Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 26, 2020

Daily Global Market Summary - 26 October 2020

Global equity markets were lower across APAC, Europe, and the US, as investors are becoming increasingly concerned over the combination of the growth in COVID-19 cases triggering a second round of major restrictions in Europe and the decreasing likelihood of a US stimulus bill being passed before next week's elections. US government bonds and the dollar were higher on the day, while the European iTraxx and North American CDX credit indices closed wider across both IG and high yield. Gold was flat and oil/silver were both lower on the day.

Americas

- US equity markets closed lower; DJIA -2.3%, Russell 2000 -2.2%, S&P 500 -1.9%, and Nasdaq -1.6%.

- 10yr US govt bonds closed -4bps/0.80% yield and 30yr bonds closed -4bps/1.60% yield.

- CDX-NAIG closed +2bps/59bps and CDX-NAHY +14bps/387bps.

- DXY US dollar index closed +0.3%/93.07.

- Gold closed flat/$1,906 per ounce and silver -1.1%/$24.42 per ounce.

- Crude oil closed -3.2%/$38.56 per barrel.

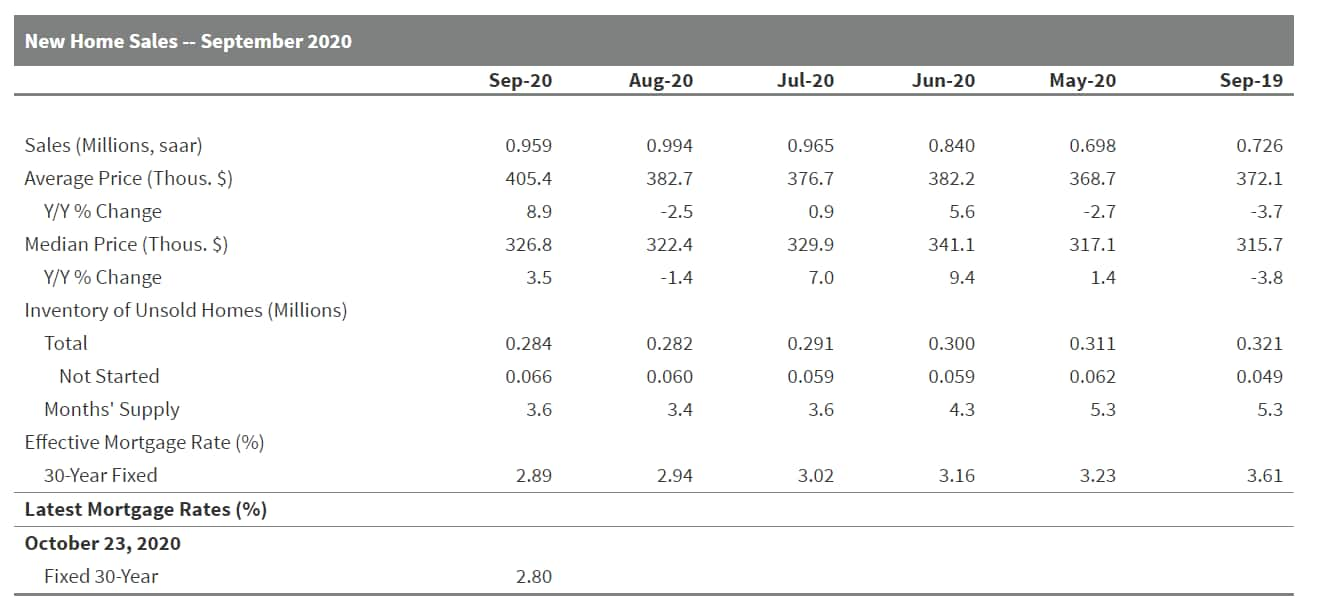

- New US home sales slipped 3.5% in September (±19.9%, not

statistically significant) to a seasonally adjusted annual rate of

959,000; third-quarter sales soared 38.4% to a 973,000 annual

rate—the highest since the fourth quarter of 2006. (Note: the

quarterly estimates are more informative than the monthly estimates

because averaging reduces statistical noise.) (IHS Markit Economist

Patrick Newport)

- Sales have picked up in all four regions. In the South, West, and Midwest, third-quarter sales stood at levels last seen in late 2006/early 2007.

- Sales of un-started homes increased for the fifth straight month to a 319,000 rate—an un-started new home sale usually turns into a single-family housing start within a couple of months. Completed homes sold were also up; sales of homes under construction tumbled from 401,000 to 329,000.

- Sales for the prior three months were revised down a cumulative whopping 18,000.

- The number of units for sale increased by 2,000 to 284,000; completed homes for sale came in at 48,000 (lowest reading since March 2014), down 4,000.

