Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsWhat connected–car services are consumers willing to pay for?

Car-shoppers are largely satisfied with subscription-based infotainment services, but value and exposure matter most. Data security and privacy remain issues.

Want to create a social-media firestorm? Announce that popular in-car features will require a subscription - on top of what people already are paying for the vehicle. General Motors and BMW have recently sparked controversy by announcing efforts to grow subscription-based products and services in future vehicles - which <span/>reportedly weren't greeted well by consumers.

But here's the rub: The perceived outrage doesn't match reality. Once consumers experience connected services, they are overwhelmingly satisfied and likely to resubscribe, according to a recent global consumer survey of <span/>nearly 8,000 consumers conducted by S&P Global Mobility.

"Consumers are welcoming to the idea of subscriptions, because it gives them exposure to features or technology that they may not have had in the past," said Yanina Mills, senior technical research analyst at S&P Global Mobility.

In a subset of about 4,500 respondents who had experienced a free trial or an existing subscription on a model year 2016 vehicle or newer, 82% said they would <span/>definitely or probably consider purchasing subscription-based services on a future new vehicle purchase.

Exposure sells subscriptions

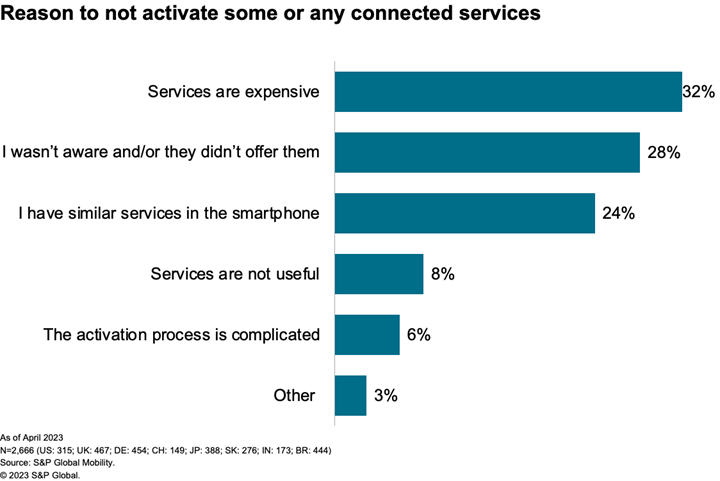

Fumbled introductions are one thing. Selling <span/>subscriptions in the here and now is another. More than one in four respondents - 28% to be exact - either did not know that connected services were available, and/or noted the dealer did not offer (or even mention) them. Improving education at point-of-sale is essential for category growth.

In-vehicle exposure is even better than education for growing demand and fostering satisfaction and retention with these services and brands. 45% of respondents had the service activated at the dealership, typically as part of a free trial period. That improves the odds of growing subscribers. "It's all a matter of exposure," Mills said.

<span/>That's because, once exposed, consumers are pretty happy with their connected services subscriptions. <span/>The vast majority of previous-subscriber respondents said they were likely to renew. Satisfaction is high as well, as 85% of respondents would recommend their service to a friend. Among individual brands, Audi Connect and BMW ConnectedDrive consistently perform well, scoring high in most global markets for the third survey year in a row.

So, how could OEMs do better in rolling out new connected ideas? When it comes to subscription-based connected services, Mills says, "Marketing is everything. Implementation is everything."

In GM's case, they touted the benefits of their new infotainment

system, to be found in its next generation of EVs. According to the

automaker, GM wishes to "manage the overall in-vehicle experience

in a more holistic way." A major goal is to "reduce complexity and

feature duplication," eliminating the redundancy between native

onboard infotainment and the customer's smartphone.

But that came with a big tradeoff: Getting rid of the Apple CarPlay and Android Auto user interfaces. The media focused on that detail, in terms of erasing any of the new infotainment system's advantages. <span/>After all, these very popular smartphone mirroring apps come standard on <span/>almost every new vehicle today.

Fanni Li, connected car services research lead at S&P Global Mobility, says that GM is quite aggressive in this area, but warns that making the change could risk GM customer satisfaction. Also at stake: GM's desire to generate $20 to <span/>$25 billion yearly through subscription services by 2030.

Subscriptions need to add value

So, how to get it right? Paid functional upgrades have been available in the market for only about three years. Despite that short <span/>timeframe, more than half of respondents already want such an upgrade in their next vehicle.

But not all subscription-based upgrades are created equal. Enhanced navigation and advanced driver-assist system (ADAS) functionality top the desirability list. "For a lot of those features, when you buy them in full at the dealership, the initial investment is overwhelming," according to Mills. A subscription brings their cost into reach.

As seen in previous S&P Global Mobility consumer surveys,

safety features prove very popular - although there are differences

in appeal by region. For instance, at a country level, Brazil

respondents have the lowest threshold for price points for paid

updates in all subscription schemes, while Japan respondents

reported the highest threshold for <span/>pricing they'd be willing to pay for the

same updates, closely followed by the UK.

