Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 23, 2020

Daily Global Market Summary - 23 October 2020

European equity markets closed higher across the region, while US and APAC markets closed mixed. US and European benchmark government bonds reversed course from the recent sell-off and were higher across both regions today, but yields were still higher week-over-week. European iTraxx and CDX-NA indices were modestly tighter on the day across both IG and high yield, but all were close to flat on the week. The US dollar, oil, and silver were lower on the day and gold was close to unchanged.

Americas

- US equity markets closed mixed; Russell 2000 +0.6%, Nasdaq +0.4%, S&P 500 +0.3%, and DJIA -0.1%.

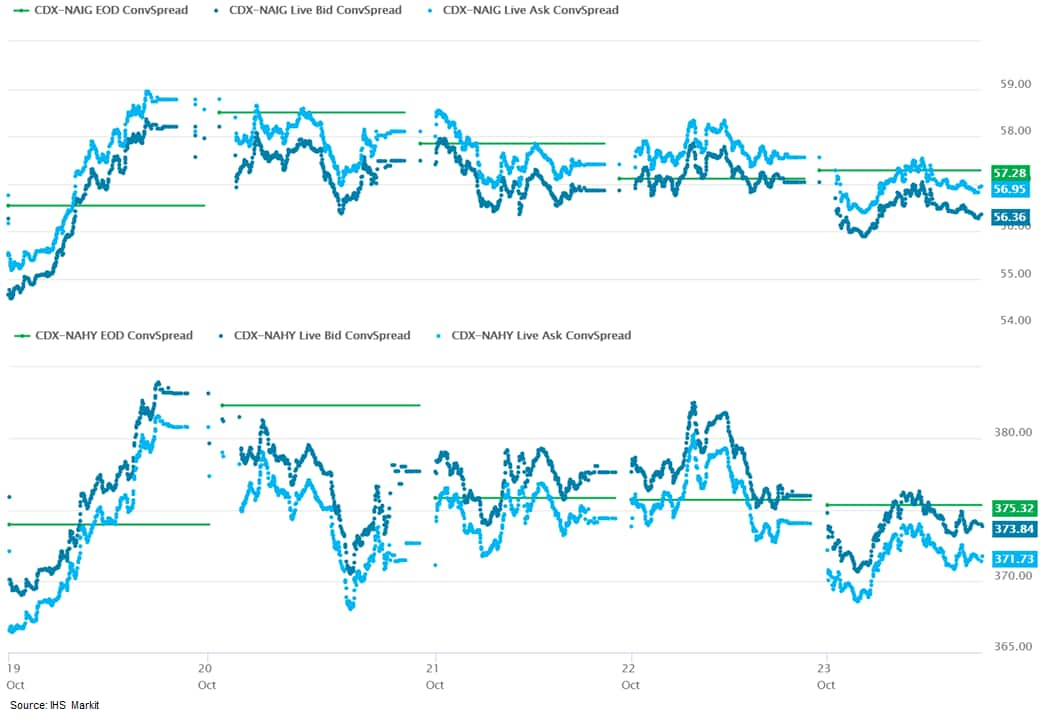

- CDX-NAIG closed -1bp/57bps and CDX-NAHY -3bps/373bps, which is flat and +1bp week-over-week, respectively.

- DXY US dollar index was -0.2%/92.75 as of 5:30pm EST.

- Gold closed flat/$1,905 per ounce and silver -0.1%/$24.68 per ounce.

- Crude oil closed -1.9%/$39.85 per barrel.

- Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 55.5 at the start of the final quarter of 2020, up from 54.3 in September and signaling the fastest increase in private sector business activity since February 2019. (IHS Markit Economist Chris Williamson)

- Service sector firms recorded a marked and accelerated rate of expansion in output. Although the upturn in activity quickened, the pace of new business growth eased slightly in October.

- Slower expansions in new orders were seen among manufacturers and service providers, with some firms stating that the ongoing impact of the COVID-19 pandemic had weighed on demand.

- Other companies noted that a number of clients were holding back on placing orders until after the upcoming presidential election.

- The rise in new business remained solid overall and was the second-fastest since March 2019.

- The increase in foreign client demand slowed notably, as manufacturers registered a renewed contraction in new export orders.

- Goods producers noted the increased use of discounting to attract clients during October, with selling prices rising only moderately.

- Cost burdens rose the steepest rate since January 2019 amid supplier shortages.

- The contest for a slice of the State of New York's offshore wind capacity saw proposal submissions from heavyweights Equinor, Ørsted and Eversource, and Iberdrola. The request for proposal (RFP) was released in July 2020, and closed recently on 20 October 2020. The RFP, the second raised by the New York State Energy Research and Development Authority (NYSERDA), will add up to 2.5 GW of offshore wind to the United State's offshore wind capacity and will include the requirement for USD400 million in private and public funding to develop New York's port infrastructure. Equinor has submitted bids for its Empire Phase 2 and Beacon Wind projects and plans to use the South Brooklyn Marine Terminal for construction and services. The port is one of 11 qualifying ports identified by the state. Ørsted and Eversource, through its Sunrise Wind joint-venture company, has submitted plans for variations of its Sunrise Wind 2 project. Iberdrola has not released any details on its bid. Equinor was successful in the first round of bids, landing the 816 MW Empire Wind Phase 1 project. Ørsted and Eversource was also a beneficiary of the first round, with its Sunrise Wind project generating 880 MW. (IHS Markit Upstream Costs and Technology's Melvin Leong)

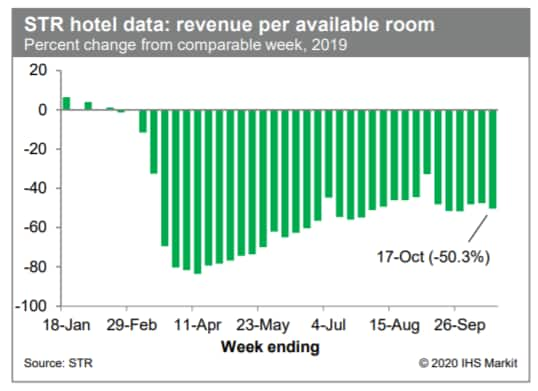

- Revenue per available room at US hotels last week was 50.3% below the year-ago level, according to STR. Improvement in this measure ceased in mid-August, highlighting recent weakness in the travel sector. (IHS Markit Economists Ben Herzon and Joel Prakken)

