Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 27, 2025

Defending Opportunities: The Rise of European Defense ETFs.

A rise in demand for European defense ETFs is being fueled by increasingly complex geopolitical tensions.

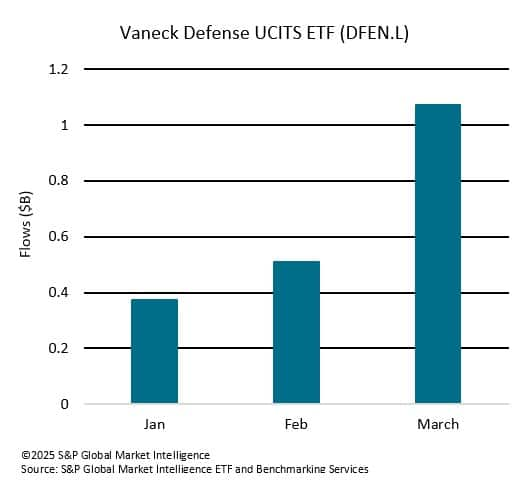

The popularity of European defense exchange-traded funds (ETFs) has surged recently, driven by significant inflows that reflect growing investor interest in the sector. Notably, the WisdomTree Europe Defence UCITS ETF - EUR Acc (WDEF) has attracted $588 million since its launch on March 4, 2025, while the VanEck Defense UCITS ETF (DFEN.L) has seen a staggering $1.9 billion in inflows since the start of the year, with over $1 billion of that amount coming in just March alone. These impressive inflows underscore the increasing recognition of the defense sector's growth potential in light of current geopolitical dynamics.

The Select STOXX Europe Aerospace & Defense ETF (EUAD) has demonstrated impressive momentum in March 2025, experiencing significant inflows and a remarkable 20.6% performance increase for the month. This surge can be largely attributed to the heightened defense spending across Europe, with Germany leading the charge in military investments. The ongoing geopolitical tensions have prompted European nations to prioritize their defense capabilities, fostering an environment ripe for investment in the defense sector. As a result, EUAD has emerged as one of the top-performing equity ETFs, capturing substantial investor interest eager to capitalize on the growth potential within the aerospace and defense industries. This trend reflects a broader recognition of the importance of national security and the strategic positioning of defense companies in a rapidly changing global landscape.

One of the key factors contributing to the heightened demand for European defense stocks is the ongoing conflict in Ukraine. The war has highlighted vulnerabilities in European security and prompted nations across the continent to reassess their defense strategies. As a result, many European countries are ramping up their defense budgets, leading to increased spending on military equipment and technology. This focus on national security has created a favorable environment for defense companies, positioning them as attractive investments for those looking to capitalize on the sector's growth potential.

NATO commitments further amplify this trend. Many European countries are striving to meet NATO's defense spending target of 2% of GDP, which has gained renewed urgency in light of recent global security concerns. As nations work to bolster their military capabilities, they are channelling significant resources into defense spending. This commitment not only strengthens the defense sector but also enhances the attractiveness of European defense stocks to investors.

The steady stream of government contracts secured by European defense companies has also contributed to the growing interest in this sector. With governments prioritizing national security and military readiness, defense firms have been awarded substantial contracts for various projects, ranging from advanced weaponry to cybersecurity solutions. These contracts provide a reliable revenue stream for defense companies, further boosting investor confidence in the sector.

In conclusion, the sudden popularity of European defense ETFs can be attributed to a combination of impressive inflows, geopolitical tensions, NATO commitments, government contracts, and technological advancements. As European nations prioritize defense spending in response to global security concerns, investors are increasingly turning to defense stocks and ETFs as an efficient way to capitalize on this growth opportunity.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefending-opportunities-the-rise-of-european-defense-etfs-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefending-opportunities-the-rise-of-european-defense-etfs-.html&text=Defending+Opportunities%3a+The+Rise+of+European+Defense+ETFs.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefending-opportunities-the-rise-of-european-defense-etfs-.html","enabled":true},{"name":"email","url":"?subject=Defending Opportunities: The Rise of European Defense ETFs. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefending-opportunities-the-rise-of-european-defense-etfs-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Defending+Opportunities%3a+The+Rise+of+European+Defense+ETFs.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdefending-opportunities-the-rise-of-european-defense-etfs-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}