Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 17, 2025

Flash US PMI signals slower business growth in December as prices spike higher

US business activity continued to expand in December, according to early 'flash' PMI data, though the rate of growth dropped to the weakest recorded for six months.

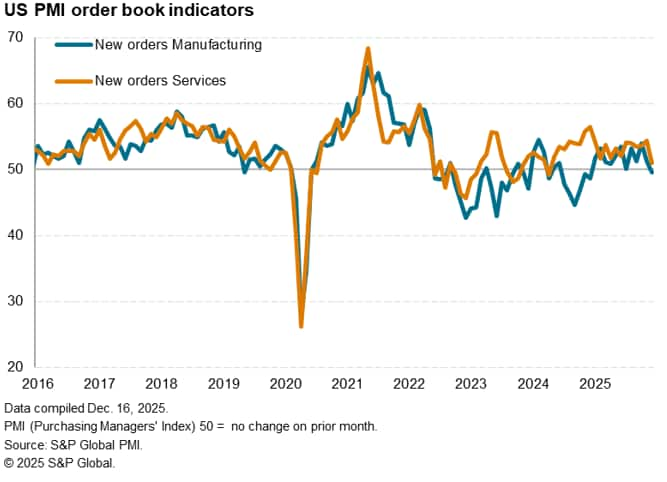

The slowdown was accompanied by the smallest rise in new business inflows recorded for 20 months. Demand for services grew only modestly, rising at a sharply reduced rate, and new orders for goods fell for the first time in a year.

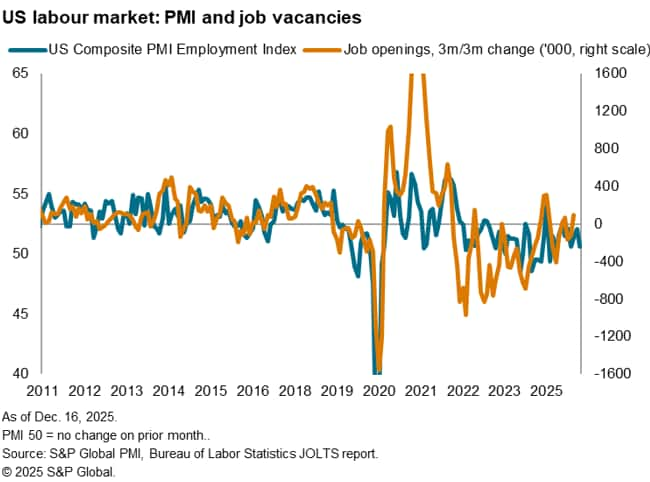

The survey also saw a slightly pull-back in business confidence in the year ahead, in turn contributing to a softening of employment growth to result in only a very modest increase in staffing numbers, notably in the services economy.

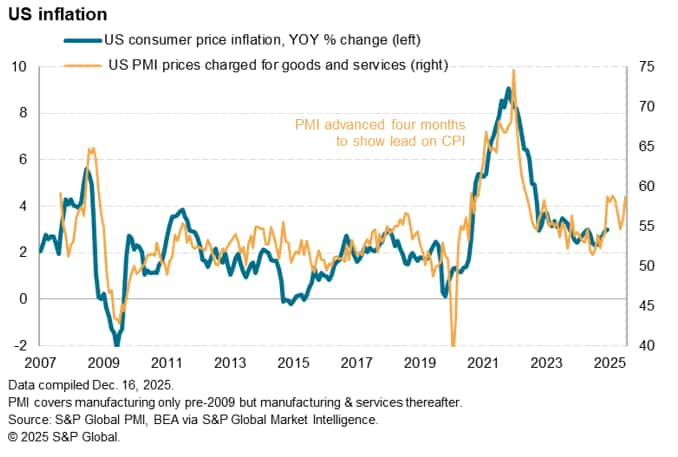

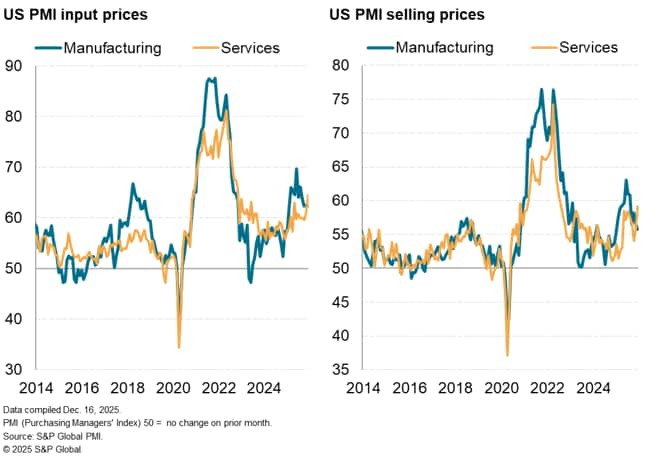

Price pressures meanwhile moved sharply higher, with average selling prices rising at one of the steepest rates seen since mid-2022 as firms passed on the steepest rise in costs recorded for just over three years, in turn widely blamed on tariffs.