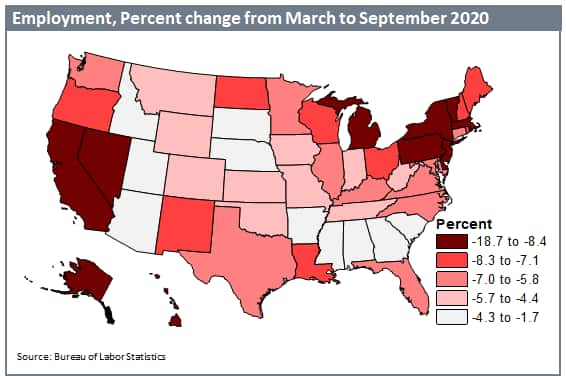

- Total US nonfarm payroll employment increased in 41 states and the District of Columbia in September 2020, gaining a net 721,000 jobs from the previous month on a seasonally adjusted basis, according to the most recent report from the US Bureau of Labor Statistics (BLS). (IHS Markit Economist Steven Frable)

- This was lower than the gain of 1.4 million jobs in August 2020 and July's increase of 1.6 million, indicating that the recovery spurred by state reopenings is continuing to slow.

- A large portion of the jobs added were in the leisure and hospitality sector, specifically in food and accommodation services, as restaurants and hotels around the country cautiously reopen for business.

- A look at the percentage change of total jobs from February to September 2020 shows which state economies have fared the best or worst since the beginning of the pandemic.

- States that were hardest hit include those that were the epicenter of the coronavirus outbreak in the Northeast, specifically New York, New Jersey, Massachusetts, and Vermont.

- Meanwhile, tourism and travel-reliant states like Hawaii and Nevada, and heavily goods-producing Midwestern states such as Michigan, have also sustained heavy blows.

- In all of these states, September payrolls are at least 9% below the February level.

- As we expected, the states that fared the best are smaller ones, with less dense metro areas and rural geographies that naturally allow for social distancing, such as Utah, Idaho, and Arizona.

- Other states hit by rising caseloads in June and August, as in the Southeast, are seeing small improvements in total employment; many of those states experienced a more rapid rebound in May and June, and so also are closer to returning to pre-pandemic levels.

- September is the third consecutive month of payroll growth deceleration since reopenings began. While employment and unemployment rates are still improving, we remain cautious as to the strength of the rebound and do not think that conditions will return to "normal" until there is a reliable vaccine or treatment to control the virus.

