Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 06, 2025

Global PMI rises in July to highest in year to date, but future expectations slip lower

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - signalled a third successive month of accelerating business activity in July, taking growth to its highest in the year-to-date.

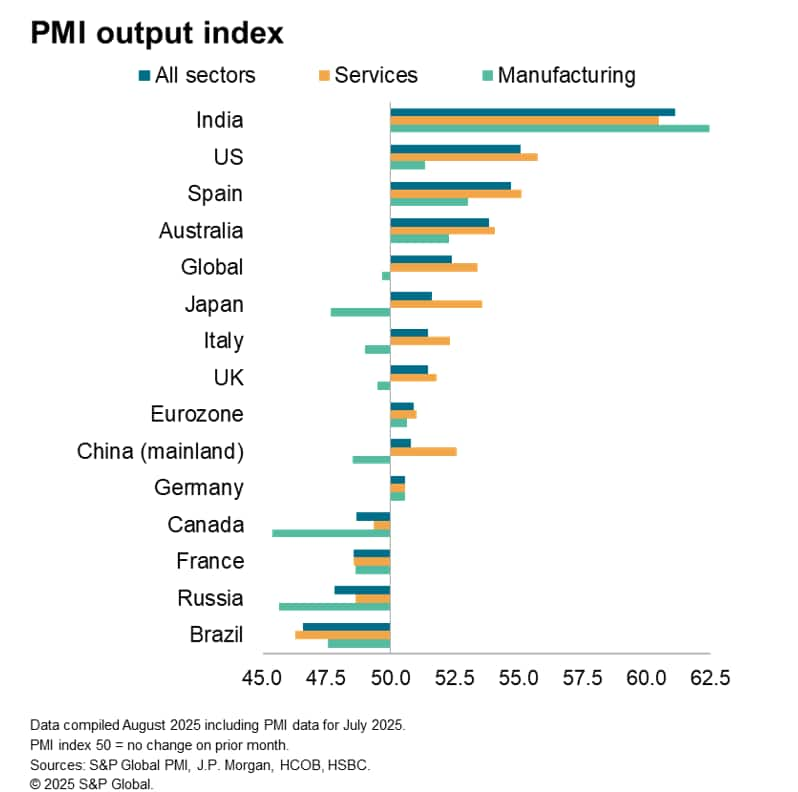

Growth was again led by India, followed by the US, but many other economies reported stronger services expansions, often offsetting manufacturing weakness, driving growth higher in Australia, the eurozone and Japan. Overall growth slowed in mainland China, however, reflecting factory malaise, and notable downturns were recorded in Brazil, Russia and Canada, pointing to an unbalanced sectoral and geographical picture of economic growth at the start of the third quarter.

