Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 27, 2020

Daily Global Market Summary - 27 October 2020

APAC equity markets closed mixed, while only the Nasdaq was higher in the US, and all major European markets were lower. US and European benchmark government bonds closed higher and iTraxx/CDX indices closed modestly wider across IG and high yield. The US dollar, gold, silver, and oil were all higher on the day.

Americas

- US equity markets closed lower except for Nasdaq +0.6%; Russell 2000 -0.9%, DJIA -0.8%, and S&P 500 -0.3%.

- 10yr US govt bonds closed -2bps/0.78% yield and 30yr bonds closed -4bps/1.56% yield.

- CDX-NAIG closed +1bp/60bps and CDX-NAHY +4bps/391bps.

- DXY US dollar index closed +0.1%/93.17.

- Gold closed +0.3%/$1,912 per ounce and silver +0.6%/$24.57 per ounce.

- Crude oil closed +2.6%/$39.57 per barrel.

- Microsoft Corp. reported today that sales rose 12% to $37.2 billion, generating a net profit of $13.9 billion in the first quarter of its fiscal year. Revenue from Azure, the company's massive cloud-computing service that has underpinned its financial success in recent years, increased 48% from the year-ago period. (WSJ)

- Tesla CEO Elon Musk has suggested that the skateboard architecture could become obsolete because of the electric vehicle (EV) manufacturer's move to structural battery packs. During a call on the company's third-quarter financials, in response to questions, the executive said the skateboard structure could become obsolete in the long term. Reportedly, Musk said, "It's just that if you have a structural pack, where the pack is contributing structural value to the car because of like the - sort of like the composite honeycomb effect of share transfer between upper and lower plate, then anything that doesn't do that is going to have to have duplicate hardware… It's going to weigh more. It's going to cost more. And then the same goes for the front and rear castings. To be frank, we're trying to make the car like you'd make a toy. If you had a toy model car, how would - and then it's got to be real cheap and look great, how would you make that? You'll cast it." Musk compared it to the evolution of aircraft as well. When this kind of transition is likely to happen is unclear, although it does indicate an area where Musk is looking to evolve Tesla's processes and engineering. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Several US lawmakers have indicated that they will make passing regulations on autonomous vehicles (AVs) a priority in 2021, no matter who wins the US presidential election on 3 November. Automotive News quotes several lawmakers on post-election plans. US House representative Debbie Dingell, from the US state of Michigan, is quoted as saying, "I'm going to be working with stakeholders that have an interest in how [the rules are] written and in the next couple of months be at the table, so we have legislation ready to introduce in early January." She also indicated that investments in electric vehicle (EV) charging infrastructure and battery technology will also be priorities. Another representative, Bob Latta of Ohio, reintroduced a previous effort at creating a federal outline to ensure safety of AVs called the Self Drive Act; Automotive News reports also that while the Self Drive Act will not move forward, there will be a new bill. Latta has been quoted as saying, "We want Americans to be the leaders in this technology. We want to use our technology and not somebody else's. It's important that we get this legislation done and get it done, not yesterday, but today." As automakers and software companies continue to push forward developing AV technology in the absence of regulations, there remains risk that some solutions will ultimately not be approved when the regulations are finally formulated. However, it is difficult to determine regulations in absence of understanding the constraints and benefits of the technology. Under current US President Donald Trump, the agencies overseeing vehicle safety largely took a hands-off approach, and let states determine their own rules. Although this is currently expedient, this could be problematic if the states' laws were contradictory and a vehicle could not operate from one state into another. The situation largely remains wait-and-see; US elections are being held on 3 November for the president as well as lawmakers at national, state and local levels. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US Conference Board Consumer Confidence Index edged down

0.4 point (0.4%) to 100.9 in October after jumping 15.0 points the

month before. (IHS Markit Economists David Deull and James

Bohnaker)

- The index was 15.2 points above its April low but 31.7 points beneath its pre-pandemic (February) high. The meager recovery in consumer confidence to date is consistent with our forecast of sharply slower consumer spending growth in the fourth quarter.

- The stability of the headline index in October masked divergence among sub-indices. The present situation index increased 5.7 points to 104.6, the highest since March, while the expectations index fell 4.5 points to 98.4.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) rose 3.3 percentage points to 6.6%. However, the net percent expecting improved employment conditions in the next six months fell 3.8 points to 13.0%.

- The net percent of respondents expecting higher incomes in the next six months edged down 0.1 percentage point to 4.2%.

- Purchasing plans mostly fell in October. The share of respondents planning to buy autos in the next six months dipped 2.1 percentage points to 9.7%, a six-month low, while the share planning to buy major appliances fell 5.3 points to 44.2%, the lowest since 2011. These readings support our view that growth of consumer spending on durable goods has exceeded a sustainable trend and is likely to decelerate in the coming months.

