Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2025

Decline in global trade driven by manufacturing in July

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade conditions deteriorated again at the start of the third quarter of 2025. Data broken down by sector signalled another broad-based reduction in export orders, led this time by the goods-producing sector.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, fell from 49.1 in June to 48.5 in July. Posting below the 50.0 neutral mark for a fourth straight month, the latest reading indicated another contraction in trade activity. Moreover, the pace of decline was among the fastest recorded since the start of 2024.

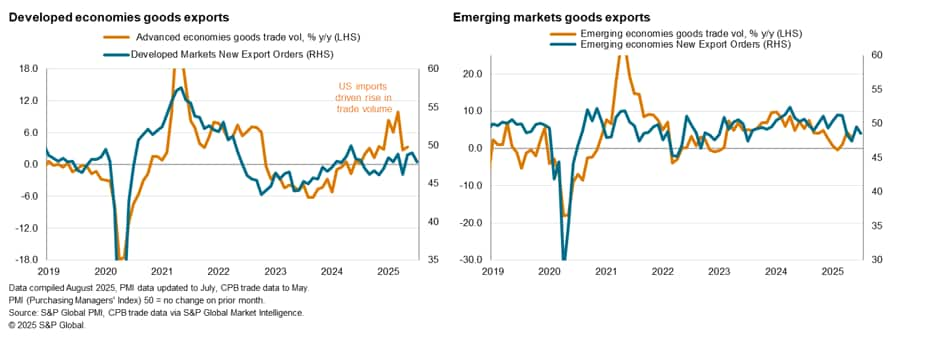

Steeper reduction in manufacturing exports

The downturn in export orders was led by the manufacturing sector in July, taking over from services. July's downturn also marked the first acceleration in the rate of decline in three months. The reduction in goods exports occurred alongside renewed drops in output and overall new orders across the sector, with the latest manufacturing PMI data reflecting the fading impact of the recent front-running of US tariffs, as well as worsening views on the impact of tariffs on global trade and underlying economic conditions. This was evident via the reduction of manufacturing inventories in the US following two strong months of stock building ahead of the original tariff deadline of July 9th. Reduced stock building in the US was accompanied not only by a drop in exports in Asia and the Eurozone, but slower US manufacturing output growth.

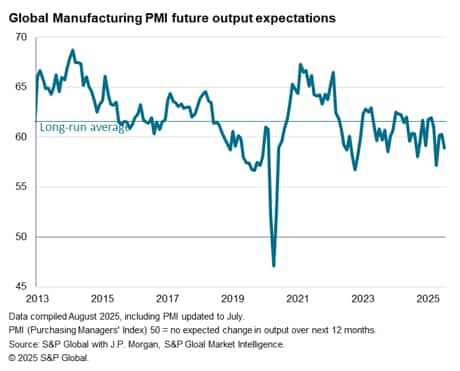

Turning to business sentiment, manufacturers' confidence likewise eased since June, which alongside falling factory sales point to subdued conditions in the goods-producing sector in the coming months. When analysing the number of mentions of 'uncertainty' among goods producers globally, remain elevated at over four times of the historical average. It is worth noting the latest data were collected ahead of several trade agreements announced around the August 1st deadline, although these are still mired in uncertainty. Even if the trade agreements help to provider some clarity regarding trade policy, the substantial front-loading of goods orders in the first half of 2025 may still weigh on output and trade activity in the latter half of 2025.

Services exports meanwhile contracted for the fourth month in a row in July. That said, the rate of contraction eased to the softest seen over this period and was only marginal. While tariff-related uncertainty and disruption also impacted services trade in July, the broader picture was one of improving service sector conditions, with solid growth in overall new business driving the fastest expansion in services activity in the year-to-date.

Detailed sector PMI data revealed divergent trends, with export growth dominated by service-related sectors, led by the insurance, software & services and banking sectors. In contrast, the forestry & paper products, resources and metals & mining sectors recorded especially sharp downturns in export orders in July.