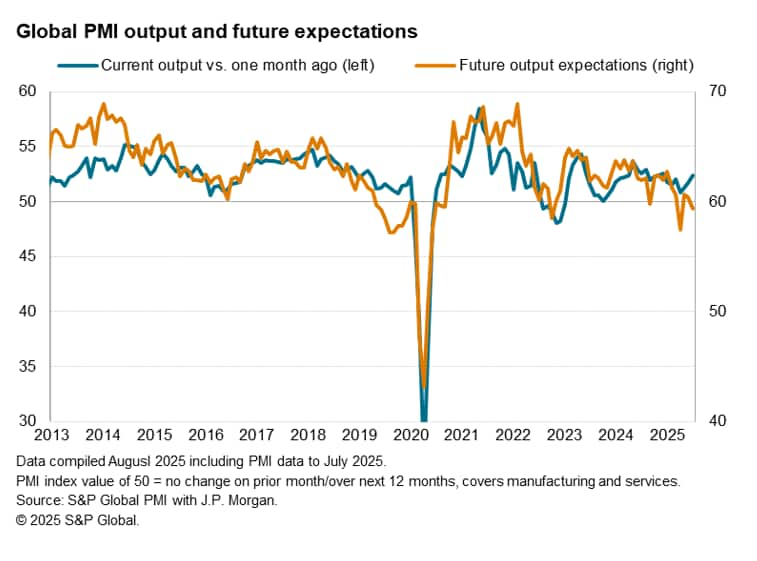

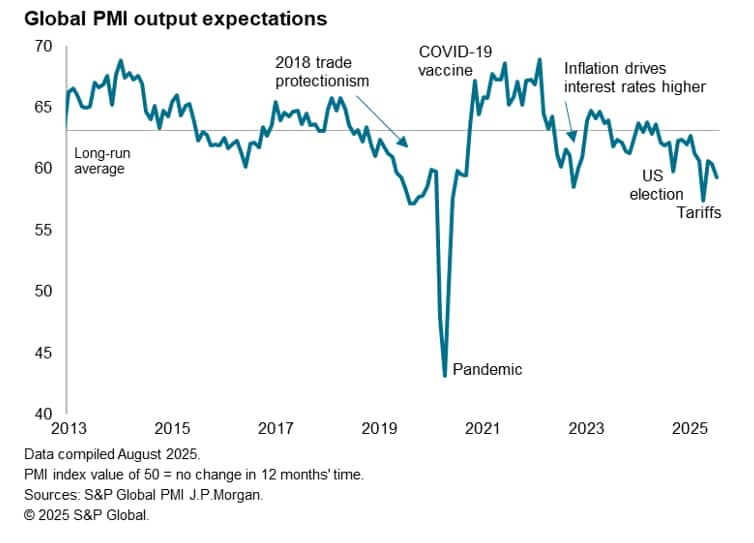

Furthermore, despite output growth accelerating globally, worldwide business confidence in the year-ahead outlook deteriorated in July to one of the gloomiest seen this side of the pandemic. Worsening sentiment, often tied to geopolitical concerns and sluggish demand, led to a slower rate of hiring globally in July.

