Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 22, 2014

MPC still split, but majority sees no need to hike UK interest rates any time soon

The minutes from the latest Bank of England Monetary Policy Committee meeting will add further to the belief that interest rates will not rise until next summer at the earliest.

Two of the nine MPC members, Martin Weale and Ian McCafferty, had voted to hike interest rates by 0.25% to 0.75% at the prior two meetings and again saw a need to start the policy normalisation process at the October meeting. However, no other members deemed higher interest rates to be appropriate, having grown worried about the outlook while seeing few signs of inflationary pressures, even when assuming sterling's recent appreciation (which has reduced import costs) could prove temporary.

Case for higher rates losing ground

The case was building for higher interest rates earlier in the year. The economic recovery was progressing well, unemployment was plummeting faster than expected and the speed of the housing market upturn was causing jitters about a bubble. The only missing ingredient of the recipe for higher interest rates was inflation, and in particular the build-up of wage pressures.

However, in recent months there have been signs that the recovery is slowing, the housing market is cooling and wage pressures have failed to materialise to any significant degree.

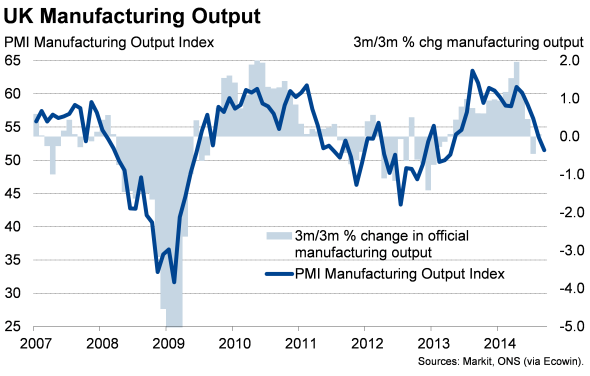

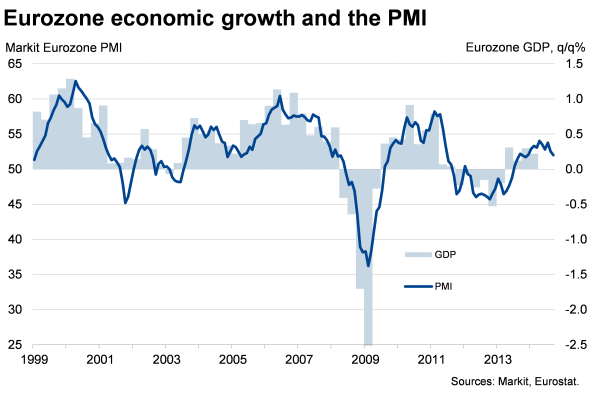

The minutes highlight how concerns stem from signs that the Eurozone may be sliding back into recession, and the extent to which slower growth on the continent will hit the UK. In particular, a sharp slowdown signalled by the manufacturing PMI in September suggests the recovery remains all-too reliant on the domestic service sector.

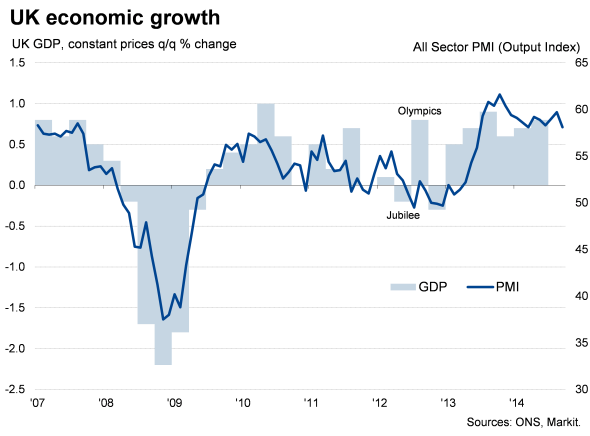

Although the PMI surveys point to GDP rising strongly again in the third quarter after a 0.9% rise in the second quarter (the MPC is assuming another 0.9% rise), the speed of the manufacturing slowdown and weakness of eurozone and global economic growth raise concerns that the UK economy is slowing faster than previously anticipated.