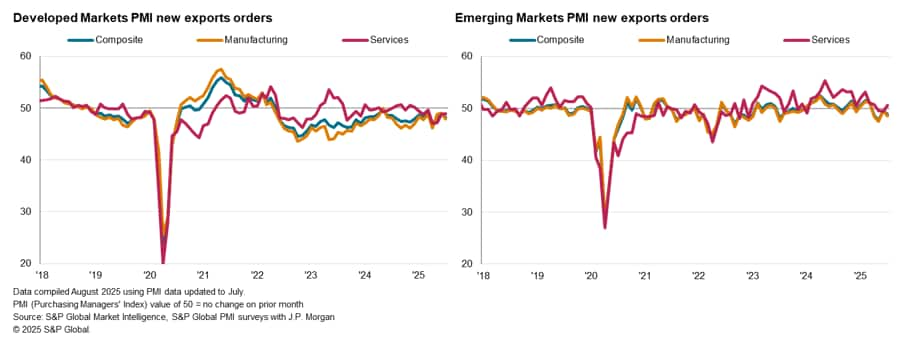

Reduction in trade activity accelerates across both developed and emerging markets

Regionally, the contraction in new export business remained broad-based in July. Moreover, rates of reduction accelerated across both developed and emerging markets after having eased in June.

Developed markets continued to record a slightly sharper rate of contraction than that seen across emerging markets. The pace at which export business for the former declined was the quickest since April, driven by a steeper drop in export sales across the goods-producing sector. The service sector meanwhile recorded the softest decline in export orders since March.

Meanwhile, export business across emerging markets fell for the fourth successive month, which was the longest streak recorded since the start of 2023. In contrast to the broad-based decline seen across developed economies, the reduction was centred on the manufacturing sector, reflecting the impact of US tariffs on goods.

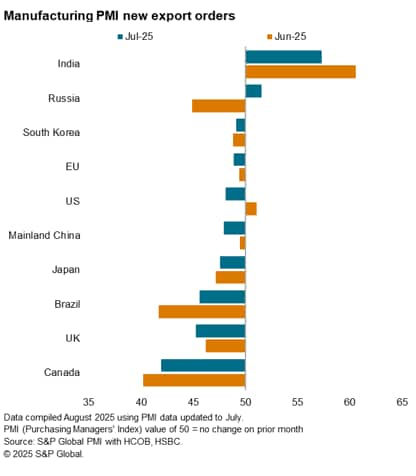

India and Russia record growth in exports amidst global decline

The number of top ten trading economies reporting higher goods exports remained at just two in July, but with changes in the mix. India retained the top position, leading export growth by a wide margin once again in July. Although the rate of expansion eased since June, it was nevertheless among the best seen in over 14 years amid a strengthening of overall Indian manufacturing sector conditions. Russia saw a renewed increase in export sales, which took over from the US as the only other economy recording higher goods exports in July. While modest, the latest rise in Russian goods exports was the first in five months and the quickest since last December.

In contrast, Canada saw another steep downturn in goods exports as tariffs continue to cast a shadow on the goods producing sector. The UK also recorded a strong reduction in export orders, though the latest decline had been among the least pronounced since the start of the year. Meanwhile, Brazil and Japan both saw softer declines in goods exports.

The US and mainland China recorded modest reductions in goods trade, the latter seeing the pace of export contraction accelerating from June as stock building activity faded. Finally, marginal declines in goods trade were seen in the EU and South Korea.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecline-in-global-trade-driven-by-manufacturing-in-july-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecline-in-global-trade-driven-by-manufacturing-in-july-Aug25.html&text=Decline+in+global+trade+driven+by+manufacturing+in+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecline-in-global-trade-driven-by-manufacturing-in-july-Aug25.html","enabled":true},{"name":"email","url":"?subject=Decline in global trade driven by manufacturing in July | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecline-in-global-trade-driven-by-manufacturing-in-july-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Decline+in+global+trade+driven+by+manufacturing+in+July+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdecline-in-global-trade-driven-by-manufacturing-in-july-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}