Global PMI at highest so far this year

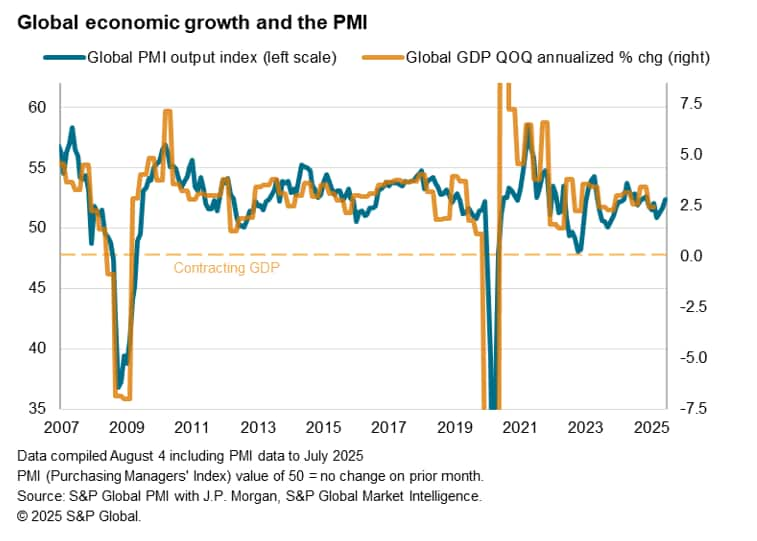

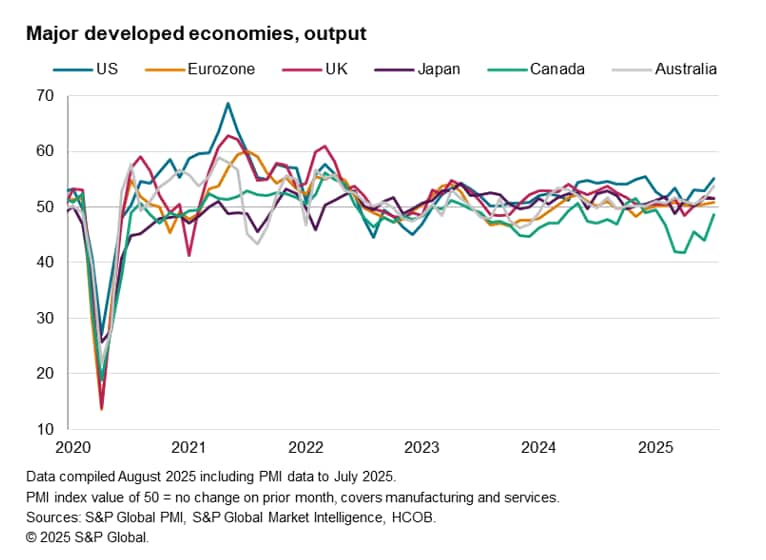

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity expanded at an increased pace for a third successive month in July, the rate of growth accelerating to the fastest so far this year. The J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, rose from 51.7 in June to 52.4 in July.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.7% at the start of the third quarter after a 2.0% expansion signalled for the second quarter. This compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic.

New orders growth also picked up globally, to the highest for four months, and backlogs of work edged higher.

The survey data therefore suggested that the global expansion has picked up momentum from the low point reached in April during heightened uncertainty caused by various US tariff announcements.

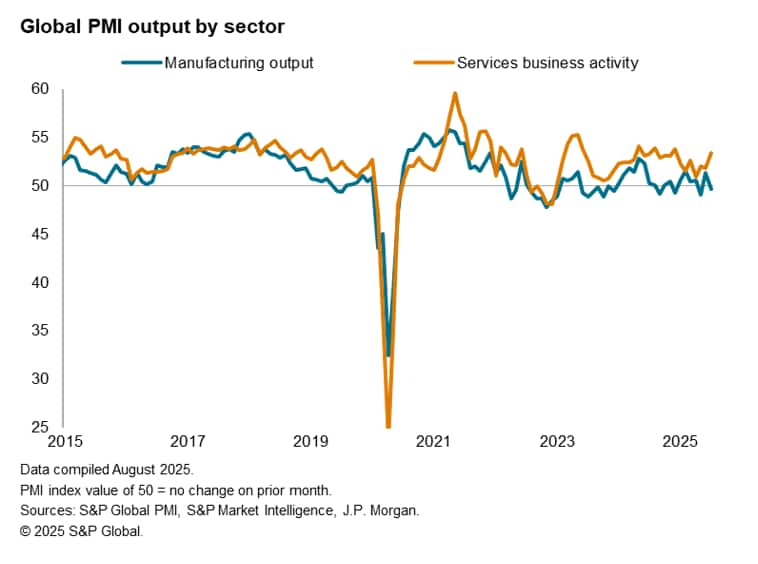

The improved rate of expansion in July was fuelled by the service sector, which expanded globally at a rate not beaten since last December. However, manufacturing output fell back into decline, after having risen sharply in June, dropping for only the second time this year. The production decline in part reflected some pay back after tariff-related inventory building in prior months.

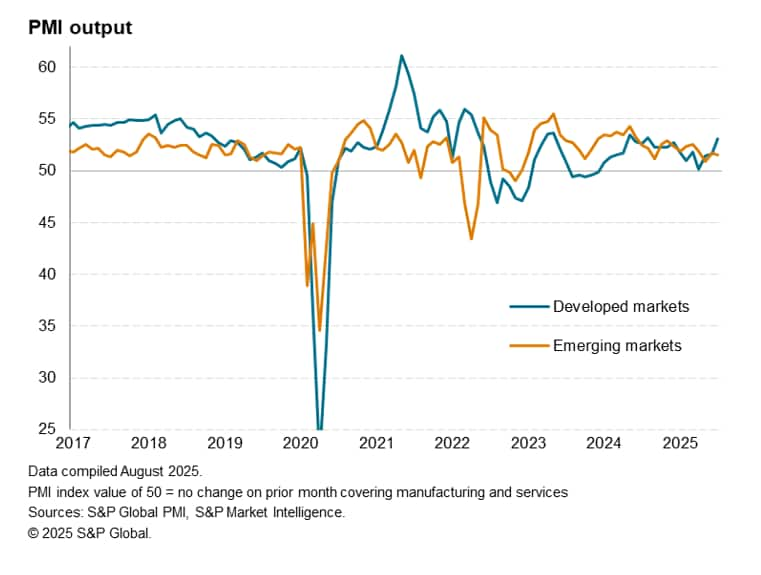

Developed world drives expansion

Developed world growth accelerated to the sharpest since August 2024, hitting one of the strongest rates seen this side of the pandemic, despite a drop in manufacturing output.

