Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 28, 2020

Daily Global Market Summary - 28 October 2020

European and US equity markets sold off sharply today, while APAC equity markets closed mixed. iTraxx and CDX credit indices were significantly wider across IG and high yield and all closed at their widest levels since rolling to the current series. US government bonds were almost flat on the day despite the heightened equity volatility, while benchmark European bonds closed mixed. The US dollar was higher on the day, while oil, gold, and silver were lower. Markets continue to assess how much the latest round of restrictive measures will dampen the economic recovery from the first wave, as governments worldwide take precautionary measures to avert overwhelming hospitals with a surge in COVID-19 patient.

Americas

- US equity markets closed sharply lower and near the lows of the day, with the S&P 500 having its worst performance in four months; Nasdaq -3.7%, S&P 500 -3.5%, DJIA -3.4%, and Russell 2000 -3.0%.

- U.S. stocks continued to sell off on Wednesday in what is shaping up to be their worst week since late March, as rising coronavirus infections shook investors' confidence in the global economic recovery. Worsening coronavirus case numbers may make more stringent restrictions imperative across the U.S. and Europe, potentially dealing a setback to a fragile economic recovery. (WSJ)

- 10yr US govt bonds closed -1bp/0.77% yield and 30yr bonds closed flat/1.56% yield.

- CDX-NAIG closed +4bps/64bps and CDX-NAHY +25bps/415bps.

- DXY US dollar index closed +0.3%/93.40, but was as high as +0.8% at 9:00am EST:

- Gold closed -1.7%/$1,879 per ounce and silver -4.9%/$23.36 per ounce. Gold is -9.2% from this summer's all-time high close of $2,069 per ounce.

- Crude oil closed -5.5%/$39.79 per barrel.

- Marvell Technology Group Ltd. is nearing a deal to acquire Inphi Corp. for about $10 billion, according to a person familiar with the matter, adding to an already record year for chip industry deals. Inphi is a maker of chips that act as the interface in gear that helps speed the flow of big chunks of information between computers and networks. Data center silicon is becoming increasing important as cloud providers are finding themselves swamped in data and look at even the most basic components to try to make their giant warehouses full of expensive equipment more efficient. (Bloomberg)

- The US goods deficit narrowed unexpectedly in September by $3.7

billion to $79.4 billion, as exports rose smartly and imports

declined modestly. The combined inventories of wholesalers and

retailers, moreover, rose 0.7%, more than we had assumed. (IHS

Markit Economists Ben Herzon and Lawrence Nelson)

- These developments raised our estimate of third-quarter GDP growth by 0.7 percentage point to 33.8% (annual rate) and our forecast of fourth-quarter GDP growth by 0.4 percentage point to 5.2%.

- Exports rose 2.7% in September, continuing a run of increases following a pandemic-induced low in May. Nearly one-half of the increase in September exports was in foods, feeds, and beverages, where exports surged to the highest level in more than six years.

- Despite the recent gains in goods exports, they still remain 11.4% below the February level, as foreign demand remains depressed.

- Imports of goods slipped 0.2% in September, but remain above the February level, as domestic demand for goods has, for the most part, recovered.

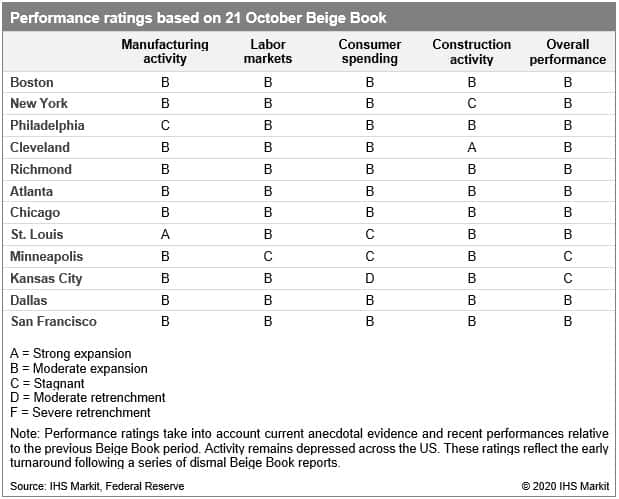

- Most parts of the country saw "slight to modest" growth in

economic activity from late August to September according to the US

Federal Reserve's latest Beige Book report, containing anecdotal

information from regional business contacts. (IHS Markit Economist

James Kelly)

- Consumer spending and employment gains in the upper Midwest and Plains states lost some momentum as a resurgence of COVID-19 cases and hospitalizations led to continued low tourism levels in major metros and falling restaurant spending in the Plains.

- Employment gains remained on a slow, steady path in much of the country while leisure and hospitality workforce growth in the West and Great Lakes regions remained sluggish.

- Manufacturers began to see stronger gains in production and new orders as demand picks back up, especially because of a surge in homebuilding and renovation in the South and West.

- The boom in residential construction encompassed much of the Mountain West and South, but limited construction labor availability and increasing materials costs meant supply of homes could not meet demand.

- This month's Beige Book indicated a strengthening recovery among manufacturers in the Midwest and South and strong homebuilding activity in the Mountain West, Great Lakes, and South.

- Employment gains and consumer spending growth continue to be influenced by the course of the COVID-19 pandemic and consumers' reactions to rising or falling prevalence of the virus in their community.

