Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 27, 2025

Stocks Soar as Shorts Roar Across EMEA Equities.

European stock markets are soaring to new heights, yet rising short interest reveals a twist of caution as investors navigate complex market dynamics.

In recent weeks, European stock markets have witnessed remarkable growth, outpacing U.S. equities by the widest margin since 2000. This surge can be attributed to several key factors that have bolstered investor confidence and driven valuations upward.

Firstly, signs of economic stability have emerged, with recent indicators showcasing improvements in both the manufacturing and services sectors across Europe. This stabilization has reassured investors, creating a more favorable environment for equity investment. Additionally, the ongoing geopolitical tensions, particularly the situation in Ukraine, have led to increased defense spending. This uptick in government expenditure has not only enhanced economic prospects but also contributed to a more robust corporate earnings landscape. The strong corporate earnings reported in the fourth quarter have further solidified the positive sentiment surrounding European equities.

Moreover, European stocks entered 2025 with relatively low valuations compared to their U.S. counterparts. This valuation gap has made European equities particularly attractive to investors seeking value, driving demand and pushing prices higher. As a result, major indices such as the German DAX, France's CAC 40, and Britain's FTSE 100 have all recorded significant gains.

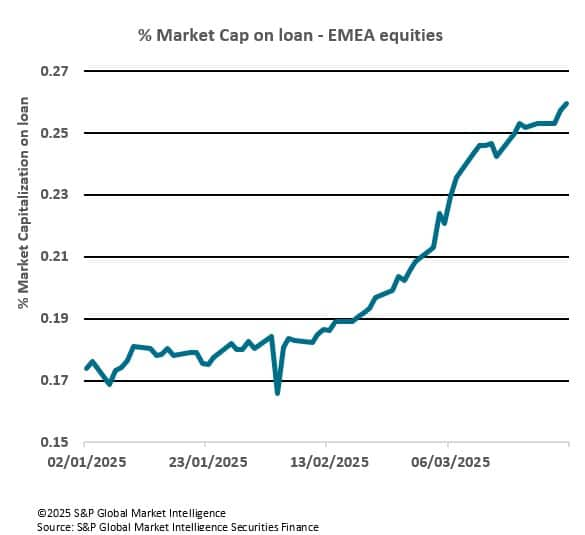

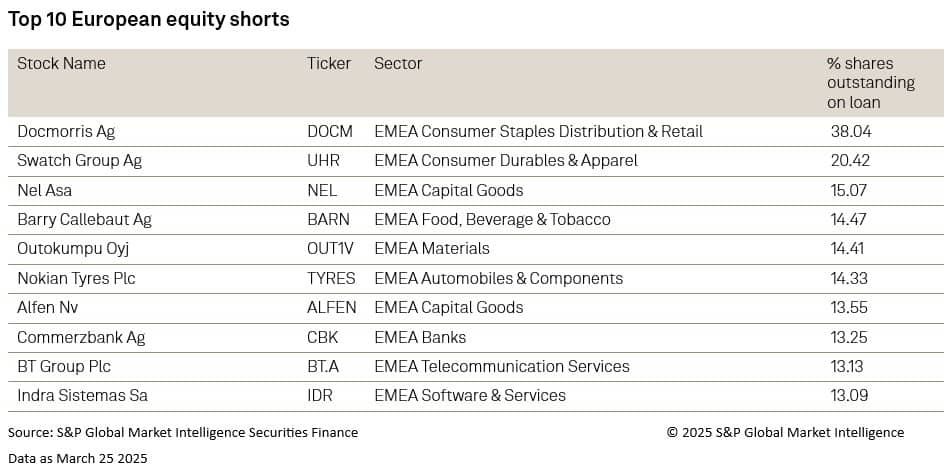

However, alongside this bullish trend, an increase in short interest has been observed across the region. This might seem paradoxical, but several factors can explain this phenomenon. For one, market sentiment plays a crucial role; some investors may perceive the recent growth as unsustainable and anticipate a correction, leading them to take short positions. Additionally, short selling can serve as a hedging strategy against potential losses in long positions, providing a safety net in volatile markets. Sector-specific concerns also contribute to rising short interest. Certain industries may face challenges that are not reflected in the broader market growth, prompting investors to short stocks within those sectors. Lastly, after substantial market gains, profit-taking becomes a strategy for many investors, leading to increased short positions as they seek to capitalize on the market's upward momentum.

The rise in short interest amidst the booming European equity markets serves as a reminder of the dual nature of investor sentiment; while many are optimistic about the growth driven by economic stability and attractive valuations, others remain wary of potential pitfalls. This cautious approach highlights a strategic mindset among investors who use short selling not only as a hedge against unforeseen market corrections but also as a way to capitalize on sector-specific vulnerabilities. Ultimately, the interplay between soaring valuations and increasing short interest underscores the importance of a balanced perspective in navigating today's financial landscape, where both bulls and bears often coexist.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-soar-as-shorts-roar-across-emea-equities-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-soar-as-shorts-roar-across-emea-equities-.html&text=Stocks+Soar+as+Shorts+Roar+Across+EMEA+Equities.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-soar-as-shorts-roar-across-emea-equities-.html","enabled":true},{"name":"email","url":"?subject=Stocks Soar as Shorts Roar Across EMEA Equities. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-soar-as-shorts-roar-across-emea-equities-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stocks+Soar+as+Shorts+Roar+Across+EMEA+Equities.++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstocks-soar-as-shorts-roar-across-emea-equities-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}