Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 17, 2021

PMI data hint at rising numbers of staff shortages

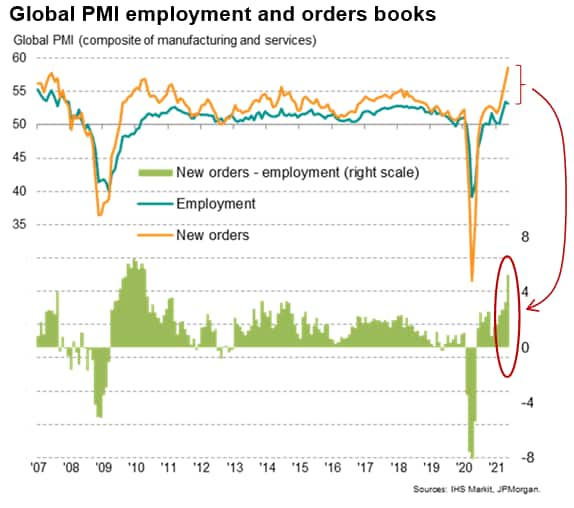

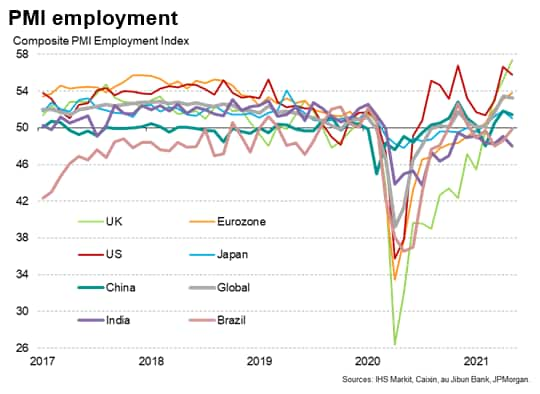

IHS Markit's PMI business surveys showed the economic recovery gaining momentum in May as output growth accelerated to the fastest for 15 years. The expansion was driven by the largest surge in demand for goods and services recorded by the survey since 2006. However, the survey also hinted at employment growth being curbed by short-term difficulties in filling job vacancies, which helped cause global employment growth to slow.

With policymakers concerned that the recent marked rise in industrial prices could spill over to higher wage growth, such staff shortages are a concern as they can improve employees' wage bargaining power, and as such will need to be monitored carefully in the coming months, especially in the US where the signs of labour shortages are most widespread.

New orders boom but jobs growth wanes

Although growth of new orders accelerated globally in May to reach the highest since 2006, employment growth slowed marginally compared to April's 14-year peak. This divergence meant global employment growth lagged demand growth to the greatest extent since 2010.

While the scale of the divergence itself is therefore not unprecedented, with a similar discrepancy seen in the immediate recovery from the global financial crisis recession, the slowing of jobs growth while new orders are accelerating is unusual in this context, notably given the speed with which demand is currently growing.