- While retail stores, restaurants, and attractions are generally open for business, subject to local capacity constraints and social distancing guidelines, sharp rises in hospitalizations in the Midwest and South during the winter months will limit consumer spending and hiring, especially in leisure and hospitality services.

- Winter weather also threatens the recovery of the restaurant industry in the Midwest and Northeast if consumers do not see outdoor dining as an appealing option.

- Homebuilders will continue to confront labor-market and

supply-chain disruptions as demand for single-family homes stays

elevated in the South, Great Lakes, and Mountain West regions.

- As the working capital of last resort with high concentration in consumer-facing, in-person businesses, Merchant Cash Advances (MCAs) have performed poorly due to the lockdowns. Going back to the well of repeat borrowers looks like it may be a recipe for a higher risk of default, as a merchant needing such high-cost funds pre-COVID would likely now be beyond saving. Methodical Management has started to see entire portfolios trading and consolidation of originators. Rapid runoff in MCA portfolios creates a tail of advances that is likely highly distressed and the servicing transfer requires the capacity to quickly triage individual credits and high-touch servicing capabilities to set up payment plans to preserve the value of any distressed trades. (Methodical Management)

- Cell-based meat and seafood companies should substantiate the

variety of sustainability and other environmental and health claims

that are likely to attract new customers and make sure they live up

to these lofty claims before entering the market, said Barbara

Kowalcyk, food safety professor at Ohio State University. (IHS

Markit Food and Agricultural Policy's Joan Murphy)

- Panelists at the October 27 International Association for Food Protection (IAFP) meeting discussed the path forward for cell-based products and some of the regulatory/science issues the emerging technologies still need to navigate before reaching consumers.

- While some companies are predicting their products are nearly ready for commerce, panelists pointed to the need for more independent research to validate the food safety and environmental claims, along with other data gaps for the new protein products.

- While there is a lot of information being generated by the cell-based protein industry, there is little in the public domain, said Isha Datar of New Harvest. The basic research tools are not well defined in the literature, and there are different approaches and it is important to understand more about alternative technologies when establishing safety, she said.

- Among the panelists was BlueNalu Inc. President and CEO Lou Cooperhouse who talked about how his cell-based seafood products will help meet increasing global demand for seafood as the supply is diminishing due to a variety of factors, such as overfishing and climate change.

- Cell-based seafood products can be made locally to reduce imports and limit the carbon footprint from shipping fish around the world, a benefit that has caught the attention of countries looking to bolster domestic supplies, such as Japan, Brussels, and Singapore.

- With its focus on finfish species, Cooperhouse said his firm has established over 100 stable cell lines, and the next step is to increase the scale of operations and put the product in commerce "in a small way" by the end of 2021.

- As for entering the foodservice sector, BlueNalu wants consumers to know their products are cell-based so he wants the products labeled. The fillets will offer the benefit of a stable, year-round supply for restaurants and less likely to be cross-contaminated in the "back of the house" because they would demand less preparation, he added.

- USDA's Philip Bronstein said FSIS and FDA are working together to harmonize the regulatory framework for these products, whether they oversee FDA-regulated seafood or USDA-regulated meat and poultry. No new regulations are needed, though the agency does plan to issue new directives to inspectors when these products come online, said Bronstein, assistant administrator in the Office of Field Operations at the Food Safety and Inspection Service (FSIS).

- Audi of America has collaborated with Applied Information and Temple to test two connected vehicle applications that can enhance children's safety in school zones and around buses. The tests are being carried out using Audi e-tron models. The first application, using cellular vehicle-to-everything (C-V2X) technology, warns the driver when the vehicle is entering an active school safety zone. It also provides a warning if drivers exceed the speed limit when children are present. This is a result of the deployment of roadside units (RSUs) in school safety zones, which receive information through C-V2X technology and in turn flash signs to alert drivers to slow down. For the second application, the technology warns drivers when they are approaching a school bus that has stopped to pick up or drop off students. Onboard units (OBUs) display C-V2X safety messages from school buses to vehicles when the bus stop arm is deployed, directing that no passing is allowed. C-V2X technology enables vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure and enables the operation of advanced driver assistance systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Two automated and connected trucks travelled from Pittsburgh, through Ohio, to Michigan. The trucks travelled more than 280 miles and delivered groceries to the Toledo Northwestern Ohio Food Bank to help support communities struggling during the coronavirus disease 2019 (COVID-19) virus pandemic. Locomation deployed its autonomous relay convoy (ARC) technology in the trucks, which enables one driver to pilot a lead truck while the following truck operated in tandem. This allows the other driver in the second truck to log off and rest. The truck platooning technology, which allows digitally connected trucks to drive closely together in convoy, is considered SAE (Society of Automotive Engineers) Level I automation. These trials are conducted by DriveOhio, an autonomous vehicle pilot program, in partnership with the Ohio Turnpike and Infrastructure Commission (OTIC) to test Level I automation. Mike DeWine, Ohio Governor, said, "In Ohio, we are designing and deploying the transportation system of the 21st century. Safety is our primary concern, and as smart mobility technologies mature, we believe these innovations will make our roads safer. Deployments, like this one, will help to inform future projects." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Scout Bio has opened two clinical trials to investigate the effectiveness of its novel gene therapy targeting feline diabetes. The Philadelphia-based firm is aiming to develop an adeno-associated virus (AAV) expressing a GLP-1 analog as a one-time injectable treatment for diabetes in cats. The company is focused on two potential therapeutic applications for SB-009 - to replace daily insulin injections and to significantly increase the percentage of cats entering remission. The initial pilot trial will recruit a minimum of 20 cats and evaluate if SB-009 is safe and efficacious in managing clinical signs and high blood sugar levels caused by feline diabetes. The second clinical study of approximately 60 cats will follow animals for six months to see if the low percentage that enter remission with insulin therapy alone can be significantly increased with the co-administration of SB-009. Scout Bio told IHS Markit Animal Health the ultimate goal is to develop SB-009 as a 'one and done' treatment. The company estimates the current feline diabetes market is valued in excess of $400 million, with growth expected. It explained the known prevalence of feline diabetes is around 1% but this figure is climbing due to improved diagnostics, increasing pet adoptions and the rising incidence of obesity. (IHS Markit Animal Health's Sian Lazell)