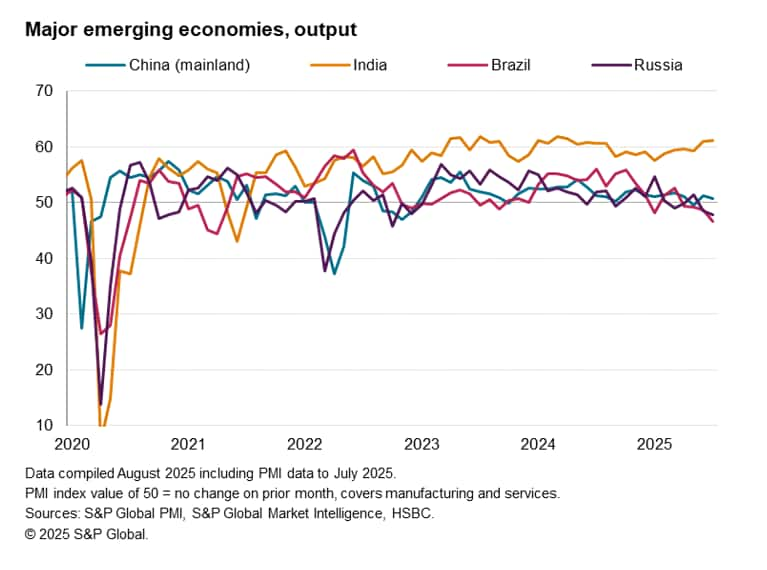

In contrast, emerging market growth dipped slightly in July, remaining above the recent low seen in May but nevertheless signalling one of the weakest expansions seen since the pandemic. A drop in emerging market manufacturing output countered faster service growth.

US leads developed world growth

Of the developed economies, the US reported the fastest output growth, its services sector powering the economy's expansion to its strongest so far this year and countering a slowdown in manufacturing.

Growth in Australia surged to its highest for over three years as companies shrugged off uncertainty, notably in the service sector, with growth in Japan likewise ticking up to its highest since February thanks to an improved service sector performance.

While the service sector also helped the UK expand, offsetting a factory decline, the rate of growth dipped lower but remained above recent lows.

Robust and accelerating growth in Spain, accompanied by improved expansions in Italy and Germany, meanwhile helped push the eurozone's growth rate up to the second fastest seen over the past 11 months, albeit with a downturn in France acting as an increased drag on the region.

Canada's downturn meanwhile moderated to its weakest since January amid softer falls in both manufacturing and service sector output.

India bucks emerging market slowdown

Looking at the major emerging markets, India bucked a broader trend of deterioration. Improved growth in terms of both goods and services in fact meant India enjoyed the sharpest upturn for 15 months and one its best performances seen over the past 15 years.

In contrast, signs of mounting economic stress were meanwhile seen in Russia and Brazil, where output fell at the steepest rates since October 2022 and April 2021 respectively. In both cases, output fell across manufacturing and services.

Business activity in mainland China meanwhile expanded for a second months after May's brief decline, but the pace of growth cooled to register the second weakest performance seen over the past ten months. Although mainland China's service sector growth hit a 14-month high, buoyed in part by domestic stimulus, manufacturing output fell for only the third time in the past two years thanks to reduced trade flows resulting from US tariffs.