- The share of respondents planning to buy homes edged up 0.2 percentage point to 6.6%.

- The proportion of respondents planning a vacation in the next six months was 44.4%, the highest since February.

- The Consumer Confidence Index continues to signal a gradual recovery in consumer attitudes that remains far from complete.

- US manufacturers' orders for durable goods rose 1.9% in

September. This followed large gains in prior months that reversed

most of the pandemic driven sharp decline in the spring. Shipments

of durable goods posted a modest increase, as did inventories. (IHS

Markit Economists Ben Herzon and Lawrence Nelson)

- The details of this report that inform our GDP tracking raised our estimate of third-quarter GDP growth 0.1 percentage point to 33.1% and lowered our forecast of fourth-quarter GDP growth 0.1 percentage point to 4.8%.

- Today's report highlights how certain segments of the goods-producing sector have essentially fully recovered. Excluding capital goods, orders for durable goods have fully recovered.

- While orders for capital goods are still shy of their pre-pandemic trend, this weakness is in defense capital goods and civilian aircraft.

- New orders (net of cancellations) for civilian aircraft have been sharply negative, on average, since March, indicating an elevated level of cancellations in the industry. Excluding defense capital goods and civilian aircraft, orders for capital goods ("core" capital goods) have surged past their prepandemic trend, setting up the second half of 2020 for robust growth of equipment spending.

- We estimate that business fixed investment in equipment rose enough in the third quarter to nearly fully reverse declines over the first half of this year, and we forecast an increase in the fourth quarter that will raise equipment spending to the highest level since the first quarter of 2019.

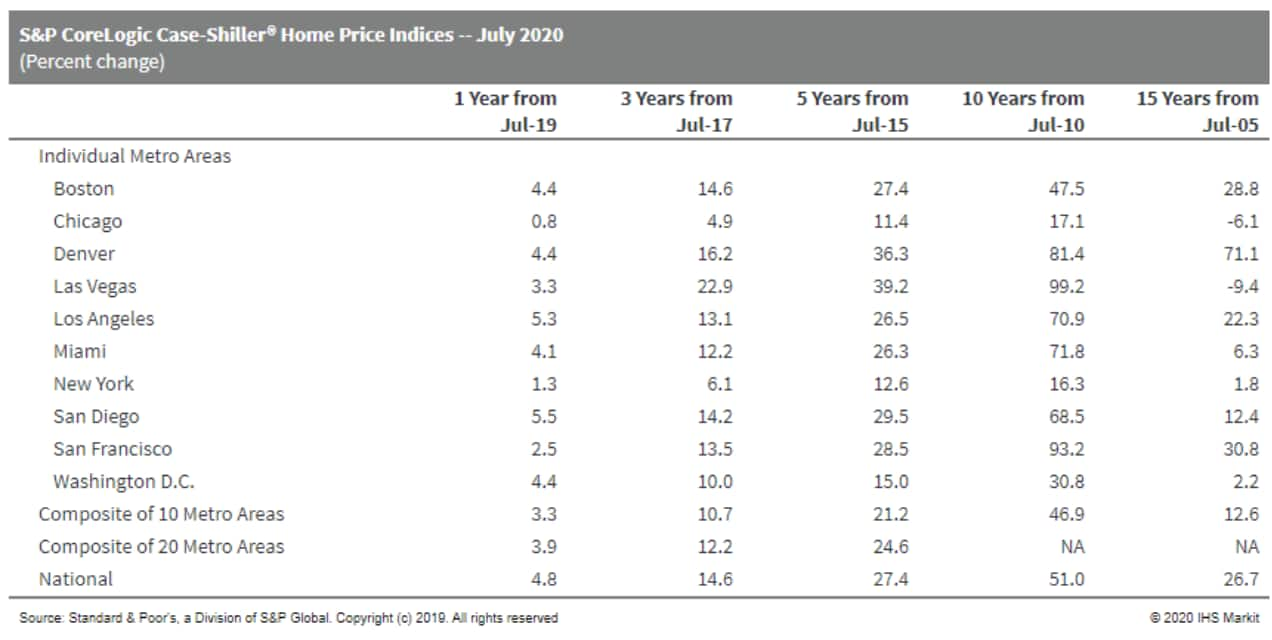

- S&P CoreLogic Case-Shiller composites surged ahead in

August. For the sixth month in a row, data in August were limited

to only 19 cities as opposed to 20 under normal circumstances. Data

for Wayne County, Michigan, were unavailable and as a result, there

are no data for Detroit in this release. Data for preceding months

(March through July) are now available. (IHS Markit Economist Troy

Walters)

- On a monthly basis, home price growth remained strong in August. Both the 10-city and 20-city composite index were up 0.5% month on month (m/m).

