests this trend represents a structural shift rather than a temporary phenomenon. As markets potentially enter a period of lower returns and higher volatility, the case for active management may strengthen further. Additionally, regulatory developments have made it easier to launch active ETFs, encouraging innovation and product development across asset classes. The pipeline of new active ETF strategies continues to grow, with particular emphasis on thematic investing, ESG integration, and alternative strategies that were previously difficult to access in liquid formats.

For investors and financial advisors, active ETFs represent an evolution rather than a revolution, combining the best aspects of traditional active management with the efficiency and accessibility of the ETF structure. As markets continue to evolve, these vehicles are likely to capture an increasing share of investment flows, reflecting their value proposition in both bull and bear market environments. With substantial assets already allocated to both equity and fixed income strategies, active ETFs have clearly moved beyond niche status to become a mainstream investment option for a diverse range of investors seeking professional management in an efficient wrapper.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-rise-of-active-etfs-in-a-bull-market-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-rise-of-active-etfs-in-a-bull-market-.html&text=The+Rise+of+Active+ETFs+in+a+Bull+market.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-rise-of-active-etfs-in-a-bull-market-.html","enabled":true},{"name":"email","url":"?subject=The Rise of Active ETFs in a Bull market. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-rise-of-active-etfs-in-a-bull-market-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Rise+of+Active+ETFs+in+a+Bull+market.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-rise-of-active-etfs-in-a-bull-market-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}