Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 21, 2014

Economic growth in China weakest since start of 2009

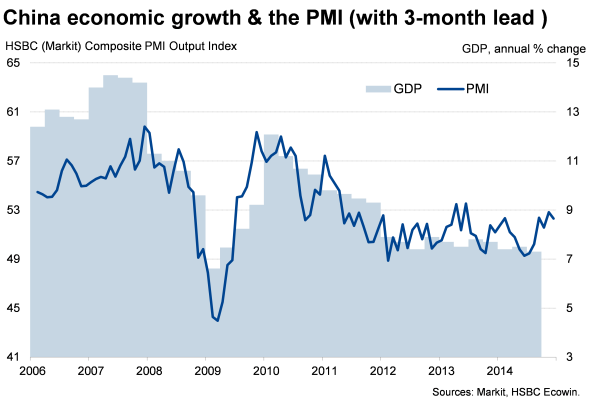

Economic growth has slowed in China to its weakest since the height of the financial crisis. Gross domestic product rose at an annual rate of 7.3% in the third quarter, according to official data, down from 7.5% in the second quarter and the slowest since the first quarter of 2009.

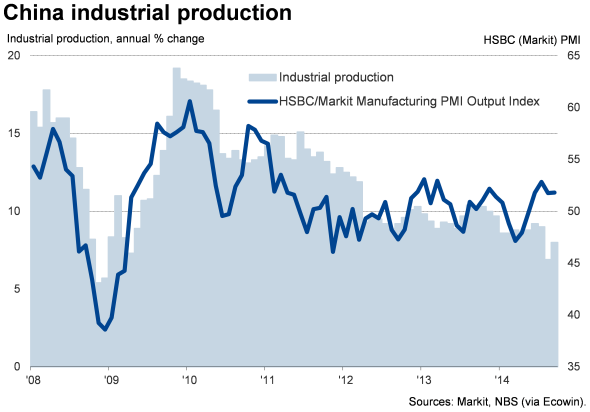

Other data releases were also suggestive of growth lowing momentum. Despite a bounce-back from the 6.9% increase in September, industrial production still rose at a historically modest pace, and at the second-weakest rate seen since April 2009 (8.0%).

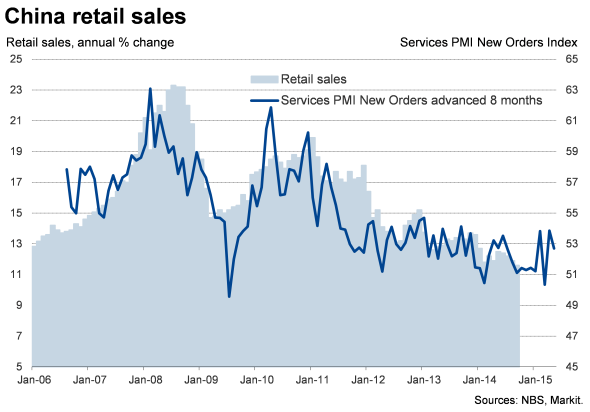

Retail sales meanwhile rose 11.6% on a year ago, down from 11.9% in August and representing a further easing from the 12.5% peak seen back in May. Excluding distortions due to New Year holidays, that was the slowest rate of increase since March 2004.

The slowdown has been largely linked to the domestic housing market, where sales are down 10.8% in the year to date, showing few signs of a turn-around due to excess supply of housing after the credit-fuelled construction boom.

Economic growth is consequently expected to struggle to reach the government's target of 7.5% this year, especially as many analysts expect growth to deteriorate further in the final quarter. The World Bank is predicting growth to slow further to 7.0% next year.

Slower growth raises expectations that the authorities will implement further targeted mini-stimulus measures to help avoid a too steep slowdown. These measures could include relaxing restrictions on property sales, though Beijing has made it clear that it will tolerate slightly below target growth, suggesting any measures will be limited.

There are also some signs that measures announced earlier in the year may already be having some impact on the economy, reducing the need to any substantial policy action. The HSBC PMI surveys, produced by Markit, which move ahead of GDP, collectively suggest that economic growth is picking up.

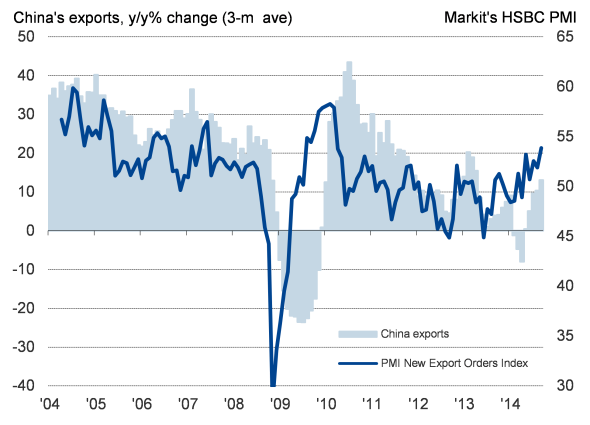

The surveys indicate that manufacturers are benefitting from the fastest rise in new export business since early 2010 (something recent corroborated by official data) and that service companies are enjoying a strengthening of domestic demand, most likely arising from the government's mini-stimulus measures.

Plotting the new orders index from the domestically-focused services PMI survey against retail sales suggests that the survey data provide an advance indication of sales growth. The PMI has been volatile in recent months, but hints at a pick-up in sales growth as we move towards the end of the year.

More insight into fourth quarter trends will be released by HSBC flash Manufacturing PMI data for October, to be released 23rd October.

China's exports

Sources: Markit, HSBC, Ecowin.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Economics-Economic-growth-in-China-weakest-since-start-of-2009.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Economics-Economic-growth-in-China-weakest-since-start-of-2009.html&text=Economic+growth+in+China+weakest+since+start+of+2009","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Economics-Economic-growth-in-China-weakest-since-start-of-2009.html","enabled":true},{"name":"email","url":"?subject=Economic growth in China weakest since start of 2009&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Economics-Economic-growth-in-China-weakest-since-start-of-2009.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+growth+in+China+weakest+since+start+of+2009 http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102014-Economics-Economic-growth-in-China-weakest-since-start-of-2009.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}