Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 03, 2025

Securities Finance Q1 and March Snapshot 2025

DOWNLOAD FULL REPORT HERE

March revenues continue with year-on-year growth.

- Monthly revenues reach $1,087M

- Exchange Traded Products increase revenues by 108% YoY

- Average fees decline YoY across both Americas and EMEA

- Average balances across All Securities edge closer to $3T

In March, securities lending revenues hit $1,087 million, marking a 3% year-on-year increase. This growth was fueled by heightened market volatility, driven by shifting expectations for the "Magnificent Seven" stocks in the U.S., rising economic risks, and President Trump's announcement of "Liberation Day" trade tariffs. Additionally, ongoing discussions about a potential ceasefire in Ukraine added to the geopolitical uncertainty.

These trends were reflected in the securities lending markets, with revenue growth shifting from U.S. equities to Asian equities and exchange-traded funds (ETFs). Monthly revenues for these asset classes surged by 34% and 108% year-on-year, respectively. Other equity markets also saw year-on-year revenue increases, particularly in American Depository Receipts (ADRs), driven by strong demand for international materials, energy, and software companies. Revenues in this sector climbed to $33.4 million, the highest level in over a year. However, both U.S. and EMEA equity revenues saw declines compared to last year, with significant drops in France and Sweden contributing to the EMEA downturn. In contrast, while U.S. equity revenues fell year-on-year, Canada, Brazil, and Mexico experienced growth.

In the fixed income markets, demand for corporate and government bonds remained robust. Although spreads widened in the corporate bond market due to increased economic risks, revenues rose as balances grew, compensating for a decline in average fees, which fell to 27 basis points—the lowest in two years, continuing a gradual downward trend over the past eighteen months. Since the start of the year, balances have increased by approximately $33 billion.

Government bond revenues also remained strong, growing 6% year-on-year compared to March 2024, with balances reaching $1.26 trillion. Demand for U.S. Treasuries dipped slightly, with average fees declining to 17 basis points, down 1 basis point from February. However, other regions performed better, with Asian government bond revenues up 27% year-on-year and EMEA government bond revenues increasing by 23%.

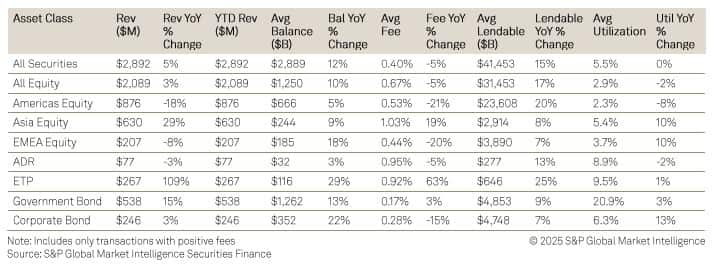

In Q1 2025, markets experienced a notable shift in investor behaviour, leading to a year-on-year increase in securities lending revenues as market volatility intensified. March alone saw securities lending revenues rise to $1,087M, reflecting a 3% YoY increase, with Asian equities and ETFs emerging as standout asset classes, generating impressive revenue growth of 34% and 108% YoY, respectively. This trend was seen throughout the quarter, where total securities lending revenues reached $2,892M, up 5% YoY. The quarterly data underscores how the movement in global investment trends has favourably impacted Asian markets, driving substantial increases in both monthly and quarterly revenues. As we head into Q2, and uncertainty grows, securities lending activity is likely to continue to reflect investor sentiment through the borrowing of thematic ETFs and tariff impacted stocks.

SAVE THE DATE

Our regular Q1 Webinar will be taking place on the April 17th 3PM UK / 10AM EST, with guest speakers Jan Trueuren from Cboe Clear. In addition to the normal quarterly update, Jan will be updating us on the project to introduce central clearing to the EMEA securities lending market. To register, please click HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2025.html&text=Securities+Finance+Q1+and+March+Snapshot+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2025.html","enabled":true},{"name":"email","url":"?subject=Securities Finance Q1 and March Snapshot 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+Q1+and+March+Snapshot+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}