Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsWealthy Americans Are Buying These Cars

By Tom Libby, Associate Director, Industry Analysis and Loyalty

Solutions and Cecilia Simon, Consultant

S&P Global Mobility analysis finds some surprising trends among vehicle registrations for ultra-wealthy households.

Ultra-wealthy households in the US aren't buying the types of cars you might expect.

Instead of expensive vehicles like Lamborghinis and Rolls Royces, the most popular car acquired by these households in the past six months has an MSRP under $48,000. Further, one of the most popular segments is a mainstream segment.

These are two of the findings emerging from a review of the S&P Global Mobility purchase behavior and demographic data of the top tier of US households. Our analysis combined income data from the Census with vehicle registration and loyalty data from S&P Global Mobility. This allowed researchers to categorize household incomes into tiers and apply these insights at various geographic levels, including zip codes.

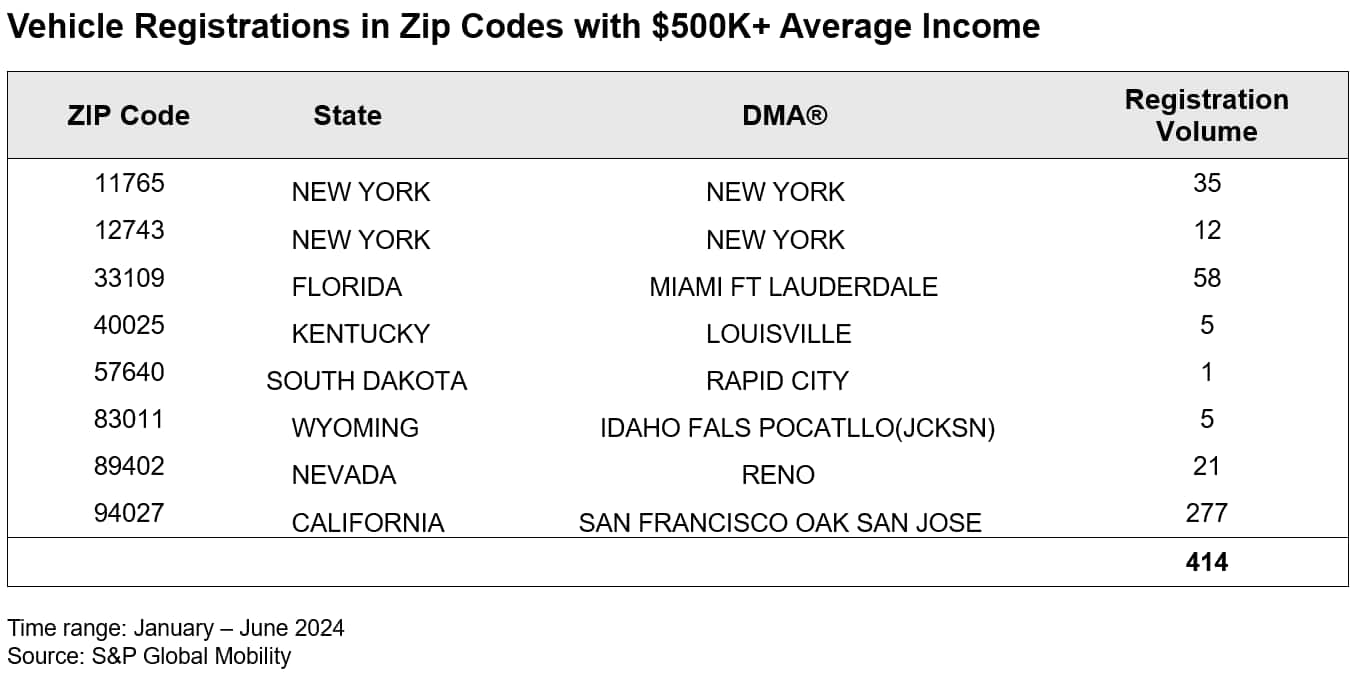

There are nine zip codes in the US with an average household income in the top tier, $500,000 and more. There were 414 retail registrations in these zip codes (one zip code did not have any registrations) in the first six months of 2024.