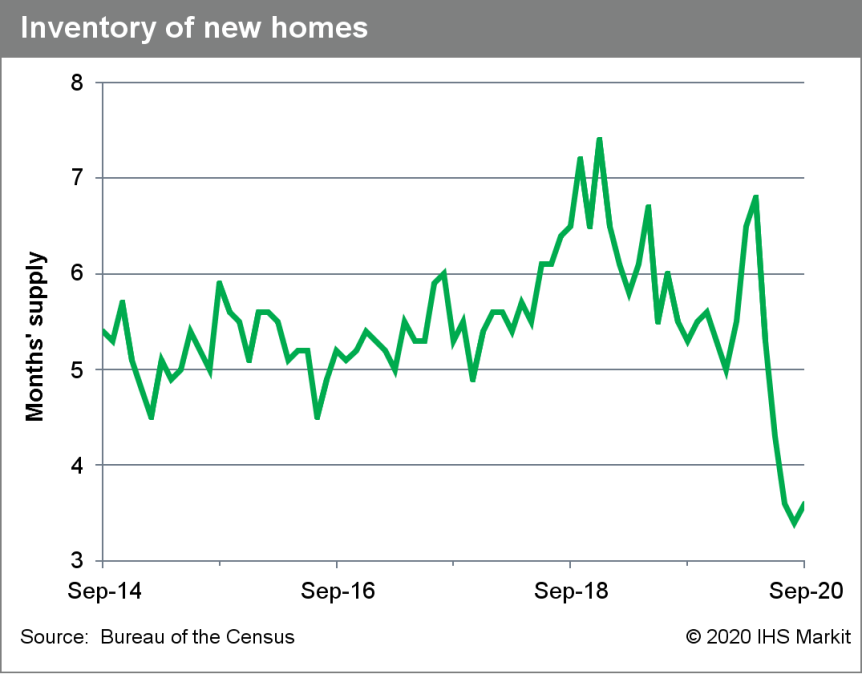

- The months' supply of unsold homes inched up 0.2 month to 3.6 months.

- Bottom line: Although reported sales slipped in September,

third-quarter sales went through the roof; sales of un-started

homes will boost housing starts over the next two months. This

report was solid.

- The average number of new coronavirus cases reported daily over the past week reached an all-time high of 68,767 on Monday, another indication that the U.S. is experiencing a fresh surge of infections as the weather turns cooler. The figures, based on a Wall Street Journal analysis of Johns Hopkins data, have increased steadily this month and include back-to-back days of more than 80,000 cases over this past week. (WSJ)

- Sheldon Adelson's Las Vegas Sands Corp. is exploring the sale of its casinos in Las Vegas, according to people with knowledge of the matter, a move that would mark the mogul's exit, for now, from the U.S. gambling industry. The world's largest casino company, Sands is working with an adviser to solicit interest for the Venetian Resort Las Vegas, the Palazzo and the Sands Expo Convention Center, which together may fetch $6 billion or more, said the people, who asked to not be identified because the talks are private. The properties are all connected along the city's famous strip. (Bloomberg)

- Gentex has reported financial results for the third quarter showing net sales of USD474.6 million, down 1% from USD477.8 million in the corresponding quarter of 2019. However, in its statement, the automotive components supplier notes that the third quarter of 2019 was its best ever quarter of sales and the third quarter of 2020 was its second best. In the year to date (YTD), Gentex's net sales have declined 18.1% year on year (y/y) to USD1.16 billion. The YTD figure was impacted by the automotive industry's production suspensions in various global regions during the period because of the coronavirus disease 2019 (COVID-19) virus pandemic. However, production resumed in North America by early June and since then automakers have been rebuilding inventories, and Gentex reports delivering 4% more interior mirrors in the third quarter of 2020 than in the corresponding quarter of 2019. Earlier this year, Gentex changed to providing a forecast of results for the second half of 2020, instead of updating its previous full-year guidance; when reporting its third-quarter results, the guidance was updated. The supplier says this practice reflects better its new cost structure in its guidance for the remainder of 2020 and into 2021. For the second half of 2020, Gentex forecasts revenue of between USD940 million and USD960 million, a gross margin of 39-40%, and operating expenses of USD95-100 million. The supplier expects to make capital expenditure of between USD25 million and USD30 million in the second half. Similar to other suppliers and automakers, Gentex drew down on its line of credit as a precautionary step amid the COVID-19 situation and in the second quarter used USD75 million of a USD150-million credit line. In the third quarter, the supplier paid USD50 million of that back and expects to repay the remainder by the end of 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In a press release on Sunday, Cenovus Energy Inc. announced the signing of an agreement to acquire Husky Energy Inc. in an all-stock transaction valued at C$13.7 billion ($10.5 billion). The transaction is expected to close in the first quarter of 2021. Under the deal, Husky shareholders will receive 0.7845 shares of Cenovus plus 0.0651 of a Cenovus share purchase warrant for each Husky share. Based on Cenovus' closing price on 23 October 2020 and total 1.0 billion Husky shares outstanding, the total equity offer value is C$3.84 billion ($2.93 billion) or C$3.82 per share. The offer price is about 21% premium to the 23 October closing price of Husky. The total transaction value includes the assumption of Husky's 30 June 2020 working capital deficit of C$223 million and C$9.67 billion of long-term debt and liabilities. Husky's largest investors, Hutchison Whampoa Europe Investments S.à r.l. and L.F. Investments S.à r.l., which owns 40.19% and 29.32% of the common shares respectively, agreed to vote in favor of the agreement. On closing, Husky shareholders will own approximately 39% of the combined company. Cenovus expects the acquisition to generate run-rate synergies of C$1.2 billion by the end of the first year after completion of the transaction. The enlarged company is expected to produce around 750,000 boe/d and have combined upgrading & refining capacity of 660,000 b/d. On closing, the enlarged company will have access to about 265,000 b/d of current takeaway capacity out of Alberta on existing major pipelines and 16 MMbbl of crude oil storage capacity. Husky's net proved reserves were 1.27 billion boe (82% oil and NGLs: 66% bitumen; 33% developed) and net 2P reserves were 1.83 billion boe (83% oil and NGLs: 65% bitumen) at year-end 2019 and net (after an applied 20% royalty) production averaged 197,600 boe/d (65% oil and NGLs: 54% heavy oil and bitumen) during the second quarter of 2020. Cenovus said Husky's diverse portfolio will enable them to deliver stable cash flow through price cycles, while focusing capital on the highest-return assets and opportunities. Husky Energy is an integrated energy company. The company is based in Calgary, Alberta. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