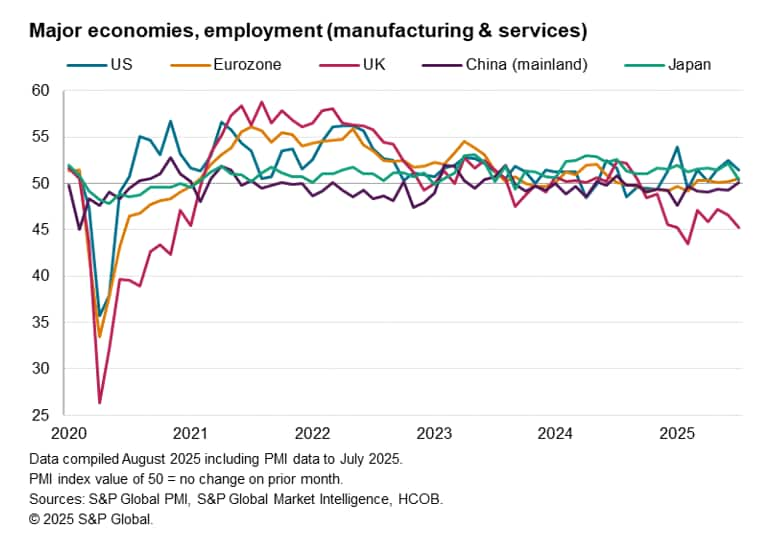

Diverging job markets

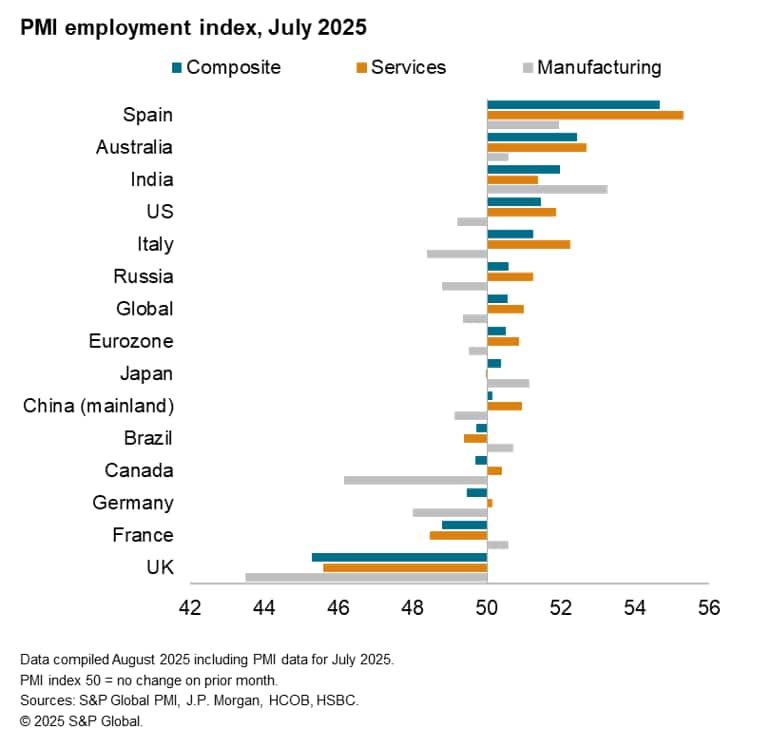

Marked divergences were also seen in terms of employment. Whereas companies in Spain, Australia, India, the US and Italy reported robust hiring, commonly led by recruitment in the service sector, broadly stalled labour markets were seen in Japan and mainland China as well as across the eurozone as whole, the latter thanks to offsetting job cuts in both Germany and France.

A notable outlier was the UK, where employment continued to fall sharply, largely reflecting recent legislation which has raised staffing costs.

