Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 20, 2014

Is the German economy growing or stalling?

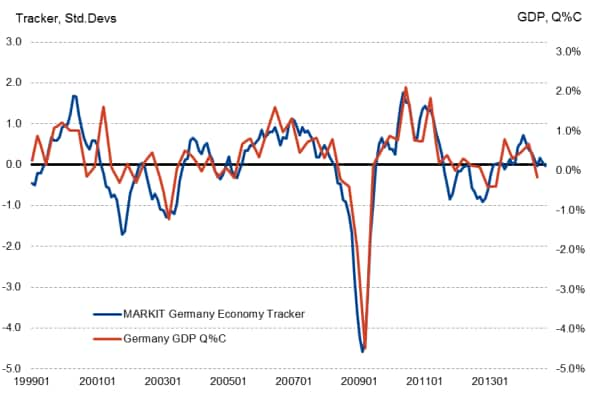

German PMI" survey data diverged from official gross domestic product (GDP) in the second quarter of 2014. Official data from Destatis showed GDP falling 0.2% in the second quarter of 2014. The contraction contrasted with PMI data, which had signalled modest growth.

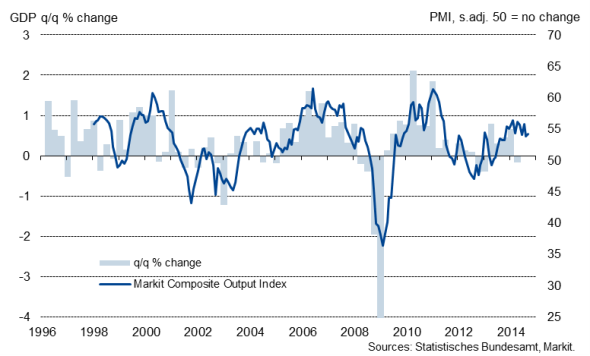

PMI and GDP data have historically exhibited a close relationship. Monthly PMI data also give an early indication of the underlying trend of the economy well in advance of official quarterly data that are generally released up to seven weeks after the end of a quarter. However, the second quarter divergence highlights how care needs to be taken in considering various factors such as weather and survey coverage when comparisons are being made.

Factors behind divergences between GDP and the PMI

Short-lived divergences between the PMI and GDP usually reflect special factors that have affected GDP data, often extreme weather. Other divergences can be attributed to GDP being affected by swings in sectors not covered by the PMI surveys, notably the exclusion of the construction sector from the Composite PMI.

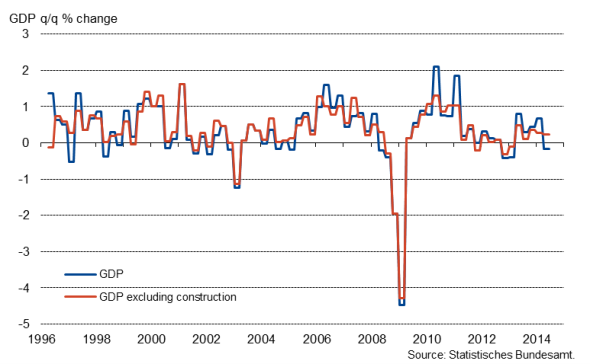

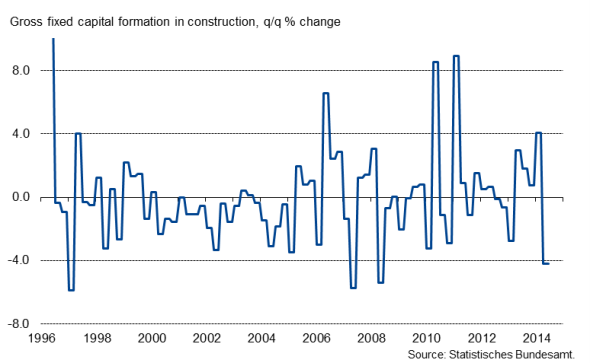

Construction played an important role in driving GDP changes in the first half of 2014. Construction is historically very volatile and heavily affected by factors such as weather conditions. If winters are unusually mild, construction tends to increase at well above average rates, while unexpected bad weather can act as a drag on construction activity. The mild winter of 2013/14 led to a 4.1% rise in construction in the first quarter of the year (the largest rise since Q1 2011), and supported a 0.7% expansion of GDP. The second quarter, however, saw a pay-back, with construction down by 4.2% (sharpest drop since Q2 2008), weighing heavily on Germany's economic growth.

