Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 17, 2021

Asia Pacific trade outlook in 2021

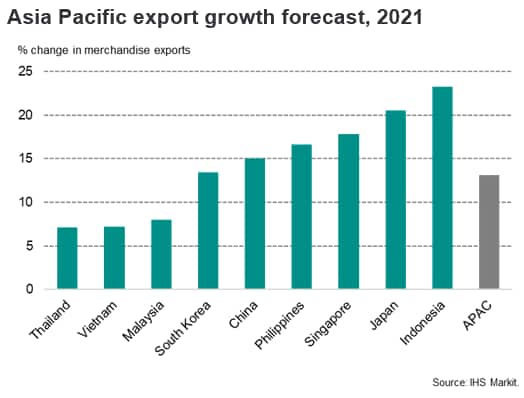

The strong rebound in global economic growth in the first half of 2021 has driven a significant upturn in Asia Pacific merchandise exports. This has further improved the overall Asia Pacific export growth outlook for 2021. Asia Pacific exports are forecast to show buoyant expansion of 13% year on year (y/y) in 2021, after contracting by 1.8% y/y in 2020. IHS Markit estimates that global trade volume contracted by 5.4% in 2020. A recovery is forecast in 2021 and 2022, with global trade volume to recover by 6.0% and 3.7%, respectively.

Key findings

- A strong economic recovery is expected in 2021, with Asia Pacific GDP growth forecast at 6.2% y/y, based on expectations that there will be progressive rollout of COVID-19 vaccines during 2021.

- A key factor underpinning the strong economic rebound in the Asia Pacific region is expected to be buoyant economic growth in China, which is forecast to grow at 8.3% y/y in 2021.

- The export rebound has been reflected in recent trade data from many Asia Pacific economies, helped by base year effects owing to pandemic-related lockdowns in the first half of 2020. For mainland China, merchandise exports rose by 27.9% y/y in May 2021. South Korea's exports have also shown buoyant growth, rising by 45.6% y/y in May.

- In the ASEAN region, Singapore's non-oil domestic merchandise exports have also shown an upturn, rising by 6.0% y/y in April, helped by a 10.9% y/y rise in electronics exports.

- Vietnam's merchandise exports showed buoyant growth in the first four months of 2021, rising by 29.6% y/y, helped by rapid growth of 30.7% y/y for exports of mobile phones and parts.

- Over the medium-term outlook, Asia Pacific exports are expected to grow at a rapid pace, helped by the sustained strong growth of intra-regional trade within Asia Pacific, as China, India, and the Association of Southeast Asian Nations (ASEAN) continue to be among the world's fastest-growing emerging markets.

Global growth and trade rebound

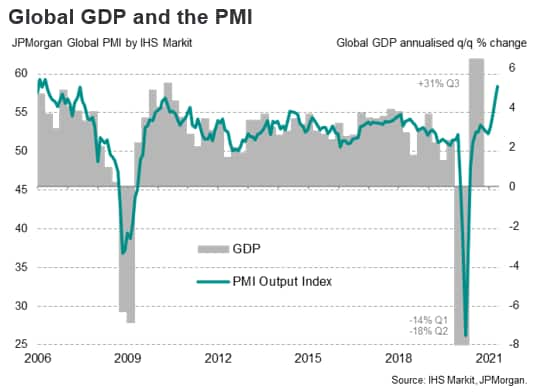

With world GDP forecast to rebound to growth of 5.7% y/y in 2021 after a contraction of 3.5% y/y in 2020, this is expected to provide a boost to the export sectors of many export-driven Asia Pacific economies. The rebound in economic growth in advanced economies such as the United States, the European Union, the United Kingdom and Canada, combined with continued strong economic momentum in China, are linked to the rapid rollout of vaccination programmes during the first half of 2021. This has supported improving Asia Pacific new export orders to key export markets in North America and Europe.

This is expected to support the growth of exports of manufactured goods and commodities through the course of 2021. Asia Pacific merchandise exports are forecast to show a strong rebound of 13% y/y in 2021, after contracting by 1.8% y/y in 2020. IHS Markit estimate that global trade volume contracted by 5.4% in 2020. A recovery is forecast in 2021 and 2022, with global trade volume to recover by 6.0% and 3.7%, respectively.

However, because of ongoing new COVID-19 waves in many Asia Pacific nations in the first half of 2021, international travel restrictions are still expected to remain a major impediment to the recovery of international tourism and travel in the Asia Pacific region during 2021. This is expected to result in a more protracted and gradual recovery path for trade in services for many Asia Pacific economies.