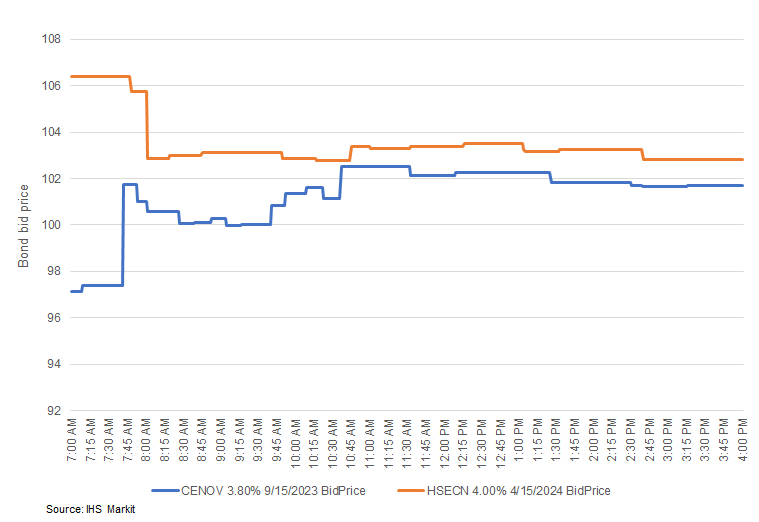

- The below IHS Markit Live intraday bond price chart shows that

the Ba2/BBB- rated Cenovus Energy 3.80% 9/2023 bond issue (blue

line) was as much 5.5% higher in price shortly after today's market

open, while Baa2/BBB rated Husky Energy 4.00% 4/2024 issue (orange

line) decreased 3.4% in price post-open.

Europe/Middle East/Africa

- European equity markets closed lower across the region; Germany -3.7%, France -1.9%, Italy -1.8%, Spain -1.4%, and UK -1.2%.

- 10yr European govt bonds closed mixed; Italy -3bps, Germany/Spain -1bp, and France/UK flat.

- iTraxx-Europe closed +3bps/58bps and iTraxx-Xover +13bps/341bps.

- Brent crude closed -2.3%/$40.81 per barrel.

- On 22 October, the Bank for International Settlements (BIS)

published a Working Paper entitled "Effects of eligibility for

central bank purchases on corporate bond spreads", by Taneli

Mäkinen, Fan Li, Andrea Mercatanti, and Andrea Silvestrini. (IHS

Markit Economist Brian Lawson)

- The study looked at the price impacts of the European Central Bank (ECB)'s Corporate Sector Purchase Programme (CSPP), initially conducted between March 2016 and December 2018.

- It noted that CSPP involved "a sizable transfer of relatively illiquid securities from the private sector to central bank balance sheets".

- It studied the effect in relative performance between eligible and ineligible bonds, concluding that CSPP "did not alter" relative performance, even when the program reached peak volume.

- The study's findings clearly question the importance of the eligibility of specific corporate bonds for the ECB's asset purchase programs in driving relative performance.

- At first sight, this appears surprising: many corporate bonds are relatively illiquid - so their eligibility for ECB purchase should have a material impact on the demand/supply balance for individual issues.

