Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 28, 2020

Alpha factors - the consummate independent voters

Research Signals - October 2020

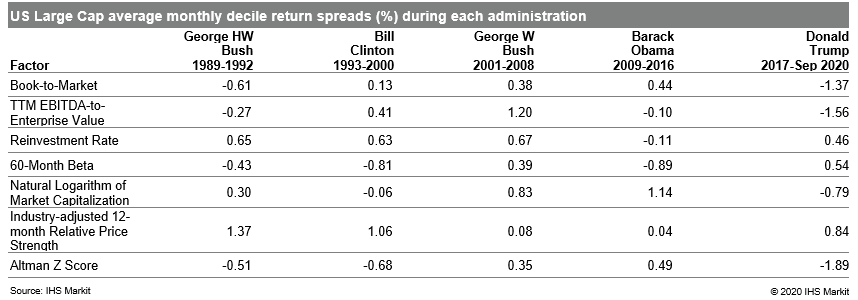

Equity investors cannot escape the deluge of political news, with headlines ranging from the gridlock surrounding the next stimulus package, rising cases of COVID-19 globally (including President Trump) and the potential of a contested election impacting markets. With this in mind, we take a quick trip through history to study factor performance during recent elections from the lens of the immediate election effect when political party changed and first 100 days of the new administration, in addition to the first year and full-term results.

- The prevailing economic environment, rather than election results, acted as a key driver of factor performance in the long term

- The two terms of the George W Bush and Barack Obama administrations were characterized by the bursting of the internet bubble in 2000 and the global financial crisis, respective market events that had prolonged effects on factor performance

- Momentum's extended cycle of outperformance over value has spanned Barack Obama and Donald Trump's administrations and has strengthened to levels last seen in Bill Clinton's term, demonstrating indifference to political affiliation

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falpha-factors-the-consummate-independent-voters.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falpha-factors-the-consummate-independent-voters.html&text=Alpha+factors+-+the+consummate+independent+voters+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falpha-factors-the-consummate-independent-voters.html","enabled":true},{"name":"email","url":"?subject=Alpha factors - the consummate independent voters | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falpha-factors-the-consummate-independent-voters.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Alpha+factors+-+the+consummate+independent+voters+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falpha-factors-the-consummate-independent-voters.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}