Recovery in Asia Pacific exports

The Asia Pacific region experienced a recession in 2020 owing to the COVID-19 pandemic, with the region's GDP contracting by an estimated 1.1% y/y. Pandemic-related lockdowns and travel bans severely hurt the economies of most Asia Pacific nations during the first half of 2020. However, during the second half of 2020, many Asia Pacific economies recovered significantly in economic momentum. This upturn was driven both by strengthening global export demand as well as the rebound in domestic consumption spending as a result of the easing of pandemic-related restrictions in many countries.

A strong economic recovery is expected in 2021, with Asia Pacific GDP growth forecast at 6.2% y/y, based on expectations that the progressive rollout of COVID-19 vaccines during 2021 will help the gradual recovery of economic activity in many OECD and Asia Pacific economies.

A key factor underpinning the strong economic rebound in the Asia Pacific region is expected to be buoyant economic growth in China, which is forecast to grow at 8.3% y/y in 2021. However, the Asia Pacific recovery is expected to be broad-based, with most major Asia Pacific economies forecast grow rapidly in 2021, albeit the momentum of recovery is being dampened by severe new COVID-19 waves in some countries.

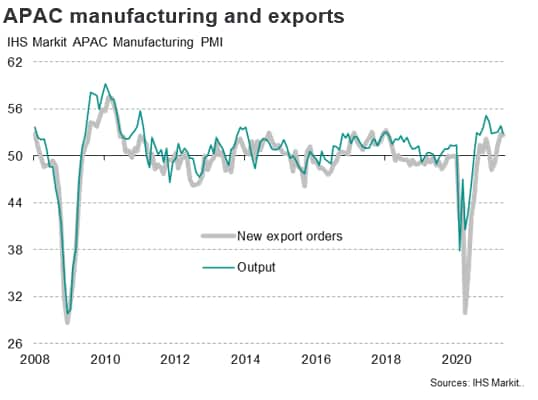

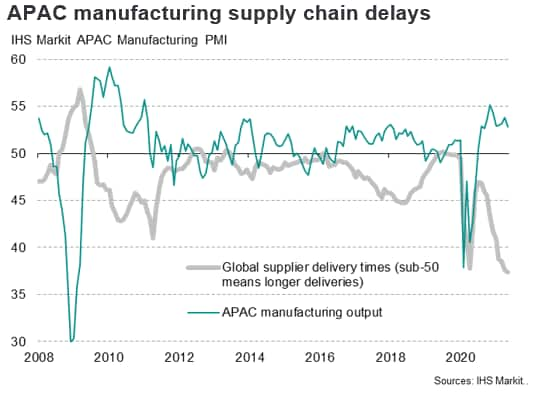

The improving economic momentum in the Asia Pacific region has been reflected by the IHS Markit Asia Pacific PMI survey index of manufacturing output, which has recovered strongly in recent months. The index has signalled the most robust expansion of production in a decade during the first half of 2021, albeit with the rate of expansion cooling in some countries during second quarter 2021 owing to the impact of new COVID-19 waves.

The export rebound has been reflected in recent trade data from many Asia Pacific economies, albeit also reflecting low base year effects from the lockdowns in the first half of 2020.

For mainland China, merchandise exports rose by 27.9% y/y in May 2021. South Korea's exports have also rebounded strongly, rising by 45.6% y/y in May 2021. Taiwan's exports rose by 38.6% y/y in May, the 11th consecutive month of positive export growth, buoyed by strong growth in exports of electronics, chemicals, and plastics.

In the ASEAN region, Singapore's non-oil domestic merchandise exports have also shown an upturn, rising by 6% y/y in April, helped by a 13% y/y rise in electronics exports. Vietnam's merchandise exports showed buoyant growth in the first four months of 2021, rising by 29.6% y/y, helped by rapid growth of 30.7% y/y for exports of mobile phones and parts.

In Australia, merchandise exports rose by 15.9% y/y in April, boosted by buoyant mineral commodities prices, notably for iron ore and coal, two of Australia's largest commodity exports. Despite severe trade measures imposed by mainland China on a wide range of Australian exports during 2020-21, Australian exports to mainland China rose by 11.2% y/y in April, reflecting very high world prices for iron ore and coal.

The recovery of Asia Pacific trade in services is expected to be much slower and protracted than for merchandise exports, owing to ongoing new COVID-19 waves that have hit many Asia Pacific economies during second quarter 2021. International travel restrictions are still expected to remain a major impediment to the recovery of international tourism and business travel for many economies in the Asia Pacific region during 2021. The re-opening of international travel is expected to be more selective in the Asia Pacific region, on a bilateral basis between countries that have implemented widespread vaccination programs.