- Minimal performance differentials also potentially undermine the policy impact of changes in ECB purchase criteria. Despite the potentially heavy importance of ECB purchases in determining the trading dynamics of individual bonds, the study implies that changed eligibility criteria will have little overall relative price and yield impact. In late September, the ECB made sustainability-linked bonds eligible for its asset purchase programs and as collateral for ECB credit from 1 January, flagging that this "signals the Eurosystem's support for innovation in the area of sustainable finance".

- IHS Markit assesses that such changes will continue producing limited relative price impact, given the modest size of corporate bond purchases within overall ECB asset purchase activity.

- At end-September 2020, the ECB's total stock of securities stood at EUR2,842 billion, of which only EUR236.4 billion were within the CSPP: asset holdings are dominated by the Public Sector Purchase Programme with EUR2,290 billion.

- Overall, aggregate ECB purchases are a crucial driver of market liquidity and the broader yield environment and risk premium, affecting corporate bonds alongside other asset classes, but with the study indicating little relative impact between individual corporate issues.

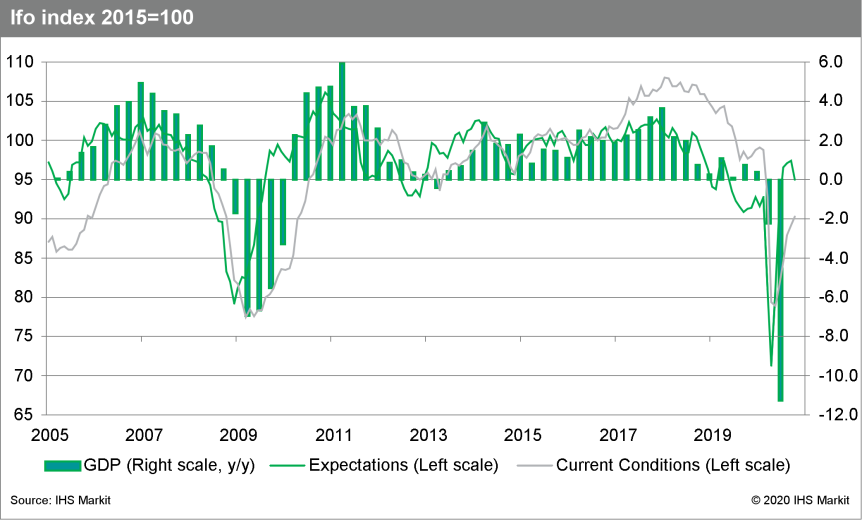

- The headline Ifo index, which reflects Germany's business

confidence in industry, services, trade, and construction combined,

has dipped modestly in October, having recovered for five

consecutive months previously. It fell from 93.2 in September

(revised down from 93.4) to 92.7 in October. This compares with

February's pre-pandemic level of 95.8, an all-time low of 75.2 in

April, and a long-term average of 97.1. The Ifo institute clearly

attribute the setback to the rising COVID-19 infection numbers in

recent weeks. (IHS Markit Economist Timo Klein)

- In October, there was a marked dichotomy between deteriorating expectations (from 97.4 to 95.0, still the highest level since May 2019) and the fifth improvement of current conditions in a row (increase from 89.2 to 90.3). Expectations worsened across all sectors in a similar manner, with construction remaining the most resilient. By contrast, current conditions deteriorated the most in the building sector, admittedly from very elevated levels. Service-sector conditions worsened modestly, whereas the business situation in the wholesale and retail trade sectors and especially in manufacturing improved sharply once more.

- The breakdown of overall indices by sector, which combines expectations and current conditions, reveals that the Ifo index was burdened by a worsening business climate in the service and construction sectors and helped by an ongoing recovery in the manufacturing sector. The climate in the wholesale and retail sectors slipped only marginally. In level terms, service-sector confidence remains slightly ahead of the others, but differences across sectors are now at their smallest since the service-sector was added to the overall index in 2005.

- The Ifo graph portraying the cyclical position of the diffusion index of the headline measure - setting the current conditions and expectations balances against each other - signals that the economy has exited the boom quadrant again, having only just returned there in August. Although the assessment of current conditions has advanced further from 3.3 to 5.9, expectations fell back from 4.3 to -0.7 and thus into negative territory. This constellation is typical of a downswing situation. The risk highlighted last month, namely that COVID-19 infections surge anew, has been realized. Without doubt, this will lead to a phase of tightened administrative restrictions lasting at least several weeks and potentially months, which will hurt economic activity in the final quarter of 2020 and the first quarter of 2021.

- October Ifo survey results signal that German economic activity

was still on an upward trajectory overall at the start of the

fourth quarter, but the unsettling effect of the resurging pandemic

is reflected in worsening expectations already, and current

conditions will surely follow next month.