- Home prices were up m/m in 17 of the 19 cities reporting. Increases ranged from 2.2% in San Diego to 0.6% in Atlanta. Growth in Chicago was flat while New York prices fell 0.2%.

- On an annual basis, home price growth increased sharply again in August. The 10-city index was up 4.7% year on year (y/y). The 20-city index was up 5.2% y/y. Both indexes experienced the fastest growth since September of 2018.

- Annual home price growth was in positive territory in all 19 cities covered. Phoenix retained the top spot by a significant margin, just shy of double-digit growth at 9.9% y/y. Seattle and Tampa followed at 8.5% and 6.9%, respectively. Charlotte was close behind at 6.7%. Chicago experienced the smallest gain at just 1.2% y/y.

- The national index jumped 5.7% y/y, the fastest pace of growth

since August 2018.

- Ecolab today reported third-quarter net income down 44% year on

year (YOY), to $246.2 million, on net sales down 6%, to $3.02

billion. Adjusted earnings totaled $1.15/share, down 24% YOY but

slightly ahead of analysts' consensus estimate of $1.13/share, as

reported by Refinitiv (New York, New York). Volumes declined due to

COVID-19 and a less-favorable business mix more than offset cost

cuts and higher selling prices.

- Global industrial segment sales fell 3% YOY, to $1.47 billion, while segment operating income was up 18%, to $293.4 million. Sales were flat in the food and beverage business, but this was offset by declines in other industrial end markets. Higher selling prices, cost cuts, and lower discretionary spending boosted operating income, however.

- Global institutional and specialty segment sales were down 22% YOY, to $896.1 million, while segment operating income fell 71%, to $82.0 million. Closures and reduced business for restaurants, lodging, and entertainment facilities cut into demand for the segment, more than offsetting higher demand for sanitizing products.

- Global healthcare and life sciences segment sales were up 33% YOY, to $321.5 million, while segment operating income increased 84%, to $65.7 million. The COVID-19 pandemic led to strong volume gains across the segment.

- Other segment sales declined 12% YOY, to $283.7 million, while segment operating income was down 13%, to $44.7 million. Lower volumes more than offset cost saving and lower discretionary spending.

- US organic farm sales generated sales of USD9.93 billion in

organic products, an increase of USD2.37 bln, or 31%, from 2016.

According to the latest report, the 2019 Organic Survey, by the

USDA's National Agricultural Statistics Service (NASS), there were

16,585 certified organic farms, a 17% increase from 2016, which

accounted for 5.50 million certified acres, an increase of 9% over

2016. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- California had organic sales worth USD3.60 billion, or 36% of the US total and four times that of any other state. It also had the most organic farms (3,012 certified farms and 965,257 certified acres). Washington (USD886 million), Pennsylvania (USD742 million), Oregon (USD454 million), and Texas (USD424 million) were the next four following states.

- The top sectors and commodities in 2019 were:

- Livestock and poultry products: USD2.48 billion, up 12%

- Vegetables: USD2.08 billion, +27%

- Milk: USD1.59 billion, +14%

- Fruits, tree nuts, and berries: USD2.02 billion, +44%

- Livestock and poultry: USD1.66 billion, +44%

- Field crops: USD1.18 billion, +55%

- Broiler chickens: USD1.12 billion, +9%

- Apples: USD475 million, +45%

- Lettuce: USD400 million, +44%

- Corn for grain: USD278 million, +70%

- Other top organic commodities with the greatest gains in value of sales from 2016 were spinach (52%), grapes (52%), cultivated blueberries (104%), raspberries (197%), and turkeys (68%).

- The survey shows that USD2.04 billion worth of organic products were sold directly to retail markets, institutions, and local/regional food hubs. Another USD300 million accounted for products sold directly to consumers at farmers' markets, on-farm stores and stands, roadside stands or stores, u-pick, community supported agriculture farms, and online markets. Value-added products such as jam, wine, cheese, and meat, generated USD727 million.

- Asked about plans for future production, 29% of farms plan to increase their level of organic production. More than 1,800 certified organic farms have 255,000 additional acres in the three-year transition period required for land to become certified as organic. An additional 710 farms not currently certified reported 61,000 acres of land transitioning to organic production.

- Argentine President Alberto Fernández has met representatives of vehicle manufacturers and workers to discuss a bill to create an automotive-sector development programme and to search for an automotive development project, reports Automotive Business. The president declared the automotive industry as strategic for the Argentina's overall production. President Fernández met with Daniel Herrero, president of Association of Automobile Manufacturers (Asociación de Fábricas de Automotores: ADEFA), Antonio Caló, general secretary of the Unión Obrera Metalúrgica (UOM), and Ricardo Pignanelli, general secretary of the Mechanics Union y Afines del Transporte Automotor (SMATA), as well as Minister of Economy Martín Guzmán. President Fernández highlighted the plans for an industry investment of USD5 billion in Argentina by the end of 2021, and the need for the creation of a regulatory framework that will boost the development of vehicle and component manufacturers in the country. ADEFA president Herrero said, "We have defined an export and specialized business model, with products with high added value that involve an intense level of long-term venture capital investment." He added, "It is the time to continue working to materialize these points and in all factors to improve competitiveness and the opening of new markets, to have an increasingly sustainable sector over time." (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed lower across the region; Spain -2.1%, France -1.8%, Italy -1.5%, UK -1.1%, and Germany -0.9%.