The path of Asia Pacific export recovery is therefore likely to be uneven across different industry sectors, with manufacturing and commodities exports leading the recovery, while some service sector exports such as the tourism and commercial aviation sectors are expected to have more gradual recovery paths.

Asia Pacific electronics sector exports rebound

The electronics manufacturing industry is an important part of the manufacturing export sector for many Asia Pacific economies, including mainland China, Japan, South Korea, Malaysia, Singapore, the Philippines, Taiwan, Thailand, and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies, with mainland China being an important supplier of intermediate electronics parts for a number of Southeast Asian electronics sectors.

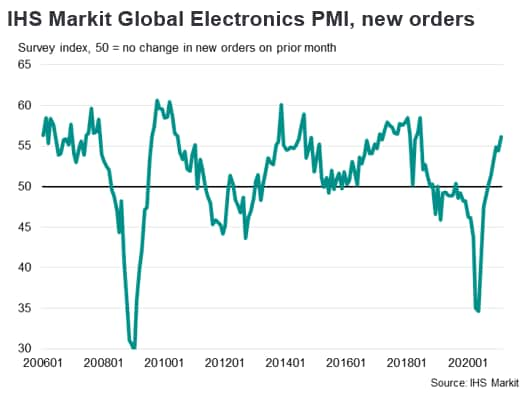

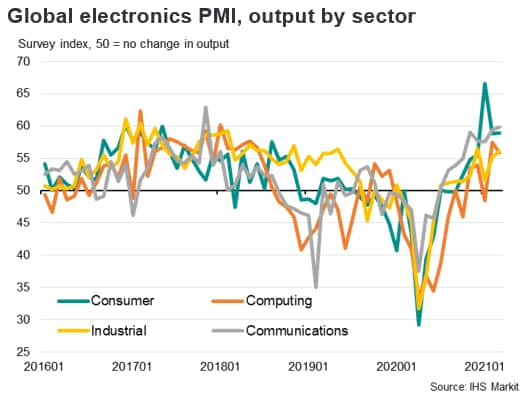

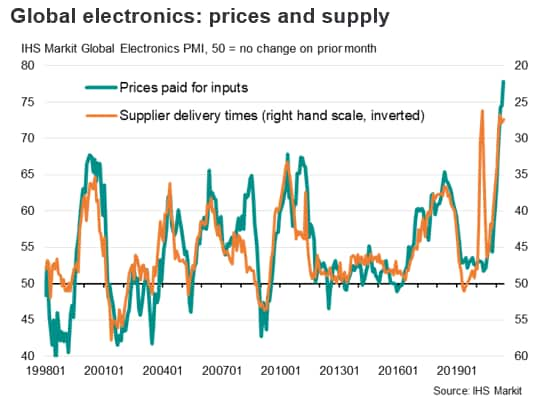

Despite severe disruptions to Asian electronics production and to global demand owing to the pandemic during the first half of 2020, the IHS Markit Global Electronics PMI has signalled a very significant rebound since mid-2020. The latest IHS Markit Global Electronics Purchasing Managers' Index for May 2021 reached the highest level recorded in 23 years, boosted by buoyant demand in key markets. Rebounding consumer spending and industrial production in key economies, notably the United States, mainland China, the European Union, and the United Kingdom, is helping to drive demand for a wide range of electronics products.

The IHS Markit Global Electronics PMI new orders index rose from a low of 35.0 in May 2020 to a level of 61.9 in April 2021, rising further to 63.3 in May 2021. New orders in May showed the fastest pace of expansion since May 2004 and were the fourth-fastest pace of expansion since the survey series began 23 years ago.

The South Korean Ministry of Trade, Industry and Energy announced that South Korea's total exports rose at a very rapid pace of 45.6% y/y in May, following an increase of 41% y/y in April. Exports of semiconductors rose by 24.5% y/y in May, the 11th consecutive month of expansion. Semiconductors exports have been helped by stronger global demand for memory chips for mobile phones and for data centres. Memory chip prices have been rising owing to the prolonged global supply shortage.

Singapore's domestically manufactured electronics exports rose by 10.9% y/y in April, after expanding at a pace of 24.4% y/y in March 2021. In April, electronics exports to the European Union were up 8.5% y/y, while electronics exports to South Korea were up by 13% y/y.

In Vietnam, exports of computers, electrical equipment and parts rose by 31% y/y in the first quarter of 2021, as global demand for computer equipment surged owing to the pandemic and the shift towards remote working by workers worldwide. Exports of these products to the United States were buoyant, rising by 46% y/y, while exports to the European Union rose by 39% y/y. Exports of mobile phones and other telephone equipment soared by 12% y/y, with exports of mobile phones and components to China rising by 63% y/y.

