Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 01, 2025

Week Ahead Economic Preview: Week of 04 August 2025

Service sector PMIs, trade data and the Bank of England in focus

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Service sector PMI surveys will provide an assessment of global economic trends in the face of ongoing tariff-related uncertainty, as will trade data from the US and mainland China. The Bank of England meanwhile meets to set interest rates amid mixed policy signals from recent economic data.

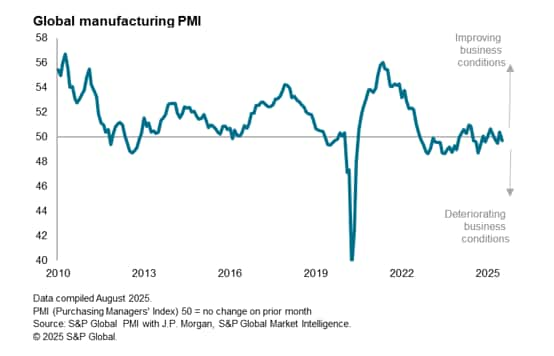

After manufacturing PMI surveys showed worldwide factory conditions deteriorating in July, linked in part to the fading boost from tariff front-loading, attention turns to the services economies in the coming week.

Being typically more domestically focused than manufacturing, as well as usually accounting for a far greater share of GDP, services PMIs are key determinants of monetary policy settings. Earlier flash PMI data for major developed economies showed some encouraging signals in terms of economic resilience in these tertiary sectors, helping offset some of the weaker trends evident in manufacturing. Most pronounced was a rise in US services output, in part linked to improving financial conditions: as stock markets rise, businesses and households often feel more confident. This should bode well for the ISM non-manufacturing/services survey.

After stronger than expected GDP growth in the second quarter, the market will be viewing any robust July services PMI and ISM readings as further diminishing FOMC rate cut hopes after US policymakers chose once again to hold rates steady at their July meeting.

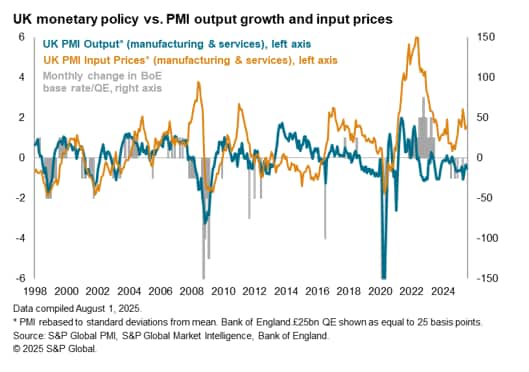

The market is, however, looking for the Bank of England to trim its policy rate by a further 25 basis points at its meeting on Thursday. That would be a fifth cut to take the Bank rate to 4.0%, its lowest since early 2023. However, the decision may not be unanimous. Despite economic growth remaining lacklustre in recent months, and steep job losses persisting into July according to the flash PMI, inflation has risen to 3.7%, well above the Bank of England's 2.0% target. Hawkish members of the Monetary Policy Committee will want to see that the recent uplift in inflation, linked in part to recent government policy changes which have increased wage costs, will prove transitory and not lead to persistent above-target inflation.

In APAC, the key data releases, besides the PMIs, are trade and inflation data from mainland China, as analysts wait to assess the impact of tariff-related pressures on manufacturing against domestic stimulus.

Worldwide service sector PMI numbers will help assess broader global economic resilience after manufacturing business conditions deteriorated in July.

Policymakers at the Bank of England will need to decide if sluggish growth warrants another rate cut despite signs of persistent inflation

Key diary events

Monday 4 Aug

Canada, United Kingdom Market Holiday

Switzerland Inflation (Jul)

Türkiye Inflation (Jul)

United States Factory Orders (Jun)

Tuesday 5 Aug

Worldwide Services, Composite PMIs, inc. global PMI* (Jul)

South Korea Inflation (Jul)

Japan BoJ Meeting Minutes (Jun)

Philippines Inflation Jul)

Indonesia GDP (Q2)

France Industrial Production (Jun)

Canada Trade (Jun)

United States Trade (Jun)

United States ISM Services PMI (Jul)

Wednesday 6 Aug

New Zealand Employment Change (Q2)

India RBI Interest Rate Decision

Germany Factory Orders (Jun)

Eurozone HCOB Construction PMI* (Jul)

France HCOB Construction PMI* (Jul)

Germany HCOB Construction PMI* (Jul)

Italy HCOB Construction PMI* (Jul)

Italy Industrial Production (Jun)

Taiwan Inflation (Jul)

United States S&P Global Construction PMI* (Jul)

Eurozone Retail Sales (Jun)

Canada S&P Global Services PMI* (Jul)

Brazil Trade (Jul)

Thursday 7 Aug

Australia Trade (Jun)

Philippines GDP (Q2)

China (Mainland) Trade (Jul)

Germany Trade (Jun)

Germany Industrial Production (Jun)

Sweden Inflation (Jul, prelim)

United Kingdom Halifax House Price Index* (Jul)

France Trade (Jun)

United Kingdom BoE Interest Rate Decision

Mexico Inflation (Jul)

Mexico Banxico Interest Rate Decision

Friday 8 Aug

Japan Household Spending (Jun)

Japan BoJ Summary of Opinions (Jul)

Japan Current Account (Jun)

France Unemployment Rate (Q2)

Taiwan Trade (Jul)

Canada Employment (Jul)

Saturday 9 Aug

China (Mainland) CPI, PPI (Jul)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide services and composite PMI plus detailed sector PMI data

Global services and composite PMI will be released on Tuesday. Additionally, detailed sector PMI data will provide valuable insights into how performance varied across industries in July in the face of latest tariff updates.

Americas: US ISM services PMI; Canada employment and trade data; Banxico meeting and Mexico inflation

Following the release of final manufacturing PMI data, both S&P Global and ISM Services PMI data will be published in the new week for insights into non-manufacturing performance. Early S&P Global Flash US PMI data pointed to a strengthening of the services economy in July, contrasting with deteriorating conditions in the goods-producing sector. Intensifying price pressures in the service sector will also be an area to monitor given its implications for monetary policy. Watch out also for US factory orders and trade data for further clues on tariff impact.

Meanwhile Canada publishes employment and trade data for July for the latest update on economic conditions following the spate of weakness seen so far with early PMI releases. Inflation data will also be due from Mexico on the same day that the Mexican central bank is set to update their monetary policy settings. The market anticipates another cut.

EMEA: BoE meeting, UK Halifax house prices; Germany trade; Eurozone retail sales

The Bank of England (BoE) convenes for their August meeting with the market expecting the policy rate to be further lowered at the upcoming meeting. The most up-to-date July S&P Global Flash UK PMI data showed that output growth slowed alongside job cuts at the start of the third quarter. While price pressures intensified, survey data has also suggested that the peak of recent inflationary pressures has passed, supporting a cut in rates.

Trade numbers from Germany will meanwhile be the data highlight in the week in Europe. According to the HCOB Flash Germany PMI, rising goods trade had helped to offset a slowdown in the service sector.

APAC: China trade and inflation data; RBI meeting, BoJ meeting materials; Australia trade; Indonesia and Philippines GDP; South Korea, Taiwan, Thailand, Philippines inflation

Trade and inflation data will be in focus from mainland China in the coming week, while a central bank meeting unfolds in India albeit with no change to the repo rate expected. Tier-1 data are also anticipated from various economies around the region.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-august-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-august-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+04+August+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-august-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 04 August 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-august-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+04+August+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-04-august-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}