- Motional, an autonomous vehicle joint venture (JV) between Hyundai and Aptiv, has partnered with public transit technology firm Via to launch a shared robotaxi service for the public. The service will be offered in one of Motional's existing US markets in the first half of next year. This partnership intends to develop a blueprint to learn how these autonomous vehicles can be integrated into mass transit systems. Under the partnership, Motional's autonomous vehicles will be connected with Via's platform, which handles booking, routing, passenger and vehicle assignment. Daniel Ramot, co-founder and CEO of Via, said, "We are excited to partner with Motional to make autonomous shared ride programs an affordable and efficient transportation alternative to the private vehicle. By combining groundbreaking on-demand mobility solutions with bestin-class technology for self-driving vehicles, we are creating new and necessary transit options for communities around the globe." This service is similar to the partnership that Motional has with Lyft in Las Vegas, which recently restarted after being suspended earlier this year in reaction to the COVID-19 virus pandemic. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Beep will deploy its two autonomous shuttles at Yellowstone National Park starting in May 2021. This deployment will be operated in partnership with the National Parks Service (NPS) to test "multi-passenger, electric automated vehicle platforms" in the park's Canyon Village. Beep and the NPS will jointly determine shuttle stops, route locations and distance. This initiative is part of the Yellowstone Visitor Use Management Program, which aims to test a range of pilot projects at the park to enhance the visitor experience. Joe Moye, Beep CEO, said, "It's an honor to be the first in the country to provide autonomous shuttles to the NPS and its visitors. Yellowstone's Visitor Use Management Program aligns with Beep's mission to provide alternative, sustainable, and innovative transportation solutions meant to transform and improve mobility for all. This demonstration will help assess how emerging technologies can enhance the visitor experience while making the roads safer and less congested for everyone". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- There were no interest rate changes by the Bank of Canada, as

expected, and rates are not expected to change until the inflation

target is sustainably met. (IHS Markit Economist Arlene Kish)

- The bank's quantitative easing program will focus more on purchases of longer-term bonds while committing to reduced purchases of at least $4 billion per week.

- In the October Monetary Policy Report (MPR), the Bank's baseline scenario estimates Canada's real GDP declines 5.7% this year and rebounds 4.2% in 2021 and 3.7% in 2022. The annual inflation outlook is very weak this year and next before it climbs to 1.7% in 2022. Inflation will hit the 2% target in 2023.

- Against the backdrop of severe weakness, potential output growth and the neutral policy rate estimates were revised down.

- Greater transparency by the Bank helps reduce uncertainty surrounding the outlook for inflation expectations. The pandemic's containment measures will dampen growth expectations in the near term. The next policy announcement is scheduled for 9 December.

- The Bank of Canada's forward guidance is very much in line with IHS Markit expectations regarding the inflation outlook and future path of monetary policy as excess capacity begins to be absorbed.

- The significant amount of excess capacity where demand has fallen below supply has kept price inflation very low.

- The jobs recovery is underway, but current job losses are still well above those during the global financial crisis.