At the state level, California, Florida and New York account for 92% of these wealthy households, with Nevada, Wyoming, Kentucky, and South Dakota making up the remaining 8%. The three leading states' high ultra-wealthy household mixes are driven by robust representation in the New York City, San Francisco, and Miami/Ft. Lauderdale DMAs.

Popular Vehicle Brands Among High-Income Households

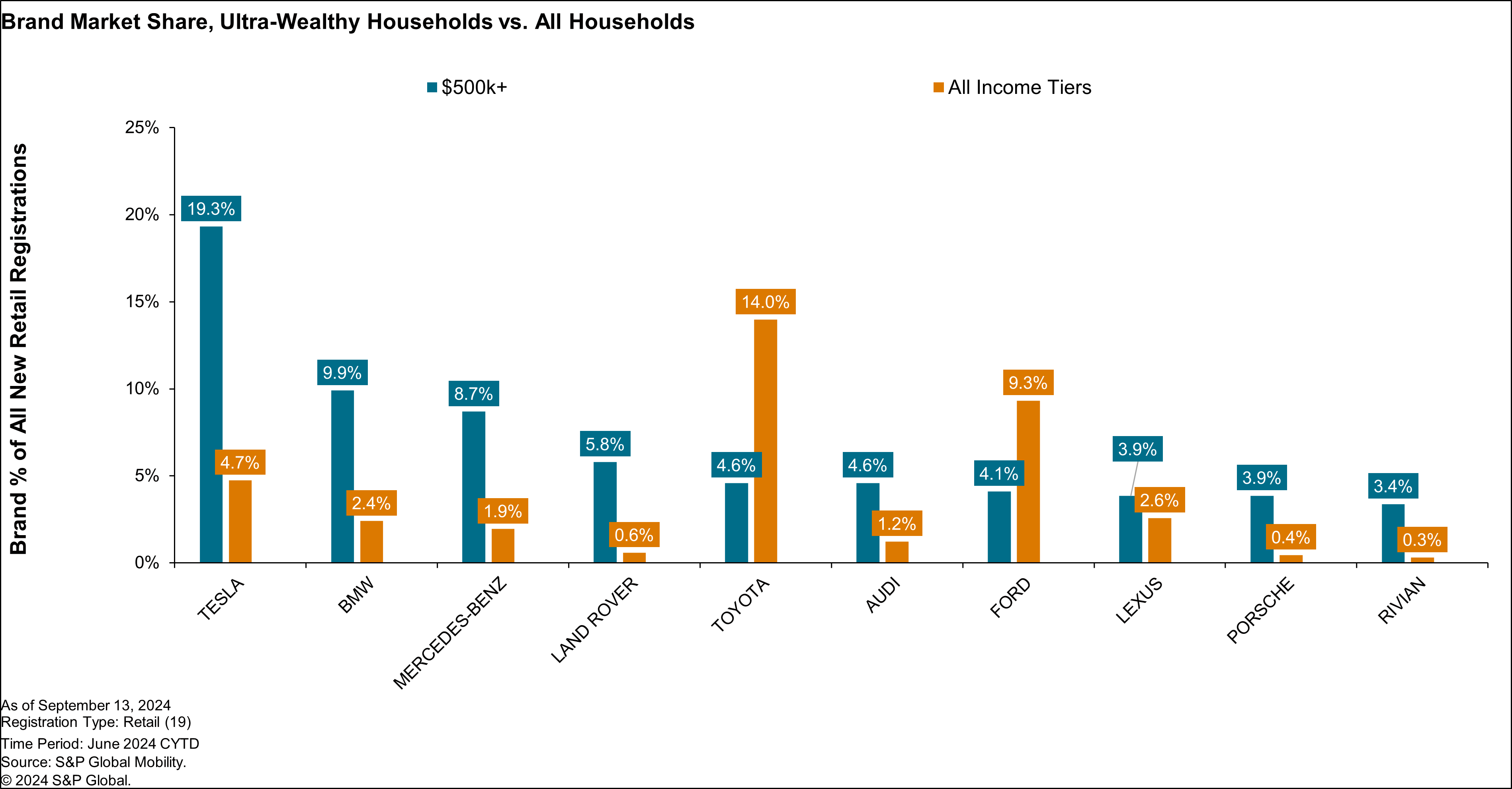

As one would expect, these households favor luxury vehicles, but not exclusively. Tesla registrations accounted for almost one of every five new registrations while BMWs comprised almost one of every ten. The next four brands appealing to these households include Mercedes-Benz, Land Rover, Audi, and the mainstream brand Toyota. These six brands by themselves captured more than half (53%) of all new registrations linked to these high-end households. The exotic brand most frequently acquired by these customers is Ferrari, which ranked #20 across all brands.

While these exclusive households have acquired exotic, luxury, and mainstream vehicles, luxury models dominate with 85% of all acquisitions, with mainstream models comprising 11% and exotics just 4%. The six most popular models include three Teslas and one each from BMW, Rivian and Land Rover. The most popular model across all categories is the Tesla Model Y, with a base MSRP of $47,988. (Tied for #7 among all models is the Tesla Cybertruck.)