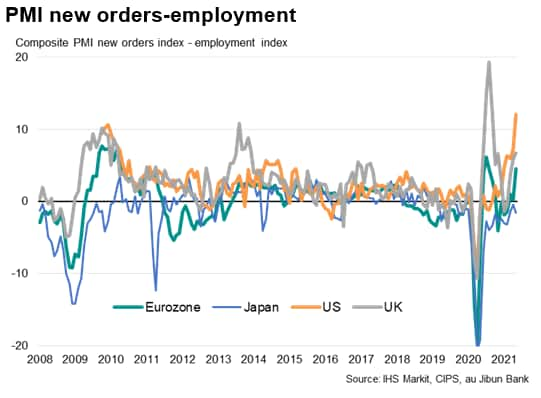

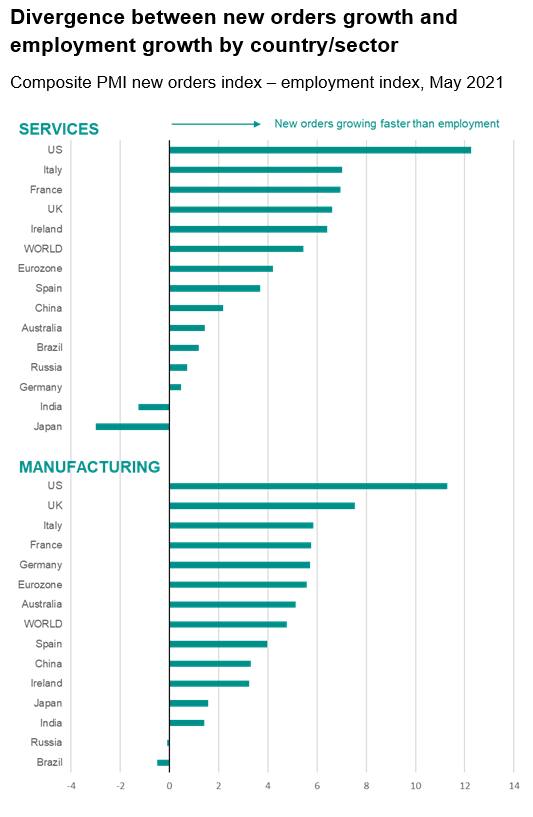

Looking further into the data, sluggish jobs growth relative to new orders growth is by far the most evident in the US, followed by the UK, France and Italy. Ireland and Spain also report a marked weakness of jobs growth relative to new orders, but the divergence is less notable in China, Australia and Brazil, while in Japan and (to a lesser extent) India, jobs growth exceeded new orders growth.

The US not only saw jobs growth lag demand to the greatest extent of all major economies, but the divergence was also the greatest recorded since data were first available in 2009.

Rising labour shortages

Analysis of the anecdotal evidence provided by responding companies showed a rising incidence of firms struggling to fill vacancies, notably in the US but also in the UK.

The lack of available labour seems counterintuitive, given the unprecedented drop in global employment seen at the height of the COVID-19 pandemic. However, hiring problems potentially reflect short-term difficulties in finding suitable staff to fill positions given factors such as virus-related travel restrictions and concerns over potential infection in jobs requiring face-to-face contact.

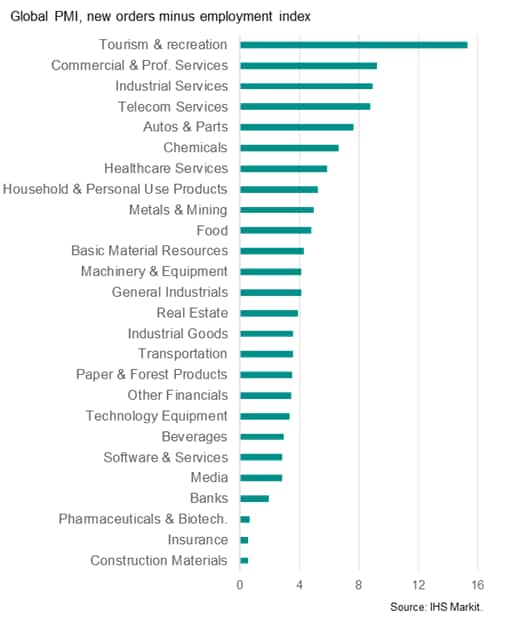

In this light, it is therefore perhaps not surprising to see that the apparent shortage of labour is greatest for the tourism & recreation sector globally, and by some margin especially as this sector was the second-fastest growing part of the global economy in May, beaten only by real estate.

Other sectors reporting a notable shortfall of employment relative to new orders growth included commercial & professional services, industrial services and telecom services.

However, labour shortfalls were not confined to services, with auto makers and chemical producers among the worst-affected sectors gauged by the divergence between employment and order book growth.

In fact, over the past year, it is the manufacturing sector that has reported the largest shortfall of hiring relative to demand than services, though it is the latter which is now seeing the highest incidence of such problems as the global economic recovery broadens out from manufacturing to services. Global PMI data showed services growth overtaking that of manufacturing in April and May as Covid-19 lockdown measures eased.

Global sector PMI data and national PMI sub-index are available on subscription from IHS Markit. Contact economics@ihsmarkit.com for further information.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-hint-at-rising-numbers-of-staff-shortages-Jun21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-hint-at-rising-numbers-of-staff-shortages-Jun21.html&text=PMI+data+hint+at+rising+numbers+of+staff+shortages+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-hint-at-rising-numbers-of-staff-shortages-Jun21.html","enabled":true},{"name":"email","url":"?subject=PMI data hint at rising numbers of staff shortages | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-hint-at-rising-numbers-of-staff-shortages-Jun21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+hint+at+rising+numbers+of+staff+shortages+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-hint-at-rising-numbers-of-staff-shortages-Jun21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}