- 10yr European govt bonds closed higher across the region; Germany/UK -4bps and France/Italy/Spain -3bps.

- iTraxx-Europe closed +1bp/59bps and iTraxx-Xover +3bps/343bps.

- Brent crude closed +2.8%/$41.61 per barrel.

- Brenntag has confirmed details of its previously announced

transformation program, Project Brenntag. The program is expected

to deliver an additional, "sustainable" annualized operating EBITDA

contribution totaling €220 million ($260 million) by the start of

2023. The program also involves about 1,300 job cuts and 100 site

closures. Brenntag's 2019 operating EBITDA was €1 billion on sales

of €12.8 billion.

- Brenntag launched a strategic analysis at the beginning of 2020 as a starting point for the transformation program. The company says that the program is designed to expand Brenntag's global market-leading position in chemicals and ingredients distribution through an increased focus, reduced complexity, and stronger partnerships with customers and suppliers. Brenntag announced last month that, starting in January 2021, the company would be steered in two global divisions with a focus on changing customer and supplier needs: Brenntag Essentials and Brenntag Specialties.

- The total net cash outflow to be incurred in course of implementing Project Brenntag is expected to amount to about €370 million. The program "will lead to significant efficiency gains and contribute to top-line growth as well," Brenntag says.

- The planned job cuts, to take place over the next two years, represent more than 7% of Brenntag's total workforce. Less than 200 of the job cuts are expected to be in Germany. Brenntag says it will strive to avoid compulsory redundancies. The measures will be further elaborated over the coming months in line with local rules and labor regulations. "This step will be anything but easy for us, but it is necessary to ensure Brenntag's success in the long term," Kohlpaintner says.

- The 100 site closures will be across all regions and half will be of third-party logistics sites, Brenntag says. The company says it will also invest in existing and new sites, create regional hubs, and close white spots in its network.

- Brenntag says it will provide further details of the program in a capital markets update on 4 November.

- German biopharma major Bayer has announced the acquisition of Asklepios BioPharmaceutical (AskBio, US), a company specializing in the development of gene therapies intended for use in a range of therapeutic areas, for a potential total consideration of USD4 billion. Bayer will pay USD2 billion upfront, and the deal envisages milestone payments capped at USD2 billion - of which 75% is expected to be paid in the first five years after the acquisition. The acquisition will give Bayer access to what it describes as an "industry-leading" adeno-associated virus (AAV)-based gene therapy platform. The transaction still needs to clear the customary closing conditions, and this is expected to take place in the fourth quarter of the year. This is Bayer's largest pharmaceutical acquisition since 2006, when it acquired compatriot company Schering. AskBio is a clinical-stage company, which has a number of assets in early-to-mid-stage clinical trials, in rare or difficult-to-treat diseases. The acquisition is the latest by a major gene-therapy specialist, following Novartis (Switzerland)'s takeover of AveXis in 2018. Gene therapies are widely expected to account for a significant and growing proportion of the global pharma market in the coming years. (IHS Markit Life Sciences' Brendan Melck)

- Daimler Buses has had its air filtration technology on its buses independently tested in response to the coronavirus disease 2019 (COVID-19) virus pandemic, according to a company statement. Daimler is attempting to ensure it can do everything possible to prevent the spread of COVID-19 on its public buses and coaches by ensuring its air filtration technology is as efficient as possible. The effectiveness of its systems have been confirmed by a research report issued by the Hermann Rietschel Institute at the Technical University of Berlin. Gustav Tuschen, Head of Development at Daimler Buses said, "The study by the Technical University of Berlin showed that the measures in our buses, such as the use of active filters with anti-viral coating, can make bus tourism safer. That is why we are clearing this filter technology and the findings from the study for competitors." This obviously a positive endorsement for Daimler Buses in the current environment. The company is using multi-layer, progressively designed high-performance particle filters, which also feature an anti-viral functional layer that filters the finest aerosols, which is how COVID-19 can be transmitted. These components are part of the buses' fully automatic air conditioning systems. (IHS Markit AutoIntelligence's Tim Urquhart)