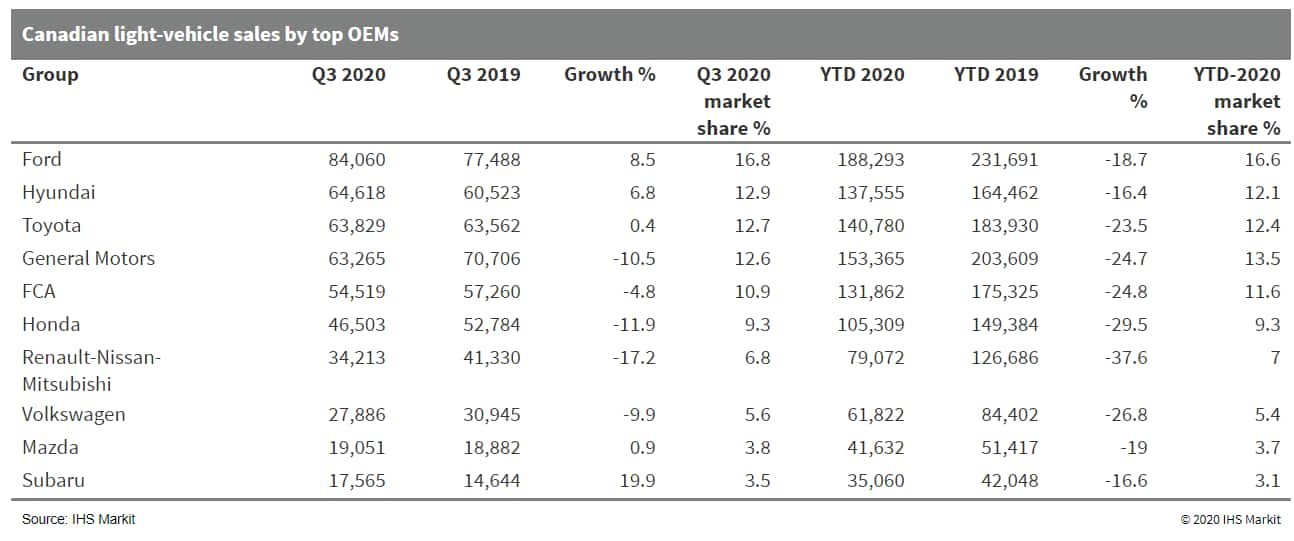

- Before the COVID-19 virus pandemic, the Canadian light-vehicle

market had been expected to continue its declines in 2018 and 2019

into 2020. Following the virus outbreak and containment measures

that caused disruption in the first and second quarters of 2020,

the market is now expected to decline 22% y/y this year. However,

the situation began to ease in June, and in the third quarter

(July-September) light-vehicle sales declined only 3% y/y.

Regardless of the impact of the COVID-19 virus pandemic on the

overall market, Canada continues to be a truck-heavy market, with

the Ford F-Series easily the best-selling product, followed by the

Ram 1500. Those products accounted for 14% of sales in the third

quarter of 2020, compared with 12.0% in the third quarter of 2019.

IHS Markit's September forecast projects a 22% year-on-year (y/y)

decline in Canadian light-vehicle sales in 2020, to 1.495 million

units, with improvement beginning in 2021. Although this is still a

notable drop, and the market is not expected to recover to 2019

volume levels before 2028, it is a less stark outlook than earlier

in the year. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed sharply lower; Germany -4.2%, Italy -4.1%, France -3.4%, Spain -2.7%, and UK -2.6%. Germany's DAX closed at its lowest level since late-May and is 16.2% below its 19 February peak.

- 10yr European govt bonds closed mixed; Italy +6bps, Spain +2bps, France +1bp, Germany -1bp, and UK -2bps.

- iTraxx-Europe closed +6bps/65bps and iTraxx-Xover +31bps/373bps.

- Brent crude closed -4.7%/$39.64 per ounce.

- UK retailer Tesco has announced it is starting a trial of delivering food via drone in Ireland. The company has teamed up with Irish start-up Manna to deliver food in Oranmore in County Galway. The trial will run for several months and shoppers can source small basket items from a selection of 700 items from Oranmore's shop via a dedicated website. Drone orders will run from 9.30am to 5pm from Tuesday to Sunday and can be tracked real-time, with an estimated delivery time of between 30 minutes and an hour. Catherine Swift, shop manager of Tesco in Oranmore, said: "We're continually looking for new ways to serve our customers a little better and this trial is an opportunity to look at meeting demand for small basket shops and quick delivery. We're looking forward to seeing how our customers in the Oranmore area respond to the service." (IHS Markit Food and Agricultural Policy's Peter Rixon)

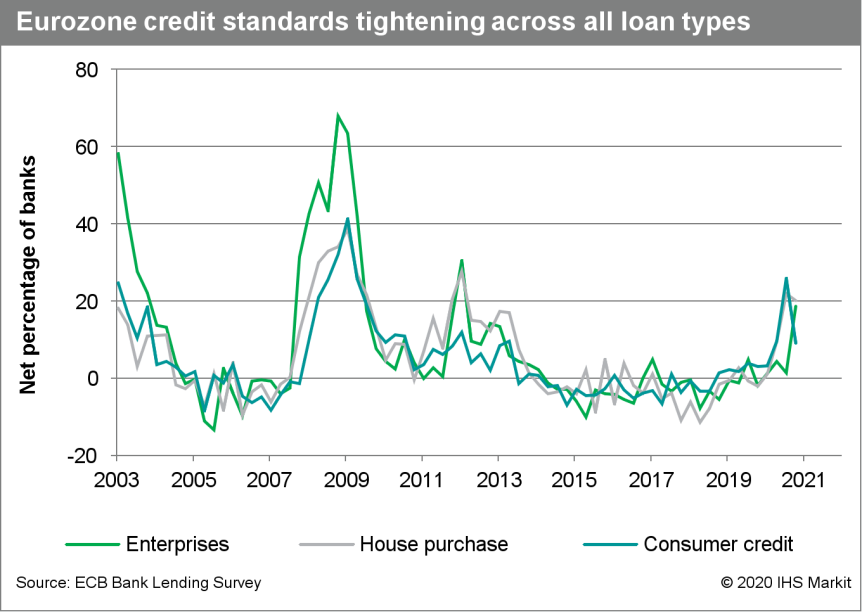

- The third-quarter ECB bank lending survey showed a pronounced

decline in firms' emergency liquidity needs. Household demand for

mortgage loans rebounded. (IHS Markit Economist Ken Wattret)

- The ECB's quarterly bank lending survey (BLS) for the third quarter was compiled between 21 September and 6 October, with 143 banks polled across the member states.

- On the supply side of the survey, the standout change in the third quarter was the tightening of credit standards for loans to enterprises. The net percentage of banks reporting a tightening of standards jumped from 1% to 19%, in line with the indications from the second-quarter survey.