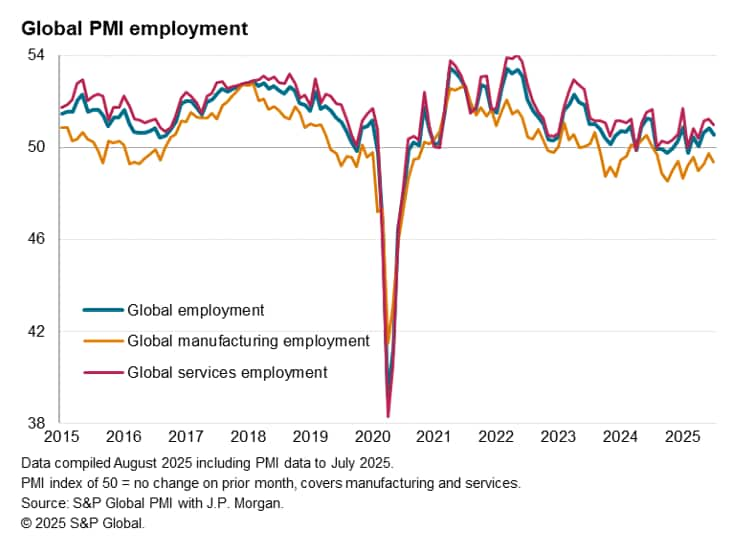

Measured globally, employment rose only modestly in July, the

rate of jobs growth moderating amid weakened service sector hiring

and increased manufacturing job losses.

Outlook optimism falls further

The reduced rate of job growth reflected the fact that, although global output growth accelerated in July, business confidence in the outlook deteriorated worldwide to one of its lowest levels in recent years. Since the pandemic, only April 2025 (amid the initial US tariff announcements), and October 2022 (during the UK budget crisis and Ukraine/Russia conflict) have seen weaker sentiment.

Companies generally blamed geopolitical uncertainty and US trade protectionism as the most common causes of reduced confidence, exacerbating signs of weakening future demand from customers.

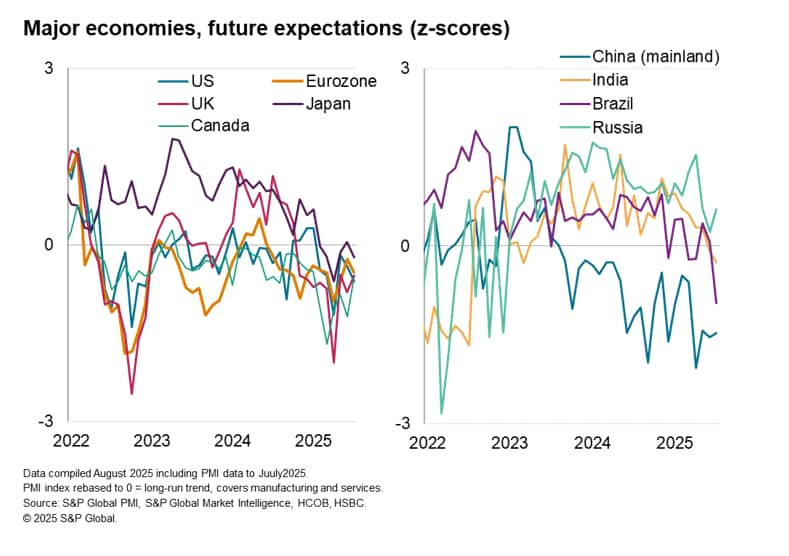

Sentiment fell globally in both manufacturing and services, and fell further below long run averages in the US, eurozone, Japan, Brazil and India. It also remained subdued by long run averages in mainland China, the UK and Canada, albeit rising in each case.

Relative to long-run norms, sentiment among the world's major economies is gloomiest in mainland China followed by Brazil and highest in Russia.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-rises-in-july-to-highest-in-year-to-date-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-rises-in-july-to-highest-in-year-to-date-Aug25.html&text=Global+PMI+rises+in+July+to+highest+in+year+to+date%2c+but+future+expectations+slip+lower+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-rises-in-july-to-highest-in-year-to-date-Aug25.html","enabled":true},{"name":"email","url":"?subject=Global PMI rises in July to highest in year to date, but future expectations slip lower | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-rises-in-july-to-highest-in-year-to-date-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+rises+in+July+to+highest+in+year+to+date%2c+but+future+expectations+slip+lower+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-rises-in-july-to-highest-in-year-to-date-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}