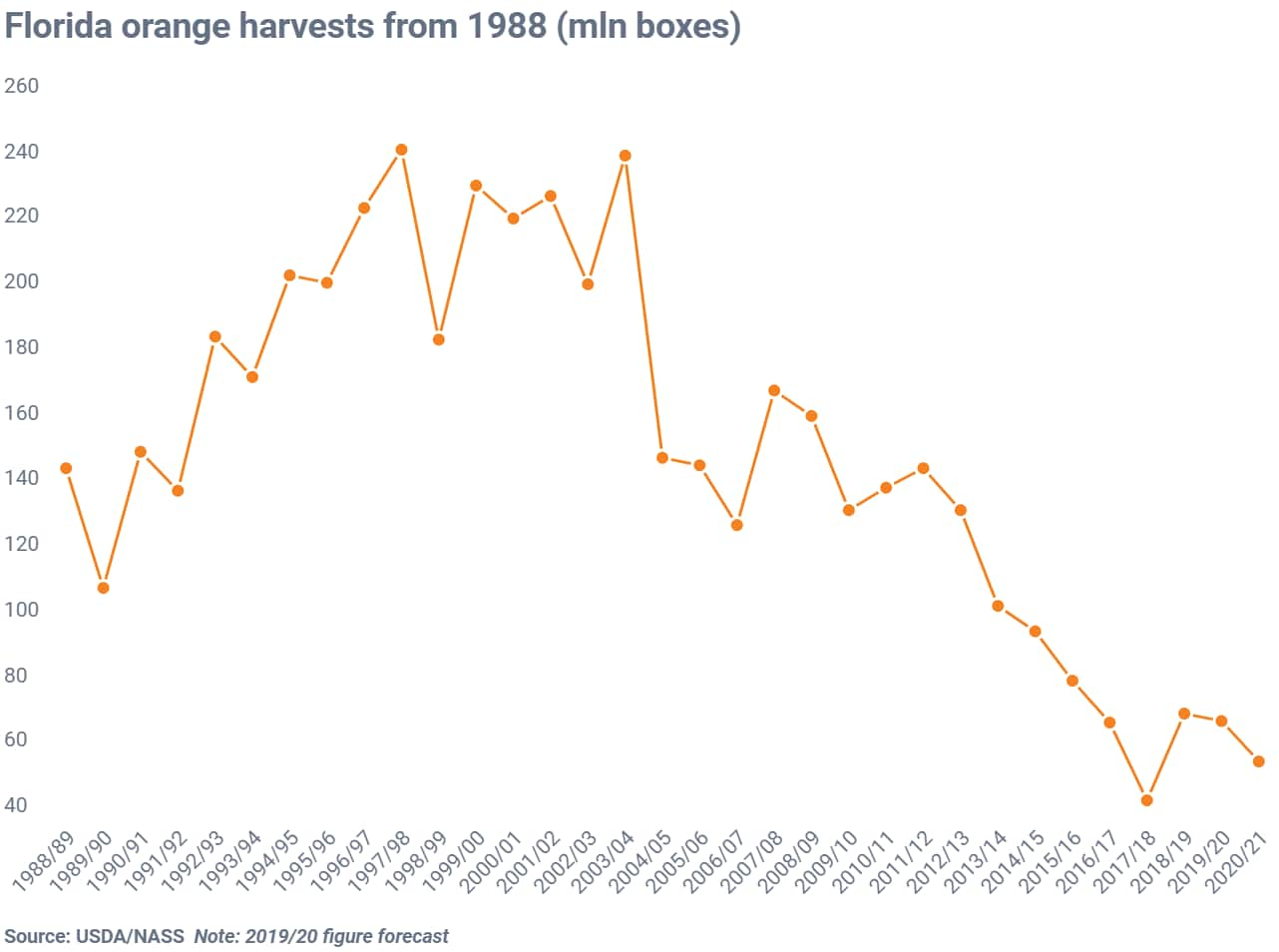

- The latest Florida Citrus Outlook Report, prepared by the Florida Department of Citrus (FDOC), says: "The impacts of a decades-long decline in Florida production has contributed to loss of market access at retail, where most of Florida's processed oranges are consumed, and a decline in total NFC distribution." (IHS Markit Food and Agricultural Commodities' Neil Murray)

- This year, the Covid-19 pandemic has changed things. "Among the rapid changes was renewed awareness among consumers of the health benefits associated with orange juice," says the report.

- "With consumers engaging in pandemic pantry preparation, the demand for orange juice, beginning in mid-March, surged significantly. By the end of the season, total orange juice sales increased by nearly 13%, compared to the previous season."

- The increase in orange juice volume for the 2019-20 season (October 2019 through September 2020) was nearly 50 million equivalent gallons, of orange juice or roughly 8.0 million grower boxes.

- Total movement of orange juice from Florida-based processors in 2019-20 was estimated to increase by 38.8 million single strength equivalent (SSE) gallons from last season to 685.4 million gallons.

- By the end of the 2019-20 season, Florida's ending orange inventory was estimated to decline to 351 million gallons (or 26.6 weeks' supply) associated with a projected 6% increase in total juice movement (FCOJ and NFC juice combined).

- "As consumers indicate a renewed awareness of the health and wellness benefits of citrus in recent months, the recovery of the industry is crucial to meet both short-term and long-term demand," observes the report.

- The USDA's latest forecast, released on October 9, 2020 for the 2020-21 citrus season, projects that total Florida citrus production will decrease by 14.4% over the previous season from 73.17 million boxes to 62.6 million boxes of oranges, grapefruit, and tangerine production. This is likely to result in more imports.

- Grower prices are projected to improve compared with the 2019-20 season, but overall returns to growers should decline with the reduced crop and higher production costs.

- The lower forecast implies Florida's juice production will decrease from preliminary 2019-20 estimates of 365 million gallons to an estimated 322 million SSE gallons in the 2020-21 season, for a 12% decline in Florida pack from fruit.

- At the same time, Brazil's juice production is projected to decrease by 404 million gallons from 1.8 billion gallons in 2019-20 to 1.4 billion gallons in 2020-21.

- Following the announcement of the deal with Fisker to build its electric vehicle (EV) under contract in Austria, Magna says it is in talks with others and would consider a North American plant to address demand, according to media reports citing Magna president Frank Klein. The Detroit Bureau reports that Klein confirmed Magna is in talks with others, although he did not disclose names. However, Klein is quoted as saying that Magna will decide within "the next few months" whether to set up a new plant somewhere in North America. The executive also said, however, that Magna will not produce vehicles to sell itself. He said, "You will not see 'Magna' vehicles on the road. We have no strategy to do our own production… Magna does have "a clear strategy to offer our services in North America," although it would prefer to lock down firm contracts before building a site. With apparent growth in EV demand, "it would probably be a facility where we would build electric vehicles," Klein is quoted as saying. Magna has not determined if the Fisker will be produced at its Graz (Austria) plant or a new plant being built in Slovakia. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Plus.ai has selected Amazon Web Services (AWS) as its cloud provider. This comes as the startup prepares for mass production of its automated vehicle system in 2021, and has received thousands of pre-orders for it. Shawn Kerrigan, COO and co-founder at Plus.ai, said, "We are excited to be the first autonomous trucking company to start mass production of an automated driving system. This milestone requires close collaboration with a number of top tier suppliers that offer the best-in-class components and services. Specifically for compute and storage capacity, the AWS team rose to the challenge with a solution that matches the scale we need for our driving system that will power thousands of automated trucks." (IHS Markit Automotive Mobility's Surabhi Rajpal)

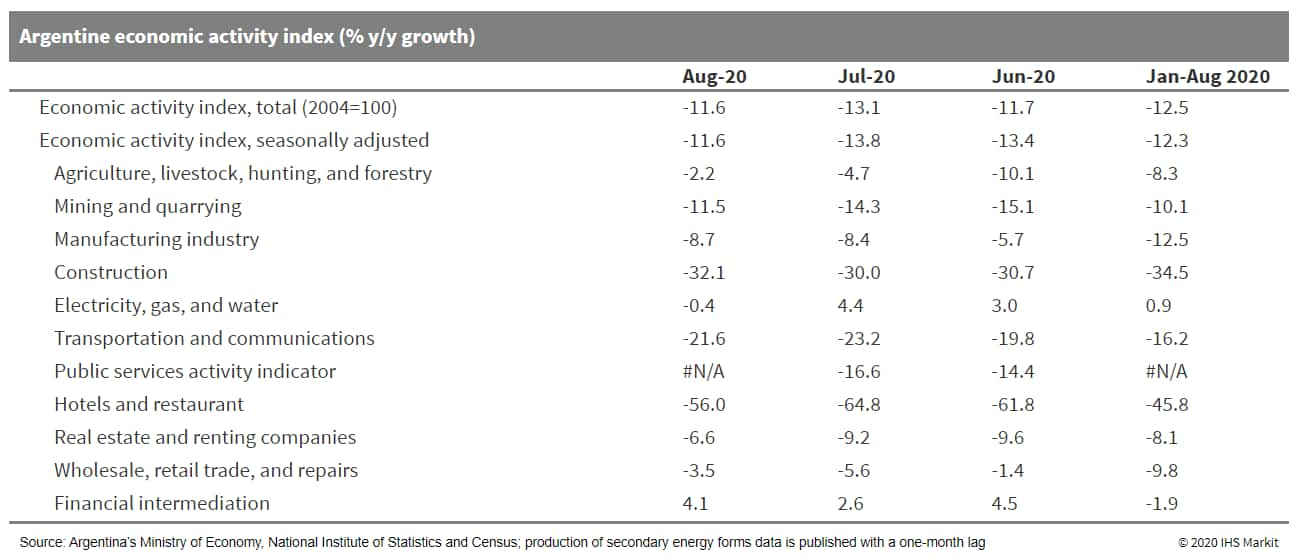

- According to data from Argentina's National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos: INDEC), the economic activity index decreased by 11.6% year on year (y/y) in August. The seasonally adjusted data show a 1.1% m/m increase during the month. The steep declines since April drove down the average for the first eight months of 2020; the activity index posted a 12.5% y/y decline. (IHS Markit Economist Paula Diosquez-Rice)

