Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2025

Faster expansion of emerging market services contrasts with renewed manufacturing downturn

Emerging market growth continued in July, according to the latest PMI data. This was as incoming new business rose at a faster pace. That said, detailed PMI data revealed a divergence in sector performance, as rising services activity contrasted with a renewed slowdown in the goods-producing sector.

The latest data pointed to the fading of front-loading activity despite an extension of the tariff deadline previously to the start of August. This was evident via export performance as well as pricing power by sector, which reflected a weakening of manufacturing sector conditions. Additionally, optimism levels among emerging market firms eased in the latest survey period to be among the lowest since the pandemic, providing mixed signals for output performance in the coming months.

Emerging markets expansion continues in July

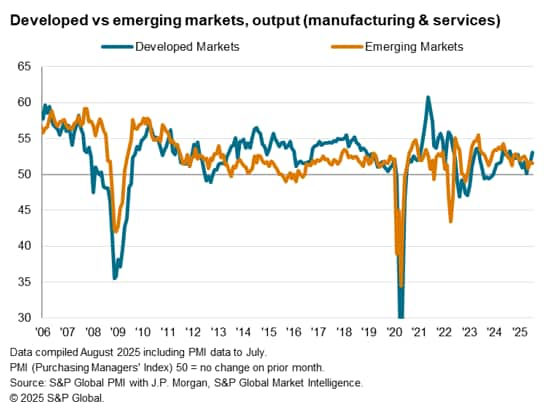

The PMI surveys compiled globally by S&P Global indicated that emerging markets further expanded at the start of the third quarter, extending the sequence of growth to just over two-and-a-half years. The GDP-weighted Emerging Market PMI Output Index posted 51.6 in July, little-changed form 51.7 in June. The rate of expansion was again below the year-to-date average and was modest overall.

The latest easing of growth pace was exclusive to emerging markets as developed economies' output growth accelerated in July to the fastest since last August. This was mainly due to stronger service sector growth in developed economies, while the slowdown in manufacturing output was consistent across both regions.

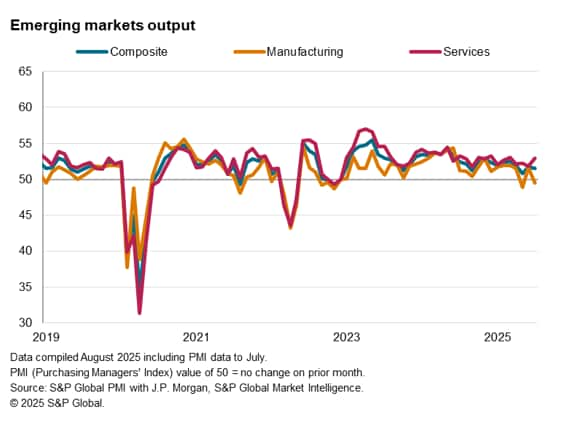

Biggest divergence in sector performance in two years

Faster services activity growth and a renewed slowdown in manufacturing output in emerging markets brought the divergence between the two sectors to its widest in two years at the start of the third quarter.

Although marginal, emerging market manufacturing output declined for only the second time in over two-and-a-half years, the previous time being in May. This was as worldwide manufacturing business conditions deteriorated in July following the fading of the boost from the front-running of orders ahead of higher tariffs. After two successive months of strong inventory building in the US, stocks of purchases contracted in July, with the effects rippling across to both developed and emerging market manufacturers. Weak production was prominent across many Asian economies. Among those posting the sharpest downturn in goods output were Taiwan and South Korea while the contraction in manufacturing production was also steep for Canada, Mexico and Brazil. Among emerging market firms, exports had notably declined only for manufacturers while service providers saw export business rise for the first time in three months.

The latest downturn in manufacturing output had notably taken place even with goods producers working through their existing orders. The fact that output fell despite domestic demand keeping overall goods new orders in growth territory among emerging markets reflected a conscious decision by manufacturers to be conservative with production, opting instead to tap into existing finished goods inventory to fulfil demand.

In contrast, the emerging market service sector expanded at the joint-fastest pace so far this year, matched only by March. The solid growth in services activity was attributed to rising services new business inflows. According to detailed global sector data, there was a sharp improvement in the financial sector, while industrial, healthcare and consumer services also recorded growth.

India remains a bright spot among major emerging market economies

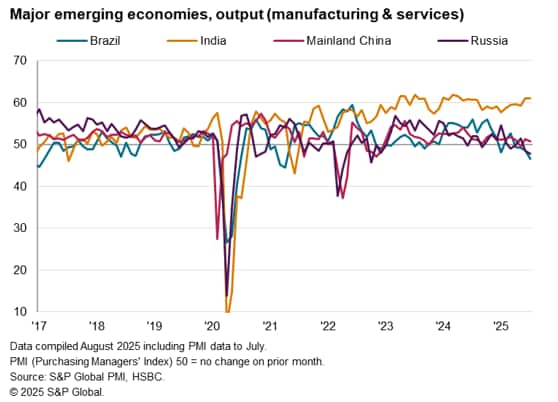

The number of major 'BRIC' emerging market economies posting output expansions remained at two in July, with India remaining at the top spot.