Luxury vs. Mainstream Segment Purchasing Behavior

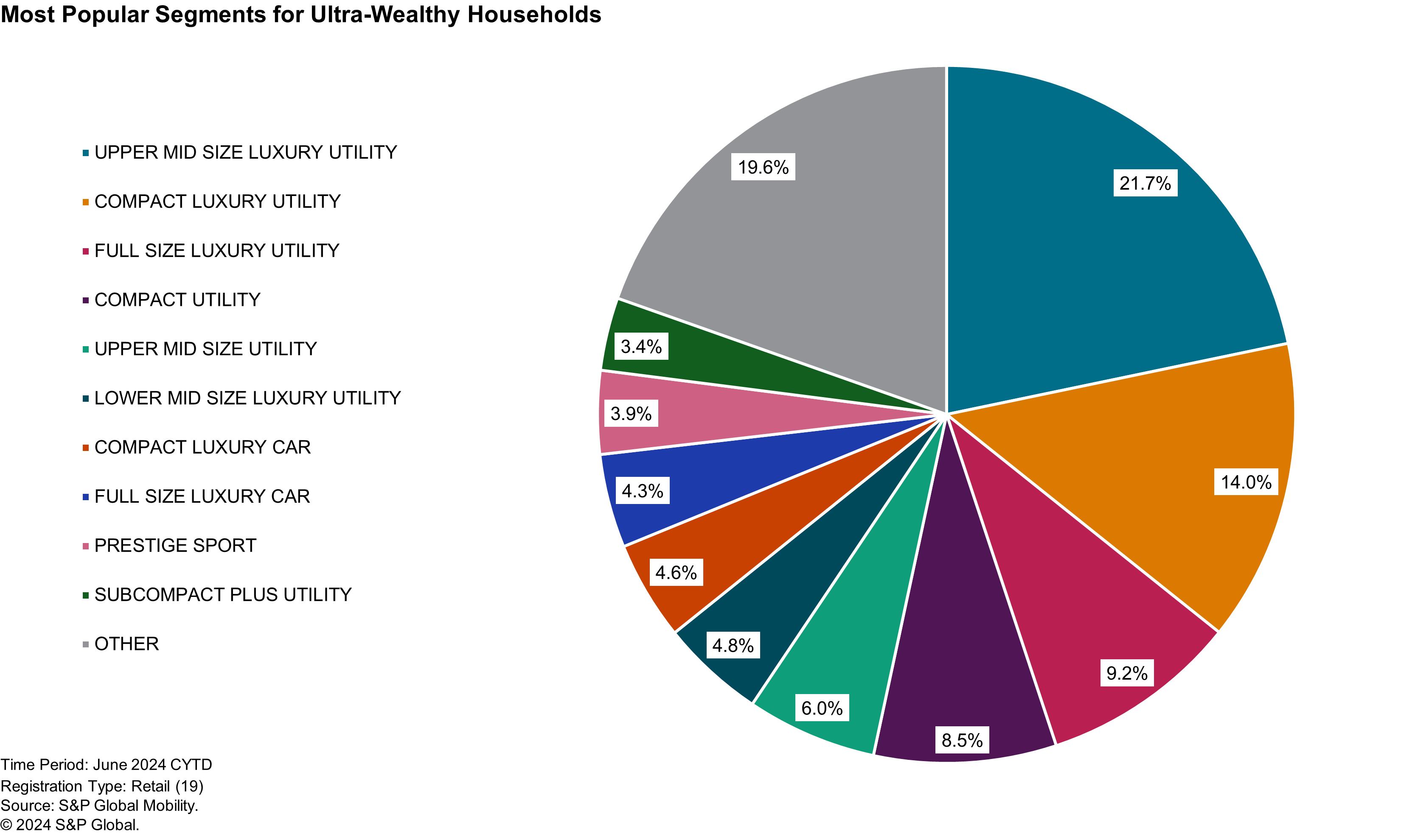

At the segment level, new vehicle registrations among this demographic are understandably skewed heavily towards the luxury market: 71.5% of their registrations fall in the luxury space. However, two of the five most popular segments — and three of the top ten — are mainstream segments, including the Compact Utility, Upper Mid-Size Utility, and Subcompact Utility Plus.

Not coincidentally, these are the three largest segments in the industry, with the Compact Utility Segment by itself accounting for 20% of the new vehicle market. This huge category includes compact crossovers marketed by every mainstream brand in the industry, including brands within the same umbrella corporation as numerous luxury brands.

