Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 04, 2025

Manufacturing PMI back into contraction as boost from tariff front-running fades

Worldwide manufacturing business conditions deteriorated slightly in July, reflecting downturns in output, new orders, exports and employment, according to the latest PMI surveys. Business confidence about the year ahead also deteriorated.

A key driver of the change to business conditions in July was the tariff environment, with the latest surveys showing signs of a fading impact of the recent front-running of US tariffs, alongside worsening views on the impact of tariffs on global trade and underlying economic conditions in the months ahead.

Especially low confidence and weak production was seen in many Asian economies, but growth and sentiment also worsened in the US, linked in part to another month of particularly sharp price rises due principally to import tariffs.

Manufacturing conditions worsen

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, fell from 50.4 in June to 49.7 in July, moving back below the 50 'no change' level to indicate a marginal deterioration in business conditions for the third time in the past four months.

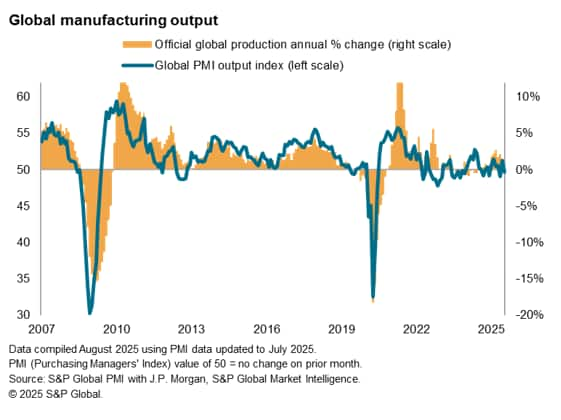

The PMI's Output Index, which measures monthly changes in factory production volumes, also showed a small decline in July. Although only modest, the drop in production followed a rise in June and represented only the second fall recorded so far this year.

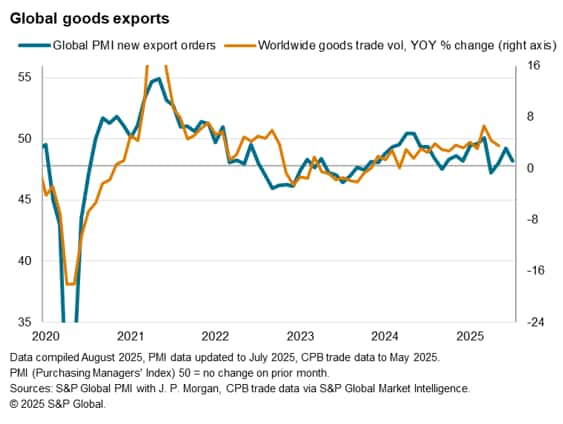

Measured globally, new order inflows into factories likewise dipped in July, after rising marginally in June, led by a slight worsening in the global export order book trend. Jobs also were cut at a slightly increased rate in factories worldwide.

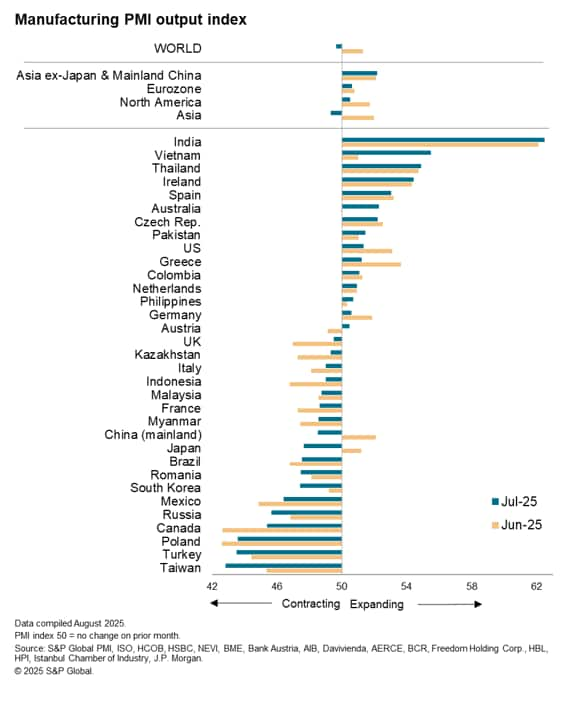

The overall dip in global production masked marked regional variations. Of the 33 economies monitored by S&P Global PMI manufacturing surveys, only 15 reported higher output compared to 18 reporting declines.

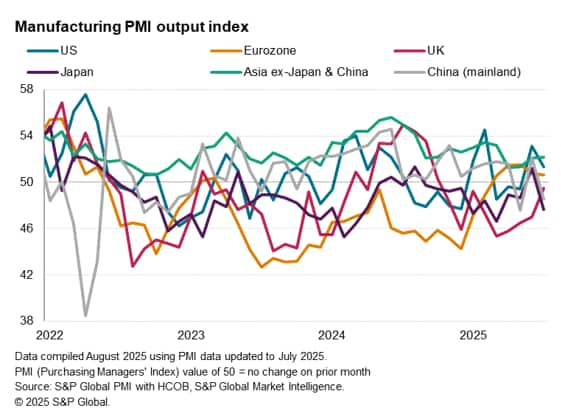

Leading the rankings was India, followed by Vietnam and Thailand, helping Asia excluding Japan and mainland China to outperform as a major region. However, the eurozone also outperformed, growing for a fifth straight month, thanks in part to strong gains in Ireland and Spain alongside expansions in Greece, the Netherlands, Germany and Austria.