- By sector, the economic activity index data show mostly declines in August. For example, there were steep declines in the hospitality sector, which was down by 56% y/y; the construction sector, which decreased by 32% y/y; the manufacturing sector, which fell by 8.7% y/y; the transport and communication sector, which dropped by 21.6% y/y; and the wholesale and retail sector, which shrank by 3.5% y/y.

- Meanwhile, Argentina's balance of trade showed a surplus of USD584 million in September, in contrast to the USD1.7-billion surplus registered one year earlier. Results for the first nine months of 2020 show a trade surplus of USD11.6 billion, higher than the USD9.5-billion surplus recorded in January-September 2019.

- Customs trade imports increased in September 2020 compared with September 2019 - the first month to post an annual rise in 2020. On the export side, a total decrease in value by 18% y/y in September 2020 was due to a 16.3% y/y decrease in volume and a decrease of 2.0% y/y in prices; the decline was driven by the decline in agricultural products, manufactured goods of agricultural origin, and fuels and energy.

Europe/Middle East/Africa

- European equity markets closed higher across the region; Spain +1.4%, UK +1.3%, France +1.2%, Italy +1.1%, and Germany +0.8%.

- 10yr European govt bonds closed higher across the region; Italy -4bps, Spain -2bps, and France/UK/Germany -1bp.

- iTraxx-Europe closed -1bp/55bps and iTraxx-Xover -5bps/328bps, which is +1bp week-over-week for both indices.

- Brent crude closed -1.6%/$41.77 per barrel.

- The flash IHS Markit Eurozone Composite PMI fell for a third consecutive month in October, dropping from to 50.4 in September to 49.4 to register the first contraction of business activity since June. (IHS Markit Economist Chris Williamson)

- Although the index remains well above the all-time lows seen during the height of the pandemic in the second quarter, the renewed decline raises the possibility that the region could see the economy contract again in the fourth quarter.

- The survey revealed a tale of two economies. Manufacturing output growth accelerated to the fastest since February 2018, supported by inflows of new orders surging at the quickest rate since January 2018, but service sector output fell for a second successive month, deteriorating at the sharpest rate since May.

- If the March to May period at the height of COVID-19 lockdowns is excluded, the latest drop in service sector output was the steepest for eight years.

- Employment was meanwhile cut across the eurozone as a whole for an eighth successive month, though the rate of job losses moderated further from April's record peak to the weakest since jobs began to be cut in March. The pace of job cuts nonetheless remained higher than at any time since June 2013 prior to the pandemic.

- Looking at price trends, deflationary pressures moderated during October. Average prices charged for goods and services fell for an eighth month running, but the rate of decline eased to the slowest seen over this period. Average prices charged in manufacturing edged higher, up for the first time since June 2019, though service sector charges continued to fall. Germany saw the largest upturn in price pressures, with average selling prices up for the first time since February.

- Looking ahead, business expectations about the coming 12 months slumped to the lowest since May, deteriorating in both manufacturing and services, with the latter seeing a particularly steep drop in sentiment. Optimism was also especially subdued in France.

- The UK government's plan to have autonomous vehicles on British motorways has come under criticism from a group of insurers and a research body, according to a report in the Guardian newspaper. The UK government was planning allow vehicles with the ability to keep in lane, accelerate and brake automatically to use their capability up to 70 mph on M roads. However, the Association of British Insurers and the independent Thatcham Research institute have warned that the use of automated lane keeping systems (ALKS) should not be classed as "automated", meaning drivers could take their hands off the steering wheel. The automated system would potentially need to return control to a human driver within three seconds to avert high-speed collisions - but insurers' research found it takes 15 seconds for the driver to be sufficiently engaged to react to avoid a hazard, roughly 500 meters distance on a motorway. Thatcham and the ABI are planning to lobby their safety concerns to the government. A consultation on proposals closes next week, ahead of potential changes to motoring legislation next year. Matthew Avery, Thatcham's director of research said, "They haven't thought it through and they've got it hugely wrong. From the technology point of view, it's a small step, but from a philosophical point of view it's a major step. What we're missing is how consumers will react and use it." There is no doubt that Thatcham and the ALKS raise valid points about how levels of autonomous vehicle technology can be introduced in real world environments. There have been a number of accidents already around the world involving the misuse of driver assistance systems. However, it is also a fact that a successful deployment of full Level 5 autonomous technology will have far-reaching and grave implications for the automotive insurance industry. (IHS Markit AutoIntelligence's Tim Urquhart)

- UK retail spending continued to recover in September after the reopening of non-essential shops from mid-June. (IHS Markit Economist Raj Badiani)

- Some households are releasing savings accumulated during the lockdown and working at home to fund home improvements and goods to make their increased time at home more comfortable. In addition, retail sales are benefiting from households spending less on services and foreign travel.

- Specifically, retail sales (including fuel sales) in volume terms increased for the fifth straight month, rising by 1.5% month on month (m/m) in September to stand 5.5% above their February pre-COVID-19 virus level.

- In annual terms, they were 4.7% higher than in September 2019.