Brand and Fuel Type Loyalty

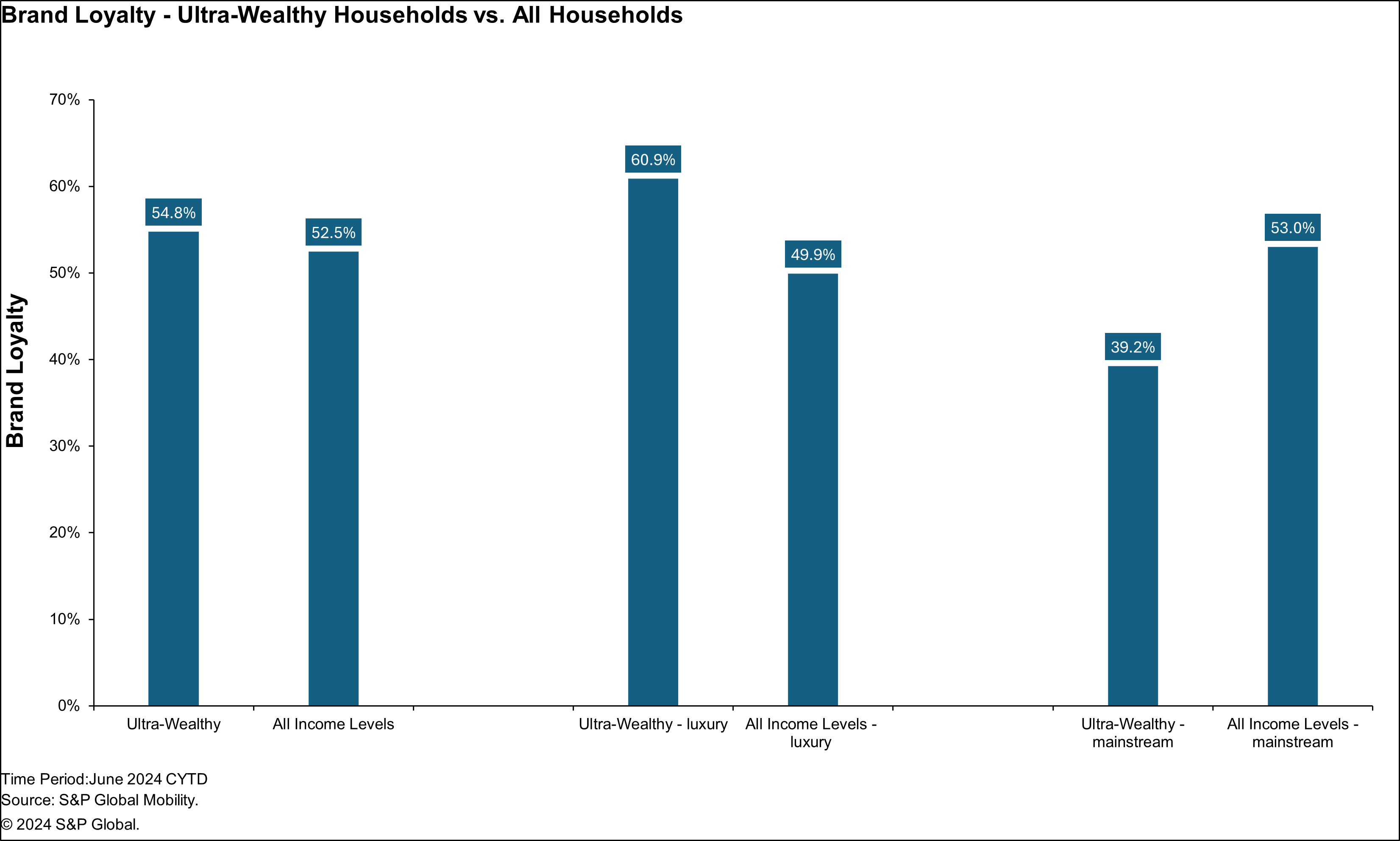

In aggregate, this demographic is slightly more brand loyal, with 54.8% loyalty versus 52.5% industrywide as of June 2024. Households with a luxury vehicle in the garage are substantially more brand loyal (60.9%) than the entire industry (49.9%), with the former pulled up by strong Tesla representation (Tesla brand loyalty consistently leads the industry by a substantial margin).

Conversely, brand loyalty of those high-income households with a mainstream vehicle in the garage is just 39.2%, far below the 53% for all households with a mainstream vehicle in the garage.