- An autonomous electric shuttle-bus service has been launched in Hamburg, Germany. The passenger service is part of the Hamburg Electric Autonomous Transportation (HEAT) project, which aims to integrate an autonomous shuttle bus into regular street traffic. The autonomous bus, which was manufactured by IAV, can cruise at speeds of up to 25 kilometers per hour and will travel along a one-kilometer route in HafenCity. Residents can hail the autonomous bus by registering using the HEAT app and must wear masks to comply with COVID-19 virus pandemic regulations. As a COVID-19 preventive measure, only three passengers are allowed to travel at a time, in addition to the bus conductor and technician, reports Hamburg News. Siemens, the Institute for Climate Protection, Energy, and Mobility (IKEM), the German Aerospace Centre (DLR), and city underground and bus operator Hamburger Hochbahn are involved in the project. Germany's Ministry for the Environment has invested EUR3.7 million (USD4.1 million) in the HEAT project. This project represents the first autonomous shuttle bus to transport passengers in Hamburg; however, the city is involved with many autonomous vehicle (AV) operations. For instance, MAN Truck & Bus, a subsidiary of Volkswagen (VW) Truck & Bus, has partnered with the German logistics company Hamburger Hafen und Logistik AG (HHLA) to test its autonomous trucks in the container terminal of Altenwender at the port of Hamburg. In addition, VW Group Research has tested Level 4 AVs in real-life urban traffic conditions in Hamburg with a fleet of five e-Golf cars. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mercedes-Benz has again stated that it intends to significantly accelerate the electrification of its high-performance sports cars, according to a report in Manager Magazin. CEO Ola Källenius recently outlined a new corporate strategy, part of which was a renewed emphasis on the brand's premium and performance credentials, and speeding up the move towards electrification was part of this program. In an interview, chief financial officer (CFO) Harald Wilhelm confirmed the company would accelerate its performance EV program. He said, "We have a very comprehensive product portfolio, including very attractive sports cars, and sports cars will go electric as well. So stay tuned." Mercedes-Benz was actually the first mainstream OEM to commercially offer an electric supercar; the Mercedes-AMG SLS Electric Drive. This car was a brave step and an important engineering exercise in terms of attempting to make a high-performance electric vehicle (EV), with the all the dynamic compromises EVs bring with the weight of their batteries. In addition, an EV's range gets exponentially shorter the harder it is driven, and this will be the key challenge in Mercedes-Benz's plans to bring out electric sports cars and supercars. Mercedes-Benz is in the final development stags before launching its Project One hypercar which uses a road-tuned version of the company's all-conquering Formula One hybrid powertrain. (IHS Markit AutoIntelligence's Tim Urquhart)

- Continental is looking at potentially selling its turbocharger business as it looks to slim down and rationalize its operations and implements a cost-cutting and efficiency drive, according to a Bloomberg report. According to those familiar with the move the company's turbocharger business is no longer seen as strategically important. According to Bloomberg, discussions are ongoing, although Continental and Citigroup - which is acting as the agent for the sale, according to the report - refused to comment. Turbochargers have been used increasingly over the last decade to help improve efficiency by downsizing engine capacity, with the goal of achieving lower emissions and improved fuel economy, especially with regards to petrol (gasoline powertrains. Modern diesel powertrains have been almost universally turbocharged since the 1990s. And while it is expected that the market will continue to grow in terms of the percentage of ICE vehicles fitted with turbochargers, Continental's business is competing with players like GarretMotion and BorgWarner which dominate the market, while electrification will see the market gradually shrink for a mature technology that requires volume and scale to make business sense. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to the latest Labour Force Survey published by

Statistics Finland, the unemployment rate in September 2020 was

7.6%, up significantly from 5.9% in September 2019. For the third

quarter of 2020 as a whole, the unemployment rate settled at an

average of 7.7%, up 1.6 percentage points from the third quarter of

2019. (IHS Markit Economist Venla Sipilä)

- In the third quarter of 2020, there was an average of 212,000 persons unemployed, a total marking an increase of 27% year on year (y/y). At the same time, the average amount of employed persons slid by 1.9% y/y, to 2,540,000.

- In September, the employment rate (the share of the employed of total population aged between 15 and 64) stood at 72.0%, down 0.7 percentage point in annual comparison. Seasonally adjusted, the employment rate in September measured 71.4%, while the unemployment rate stood at 8.4%.

- The amount of inactive population in the third quarter increased by 0.9% y/y, while the amount of persons in disguised unemployment rose by a faster rate of 14.4% y/y.

- In addition, data from the Ministry of Economic Affairs and Employment show that, at the end of September, there were 316,000 persons registered as unemployed jobseekers at the Employment and Economic Development offices, an amount that signifies a decelerating yet still rapid y/y gain of nearly 40%. The total of jobseekers who had been looking for work for over a year increased by around 30% y/y, to 81,000, while the number of new vacancies reported at the Employment offices fell by over 11% y/y.

- The continued deterioration in Finnish labor market metrics well fits IHS Markit expectations. Wholesale and retail and the hotel and restaurant service sectors remain among the fields worst affected by falling employment, reflecting the shock from the COVID-19 virus crisis.