- SEAT has launched its multimodal mobility platform that will enable operators to manage vehicle fleets digitally. The development of the platform is carried out at its software development center SEAT:CODE. SEAT's urban mobility brand, SEAT MÓ, is the first operator to deploy the new platform for its services. Now, the automaker has made the platform open to other businesses and external operators, both for public and private shared services. Carsten Isensee, SEAT vice-president for finance and IT, said, "This platform shows that we are no longer just a vehicle manufacturer, but also a mobility services provider. SEAT is now able to sell software and that's a great added value for the company." SEAT's interest in urban and last-mile mobility is consistent with the needs of countries and regions where it has a strong presence - including Spain and Portugal - and carves out a clear space that complements the other Volkswagen Group (VW) brands. Last year, it launched two pilot projects aimed at improving the mobility of its employees at the Martorell factory in Spain. It has also joined Madrid in Motion, a multi-sector, public-private open innovation hub that creates sustainable urban mobility. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Veoneer has announced that it has reduced its losses during the third quarter of 2020 despite lower sales. During the three months ending 30 September, the company recorded net sales of USD371 million, a fall of 19.7% year on year (y/y). At the same time, its gross profit dropped 26% y/y to USD54 million. However, operating losses have been reduced from USD122 million to USD103 million as it decreased its research, development and engineering (RD&E) costs from USD144 million to just USD124 million. Sales fell across all of its product areas during this timeframe. Restraint Control Systems declined by 2.6% y/y to USD188 million, while Active Safety retreated by 4.5% y/y to USD170 million. Brake Systems plummeted from USD91 million to USD13 million. As a result of the impact of the coronavirus disease 2019 (COVID-19) virus pandemic, net revenues for first three quarters of the year have contracted by 37.5% y/y to USD918 million, while gross profit dropped 53.2% y/y to EUR110 million. However, operating losses were cut from USD388 million to USD290 million. (IHS Markit AutoIntelligence's Ian Fletcher)

- Turkey's Automobile Joint Venture Group (Türkiye'nin Otomobili Girişim Grubu: TOGG) has revealed that the longer battery life in its range of TOGG products than its competitors is driven by the use of liquid cooling and an innovative battery management system, reports Daily Sabah. According to the source, the vehicle's lithium ion (Li-ion) battery will incorporate a nickel, manganese, and cobalt oxide (NMC) cathode that will optimize energy and power density. The battery modules will include pouch-type cells with high-energy density, wherein these cells will be enclosed with aluminum coverage to provide high structural strength. According to the automaker, the cars will have a 300-500 km range and can be charged to 80% in less than 30 minutes. The statistics came shortly after TOGG announced its partnership with China-based Li-ion battery-producing company Farasis Energy. (IHS Markit AutoIntelligence's Tarun Thakur)

- Ethiopia's headline inflation remained in double-digit

percentages yet slowed to 18.7% in September amid softer food

prices, reaching the same level as in January. Meanwhile, Ethiopian

Prime Minister Abiy Ahmed announced the success of the country's

newly introduced currency notes. (IHS Markit Economist Alisa

Strobel)

- As part of Ethiopia's continuous development strategy outlined in the "Homegrown Reform Agenda", a de-monetization process was launched in September and has led to the opening of bank accounts for 1.3 million Ethiopian citizens, according to a statement by Prime Minister Ahmed to the media. Furthermore, Ethiopians have a three-month window to deposit their old currency notes and, in return, they will be given a bank account to withdraw new currency notes.

- In the meantime, annual headline inflation reached 18.7% in September, down from 20% in August and a second consecutive month of decline. Higher food prices amid worsening market conditions had pushed prices up to 22.3% in June. Price levels have remained elevated since April's rise to 22.9%.

- Market conditions are expected to remain unfavorable for lower prices through the remainder of this year, given the uncertainty regarding a repetition of supply disruptions caused by the COVID-19 pandemic. Food prices are expected to remain high despite expected improved growth in agricultural sector output in the second half of 2020. Meanwhile, commercial farms are expected to remain challenged by a shortage of foreign currency for imports of feed inputs and vaccines. Currency shortages were a contributing factor that drove the elevated price levels recorded prior to the onset of the COVID-19 virus outbreak.

- The low foreign-exchange reserves are contributing to a significant rise in consumer goods' prices, as import costs are high. We expect to see some sort of import substitution efforts by the government as a policy incentive to counter this problem. Although export volumes and diversification of the export base have improved, the loss in competitiveness amid a strong currency in comparison to regional trading partners has weighed on Ethiopia's balance of payments, worsening the current-account deficit.

Asia-Pacific

- APAC equity markets closed mixed; Australia -1.7%, South Korea -0.6%, Hong Kong -0.5%, Japan flat, Mainland China +0.1%, and India +0.9%.