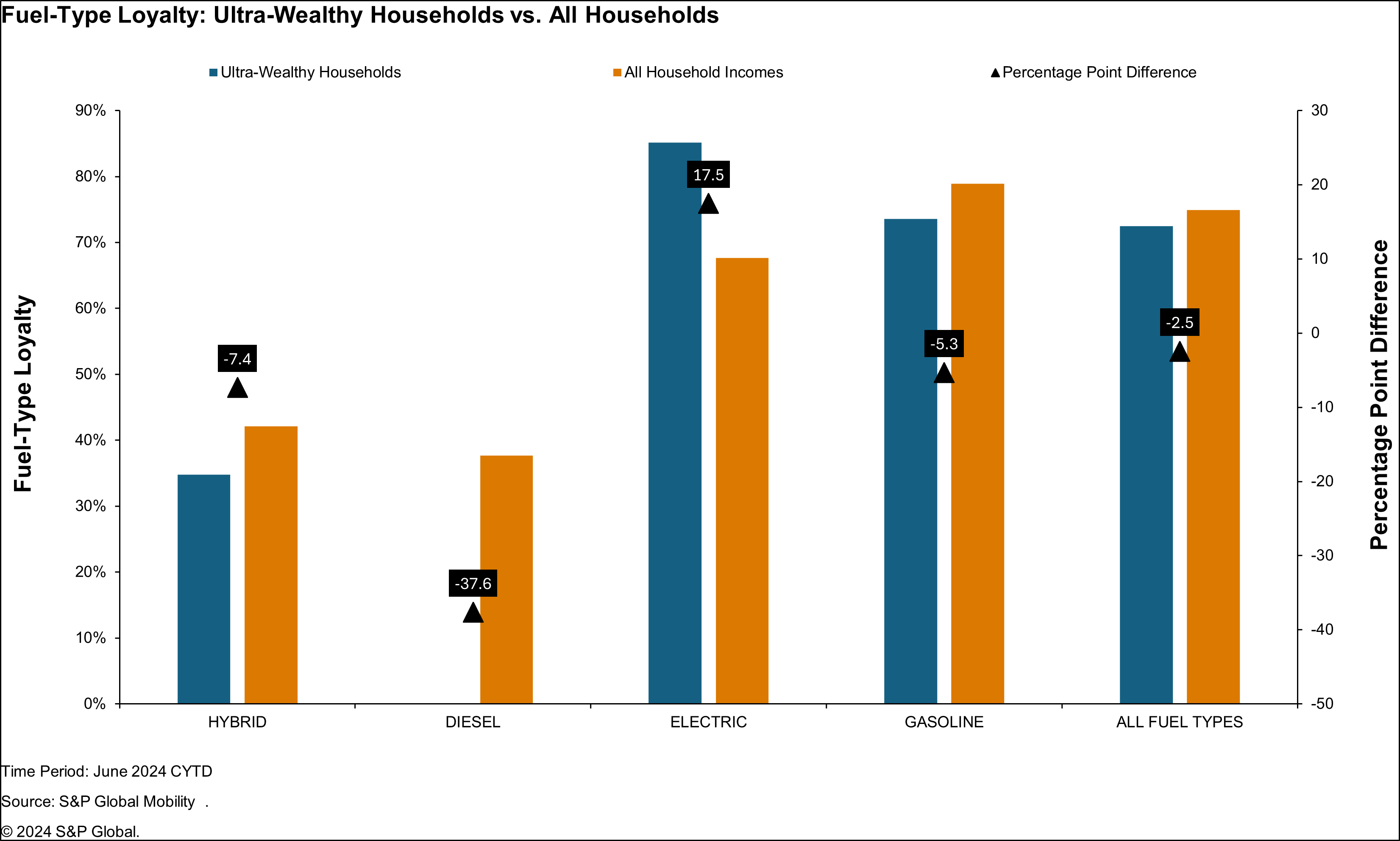

Looking at fuel type loyalty, these high-end households are less likely to stay with a hybrid vehicle than the rest of industry (34.8% vs. 42.1%), but much more likely to stay loyal to their electric vehicle (85.1% vs. 67.7%). This exceptionally high EV fuel type loyalty is most likely due in part to these households' strong financial positions which eliminate the challenge of EV price premiums.