India continued to lead the emerging market expansion by a wide margin as composite output growth unfolded at the fastest pace since April 2024. The manufacturing sector remained the stronger performer, deviating from the global trend of contracting goods production.

This was followed again by mainland China, though output growth had notably eased to a marginal pace in July. Stronger service sector growth failed to offset a renewed downturn in manufacturing production in the latest survey period.

Russia and Brazil meanwhile stayed in contraction, with the rates of decline both picking up from June. The reduction in Russian output was the quickest since October 2022, attributed to worsening performances across both manufacturing and service sectors.

Finally, output in Brazil declined at the fastest rate since April 2021 with an especially sharp fall in services activity in July. Political uncertainty, US tariff policy and challenging economic conditions were reported as factors negatively affecting business activity in July.

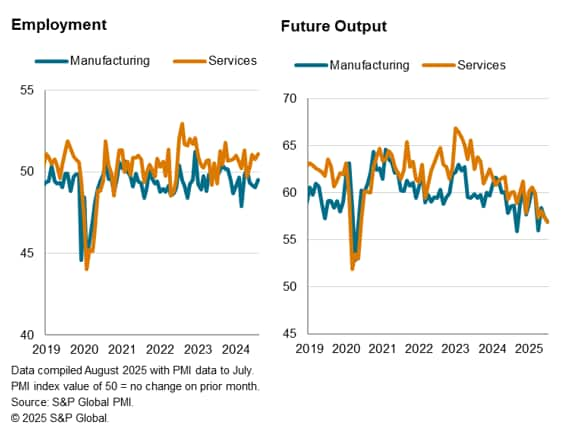

Business confidence wanes in July

While emerging market business activity continued to expand in July, business confidence notably softened to provide evidence for potential slower growth in the months ahead. Overall optimism levels were at the second lowest since May 2020, ranked just behind April (when higher-than-expected US tariffs was initially announced). This came as business confidence fell in both the manufacturing and service sectors. Specifically, among global goods producers, reports of demand or business expectations being adversely affected by "uncertainty" remained elevated by historical standards, even though the severity eased from April's recent peak.

Meanwhile on employment conditions, job shedding had continued in the manufacturing sector amidst the slowdown in production but faster jobs growth among services firms kept overall staffing levels on the rise in emerging markets. The latest employment data further alluded to the likelihood of the divergence in sector performance sustaining in the near-term.

Pricing power differs by sector

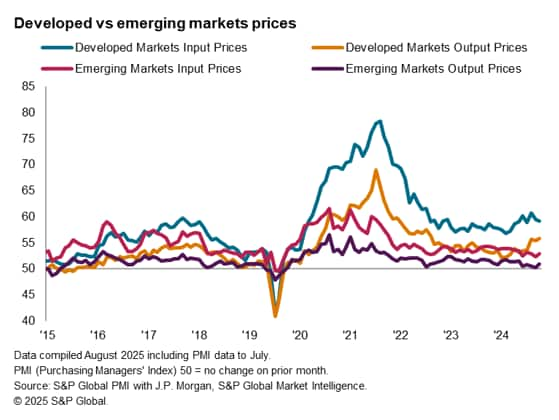

The divergence in sector conditions were further evident via PMI prices data, with services firms showing greater pricing power as compared to their manufacturing counterparts in the face of tariff disruptions.

Average input prices among emerging market firms increased at a faster pace at the start of the third quarter. This was with manufacturing input price inflation rising to the highest level in five months while services cost inflation remained at around the same level as in June.

Despite higher cost inflation, emerging market manufacturers continued to absorb cost increases, and going further by lowering their charges for a third successive month in July. The rate of discounting was again marginal, but that had nevertheless reflected pressure from rising competition and subdued demand.

In contrast, service providers lifted their selling prices at the quickest pace since February as improvements in demand enabled firms to pass on rising costs to clients. This brought overall selling price inflation to the highest level in five months, though the rate of inflation remained below-average to indicate subdued price increases at the start of the second half of the year.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffaster-expansion-of-emerging-market-services-contrasts-with-renewed-manufacturing-downturn-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffaster-expansion-of-emerging-market-services-contrasts-with-renewed-manufacturing-downturn-Aug25.html&text=Faster+expansion+of+emerging+market+services+contrasts+with+renewed+manufacturing+downturn+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffaster-expansion-of-emerging-market-services-contrasts-with-renewed-manufacturing-downturn-Aug25.html","enabled":true},{"name":"email","url":"?subject=Faster expansion of emerging market services contrasts with renewed manufacturing downturn | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffaster-expansion-of-emerging-market-services-contrasts-with-renewed-manufacturing-downturn-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Faster+expansion+of+emerging+market+services+contrasts+with+renewed+manufacturing+downturn+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffaster-expansion-of-emerging-market-services-contrasts-with-renewed-manufacturing-downturn-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}