- This was above the historic average (+8), though well below the peaks during the Global Financial Crisis (GFC) and subsequent eurozone crisis, when net percentages peaked at around 60% and 30%, respectively. The main factor driving the tightening in the third quarter was risk related to the deterioration in economic and firm-specific conditions.

- The third-quarter survey also showed a further expected tightening of credit standards in the fourth quarter (+18), again reflecting concerns around the economic recovery due to uncertainties regarding the pandemic and the prolongation of fiscal support.

- Among the largest eurozone member states, credit standards on loans to enterprises tightened in Germany, Spain and France, while they remained unchanged in Italy.

- Looking at the demand side of the survey, loan demand from enterprises plunged in the third-quarter survey, from a record high of +62 in the second quarter down to -4, as firms' emergency liquidity needs eased following the unwind of lockdowns and economic activity rebounded.

- In line with this, there was a bigger decline in demand for short-term loans (net percentage -10) than long-term loans (-1). Financing needs for fixed investment again declined in the third quarter (-26), though by less than in the second (-46).

- Among the largest eurozone member states, demand for loans to enterprises continued remained very elevated in Germany (+28) and Italy (+70) but plunged in France (-58) and Spain (-60). The sharp falls in the latter two countries reflected a correction following exceptionally high precautionary demand in the second quarter. Banks in all the largest eurozone countries continued to report a negative contribution for financing needs for fixed investment.

- Switching to the BLS data on households, the third-quarter survey showed a continuation of tightening credit standards on loans for house purchase (net percentage of +20 versus +22 in the second quarter) and for consumer credit and other lending (+9 versus +26 in the second quarter).

- The net percentage of +20 for housing loans remained well above its historical average since the start of the survey in 2003 (+6%) and a further tightening is also expected in the fourth quarter (+12). The difficult economic climate was again cited as the main factor leading to tighter credit standards.

- Risks associated with the economic outlook and creditworthiness of households affected by the pandemic were the main factors contributing to the tightening of credit standards on consumer credit in the third quarter. Standards tightened further in Germany, Italy and especially Spain, while they remained unchanged in France.

- Banks indicated an increase in the share of rejected loan

applications for consumer credit and other lending in the third

quarter (+16, after +15 in the second quarter), mainly due to

deteriorating income and employment prospects. The rejection rate

increased most among banks in Spain.

- Continental has bought a minority stake in LiDAR startup Aeye for an undisclosed amount. This will help Continental to strengthen its position in the field of automated driving and will enhance its current short-range LiDAR technology, which is scheduled to go into production by the end of this year. This investment is a strategic partnership as the companies will jointly develop sensors for deployment in vehicles scheduled for the end of 2024. Blair LaCorte, CEO of AEye, said, "ADAS solutions require a unique mix of performance, scalability, packaging, and a long-term commitment to reliability and safety. Continental is a recognized leader in automotive sensing technology as well as in automotive product industrialization and commercialization. We look forward to working closely with their team to customize our modular and scalable design to deliver Continentals high-performance long-range LiDAR systems to the world's leading vehicle manufacturers." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BASF has announced third-quarter results in line with the preliminary figures it published on 9 October. The company swung to a net loss of €2.1 billion ($2.5 billion), compared with a net profit of €911 million in the prior-year quarter, on impairments totaling €2.8 billion owing to the impacts of COVID-19 and restructuring, as previously reported. BASF group sales of €13.8 billion were down 5% year on year (YOY). BASF also confirmed that third-quarter EBIT before special items (operating profit) rose sharply compared with the previous quarter, to €581 million, up by €355 million and beating analysts' consensus estimate by 47%. On a YOY basis, EBIT before special items dropped 45%, owing mainly to a much lower contribution from the chemicals segment. The big sequential improvement in EBIT before special items "was mainly driven by good business development in September," says Martin Brudermüller, chairman of BASF. The YOY decline in sales was mainly driven by negative currency effects in all segments, but especially in the agricultural solutions and surface technologies segments. Revenue fell 27% YOY in the chemicals segment owing mainly to an unplanned outage at the steam cracker at Port Arthur, Texas. Higher price levels overall, primarily owing to higher precious metal prices in the surface technologies segment—where sales increased 25% YOY—had an offsetting effect. Portfolio effects, especially in the materials segment from the acquisition of Solvay's nylon business, also had a positive impact on sales. Sales of the materials business decreased 8% YOY and revenue from industrial solutions dropped 13%. BASF's third-quarter group sales increased sequentially and were €1.1 billion higher than in the previous quarter.

- France's consumer confidence index stood at 94 in October,

slightly down from 95 in September. The index has hovered between

94 and 96 over the last five months, following a sharp decline from

104 in February to 92 in May. (IHS Markit Economist Diego Iscaro)

- In October, the breakdown of the data shows a clear deterioration of the most forward-looking elements of the survey. Consumers' views of their future standard of living and economic outlook worsened in October, while the index measuring unemployment expectations rose to a three-month high.

- The number of households considering making a major purchase over the coming year remained unchanged at a level below its long-term average. At the same time, the index measuring households' saving intentions remained well above its long term average despite easing compared to September.

- Meanwhile, the sub-indices measuring past living standards and economic situation remained unchanged in October.

- The strong rebound in COVID-19 cases, which has prompted a substantial tightening of containment conditions, is clearly having an impact on confidence. The French government is expected to tighten measures even more, very likely in the very short term, suggesting that households' views on their future financial situation is likely to deteriorate even more over the coming months.