- The outlook for labor markets remains downbeat, as the weakness of industrial employment keeps spilling over to the service sectors. In particular, expectations among retailers have recently weakened, and this has further negative implications for the employment outlook.

- Autoliv has announced a modest improvement in sales and profits during the third quarter of 2020. For the three months ending 30 September, its net sales have increased by 0.5% y/y to USD2,037 million. By product area, its Seatbelt Products business slipped by 1.3% y/y to USD1,332 million, while its Airbag Products and Other improved by 4% y/y to USD706 million. The company said that its adjusted operating income has increased by 12.7% y/y to USD206 million. Its net income also expanded by 14.9% y/y to USD99 million. This has helped the rate of decline of its financial performance during the year to date (YTD) as it was hit hard by the COVID-19 virus pandemic in the first half. During this nine-month period, net sales are now down by 22.4% y/y at USD4931 million, while adjusted operating income has dropped by 68% y/y to USD170 million. Net income now stands as a loss of around USD0.6 million versus a profit of USD307 million last year. The component supplier's performance this quarter has been far better than in recent times. Autoliv has said that this is partly due to its business recovering at a far faster rate than that of the market, while its cost reduction activities have contributed to the improvement in profitability as well. Nevertheless, Autoliv's full-year performance is expected to be below 2019's as a result of the impact of COVID-19 in earlier months. Overall, it now sees net sales growth as being down by 14.5% y/y, with organic sales growth down by 13% y/y. Its adjusted operating margin is expected to be at around 6.0%. (IHS Markit AutoIntelligence's Ian Fletcher)

- Sabic reports a net profit of 1.09 billion Saudi riyals ($290 million) for the third quarter, a 47% rise year on year (YOY), due to higher product prices, increased sales volumes, and improved margins. Sales declined 11% to SR29.30 billion compared with the prior-year period, with EBITDA down 26% YOY to SR5.67 billion. In its petrochemicals business unit, Sabic's largest, the company reports third-quarter sales of SR25.55 billion, up 20% on the second quarter. Average selling prices rose 13% and sales volumes were up 7% compared with the previous quarter, it says. EBITDA was up 63% compared with the second quarter at SR5.31 billion. Ethylene glycol (EG) prices improved in the third quarter due to a reduction in supply coupled with an improvement in demand, especially in polyester and polyethylene terephthalate (PET) bottle resin across regions, it says. Methanol demand also began recovering in the third quarter. In its polyethylene (PE) unit, prices rose in the third quarter, supported by steady demand and better macroeconomics conditions, according to Sabic. Polypropylene (PP) prices also improved compared with the previous quarter, supported by healthier demand from automotive and steady demand for applications such as personal hygiene, it says. Polycarbonate prices also rose in Asia following an increase in feedstock prices, it adds. "Demand for automotive, construction, and electrical appliances improved from the low levels observed in the second quarter of 2020. However, an increase in demand may be offset by increased supply from announced capacity additions," Sabic says. The company's agri-nutrients business saw sales slip 1% to SR1.57 billion compared with the previous quarter, driven by a 5% fall in sales volumes that offset a 4% increase in average selling prices. Urea prices increased in the quarter due to tighter supply-and-demand balances, with favorable farming conditions across multiple regions, it says. Demand improved in India, Southeast Asia, and South America, and outages in the Middle East, Southeast Asia, and the Black Sea/Baltic region tightened supply, Sabic says.

- The Bank of Uganda (BoU) maintained its benchmark policy rate

at 7% during the 22 October meeting of its monetary policy

committee (MPC). The central bank rate (CBR) was lowered from 8.0%

to 7.0% in June. (IHS Markit Economist Alisa Strobel)

- The central bank's MPC announced that it would maintain the CBR at 7% in October. However, the MPC said it was concerned that cost-price factors are set to pressure inflation rates and thereby negatively affect consumer demand.

- The band on the CBR has also been maintained at plus or minus 2 percentage points, while the margin on the rediscount rate and bank rate is unchanged at 3 and 4 percentage points on the CBR, respectively. The rediscount rate and the bank rate were maintained at 10% and 11%, respectively, at the MPC meeting.

- At the MPC meeting, the BoU maintained its economic growth outlook for Uganda at 2-3% during fiscal year 2020/21, which commenced in July, highlighting that Uganda remains highly vulnerable to periodic bouts of global financial volatility. Additionally, the flow of private sector credit (PSC) could remain subdued due to commercial banks facing increasing non-performing loans (NPLs), said the central bank.

- Uganda's economic growth is expected to slow by around 3-3.5 percentage points in 2020, compared with 2019's performance. The easing of the coronavirus disease 2019 (COVID-19) pandemic-related lockdown and the stability of the exchange rate have boded well for a recovery of economic activity, as the Uganda Purchasing Managers' Index® (PMI), compiled by IHS Markit, confirmed with a reading of 54.4 in September, suggesting improved business confidence across all sectors except agriculture.