Growth in North America meanwhile slowed, reflecting only a modest increase in US production and steep downturns in both Canada and Mexico. Output declines nonetheless moderated in both Mexico and Canada to mean the steepest downturn worldwide was recorded in Taiwan during July, followed by Turkey and Poland.

Production notably fell back into decline in both mainland China and Japan after short-lived gains in June.

Tariff front-running fades

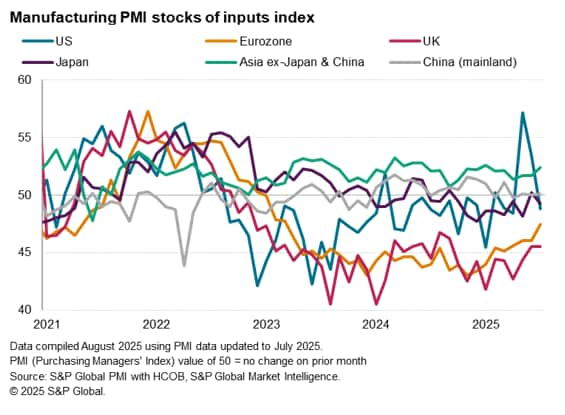

A key determinant of the shifting production patterns in recent months has been the news flow on US tariffs. Concerns regarding the impact of US import tariffs on prices and supply availability prompted unprecedented inventory building by US manufacturers back in the second quarter, both in terms of raw materials and finished goods stock holdings, which showed signs of reversing in July. US stocks of both finished goods and inputs in fact fell in July. This not only dampened the US PMI numbers, but also played a role in weakening the output and export data for many of the US's trading partners such as mainland China, Japan and Taiwan (which saw the three steepest deteriorations in production indices compared to June).

Optimism amongst gloomiest since 2022

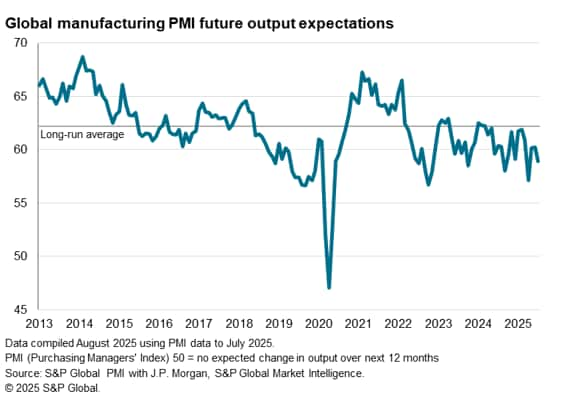

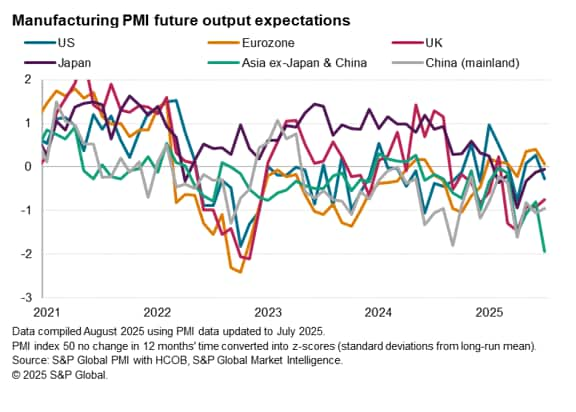

Business optimism about the year ahead meanwhile deteriorated globally in July, with the Future Output Expectations Index falling further below its long-run average to register the fourth-lowest reading since late-2022. Companies widely blamed uncertainty and disruptions caused by US tariff announcements and concerns over future global trade flows.

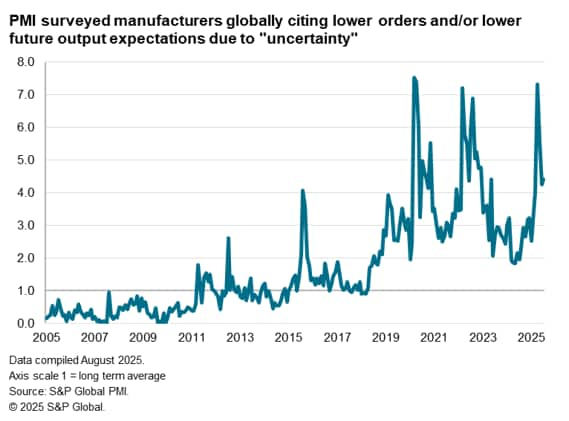

Although global reports of demand or business expectations being adversely affected by "uncertainty" has fallen sharply from April's recent peak, the incidence remains very elevated by historical standards, and ticked higher than recorded in June, underscoring the extent to which manufacturing is being subdued globally by a lack of clarity on geopolitics and the trade environment in particular.