- The monthly gain in September 2020 was due to increased spending for home improvements, highlighted by spending in household goods and other goods stores increasing by 0.9% m/m and 7.3% m/m, respectively. In addition, textile, clothing, and footwear stores reported reviving sales for the fifth straight month, rising by 3.7% m/m. However, they remained 12.7% below their February pre-COVID-19 virus levels.

- Fuel sales volumes were still 8.6% below February because of reduced travel as many continued to work from home in September.

- Non-store retailing fell back in volume terms during for the third straight month in September, contracting by 1.9% m/m, but was still 36.7% higher than the February pre-COVID-19 virus levels and accounts for about one-third of all retail spending.

- Sales on the high street, or in physical shops, rose above its pre-lockdown levels for the first time, with spending in non-food stores in September being 1.7% higher than the February level.

- The strengthening recovery in retail sales in September was surprising, but IHS Markit continues to assess that the immediate outlook for retail spending remains challenging.

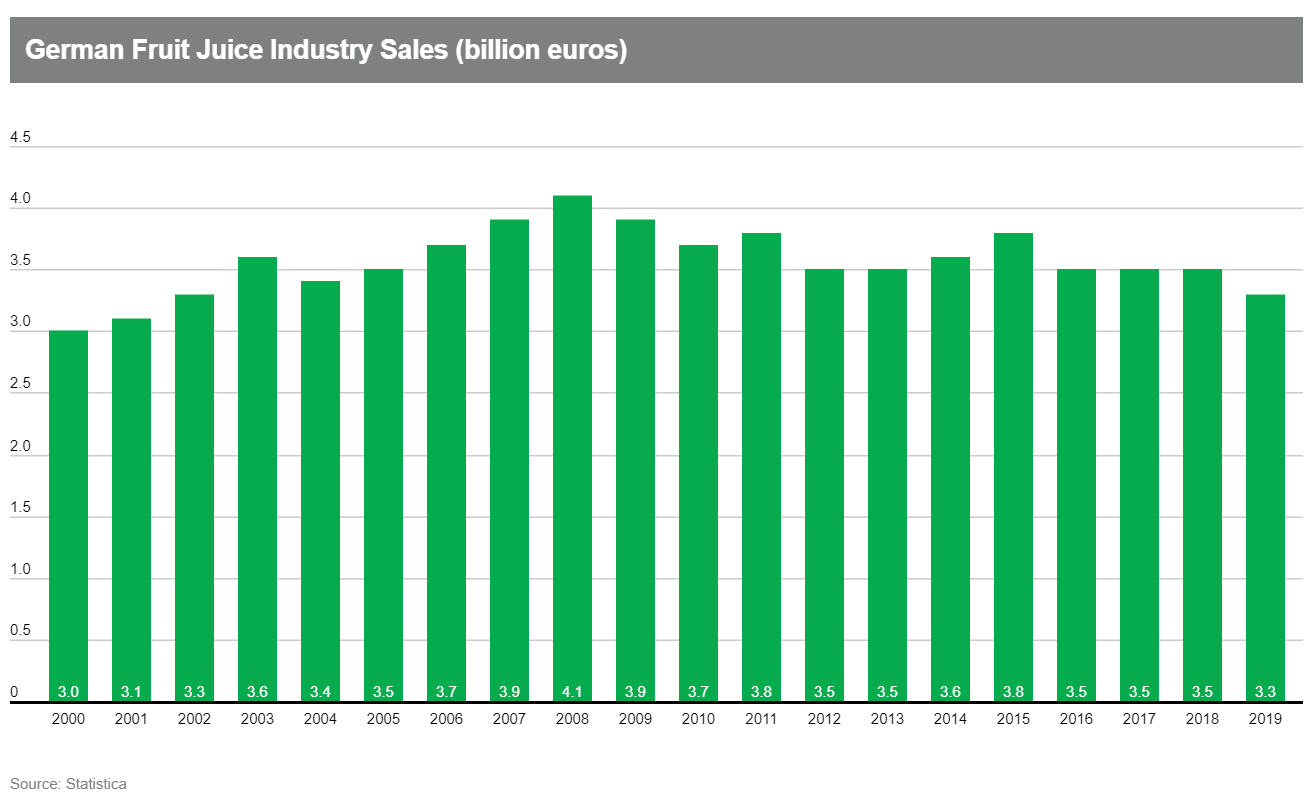

- Sales of all German fruit juices were worth EUR3.3 billion (USD3.8 billion) in 2019, according to recent data. This compares with EUR3.5 billion worth of sales in 2018. German sales peaked at EUR4.1 billion in 2008 and since then have been in slow but steady decline, according to figures from Statistica. When inflation is factored in, the fall is worse than the basic figures show. German juice consumers are still not all well-informed about fruit juice, according to a new survey from the German Fruit Juice Industry Association (VdF). Its findings, published yesterday (22 October 2020) are that more than half think that sugar can be added to reconstituted juice and that it does not contain 100% fruit. They also think that colorings, preservatives and water may be added. For these reasons they take it as the "worse" juice and 60% of those surveyed said that they prefer NFC juice. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Plastic Omnium has announced its sales revenues during the third quarter of 2020 have dipped. During the three months ending 30 September, the company said that its economic revenues - which include a percentage of sales by its various joint ventures (JVs) - slipped by 6.4% year on year (y/y) to EUR2,097 million. Revenues at its Plastic Omnium Industries business dropped by 11.9% y/y to EUR1,497 million while Plastic Omnium Modules improved 10.8% y/y to EUR600 million. However, after the EUR177 million from its JVs was taken out, an increase of 15.9% y/y, its consolidated revenues retreated by 8.1% y/y to EUR1,920 million. Nevertheless, as a result of the falls suffered due to the COVID-19 virus pandemic, its year-to-date (YTD) sales revenues are significantly down. For the nine months, economic revenues dropped by 22.2% y/y to EUR5,330 million, with a tumble suffered by both Plastic Omnium Industries and Plastic Omnium Modules, while consolidated revenues stood at EUR4,881 million, a decline of 23.2% y/y. Global automotive production improved significantly during the third quarter after the disruption during the first half of the year. However, Plastic Omnium has made progress in some areas at an even greater rate. According to its statement, in Europe it was helped by the robustness of its modules business in Germany, as well as the success in the selective catalytic reduction (SCR) systems which led to an improvement compared to the third quarter of 2019. It was also helped by outperforming the market in Asia. (IHS Markit AutoIntelligence's Ian Fletcher)