- IHS Markit is concerned that increasing NPLs and high lending interest rates could delay the recovery of extensions of PSC to pre-COVID-19 levels. Furthermore, PSC declined by 0.1% in August due to risk-aversive tendencies of commercial banks, making them prefer investing in Treasury instruments as opposed to lending to the private sector.

Asia-Pacific

- Most APAC equity markets closed lower across the region; India -1.3%, Mainland China -0.8%, South Korea -0.7%, Australia -0.2%, and Japan -0.1%.

- People's Bank of China (PBOC) governor Yi Gang said at the Bund

Summit conference on 24 October that China will improve the

flexibility of the yuan and reduce restrictions on cross-border use

of the currency in an effort to promote the opening of the

country's financial services industry. (IHS Markit Economist Yating

Xu)

- China plans to expand several outbound investment schemes to meet onshore investors' need to allocate assets globally as the yuan appreciates steadily against the dollar, according to Xinhua.

- Total cross-border use of the yuan grew 24.1% year on year (y/y) in 2019, according to the PBOC.

- The yuan's share of global currency reserves was the fifth largest in the International Monetary Fund's (IMF's) currency composition of official foreign exchange reserves, with the share increasing by 0.88 from 2016 to reach 1.95% by 2019.

- With the barriers on the use of the yuan abroad gradually removed and the yuan increasingly used in cross-border payments and financing worldwide, yuan internationalization is expected to be further advanced.

- The strong yuan, supported by China's earlier economic recovery, eases the pressure of capital flight, which will help with the development of yuan flexibility.

- Fundamental issues such as China's debt overhang, rising labor costs, and escalation of trade disputes with the United States remain obstacles to capital inflow in the long run.

- Despite China's strong exports and growing current account surplus, the increase in foreign reserves was limited in the first three quarters, and the capital account remained in deficit, indicating net capital outflow since the beginning of 2020. Given these circumstances, capital account liberalization may still be a long way ahead.

- Chinese automaker Geely is to build a plant in Chongqing (China) to produce premium electric vehicles (EVs) for Polestar, reports Reuters. The new plant will have annual production capacity of 30,000 premium EVs and will be run by a wholly owned, newly registered company. Geely currently produces the Polestar 1 plug-in hybrid coupé at its Chengdu plant, while production of the brand's mass-market model, the Polestar 2 EV, is located at its Taizhou plant. At the time of writing, Geely has yet to comment on the reported new plant in Chongqing. Geely entered into a strategic agreement with Chongqing Liangjiang New District, an industrial development zone, in early July to build a manufacturing base for premium new energy vehicles in the development zone. The Reuters report, which has not been commented on by the automaker, offers more information regarding Geely's production plan and links the Chongqing facility with Polestar production, although it is still unclear whether the site will be used solely for Polestar models. According to recent media reports, Geely will begin production of several new models for Polestar in Chengdu over the next three years. (IHS Markit AutoIntelligence's Abby Chun Tu)