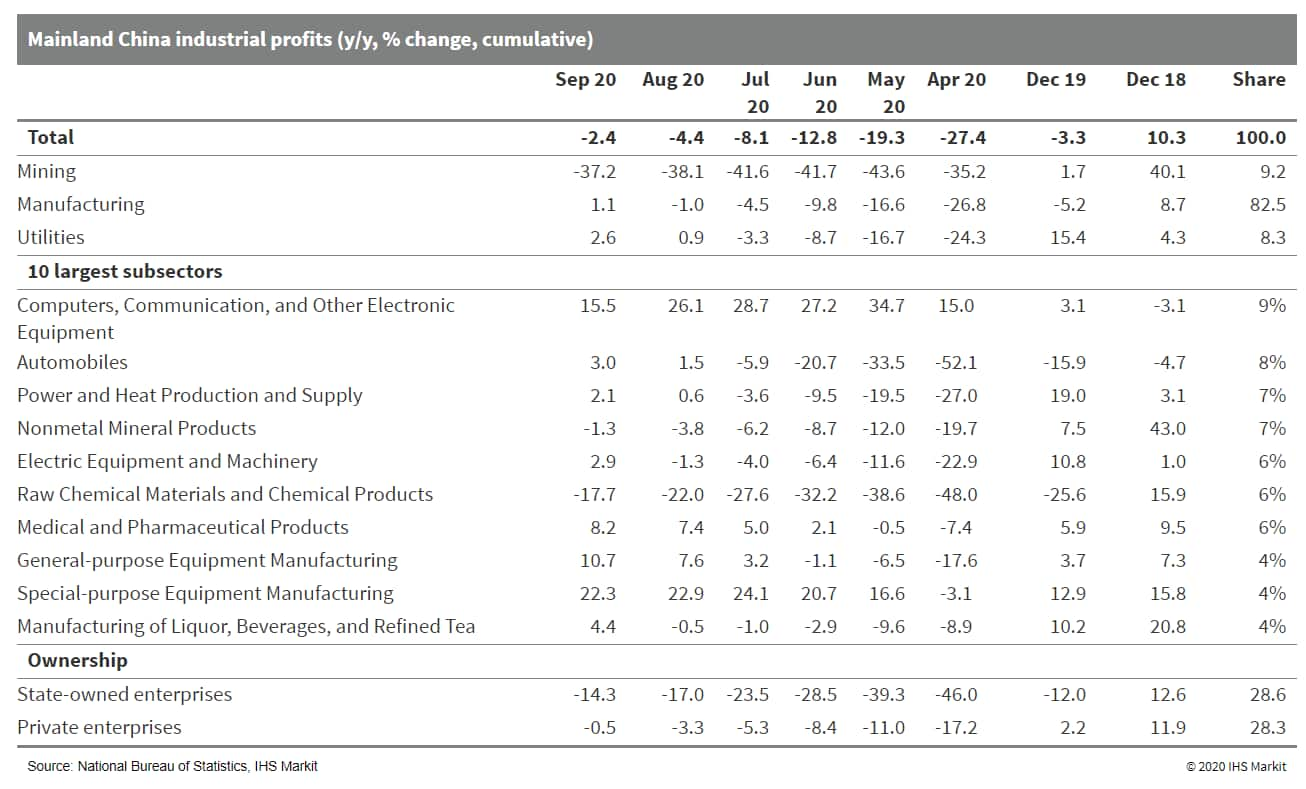

- Chinese industrial profit rose 10.1% year on year (y/y) in

September, decelerating from a 19.1% y/y expansion in the preceding

month, according to the release by the National Bureau of

Statistics (NBS). The slower recovery in September was largely due

to price deflation of some industrial goods, while operating

revenue growth accelerated to 6.9%. Preparations in anticipation of

depreciation in some sectors and the rising base effect also

dragged down the headline growth. (IHS Markit Economist Yating Xu)

- The continuous recovery in industrial production and sales, in addition to declining operating costs, led to the quarter-on-quarter improvement in industrial profits. The year-to-date contraction narrowed to 2.4% y/y in September from 4.4% in August. Industrial profits expanded 15.9% y/y in the third quarter, up 11.1 percentage points from the second-quarter 2020 figure.

- By sector, 21 out of the 41 surveyed sectors reported y/y profit increase in the first three quarters, up from 16 in August. Profits in high-tech sectors remained strong, with acceleration recorded in the electronic equipment and special-purpose equipment segments. Profit growth in upstream sectors decelerated, particularly in the ferrous-metals smelting and chemical products manufacturing sectors. The growth momentum in downstream consumption goods manufacturing continued to moderate.

- Industrial enterprises continued to build up inventory as the inventory of finished goods increased by 8.2% y/y, up 0.3 percentage point from the previous month, marking the second straight month of acceleration.

- Profitability improved across ownership types. Profit contraction in the state-owned sector continued to narrow, but it remains the worst-performing sector. Profits in the private sector improved to near year-ago levels, and foreign firms registered y/y profit growth through September. The average liability-to-asset ratio remained unchanged for the third consecutive month, at 56.7%.