- Continental has said that its preliminary third quarter results are better than expected, although impairments and restructuring expenses have had a negative impact on EBIT for the period. According to a company statement, revenue for the third quarter stood at EUR10,295 billion (USD12.200 billion) which equated to an adjusted EBIT margin of 8.1% as opposed to 5.6% at the equivalent point last year. Actual revenue fell 2.7% year on year (y/y) after consolidation and exchange rate effects. Automotive Technologies revenue was EUR4.101 billion (third-quarter 2019: EUR4.673 billion) and the adjusted EBIT margin was 2.4% down from 5.0%. Sales in the tyre business in the quarter were down to EUR4,101 billion in comparison to EUR4.673 billion last year. The Powertrain business was almost identical to last year's third-quarter revenue at EUR1,909 billion. As part of its preliminary third-quarter financial results, Continental will book impairments of EUR649 million in the third quarter of 2020 in the Vehicle Networking and Information business These impairments predominantly result from an assumption by Continental that there will not be a material increase in global light-vehicle production during the upcoming five-year period. Additionally, restructuring expenses and asset impairments that are part of the expanded "Transformation 2019-2029" restructuring will cost EUR687 million in the third quarter of 2020. Continental will release definitive third-quarter results on 11 November. (IHS Markit AutoIntelligence's Tim Urquhart)

- Banks in Czechia, Hungary, Poland, and Slovakia tightened credit standards for corporate and household loans in the second quarter of 2020 because of worsening economic prospects and deteriorating creditworthiness of borrowers, according to most recent bank lending surveys that reveal changes in lending policy as well as changes in demand for loans. As a result of the negative economic impact of the coronavirus disease 2019 (COVID-19)-virus spread, private-sector credit growth slowed in all four countries in the second quarter, despite various central bank and government stimulus measures implemented in response to the pandemic. Tightening of credit standards manifested in stricter collateral requirements, smaller loan sizes, and for housing loans, a lower loan-to-value (LTV) ratio. As financial conditions worsen, credit risk associated with corporate and household loans has increased, while tighter lending standards have driven the fall in demand for credit. (IHS Markit Banking Risk's Greta Butaviciute)

- Czechia - Banks have tightened credit standards for all corporate loans, including small and medium-sized enterprises (SMEs) and large corporations, as well as for short-and long-term loans. In addition, banks appear to have tightened standards for housing loans despite the Czech National Bank's measures aimed at relaxing credit standards for mortgages, which included increasing the recommended LTV from 80% to 90% and removing the debt-to-income ratio from its recommendations as of April.

- Hungary - Credit conditions have significantly tightened and demand for long-term loans has decreased. The amount of outstanding loans to the corporate sector contracted in the second quarter of 2020 compared with the previous quarter.

- Poland - The majority of banks significantly tightened their credit standards in the second quarter, while demand for loans decreased, in particular among SMEs and individual consumers. Lenders have experienced a fall in demand for corporate and household loans, the former driven by subdued need for fixed investment financing.

- Slovakia - Similar to lending trends in other countries, banks in Slovakia have tightened credit standards for both corporate and household loans because of negative economic prospects and deteriorating creditworthiness of borrowers. Worsening outlook for industries most affected by the COVID-19 virus also contributed to the tightening.

- In IHS Markit's view, ongoing economic uncertainty and deteriorating creditworthiness of borrowers are likely to lead to banks further tightening credit conditions in the second half of 2020.

- The Turkish central bank defied consensus expectations and held its main policy interest rate unchanged at its October rate-setting meeting. While the central bank did increase the interest rate corridor, the lira nonetheless reflected markets' displeasure, falling to nearly TRY1/USD8.00. The lack of a further tightening of monetary policy will exacerbate lira instability heading into November and further burden hard currency reserves. (IHS Markit Economist Andrew Birch)

- The Central Bank of the Republic of Turkey (TCMB) held its main policy rate - the one-week repo rate - unchanged at 10.25% at its 22 October meeting of the Monetary Policy Committee. The Bank did, however, lift the late liquidity rate by 100 basis points, to 14.75%.

- In the press release alongside the move, the TCMB stated that monetary policy had tightened since the last meeting, when the Bank had raised the policy rate by 200 basis points. Tighter credit and the higher interest rate since September, the Bank argues, have contained inflationary expectations and will reduce inflation risk.

- Expectations of a rate rise were strong because the TCMB had already pushed its average rate of market funding to around 12.5%. Since late July - when the current lira depreciation began - the TCMB began financing an increasing share of the market through the overnight and the late-liquidity windows rather than dispensing money at the main policy rate. This practice had pushed the average rate of funding sharply up since late July.

- The increase to the late liquidity rate suggests that the TCMB will intensify this process, likely pushing up the rate at which it funds the markets to 13% and higher. So, though the main policy rate was unchanged, we do expect that monetary policy will generally tighten over the next month. However, because it is tightening through this "back-door" method, this tightening will not provide stability to the lira.

- Immediately after the Monetary Policy Committee meeting, the lira tumbled, dropping by approximately 2% from the previous day, nearly touching TRY1/USD8.00. In the days and weeks leading up to the October meeting, the lira had actually been appreciating against the dollar, as expectations were nearly unanimous that the Bank would raise its main policy rate by at least 100 basis points and, more likely by 200 basis points.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China -1.0%, Australia -0.1%, Japan/South Korea +0.2%, India +0.3%, and Hong Kong +0.5%.

- The au Jibun Bank flash Composite PMI,compiled by IHS Markit and based on 85-90% of responses received from the monthly surveys, came in at 46.7 in October, broadly unchanged on 46.6 in September. The index signalled a further marked decline in private sector output across both manufacturing and services but with the rate of decline easing marginally and the slowest since February, prior to the escalation of the global pandemic outbreak. (IHS Markit Economist Bernard Aw)

- The latest survey data suggest that the pace of recovery is not only slow but failing to gain momentum. The average PMI rose 14.1 points from 31.5 in the second quarter to 45.6 in the third quarter, but stubbornly weak demand may limit the extent to which activity rebounds in the fourth quarter.