GDP (including construction) and the PMI

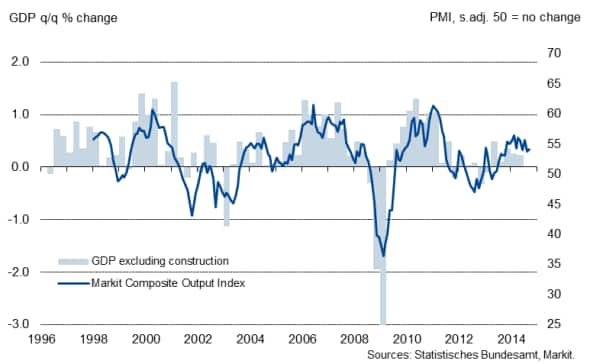

GDP (excluding construction) and the PMI

GDP (including and excluding construction)

In order to remove the volatility caused by the weather-dependent building sector, we can exclude construction from the official GDP data. The resulting data show that GDP excluding construction in fact increased by 0.2% in the second quarter, down only slightly from a 0.3% expansion in the first three months of the year.

Another factor that is likely to have affected the drop in GDP is the timing of public holidays in Germany. With Labour Day falling on a Thursday (1st of May), many people took the Friday off work to 'bridge' the holiday over the weekend, thereby leading to a greater than usual drop in output over the month. While the public holiday was accounted for by standard seasonal adjustment estimation, it is more difficult to capture the effect of 'bridge' days.

Worrying picture of the health of the German economy

Last week, Germany's Federal Minister for Economic Affairs and Energy, Sigmar Gabriel presented the government's Autumn Statement, in which Germany's economic growth forecast for 2014 was cut from an initial 1.8% to 1.2%. Furthermore, oofficial data showed industrial production falling at the sharpest rate since the financial crisis and exports plunging substantially.

However, it is likely that the weak industry data in part reflect common problems with official statistics not properly accounting for the variable timing of school holidays, which can play havoc with standard seasonal adjustment techniques. Moreover, while geopolitical tensions and sluggish growth in some of the world's largest economies weigh on sentiment and economic performance overall, households' consumption remains healthy, thanks to a robust labour market and rising wages.

PMI data paint a similar picture on the health of the German economy. The survey data show geopolitical tensions and the sanctions on Russia had weighed heavily on the performance of Germany's internationally-focused goods-producing sector, with the Markit/BME Manufacturing PMI dropping to a 15-month low. In contrast, the service sector continued to expand at a robust pace in the third quarter.

We're consequently forecasting growth of around +0.25% for Germany in the third quarter, with growth largely driven by the services economy. However, data for the service sector are considerably sparser, adding uncertainty to the forecast.

The picture should become a little clearer with the September industry statistics which are due to be released in early November just ahead of the preliminary estimates of third quarter GDP.

Gross fixed capital formation in construction

German GDP Model

Sources: Markit, Ecowin.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-economics-is-the-german-economy-growing-or-stalling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-economics-is-the-german-economy-growing-or-stalling.html&text=Is+the+German+economy+growing+or+stalling%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-economics-is-the-german-economy-growing-or-stalling.html","enabled":true},{"name":"email","url":"?subject=Is the German economy growing or stalling?&body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-economics-is-the-german-economy-growing-or-stalling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Is+the+German+economy+growing+or+stalling%3f http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102014-economics-is-the-german-economy-growing-or-stalling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}