- Valeo has announced that its sales have slipped during the third quarter of 2020. During the three months ending 30 September, the company's sales revenues fell by 8% year on year (y/y) to EUR4,389 million. Of this, original equipment sales made up EUR3,751 million, a decline of 7.3% y/y. In terms of sales by business group during the quarter, all have some degree of decline. Its Comfort & Driving Assistance Systems have decreased by 5.1% y/y to EUR873 million, as Powertrain Systems retreated by 8% y/y to EUR1,149 million. Its Thermal Systems business recorded a drop of 10% y/y to EUR1,017 million, and its Visibility System business sales fell by 9.3% y/y to EUR1,322 million. The sales revenues in the year to date (YTD) reflect the impact of the steep falls in the first half of the year as a result of the COVID-19 virus pandemic, and now stand at EUR11,447 million, a decline of 21.3% y/y. The company's revenues have improved substantially as a semblance of normality returned to production demand after the challenges in the first half which resulted in stoppages. The decline in sales revenues during the third quarter also included a 2.6 percentage point impact due to currency exchange rates, which the company pointed out was due mainly to the appreciation of the euro against the US dollar and Chinese yuan. Despite the decrease in original equipment sales, Valeo has stated that this in line with market performance on a like-for-like basis. (IHS Markit AutoIntelligence's Ian Fletcher)

- On an annual basis, Spain's total employment fell by 3.5% y/y,

or by 0.7 million jobs to 19.1 million in the third quarter, after

a 6.1% y/y fall in the second, which was the first drop since early

2014. (IHS Markit Economist Raj Badiani)

- This compares to gains of 1.1% y/y in early 2020, 2.3% in 2019 and 2.7% in 2018.

- A breakdown by economic activity reveals that services endured the sharpest job losses in the third quarter, down by 3.6% y/y (533,600 jobs) to 14.5 million. Industry employment was 4.6% lower y/y, implying 128,100 fewer jobs to stand at 2.7 million.

- Firms shed workers on temporary contracts, which decreased by 13.0% y/y or 0.58 million to 3.9 million during the third quarter, matching the loss of permanent jobs (down 4.1% y/y or 0.681 million). Spain has a high incidence of temporary employment, which reflects still dense job protection legislation for permanent workers.

- We fear that the patchy recovery in Spanish tourism during the summer season triggered widespread cancellation or non-renewal of many seasonal temporary contracts.

- On a seasonally adjusted basis, employment rose by 3.0% quarter on quarter (q/q) during the third quarter after falling by 6.7% q/q in the second quarter and 0.4% q/q in the first (the first drop since late 2013).

- The INE notes that workers suspended via the Temporary Suspension of Employment (ERTE) are classified as employed. The ERTE scheme allows firms to suspend employment, with workers able to apply for unemployment benefits during the time of their suspension.

- Meanwhile, the number of unemployed people increased by 15.8% y/y to stand at 3.72 million during the third quarter. Therefore, the unemployment rate increased to 16.4% in the third quarter, up from 14.0% a year ago.

- However, the rise in the unemployment rate has been moderated by workers who are in the government's furlough scheme are not included as unemployed in this survey. Spain is using the ERTE employment protection scheme to limit the number of redundancies in the face of an enforced lockdown of the economy.

- INE reports that over a million people lost their jobs during the second quarter, but not classified because they did not meet the technical conditions to be included in this group, such as actively seeking work. This cut the activity rate by several percentage points to 55.5% in the second quarter. But this was partially remedied in the third quarter, when the activity rate rose to 57.8%.

- With Spain enduring a deep recession in the first half of 2020 alongside a new state of emergency across Spain to tackle rising COVID-19 infections, the labor market conditions are likely to remain under pressure during the remainder of 2020 and early 2021.

- According to the Swedish National Institute of Economic

Research (NIER), Sweden's economic tendency indicator improved to

96.3 in October, a marked improvement compared with the all-time

low of 61.2 in April. It is now close to the 20-year average of

100, having grown every month in the last six months. (IHS Markit

Economist Daniel Kral)

- The improvement in October was broad based with manufacturing, retail trade, the service sector as well as with consumer confidence growing between 1.3 to 2.4 points. The overall economic tendency indicator is now higher than it was in October last year, with manufacturing almost 10 points higher. Consumer confidence is, however, 3.2 points lower.

- Manufacturing confidence rose by 1.3 points in October, driven by companies being more positive about their current stocks and order books. Consumer confidence increased by 1.6 points because of more optimistic expectations regarding personal finances over the next 12 months; fewer households expected unemployment to rise for the sixth month in a row.

- Services-sector confidence improved by 1.4 to 88.4, the weakest among the main sectors. Respondents in October were more optimistic about future demand and less pessimistic about current demand.

- The latest confidence indicators point to the carrying of the positive momentum from the third quarter into the fourth. However, the survey was conducted between 30 September and 20 October for companies and between 1 and 15 October for households, which means that the adverse developments across Europe in the latter half of the month are not adequately reflected.