- The sequential growth momentum of industrial profits is

expected to moderate further in the fourth quarter as recovery

momentum is slowing. Property sales and infrastructure investment

seem to have lost strength and the Producer Price Index (PPI) fell

for two consecutive months. However, consumption and manufacturing

investment are likely to be the new drivers of China's economic

recovery in the coming quarters. Meanwhile, accelerating inventory

growth will support further improvements in industrial profits.

- Zhejiang Geely Holding Group (Geely) has partnered with China Mobile to develop 5G-based intelligent connectivity solutions to support autonomous vehicle operations, reports Gasgoo. The companies will co-operate in the fields of 5G-enabled auto-related intelligent connectivity, autonomous vehicle (AV), mobility service, low-orbit satellite communications, smart city and industrial internet, home internet, big data, and artificial intelligence. Li Shufu, chairman of Geely, said, "Geely will transform into a global innovative technology company. Scientific and technological innovation is a must-go approach for enterprises' progress and development, and enterprise's progress and development cannot be divorced from science and technology innovation". The companies will leverage each other's expertise in resources, technologies and market influence to promote the applications of 5G-enabled intelligent automobiles and smart mobility services. Geely's AV capability is presently at Level 2 and it aims to provide Level 3 services with 5G and cellular-based vehicle-to-everything (C-V2X) technologies in 2021 for some brands. Last year, Geely shared its vision for AVs at the 2019 Dragon Bay Forum in Hangzhou Bay. The company has announced plans to launch two low-orbit satellites this year in an attempt to enable accurate navigation data for AV development. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- FAW Volkwagen (VW), VW's joint venture (JV) with FAW Group, has begun trial production of the ID.4, based on VW's MEB electric vehicle (EV) platform, at its Foshan plant in Guangdong province, southern China. The sport utility vehicle (SUV) from VW's ID series of EVs will be produced by both the SAIC VW JV and FAW VW in China in the fourth quarter. The automaker is expected to unveil the ID.4 at Chinese debut event in Shenzhen scheduled on 3 November. As the launch of the ID.4 approaches, more news has surfaced centered on VW's preparations for volume production of its ID series of EVs and of MEB-based EVs from the group's other brands, including Skoda and Audi. The ID.4 will be the first MEB-based model to help the automaker gauge consumer interest in this brand-new model line-up. Given that both FAW VW and SAIC VW will be producing the ID.4 in the fourth quarter, VW is likely to develop different variants for each JV. The Foshan plant will be the main facility in FAW-VW's production network for EV production. The site will be leveraged for the production of at least five MEB-based models for the VW brand in 2022, including the ID.6 mid-size SUV and the full-size ID. Vizzion sedan. (IHS Markit AutoIntelligence's Abby Chun Tu)

- As per IHS Markit's Commodities at Sea, during September 2020, coal and iron ore arrivals into Japan are calculated at 13.5mt (down 11% y/y) and 6.4mt (down 25% y/y). During the first nine months of 2020, total coal imports at the Japanese ports are calculated at 131mt, down 6% y/y. In terms of cargo grade, thermal and metallurgical coal arrivals during the specified period stood at 93.2mt (down 3% y/y) and 37.9mt (down 13% y/y), respectively. Total iron ore imports into the World's third-largest steel producer during the nine months of this year stood at 59.9mt (down 19% y/y). The decline was from its major trade partner Australia and Brazil where imports stood at 41.4mt (down 18% y/y) and 9.1mt (down 16% y/y), respectively. A significant decline in iron ore usage is on the back of a slump in Japan's crude steel production which in the eight months of this year was announced at 59.5mt, down 21% y/y. As per the Japan Iron and Steel Federation, crude steel output in the country in September 2020 declined 19.3% y/y (marking the seventh monthly consecutive decline) as COVID-19 continued to outweigh demand. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- The Singapore economy has been hit by multiple shocks during

2020 from the impact of the protracted lockdown on domestic

consumption and business activity, as well as the collapse of the

tourism industry due to international travel bans. The Singapore

Ministry of Trade and Industry (MTI) has sharply revised down its

GDP forecast for calendar 2020 to a range of -5.0% to -7.0%. (IHS

Markit Economist Rajiv Biswas)

- Utilizing its deep fiscal reserves, the Singapore Government has deployed massive fiscal stimulus measures to support domestic demand, helping to support many segments of the economy that are experiencing severe downturns, including tourism, retail trade, commercial aviation and construction. Despite the severe economic shocks, Singapore has remained resilient, continuing to position itself as the Asia-Pacific region's leading international financial center.

- The latest survey data showed that the IHS Markit Singapore Purchasing Managers' Index™ (PMI) rose from 43.6 in August to 45.1 in September. Despite the improvement, the PMI still signaled a contraction in economic activity. However, the average PMI reading for the third quarter was notably higher than that seen in the second quarter, representing a rebound from the peak impact of the COVID- 19 pandemic.