- BAIC BJEV, the electric vehicle (EV) unit of BAIC Motor, has announced the pricing for the Alpha-T, the first EV from the Arcfox brand on 24 October in China. It has three range options: a 480-km standard-range version, a 653-km long-range version and a dual-motor performance model with a range of 600 km. The standard-range model, fitted with a 67.3-kWh lithium-ion battery pack, starts from CNY241,900 (USD36,189). The long-range model starts from CNY261,900 while the performance model is priced at CNY319,900. The Alpha-T also features Harman's digital cockpit, which supports four displays, including a 20.3-inch 4K high-definition integrated infotainment touchscreen, and a 12.3-inch wide color gamut LCD digital instrument. The vehicle's infotainment system, which runs on the Android OS platform, also supports multiple control options, including facial recognition, gesture control, voice recognition, and touch control. The Alpha-T is a fresh start for BAIC Motor in the EV market. With the Arcfox brand, the automaker has planned a series of EVs under a partnership with Magna to tap into the premium EV segment. Production of Arcfox models will be located in BAIC's Zhenjiang plant with Magna overseeing engineering and manufacturing of all new models. Through 2022, we expect the Arcfox brand to have a least four new models based on the BE21 architecture, including the Alpha-T SUV, a compact SUV and a compact sedan. The Alpha-T, as the first Arcfox, speaks well for Chinese automakers' carmaking approach and how they intend to win consumers as the industry transitions to electrification. Through aggressive pricing strategies and the application of premium materials and cutting-edge technologies, including new battery cells, driver assistant functions and connectivity systems, new brands from local OEMs will have a good chance to differentiate themselves in a crowded market to compete with foreign rivals. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan has committed to achieving a target of a carbon-neutral society and zero emissions of greenhouse gases by 2050, according to the Washington Post. Japan's Prime Minister, Yoshihide Suga, said "We need to change our thinking to the view that taking assertive measures against climate change will lead to changes in industrial structure and the economy that will bring about great growth." The country greatly relies on fossil fuels to meet its energy requirements. According to the Financial Times (FT), Japan relied on fossil fuels for 81% of its primary energy supply in 2010 but that had risen to 87% by 2017 as most of the country's nuclear reactors were kept offline after the Fukushima disaster. Although the main focus of the new policy is on reducing the use of fossil fuels to generate electricity, the country's automotive sector is likely to aim to increase the use of battery electric vehicles (BEVs) and fuel-cell electric vehicles (FCEVs). Japanese automakers including Nissan, Toyota, and Honda are at the forefront of vehicle electrification. In June last year, Toyota pulled forward its electrification sales target by five years, citing a surge in the popularity of the technology. The automaker plans for half of its global sales to be electrified vehicles by 2025 - five years ahead of previous plans. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Coca-Cola European Partners (CCEP) has made an AUD9.2 billion (USD9.14 billion) takeover bid for Australia's Coca-Cola Amatil (CCA). This represents AUD12.75 per share, equivalent to the stock price in February before the Covid-19 pandemic hit earnings and sent the price down to AUD12.32/share at the time of the offer. The price has since risen to AUD12.38/share. CCA posted an AUD8.8 million half-year net loss in August this year, down from a net profit of AUD168 million for the previous corresponding period. Sydney-based CCA said it had received previous offers from CCEP and added that, based on the current price and conditions of the proposal, it was in the best interests of independent shareholders to allow CCEP to conduct due diligence to determine if a binding deal could be offered. London-headquartered CCEP is listed on four stock exchanges and operates in 13 countries, while CCA operates in Australia, New Zealand, Indonesia, Papua New Guinea, Fiji and Samoa. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Porsche Cars Australia has postponed the launch of its electric Taycan sports sedan from December to late February next year due to pandemic-related border closures and lockdown conditions, according to Go-Auto. The pandemic and lockdown has prevented Porsche's headquarters and training center in Melbourne from delivering the requisite preparations and training. Head of PR for Porsche Australia, Chris Jordan, explained that under Porsche corporate policy, no all-new model can be delivered until every salesperson and service technician in the country has been fully trained. The Porsche Taycan is an E-segment battery electric sports sedan launched last year. The vehicle has been developed to live up to Porsche's heritage of performance vehicles, as well as building on Porsche's recent history of hybrids and electrification, particularly in racing vehicles. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Speaking on Monday at the inaugural session of the fourth India Energy Forum by CERAWeek, organized in a virtual format by IHS Markit, Indian prime minister Narendra Modi said that this year has been challenging for the energy sector. Energy demand has fallen by almost a third and there has been price instability, and this has impacted investment decisions, said Modi. Leading international bodies have also predicted a contraction in worldwide energy demand over the next few years, but these agencies project that India will emerge as a leading energy consumer. As a result, India's energy future is bright and secure, he said. "India is set to nearly double its energy consumption over the long term," Modi said. "There are many areas in which we see this vibrancy. For instance, India is the third-largest and the fastest-growing aviation market, in terms of domestic aviation. Indian carriers are projected to increase their fleet from 600 to 1,200 by 2024." Access to energy must be affordable and reliable. India's energy plans should also follow the country's India's global commitments for sustainable growth, according to Modi. "India's energy sector will be growth-centric, industry friendly, and environment conscious," he said. "India is among the most active nations in furthering renewable source of energy. In the last six years, more than 360 million light-emitting diode (LED) bulbs have been distributed and 11 million smart LED streetlights have been installed." Modi says that India's planned reduction in emitted greenhouse gas is equivalent to more than 45 million metric tons/year (MMy/y) of carbon dioxide. This will be achieved partly through greater use of renewables and reports have suggested that India is one of the most active markets for clean energy, said Modi.

- Aurobindo Pharma (India) said today (26 October) that it has agreed to divest Natrol, a wholly-owned unit of its US-based subsidiary Aurobindo Pharma USA, to private equity firm New Mountain Capital (US) for USD 550 million. According to The Press Trust of India, Aurobindo said that proceeds from the sale of Natrol, which has evolved into a leading player in the nutraceuticals segment, will be used to reduce debt and to support other new strategic initiatives. The unit will be sold to an affiliate of New Mountain Capital to combine with Jarrow Formulas (US), according to the source. Subject to closing conditions and regulatory approvals, the all-cash transaction is expected to be completed by January 2021. Aurobindo had acquired Natrol in 2014, and the unit is reported to have been a consistently profitable and growing business. The sale comes as part of Aurobindo's re-evaluation of strategic options for its global business, and follows the announcement of plans to expand its biosimilars operations with a focus on Europe. Aurobindo recently spun-off its biosimilars division into a wholly owned subsidiary - CuraTeQ Biologics - as part of its strategy to focus on this higher-risk, research-intensive business segment. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2020.html&text=Daily+Global+Market+Summary+-+26+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}