Strong fourth quarter ends on softer note

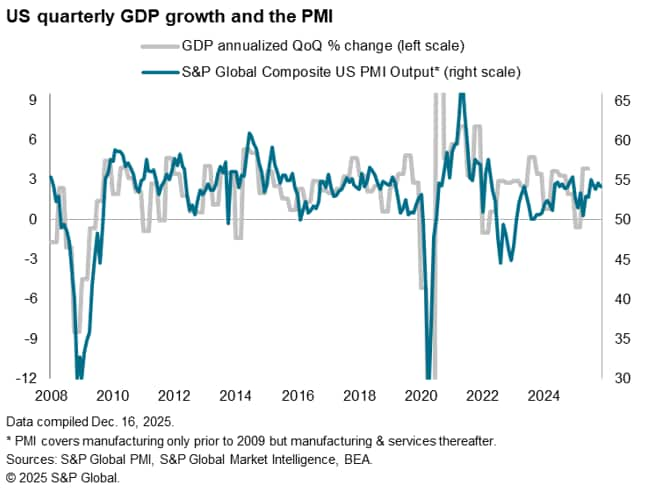

The headline S&P Global US PMI Composite Output Index fell to 53.0 in December from 54.2 in November, according to the 'flash' reading (based on about 85% of usual survey responses). The latest reading is the lowest since June, though continues to indicate robust economic growth. Output has now grown continually for 35 months.

Similar rates of output growth were recorded across both manufacturing and services in December, although growth rates slowed to three- and six- month lows respectively in response to cooler demand conditions. Manufacturing new orders fell, albeit only modestly, for the first time for a year, while inflows of new work in the service sector slipped to a 20-month low. Measured overall, new orders consequently rose only modestly in December to register the smallest increase since orders fell slightly back in April 2024.

The flash data therefore suggest that, although the survey points to annualized GDP growth of about 2.5% over the fourth quarter, growth has now slowed for two months and, with sales growth waning especially sharply in the lead up to the holiday season, growth may soften further as we head into 2026.

Hiring close to stalling

Employment growth also worsened in December. The marginal rise in jobs reported was the lowest since September and the second-weakest recorded over the past eight months. Although jobs growth edged up to the highest for four months in manufacturing, service sector employment came close to stalling, with firms in the sector reporting the smallest net gain to payrolls since April.

Job growth was commonly constrained principally by concerns over costs, lacklustre demand and uncertainty over the economic outlook, though with some companies also continuing to report labor shortages.

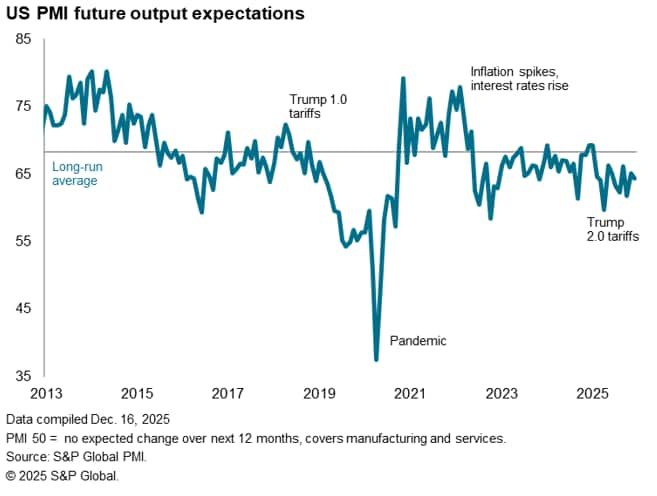

Confidence wanes at year-end

Companies' expectations about output in the year ahead remained positive on balance and above some of the lows seen this year, but deteriorated slightly across both manufacturing and services to fall further below the survey's long-run average. Lower confidence was commonly blamed on price increases, uncertainty and reduced customer spending, often in turn linked to tariffs and other government policies. Pessimism was countered by hopes of greater policy support, including lower interest rates and more government fiscal stimulus, alongside plans for new product development and greater investment in sales and marketing in other firms.

Prices spike higher

Inflationary pressures meanwhile intensified markedly in December. Higher prices are again being widely blamed on tariffs, with an initial impact on manufacturing now increasingly spilling over to services to broaden the affordability problem

Although manufacturers reported a marginal slowing of input cost inflation, the rate of increase remained elevated by standards seen over the past three years. Cost growth meanwhile accelerated in the service sector to the highest for just over three years. The latest rises were most commonly blamed on tariffs alongside rising labor costs.

Increased costs again fed through to higher selling prices, with the overall rate of inflation rising to the steepest since July and one of the highest recorded since the post-pandemic price surge seen in 2022. Although intensifying competition often restricted the ability of manufacturers to pass through cost increases, resulting in the slowest rate of selling price inflation since January, charges in the service sector were hiked to a degree not seen since August 2022.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-slower-business-growth-in-december-as-prices-spike-higher-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-slower-business-growth-in-december-as-prices-spike-higher-Dec25.html&text=Flash+US+PMI+signals+slower+business+growth+in+December+as+prices+spike+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-slower-business-growth-in-december-as-prices-spike-higher-Dec25.html","enabled":true},{"name":"email","url":"?subject=Flash US PMI signals slower business growth in December as prices spike higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-slower-business-growth-in-december-as-prices-spike-higher-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+US+PMI+signals+slower+business+growth+in+December+as+prices+spike+higher+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-slower-business-growth-in-december-as-prices-spike-higher-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}