Ethnic Composition of Ultra-Wealthy Households

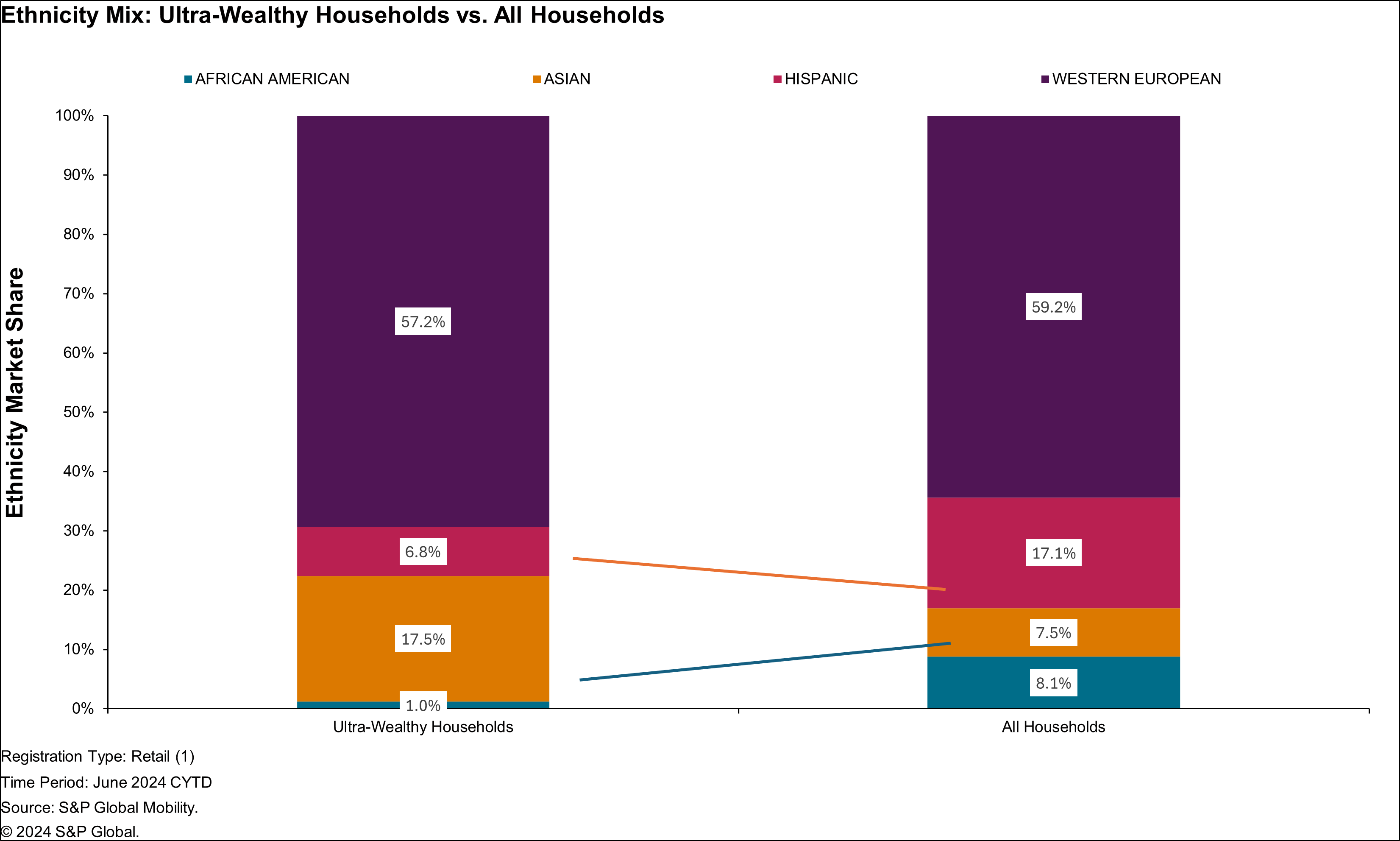

Lastly, the ethnic composition of this high-end cohort includes Asian households at 17.5%, more than twice the national average, while both African American (1%) and Hispanic (6.8%) households trail national averages by substantial margins. The high Asian share can be attributed at least in part to the high Tesla mix, given Tesla's extraordinarily high Asian mix in the first six months of this year (28%).

Conclusion

In summary, several of the findings from this review are intuitive, but not all. That these high-income households tend to be clustered in California, New York and Florida makes sense. And, obviously the New York, San Francisco and Miami DMA trends drive the state results, though Los Angeles would also be a natural fit. Further, these ultra-wealthy households may not want to be bothered with the new vehicle acquisition process, leading them to simply "get another one" of whatever is in the garage, driving up luxury brand loyalty. Finally, one of the main barriers to EV adoption - premiums versus same-size ICE vehicles - simply does not exist for these households, leading to their exceptionally high EV loyalty.

On the other hand, some findings that do not necessarily fit with one's perceptions of this cohort include the low mix of exotic vehicles and the relatively strong showing for Toyota. And if one were asked to guess which model industry-wide is the most popular with this exclusive cohort, the Model Y may not be at the top of the list. Further, even though its vehicles are everywhere, the Compact Utility Segment does not immediately come to mind in discussions about the ultra-wealthy.

Lurking in the background of this entire review is Tesla. Three

of the four most popular models for these ultra-wealthy households

are Teslas; the #1 DMA is San Francisco, Tesla's former base;

Tesla's share of this cohort is a robust 19.3% versus 4.7%

nationally; these high-end homes are exceptionally brand loyal

(85.1%) when a luxury vehicle is in the garage, driven at least in

part by Tesla's industry-leading brand loyalty that varies between

65% and 75%; and, finally, 17.1% of the ultra-wealthy households

are Asian, a finding undoubtedly driven by Tesla's strong appeal to

Asians (28% of Tesla buyers in the first six months of 2024 were

Asian).

Demo Our Loyalty Analytics Tool

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.