- Business activity continued to contract in September, with reduced output concentrated in sectors relating to accommodation & food services as well as administrative & support services. Underlying data showed that construction activity returned to growth as project sites were permitted to restart and workers being cleared to resume work. Manufacturing output was also broadly stable.

- The latest manufacturing output data for September showed a strong rebound, rising 24.2% y/y. This reflected very rapid expansion in biomedical manufacturing output, which rose by 89.8% y/y, with pharmaceutical output up 113.6% y/y. Electronics output also showed strong growth.

- However, the transport engineering sector contracted sharply, down 35.8% y/y, with aerospace engineering down 44% y/y due to the disruption in global air transport, while the marine and offshore engineering segment recorded a decline of 40.9% y/y, reflecting the slump in the global oil and gas sector.

- As the impact of the pandemic widened in the Asian region during April, the headline IHS Markit Global Electronics PMI fell to 43.3 in April, down from 48.6 in March, to signal a sharp deterioration in business conditions faced by electronics manufacturers. However, since April, the IHS Markit Global Electronics PMI has showed significant improvement, with the headline index rising to 51.1 in September, the first expansion in business conditions for 13 months.

- Based on the assumption that COVID-19 vaccines will be deployed during the course of 2021 in many countries worldwide, the pandemic is expected to gradually be brought under control. This is expected to allow the Singapore economy to return to positive growth during 2021-22. GDP is forecast to grow by 3.7% in 2021, strengthening to a more rapid pace of 6% in 2022 as the economy recovers from the pandemic.

- Despite an 11.3% y/y plunge, Thai vehicle production witnessed its highest monthly output in September since pre-COVID-19 levels in February, largely driven by robust output of pick-ups, SUVs, and passenger cars for the domestic and export markets. OEMs are currently ramping up their production during the fourth quarter of 2020 in the wake of an improved market outlook driven by attractive sales promotions and the government's economic stimulus measures. Thai light-vehicle production is anticipated to fall 33.4% y/y in 2020 to around 1.33 million units. (IHS Markit AutoIntelligence's Jamal Amir)

- Indonesia's financial services authority, Otoritas Jasa Keuangan (OJK), has announced in a press release dated 23 October that it will extend multiple measures to assist banks during the COVID-19-virus pandemic by a year to March 2022. These measures were initially announced on 28 May 2020 and include allowing banks to exempt assessing low-quality assets (loan at risk: LAR) in the financial soundness test, delaying the 2.5% capital conservation buffer (CCB) for BUKU3 and BUKU4 banks (smaller banks), and pushing back the higher net stable funding ratio (NSFR) and liquidity coverage ratio (LCR) requirement. The scheme will also be extended to March 2022 in terms of restructuring loans; however, the chairman of the board of commissions of the OJK, Wimboh Santoso, said that this will only be offered "selectively" to particular banks to "avoid moral hazard". OJK did not elaborate on which banks will be allowed to extend the restructuring. Several countries have extended the time frame of their COVID-19-virus measures, including Malaysia, which introduced a targeted follow-on scheme to its loan moratorium for troubled borrowers, and India introduced a loan restructuring scheme after the end of the blanket loan moratorium. In Indonesia's case, the extension came well before the expiration date of the COVID-19-virus-related schemes. (IHS Markit Banking Risk's Angus Lam)

- New Zealand's headline consumer price index (CPI) rose 0.7%

quarter on quarter (q/q) on a non-seasonally adjusted basis in the

September quarter, which was led by vegetable prices, according to

official figures from agency Statistics New Zealand. This is a

reversal in trend from the previous quarter, which saw a 0.5% q/q

drop in inflation when oil prices fell sharply and the COVID-19

pandemic peaked. (IHS Markit Economist Bree Neff and Andrew Vogel)

- The largest contributor to the uptick in CPI in the third quarter was food prices, which were up - driven by an 18% q/q increase in vegetable prices- with biosecurity-induced import restrictions for courgettes from Australia one driver of the surge, and broader uncertainty caused by the pandemic another.

- Additionally, housing and utilities costs were a key contributor to inflation for the quarter owing to higher property rates and related services charges, while transport costs owing to a recovery in the cost of private transportation services.

- The inflation rate of tradeables rebounded in the September quarter likely influenced by the increase in imported food prices - bringing the annual change to just -0.1% y/y. The inflation rate of non-tradeables was lifted during the quarter by the rise in property rates and other housing services charges, and private transport costs.

- The inflation result in the September quarter was slightly lower than IHS Markit's expectations for 1.5% y/y. Barring continued issues with food imports and prices, we still feel comfortable with our expectations for annual average inflation of roughly 1.6% for 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2020.html&text=Daily+Global+Market+Summary+-+27+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}