Relative to long-run averages, the eurozone stood out as a region seeing above-average sentiment, reflecting hopes that domestic stimulus - especially in the form of increased fiscal spending - will help offset the damaging effect of US tariffs. However, even here, sentiment slipped to a three-month low.

There was meanwhile a notable divergence in sentiment trends in Asia. Whereas optimism ticked higher in both Japan and mainland China, sentiment in the rest of Asia sank to its lowest since data were first available 13 years ago barring only the early months of the pandemic, largely fueled by tariff worries.

Notably, sentiment also fell in the US as producers grew increasingly concerned about the impact of US polices on demand and inflation.

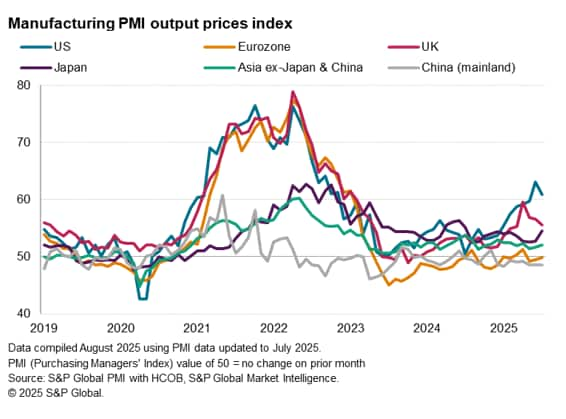

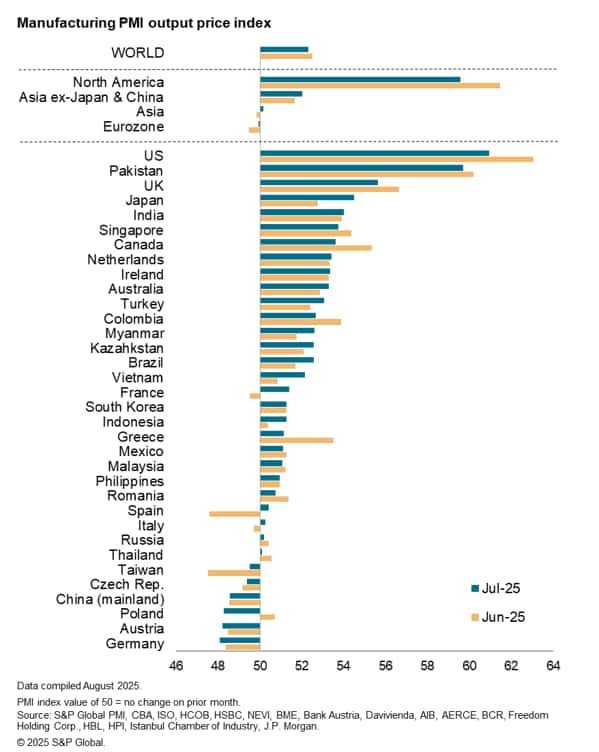

US producers report steepest price rises for third straight month

Concerns among US producers over the inflationary impact of tariffs reflect another month of sharply rising input costs in the US, which in turn fed through to the steepest rise in average selling prices of all economies surveyed in July. This was the third successive month (and the fourth time in the past five months) in which the US has topped the rankings in terms of selling price inflation.

In contrast, selling prices fell marginally in the eurozone for a third successive month, led by falling prices in Germany, and dropped in mainland China for an eighth straight month.

Outlook

The PMI data therefore indicate that the second quarter boost to global manufacturing and trade from the front-running of US tariffs faded in July, accompanied by a deterioration in business optimism about the year ahead amid ongoing tariff-related worries.

While producers in Asia outside of mainland China and Japan have reported the strongest, most resilient, output growth in July, these same firms have become the most pessimistic about future prospects, adding to concerns about future global production trends.

However, even US producers, supposedly being protected by US tariffs, have reported weakening production growth and gloomier prospects in July, partly reflecting intensifying concerns over the impact of tariffs on sales and inflation. Concerns over the latter reflect the fact that US producers have now reported higher selling price inflation than all other economies surveyed by the PMI in four of the past five months.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-back-into-contraction-as-boost-from-tariff-frontrunning-fades-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-back-into-contraction-as-boost-from-tariff-frontrunning-fades-Jul25.html&text=Manufacturing+PMI+back+into+contraction+as+boost+from+tariff+front-running+fades+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-back-into-contraction-as-boost-from-tariff-frontrunning-fades-Jul25.html","enabled":true},{"name":"email","url":"?subject=Manufacturing PMI back into contraction as boost from tariff front-running fades | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-back-into-contraction-as-boost-from-tariff-frontrunning-fades-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+PMI+back+into+contraction+as+boost+from+tariff+front-running+fades+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-back-into-contraction-as-boost-from-tariff-frontrunning-fades-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}