Official statistics also point to worrying signs of weakness in the UK's manufacturing and trade data. Having enjoyed strong growth earlier in the year, factory output rose a meagre 0.1% in the three months to August while goods exports fell 3.1%, according to official data.

Data for Germany have been even worse, pointing to the possibility of a renewed recession in the euro area's largest member.

Pay barely rising and inflation falling

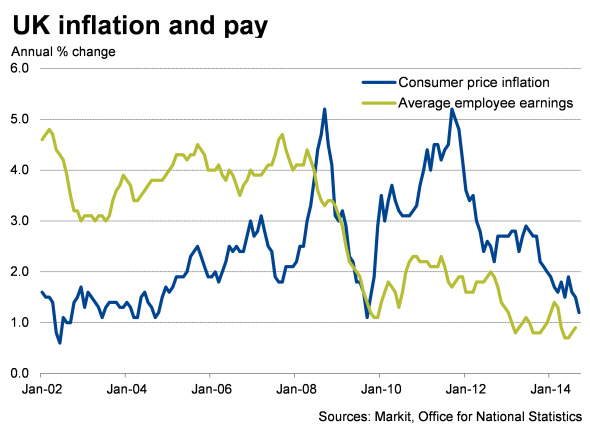

Policymakers are meanwhile still struggling with the puzzle over pay. Despite unemployment slumping to a six-year low of 6.0%, regular pay rose just 0.9% on a year ago in the three months to August, edging up further from the record low of 0.7% seen in the three months to June but remaining historically weak and, importantly, still below inflation.

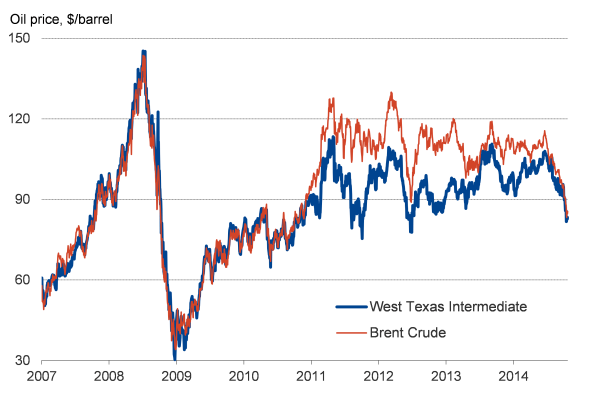

Inflation itself fell to a five-year low of 1.2% in September. With oil prices falling dramatically in recent weeks on worries about weak global demand and wage pressures remaining subdued, an imminent pick-up in inflation is not the MPC's most pressing concern at the moment. The MPC's focus is instead once again shifted to making sure the recovery can be sustained without fizzling out.

There remains the possibility - raised by Weale and McCafferty - that slack in the economy is being eroded rapidly and that pay could rise sharply in coming months. While this view has some merit, it now seems unlikely that pay will spike higher until the new year. Unless pay growth shoots up in the next couple of months, a rate rise soon after the General Election now looks the most likely scenario.

Oil prices

Source: Ecowin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-economics-mpc-still-split-but-majority-sees-no-need-to-hike-uk-interest-rates-any-time-soon.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-economics-mpc-still-split-but-majority-sees-no-need-to-hike-uk-interest-rates-any-time-soon.html&text=MPC+still+split%2c+but+majority+sees+no+need+to+hike+UK+interest+rates+any+time+soon","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-economics-mpc-still-split-but-majority-sees-no-need-to-hike-uk-interest-rates-any-time-soon.html","enabled":true},{"name":"email","url":"?subject=MPC still split, but majority sees no need to hike UK interest rates any time soon&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-economics-mpc-still-split-but-majority-sees-no-need-to-hike-uk-interest-rates-any-time-soon.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=MPC+still+split%2c+but+majority+sees+no+need+to+hike+UK+interest+rates+any+time+soon http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-economics-mpc-still-split-but-majority-sees-no-need-to-hike-uk-interest-rates-any-time-soon.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}