- Abu Dhabi National Oil Co. (Adnoc) sees significant new opportunities for enhanced partnerships in India, particularly across its downstream portfolio in the country, according to Ahmed Al Jaber, Adnoc CEO and UAE minister of industry and advanced technology. Al Jaber was speaking during a virtual roundtable session organized by the Indian energy ministry between India's Prime Minister Narendra Modi and global oil and gas company CEOs. Adnoc has launched a plan to expand its chemicals, petrochemicals, derivatives, and industrial base in Abu Dhabi. "I look forward to exploring partnerships with even more Indian companies across our hydrocarbon value chain," says Al Jaber. India's "remarkable growth as an economic power has cemented its place as one of the world's largest energy consumers. In fact, it represents the second biggest market for Adnoc," he says. The company says that over the past two years it has enhanced strategic energy links with India—a key growth market for crude, refined, and petchem products. It is also a stakeholder in one of India's largest refinery and petchem projects to be constructed on India's west coast. In February 2019, Kerala State chief minister Pinarayi Vijayan said that Adnoc had offered to invest in a petchem complex being built at Kochi. Vijayan said that India is top on the investment agenda for Adnoc and that Al Jaber sees big potential in the petroleum sector in India. Al Jaber, during the India Energy Forum by CERAWeek in 2018, organized by IHS Markit, said that the company looked forward to deepening its ties with Indian energy partners across the entire crude, refining, petchem, and derivatives value chain.

Asia-Pacific

- APAC equity markets closed mixed; India -1.5%, Japan -0.3%, Hong Kong -0.3%, Australia +0.1%, Mainland China +0.5%, and South Korea +0.6%.

- South Korea rebounded sharply in the third quarter of 2020,

recovering over half of its quarter-two losses. (IHS Markit

Economist Dan Ryan)

- In the third quarter, real GDP increased by 1.9% (7.9% annual rate) over the previous quarter. However, this still left real GDP down by 1.3% compared with a year earlier.

- The growth was almost entirely due to exports. This coincides with monthly balance of payments data; both show exports up by 15% over the previous quarter.

- The rise in exports was not accompanied by a corresponding rise in imports. Therefore, the raw materials needed to produce export goods were apparently drawn from inventories, which fell substantially in the third quarter.

- Fixed investment was a drag on growth; companies clearly feel that capital expenditures are not necessary when production remains significantly below capacity.

- Private consumption fell slightly, likely as a correction to the surprising rise in the second quarter; government consumption was essentially flat, although another round of fiscal expansion seems likely in the fourth quarter.

- The third-quarter rebound was welcome, but not as good as hoped. Weak domestic demand, in particular, meant that manufactured exports would be the main growth driver, which, in turn, were limited by growth and demand from trading partners.

- Domestic spending should improve in the fourth quarter. In addition to likely government stimulus, the manufacturing sector's rising revenue should lead to increased spending on consumption - by workers - and on fixed investment by the firms themselves.

- The sharp drop in inventory investment also bodes well, at least for the short term. It means that any demand for goods will need to be met via new production and output.

- Exports, however, are unlikely to be a huge growth driver, especially as the Northern Hemisphere confronts with a possible resurgence of the pandemic. The only exception would be a sudden resolution to current trade wars, which appears unlikely.

- SK Innovation has unveiled its direction of "Battery for Next Generation" at InterBattery 2020 hosted by South Korea's Ministry of Trade, Industry, and Energy, according to a company press release. The company is developing next-generation fast charging batteries for electric vehicles (EVs). The charging technology will enable a 500-mile round-trip only by charging the batteries twice for 10 minutes each time. The company expects to complete the development by as early as the end of this year or the first half of 2021. It is also developing long-life batteries, enabling long-range driving. "SK Innovation has made a huge investment in R&D [research and development] to become a total energy solution provider since 1982. We will unveil most notable examples of our capacity recognized by our global partners in the exhibition. By sharing the future of batteries with the market and customers, we will create an opportunity to grow together with a variety of ecosystems including EVs," said SK Innovation vice-president of public relations Su-Kil Lim. SK Innovation said that it has already successfully test-drove an EV with long-range batteries that ran 1,000 km. The long-range driving is enabled and supported by the technology using high-density nickels as well as the company's own technology that does not cause battery-efficiency issues even after more than a thousand times of charging and discharging. In August, SK Innovation also partnered with Nobel Laureate Professor John Goodenough to develop next-generation battery technologies. Professor Goodenough will work with the company on a new battery that provides higher energy density and better safety at a competitive cost. (IHS Markit AutoIntelligence's Jamal Amir)

- Shanghai plans to set up special government-guided funds to

support the high-quality development of advanced industries,

according to a notice issued by the local government on 27 October.

(IHS Markit Economist Lei Yi)

- Targeted financial support aims to enable innovative breakthroughs in advanced industries including integrated circuits, artificial intelligence, and bio-medicine. Additionally, industrial clusters with international competitiveness should be formed for key industries like electronics, auto, and high-end equipment. The funds will also be utilized to promote upgrading of the traditional manufacturing sector, as well as the integration of advanced manufacturing and modern services.

- The funds could be used in the forms of subsidy, award, government procurement, interest discount, etc. An annual budget will be approved by the local finance department with specific investment targets, of which the performance will be assessed, and the information will be made publicly available.

- Offering targeted financial support for advanced industries will boost investment and accelerate Shanghai's economic recovery from the pandemic shock. Notably, investment relating to integrated circuits have doubled year on year (y/y) in the first three quarters, significantly driving up Shanghai's manufacturing investment, which reported growth of 18.7% y/y.