- Intakes of new business fell further in October, reflecting subdued domestic and foreign demand due to cautious consumer behavior, weakened firms' balance sheets and a global resurgence of infection cases. Operating capacity also remained in surplus, as reflected by a further rise in backlogs of work, although the increase was the slowest for eight months.

- The survey revealed some positive signs, however. First, employment was broadly stable in October, with workforce numbers in both manufacturing and services largely unchanged from September. Second, business sentiment improved to the strongest for over two years, rising especially among services firms. In fact, the level of optimism in the service sector rose to the highest since February 2019.

- Subdued inflationary pressures persisted at the start of the fourth quarter. Having been relatively unchanged in the past two months, input costs rose marginally during October, but the rate of increase, particularly in import-related expenses, was restrained by a stronger yen.

- With the recovery gradual, and facing substantial downside risks, there would be increasing expectations of the government to provide additional fiscal support, with the aim to provide aid to firms and workers, as well as stimulating demand. Anecdotal evidence from PMI survey data indicated that the government's 'Go to Travel Campaign' had encouraged domestic travel and provided a much-needed boost to the tourism sector which has been greatly affected by international travel restrictions and border controls.

- Japan's CPI fell by 0.1% month on month (m/m) on a seasonally adjusted basis in September while holding at the year-earlier level. The CPI, excluding fresh food (core CPI), and the CPI, excluding fresh food and energy (core-core CPI), both rose by 0.1% m/m. However, the core CPI continued to fall, moving down 0.3% year on year (y/y), while the core-core CPI held at the year-earlier level. (IHS Markit Economist Harumi Taguchi)

- The weaker CPI largely reflected softer fresh food prices because of improved harvests. However, marginal softening in deflation of the core and core-core CPIs largely reflects improvements in accommodation fees and increases in prices of clothes and footwear.

- Japan's CPI is likely to decline as the effect of the consumption tax increase in October 2019 drops out. Although the resumption of economic activity will probably gradually lift prices, deflationary pressure could continue over the near term, as declines in wages and social distancing practices will keep consumers cautious about spending.

- Deflationary pressures could increase because of the government's introduction of subsidy plans, which will lower restaurant charges and event fees to some extent, and its intention to lower mobile phone prices. Greater usage of new technology and labor-saving automation for adopting new lifestyles could also lower prices. Whether deflationary pressure persists or not depends on whether these stimulus moves and technologies can boost consumer spending and create new jobs.

- Chinese electric vehicle (EV) startup NIO is planning to develop its own computing chips for autonomous vehicle (AV) operations, reports Gasgoo. The plan is still in a nascent stage and is mainly driven by NIO's chairperson and CEO William Li Bin. To support this plan, NIO has also set up an independent hardware team internally named "Smart HW". William Bin Li had earlier unveiled the possibility of NIO developing its own AV chips during the Chengdu Motor Show 2020. NIO has received an AV test license from the California Department of Motor Vehicles (DMV). The company has developed its advanced driver assistance system (ADAS), Nio Pilot, which is integrated with Mobileye's chip EyeQ4. The company recently rolled out a new function to its NIO Pilot system, called the Navigate on Pilot (NOP), which will enable vehicles to perform certain functions, such as auto-land changing, automatically on designated routes covered by high-resolution mapping. (IHS Markit Automotive Mobility's Surabhi Rajpal)

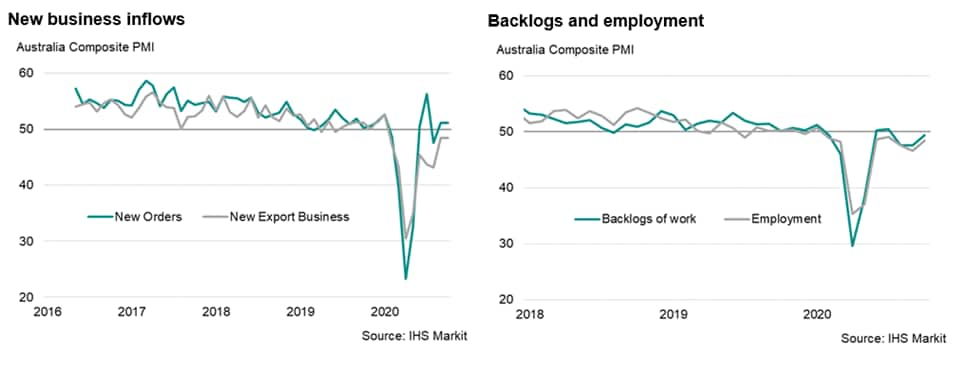

- The IHS Markit Flash Australia Composite PMI, covering both manufacturing and service sectors, rose 2.5 points from 51.1 in September to 53.6 in October. The improvement signalled the fastest increase in private sector output for nearly a year. This built on the gains registered in the third quarter (which saw an average index reading of 52.8). (IHS Markit Economist Bernard Aw)

- The stronger upturn in the Australian private sector economy coincided with a further easing of social distancing restrictions, particularly in Victoria, which benefited the service sector in particular.

- Services business activity rose sharply in October amid greater consumer confidence and more events permitted to be held.

- Overall activity was also supported by further growth in manufacturing production, though the rate of factory output expansion moderated from September, in part related to delivery delays of input materials due to logistical issues.

- Worryingly, the recent increase in demand for Australian goods and services has not been commensurate with the stronger performance in private sector output, casting doubts on the sustainability of the recovery.

- Orders for goods and services rose for a second straight month in October, but at a rate similar to September and one that was only marginal overall, suggesting that consumption and investment continued to struggle despite loosening COVID-19 curbs.

- Part of the reason for subdued overall demand was linked to weakness in the external market. Foreign sales of Australian goods and services remained in decline for the ninth month running in October amid border restrictions and weak demand at overseas clients.

