Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

Spanish unemployment eases further as economic recovery continues

The Spanish labour market showed further signs of tentative improvement during the third quarter of 2014 as unemployment dipped again and employment rose to the highest for two years, driven by job creation in the private sector.

The unemployment rate dropped to 23.7%, the lowest in 11 quarters. However, some 5.4 million are still classified as unemployed. The rate of unemployment for those under the age of 25 also fell, but remained high at 52.4%.

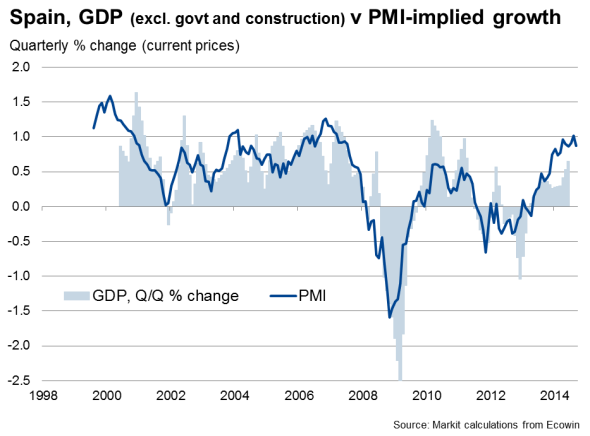

The improvements in the labour market data in recent times have mainly reflected a return to output growth in the economy. Gross domestic product rose 0.6% in the second quarter of the year, the fourth successive quarterly rise in output and the strongest since the end of 2007.

Today's estimate from the Bank of Spain of a 0.5% increase in GDP during the third quarter is broadly consistent with PMI data for the manufacturing and service sectors, which likewise signalled further solid improvements in the economy during the third quarter of the year. The Spanish PMI data has so far held up relatively well amid more marked slowdowns in other eurozone nations.

Markit Spain Composite PMI v GDP

There were some signs of rates of expansion easing from the PMI surveys as the third quarter drew to a close, however. This was particularly the case with regards to new orders, which increased at the slowest pace for seven months in September and puts a question mark over the sustainability of the Spanish economic recovery going forward.

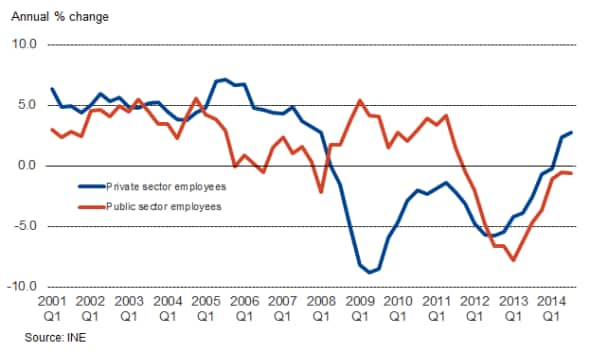

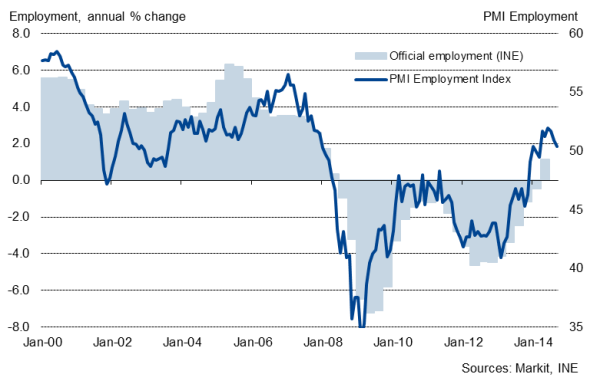

In terms of employment, PMI data signalled a sixth successive month of job creation in September, led by manufacturers. With the public sector continuing to reduce staff, the economy is reliant on private firms to create jobs and official data showed the fastest annual rise in private sector employee numbers for six-and-a-half years in the third quarter.

Public and Private Sector Employees

However, the increase in staffing levels signalled by the PMI in September was the weakest in the current sequence of growth as services employment stagnated. As with trends in output and new orders, it seems that rates of expansion may have peaked.

The official labour market data themselves also contain some worrying elements. Firstly, the number of under-25s in the labour market fell again year-on-year and is down by over 30% since prior to the economic crisis. The loss of young talent from the labour market is a real risk to the country's future success.

Markit Spain Composite PMI Employment Index

Another worry revolves around the extent to which jobs growth is being driven by companies hiring staff on temporary contracts rather than permanent ones. Although both rose over the year, the increase in temporary contracts (4.6%) was much stronger than the expansion in permanent roles (1.3%).

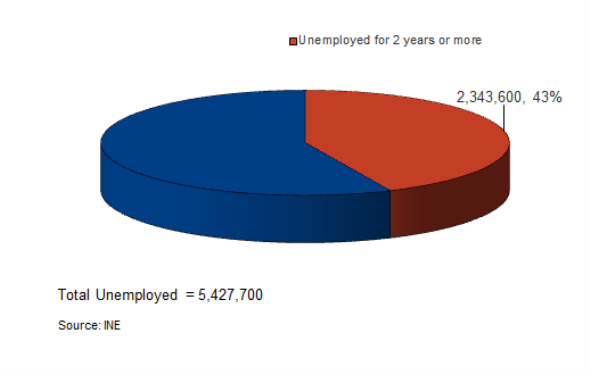

For those still looking for work, which is still a large proportion of Spaniards, there will also be concerns at their ability to get back into employment, or even find their first job. The proportion of the ranks of the unemployed that have been out of a job for two years or more is up to 43% (2.3 million). Meanwhile, close to 600,000 unemployed people are still looking for their first job. If growth of GDP has already peaked then the outlook for those currently out of work remains bleak.

Unemployment by duration

The first indication as to how the Spanish economy has performed at the start of the fourth quarter of the year will be provided by the PMI data for October. Manufacturing data will be released on the 3rd of November, with services following on the 5th.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-Spanish-unemployment-eases-further-as-economic-recovery-continues.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-Spanish-unemployment-eases-further-as-economic-recovery-continues.html&text=Spanish+unemployment+eases+further+as+economic+recovery+continues","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-Spanish-unemployment-eases-further-as-economic-recovery-continues.html","enabled":true},{"name":"email","url":"?subject=Spanish unemployment eases further as economic recovery continues&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-Spanish-unemployment-eases-further-as-economic-recovery-continues.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spanish+unemployment+eases+further+as+economic+recovery+continues http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-Spanish-unemployment-eases-further-as-economic-recovery-continues.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}