But there are some pan-global trends worthy of note. Paid upgrade safety features, such as high-beam assist and driving-video recorder, earned the highest satisfaction - 89% - of all connected services. Likewise, navigation and safety/security features were the ones most desired in respondents' next vehicles.

Less expensive comfort features, such as heated seats and a heated steering wheel, prove less popular for subscriptions. Compared to more novel and higher-priced technology features, these less-expensive options have less perceived value when structured as a subscription - especially when they have long been available as standard on upper-trim models. As Mills notes, "When everything becomes a subscription, it becomes overkill."

Getting heated over seats

BMW may have crossed that line with their expansion of connected services. Many observers boiled down the complex model- and market-specific program to one common theme - surprisingly charging owners to use heated seats that were already installed in their cars.

S&P Global Mobility survey data suggests, however, that this furor was a tempest in a teapot. Fewer than 30% of survey respondents are willing to pay for heated seats or a heated steering wheel by monthly subscription, anyway. Value-wise, these features are <span/>relatively affordable to buy in a single payment, reducing the need to spread out payments over a subscription.

"The frequency of usage is an important factor," Mills observed. "If you have a feature that you only use once or twice, you're not going to renew that feature." Using heated seats or a heated steering wheel is very climate-dependent, so usage can vary by season.

Smartphone vs Native

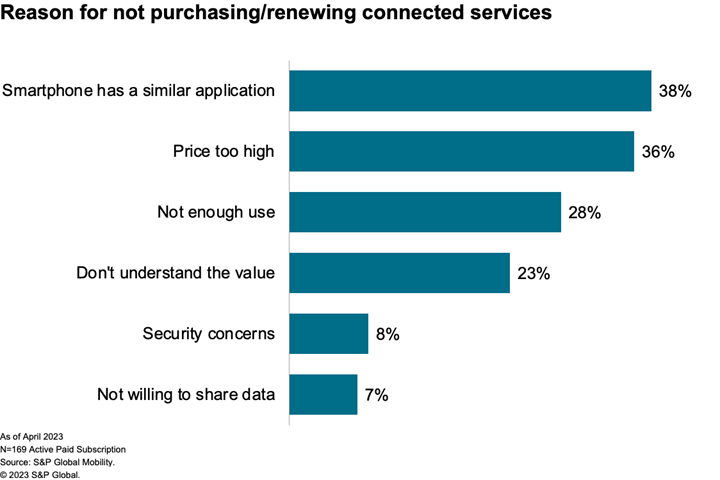

While ADAS functionality or heated seats can't be provided by smartphones, many infotainment services are. And consumers are accustomed to using their smartphone for navigation and entertainment features - from maps to music to hands-free texting.

As consumers pare down their subscriptions, features that are redundant between the vehicle and the phone <span/>likely are the first to go - and the smartphone <span/>almost always wins. S&P Mobility found that Gen Z and Millennial respondents are most likely to drop connected-services subscriptions because of similar services on their smartphones.

GM's elimination of Apple CarPlay and Android Auto takes the smartphone out of the equation. This could improve their <span/>odds of gaining and retaining subscriptions. But given that 89% of current connected-services subscribers resubscribe anyway, the potential modest increase in subscriptions isn't the primary reason for GM going native. GM sees an opportunity in consumer usage data.

"GM cannot get consumers' usage data from the infotainment system if users only connect via third party apps like Apple CarPlay and Android Auto," Li said. "Having this data on their own will become one of the competitive advantages for OEMs."

Privacy and Trust

But when it comes to vehicle data usage, Mills says, "It's a delicate balance for automakers." While accessing consumer data also improves features like EV-specific routing and range estimates, consumers are concerned about data privacy. 37% of respondents worry about security issues, while 32% fail to understand the value that a connected service would provide from the shared data.

Turns out the best way to win over consumers is to give them something for free. 74% of respondents are willing to share data in exchange for free services, with Gen Z and Millennials being the most (80%) likely. Again, there are regional differences: Consumers living in Japan are the most reluctant, with just 58% being willing to share data for free services, whereas 90% of consumers in India are willing to make that exchange.

But who do consumers trust with their data? OEMs are the most trusted, with 31% of consumers feeling comfortable with them. That's higher than the trust level associated with technology companies (23%). The difference in trust <span/>likely stems from how much data is available to each respective entity. As Mills notes, for automakers, "That amount of data is limited. It doesn't go to the depth of where your personal devices go."

In other words, your smartphone apps already know far more about you than your SUV <span/>likely ever will.

Subscription-based connected services provide great potential for OEMs. High consumer satisfaction and renewal rates show that buyers are willing to subscribe. But proper marketing and implementation are essential for success, especially regarding concerns of value and data privacy.

(Disclosure: The survey was in the field in March - well after BMW

had been involved in the heated-seat issue, but before GM had

announced its plans for a new native architecture designed around

offering connected car services)

SURVEY: ADVANCED DRIVER ASSISTANCE SYSTEMS

SURVEY: PREMIUM AUDIO ENTERS THE MASS MARKET

FOR MORE CONSUMER SURVEY INSIGHTS

LISTEN TO THE PODCAST ON THIS SUBJECT

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.