- Prime Planet Energy & Solutions, a battery joint venture (JV) between Toyota and Panasonic, has announced plans to boost the efficiency of its development and production processes by 10 times to compete with Chinese rivals, according to Reuters, citing a statement by the JV's president, Hiroaki Koda. Prime Planet is looking to standardize battery designs and helping streamline operations of materials suppliers. The company is looking to cut battery costs over the next several years, similar to Tesla's plans. The JV was established at the beginning of this year to develop competitive and cost-effective batteries for Toyota and other customers across the globe. The scope of business operations under the JV includes research, development, production engineering, manufacturing, procurement, order receipt, and management of automotive prismatic lithium-ion (Li-ion) batteries, solid-state batteries, and next-generation batteries. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Volkswagen (VW) Group's heavy truck unit TRATON has signed a joint-venture (JV) agreement with Japan's Hino to develop e-mobility products, according to a company statement. The two partners will combine their strengths to develop battery electric vehicles (BEVs), fuel-cell vehicles (FCVs), and relevant components as well as creating common electric vehicle (EV) platforms including software and interfaces. President and CEO of Hino Motors, Yoshio Shimo, said, "I am delighted that we can follow our procurement joint venture and further embodying our synergy with TRATON in e-mobility, helping to reduce global CO2 emissions and fighting global warming. We will combine our strengths as leading commercial vehicle manufacturers to offer EVs with the highest value for customers, through joint planning of commercial EVs." The collaboration will allow for the development of electric platforms and electrification components beyond the boundaries of both automakers. The companies will utilize their strengths to promote an efficient and rapid technological development. While TRATON is focused on heavy-duty applications, Hino focuses on light- and medium-duty trucks. The initiative is part of the CO2 emission-reduction goal set by Hino through to 2050. In October last year, Hino and TRATON formed a procurement JV called Hino & TRATON Global Procurement GmbH. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japanese-owned Morinaga Milk Industry has announced that its German dairy ingredient subsidiary MILEI will more than double its lactoferrin production capacity. Morinaga will spend EUR15.0 million to bring lactoferrin production capacity at its Leutkirch plant in southern Germany to 170 tons. The ramp up is expected to start in April 2021. According to Morinaga Milk, demand for lactoferrin as a functional ingredient for infant formula, supplements and other foods has been growing particularly in Western countries and Asia, which is seen as a long-term growth trend. The company claims that MILEI has the largest global share of the global lactoferin market in terms of production and is willing to increase it further. MILEI offers lactoferrin, whey protein concentrate, lactose and other dairy ingredients mainly in Europe and Asia. Under the global strategy of Morinaga Milk, MILEI plays an important role supporting production and sales of ingredients for infant formula, supplements and others. Morinaga's net sales in the year to 31 March 2020 grew 1.3% to JPY590.9 billion. Dutch FrieslandCampina has also recently announced an increase in the production capacity of lactoferrin, to 70 tons. In June this year, Australian-owned Beston Global Food Company has sold its dairy farms with part of the funds going towards its Jervois plant, to increase lactoferrin production by around 20 tons a year by 2023. In 2018, New Zealand's Synlait said it will double its lactoferrin at its Dunsandel plant, with lactoferrin sales in financial year 2020 (ended 31 March) reaching 30 tons. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Tata Motors has released its financial results for the second quarter of its fiscal year (FY) 2020/21, showing that the business is continuing to face difficulties. For the three months ending 30 September, it said in a filing to the Bombay Stock Exchange (BSE) that it had recorded a fall of INR535.3 billion (USD7.25 billion) in its consolidated sales revenues, down by 18.2% year on year (y/y), as the COVID-19 virus continued to affect its operations. The company also posted a consolidated net loss of INR3.14 billion, a much wider decline compared with the INR2.16 billion recorded a year ago. In the first half of the FY, consolidated revenues declined by 32.6% y/y to INR855.1 billion and net loss totaled INR87.5 billion, compared with a net loss of INR39.1 billion in the previous year. In its outlook, Tata Motors Group expects a gradual recovery of demand and supply in the coming months despite concerns around the risk of a second wave of infection in many countries and other geopolitical risks. The Group recently revealed its target to significantly reduce its consolidated automotive net debt of INR480 billion, excluding the company's vehicle finance business, in the next three years. (IHS Markit AutoIntelligence's Isha Sharma)

- MG has launched the new plug-in hybrid version of its HS sport utility vehicle (SUV), the HS PHEV, in Thailand, according to a company statement. The HS PHEV's powertrain includes a 1.5-litre four-cylinder turbocharged gasoline (petrol) engine (rated at 199 kW maximum power and 250 Nm maximum torque), 90 kW electric motor, 16.6 kWh lithium-ion battery module and 10-speed automatic transmission. The maximum power output of the hybrid engine system is 209 kW and maximum torque is 480 Nm. The vehicle has an all-electric driving range of 67 km on a single charge and is equipped with various safety and technological features. The MG HS PHEV is priced at around THB1.36 million (USD43,490.5). The vehicle is assembled locally at the automaker's plant at Hemaraj Eastern Seaboard Industrial Estate2 in Chon Buri province. MG's latest move is in line with the Thai government's aim to increase the adoption of alternative-powertrain vehicles - including hybrids, plug-in hybrids, and EVs - and started promoting the alternative-powertrain vehicle industry in 2017 by launching incentives for automakers, component suppliers, and other companies. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-october-2020.html&text=Daily+Global+Market+Summary+-+28+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}