In Malaysia, exports of electrical and electronic products, which accounted for 34.8% of total merchandise exports, have been extremely strong, up 42% y/y in April, after rising by 47% y/y in March.

Asia Pacific supply chain and shipping disruptions

The strong growth in Asian exports to the United States and Western Europe during the first half of 2021 has created bottlenecks for shipping owing to shortages of containers, resulting in soaring freight rates on key Asian routes. Average Asia-US East Coast container freight rates on short-term contracts are up 56% from May 2020. The problems for the shipping industry have been further compounded by port congestion in Southern Chinese ports, reflecting major shipping delays at Yantian port since late May 2021 owing to the impact of stringent health measures as a result of a COVID-19 cluster outbreak. Yantian International Container Terminal is one of China's largest container ports. With peak shipping season looming for Christmas retail orders from the United States and Europe, shipping bottlenecks and freight rates in Asia are likely to stay at elevated levels during the third quarter of 2021.

Indian ports also faced disruption during May 2021 owing to the impact of the large new COVID-19 wave that hit the nation, resulting in some temporary port closures as well as delays to shipments because of health safety measures.

In the electronics industry, the strength of global electronics demand is continuing to exacerbate semiconductors shortages for some manufacturing industries, notably the global automotive sector. Supply chain disruptions to semiconductors production have also impacted on the situation. The new COVID-19 wave in Taiwan has increased risks of potential supply chain disruptions at semiconductors plants impacted by Covid clusters. Meanwhile the latest IHS Markit Global Electronics PMI survey shows evidence of sharp increases in electronics industry input prices as well as output prices, mainly reflecting shortages of essential raw materials.

Asia Pacific trade outlook

The central case global economic scenario for 2021 is positive, with the world economy forecast to show improving momentum through the course of 2021 as COVID-19 vaccination programmes are rolled out. Many of the world's largest economies, including the United States, the European Union, the United Kingdom, and China, have been rapidly progressing with vaccination programmes during the first half of 2021. This has allowed domestic demand to strengthen in these economies, with gradual easing of lockdown conditions in markets in this grouping that are currently experiencing significant new waves of COVID-19 cases. Consequently, this should help to support the strong rebound in world merchandise exports during 2021, which are forecast to grow at a pace of 14.7% y/y following a severe contraction of 7.5% y/y in 2020.

With many of the East Asian economies, such as China, Japan, and South Korea, having large manufacturing export sectors, the upturn in electronics exports is helping to underpin the rebound of manufacturing exports. This is also supporting demand for industrial raw materials from Asia Pacific commodity-exporting nations such as Australia and Indonesia.

However, the recovery of Asia Pacific trade in services is expected to be delayed and protracted, as international travel restrictions continue to constrain any early recovery in exports of tourism and commercial aviation, which are an important component of total services exports for many Asia Pacific economies.

Over the medium-term outlook, Asia Pacific exports are expected to grow at a rapid pace, helped by the sustained strong growth of intra-regional trade within Asia Pacific, as China, India, and ASEAN continue to be among the world's fastest-growing emerging markets.

The rapid growth of Asia Pacific exports is also expected to be strengthened by the regional trade liberalisation architecture. A wide range of bilateral and multilateral trade liberalisation initiatives have either been implemented or are planned in Asia Pacific. This includes the large recent Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Regional Comprehensive Economic Partnership (RCEP) multilateral trade agreements and an increasing number of major bilateral free trade agreements (FTAs) such as the recent EU-Vietnam FTA and the Indonesia-Australia Comprehensive Economic Partnership Agreement.

However, regional geopolitical tensions do pose risks to bilateral trade development among some Asia Pacific nations. The recent China-India border clash has impacted bilateral trade and investment flows, while the China-Australia trade war has hit Australian exports of a wide range of commodities to China. Nevertheless, the long-term outlook for Asia Pacific trade growth remains very positive, boosted by the continued rapid long-term growth forecast for the Asia Pacific region over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasia-pacific-trade-outlook-in-2021-Jun21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasia-pacific-trade-outlook-in-2021-Jun21.html&text=Asia+Pacific+trade+outlook+in+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasia-pacific-trade-outlook-in-2021-Jun21.html","enabled":true},{"name":"email","url":"?subject=Asia Pacific trade outlook in 2021 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasia-pacific-trade-outlook-in-2021-Jun21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+Pacific+trade+outlook+in+2021+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasia-pacific-trade-outlook-in-2021-Jun21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}