- The absence of a robust pickup in new business saw firms' operating capacities rarely tested.

- Backlogs of work declined further in October, though at the slowest pace for three months, hinting at excess capacity. With capacity in surplus, firms continued to reduce their headcounts as part of efforts to control costs and remain viable. Overall employment fell for a ninth straight month, with lower workforce numbers seen across both manufacturing and services, with the former cutting jobs again after a modest rise in September.

- Suppliers continued to struggle to make timely deliveries at the start of the fourth quarter, with workers' strikes at ports contributing to logistical delays. Average lead times lengthened to the greatest extent seen since the record rates of April and May at the height of the pandemic.

- The delay in receiving manufacturing inputs has had an impact on production, with some respondents highlighting that output was reduced due to insufficient materials. A lack of improvement in supply chains in the coming months could further dampen factory production.

- Australian private sector firms meanwhile faced a further increase in input costs during October, with services reporting a sharper rate of input price inflation. A larger wage bill due to reduced government subsidies, alongside greater costs of raw materials and increased freight fees, all pushed expenses higher.

- Goods producers were able to pass some of the rise in costs on to their customers, with factory gate prices rising at the fastest rate for seven months. In contrast, services providers had to absorb higher expenses and, in some cases, even provide discounts to stimulate sales amid subdued demand.

- We expect the recovery in the Australian economy to continue in the fourth quarter, though the extent of economic growth relies heavily on demand reviving. Much will in turn depend on whether social distancing measures can be loosened further, and border restrictions relaxed. The October survey indicated the strongest business sentiment for just over two years, underpinned by expectations of the economy opening up further in coming months.

- Tesla has increased the cost of using a supercharger in Australia by almost 25% in October, according to Car Advice. According to the report, the cost of supercharging a Model 3 long range vehicle from 0 to 100% has increased from around AUD35 last month to AUD43.3 this month. Tesla had recently cut the price of its Model 3 in Australia by as much as AUD7,000. The increase in cost of supercharging the vehicles by almost 25% is likely to negate the positive impact of the price reduction to some extent. The increase in running cost due to more expensive charging is still cheaper than the running cost of most comparable internal combustion engine cars. Tesla sold 1,948 vehicles in Australia in 2019 and is expected to sell 2,300 units this year, according to IHS Markit's light-vehicle sales data. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- All new cars sold in Australia may soon be required to include an autonomous emergency braking (AEB) system as standard, according to a recent federal government proposal to reduce road trauma caused by light vehicles, reports Car Advice. Until now, AEB systems were voluntary for automakers complying with Australian Design Rule (ADR) guidelines. In a Regulation Impact Statement issued in October 2020, the government proposed introducing a new ADR) mandating car-to-car and pedestrian-detecting AEB systems on all new-generation models from July 2022, and on all new cars from July 2024. Automakers and authorities globally are focusing on increasing active safety technologies and devices in vehicles to reduce accidents and help protect occupants. AEB systems automatically apply the brakes on a car if they detect a potential collision with another vehicle, pedestrian or cyclist. Tony Weber, the chief executive of the Federal Chamber of Automotive Industries (FCAI), said, "Australian Government figures indicate that around 66 % of all new passenger, SUV and light commercial vehicles sold in Australia have AEB fitted." (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Ride-hailing firm Grab said its third-quarter group revenue has reached more than 95% of pre-COVID-19 pandemic levels, reports Reuters. Ming Maa, president of Grab, said, "Our business recovery continues steadily, with Q3 group revenues climbing to over 95% of pre-COVID-19 levels. Having laid this foundation, we will focus on expanding our financial services and merchant services business through the rest of the year and beyond". Maa also said demand for its food delivery service has increased, and this business now generates more than 50% of Grab's revenue. Since the start of the pandemic, Grab added food delivery and insurance services to its platform. This year, Grab laid off 360 employees, representing 5% of its total workforce, owing to the pandemic. Grab is focusing on expanding its range of services, from transport to food delivery and payments, and making aggressive efforts to expand. The company recently raised USD200 million in funding from South Korean private equity firm STIC Investments. Grab's app has been downloaded on 166 million devices and it processes more than 6 million ride orders per day. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indian biopharmaceutical company Biocon has posted a 22% year-on-year (y/y) drop in consolidated net profit to USD1.69 billion (USD22.946 million) for the second quarter ended September 2020, due to higher costs. According to India's Business Standard, the net profit fall was recorded despite a 10% y/y rise in revenue to INR17.6 billion. The profit decline is attributed to higher research & development (R&D) expenditure, staff costs, foreign exchange losses, and other expenses. The company particularly highlighted investment in COVID-19 pandemic-related product development. Kiran Mazumdar-Shaw, the company's executive chairperson, said "As part of our commitment to address the novel coronavirus pandemic in India, the Biocon group is working on a comprehensive portfolio of products for treating mild to severely ill COVID-19 patients." The company has launched Araflu, a branded generic version of favipiravir (Avigan; Fujifilm Toyama Chemical, Japan), as an emergency treatment for mild-to-moderate cases of COVID-19. It has also increased production of its CytoSorb extracorporeal blood purification (EBP) product after it received regulatory approval in India for emergency use to reduce pro-inflammatory cytokines levels in confirmed COVID-19 patients, as well as production of its novel monoclonal antibody Alzumab (itolizumab), which has received emergency approval in India as a treatment for cytokine release syndrome (CRS) in patients with moderate-to-severe acute respiratory distress syndrome (ARDS) due to COVID-19. Biocon's contract research arm Syngene has also started manufacturing remdesivir under a voluntary licensing agreement with Gilead (US), for the emergency treatment of COVID-19 patients. The second quarter profit fall highlights increased costs and expenditure, including outlays for ramping up production of re-purposed medicines in the emergency treatment of COVID-19. The longer-term viability of these investments remains to be seen, with global demand for remdesivir likely to be dampened by a World Health Organization (WHO) study that concluded the drug did not have a substantial effect on survival and hospitalization rates. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--23-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--23-october-2020.html&text=Daily+Global+Market+Summary+-+23+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--23-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 October 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--23-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+October+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--23-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}