Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsUS Commercial Vehicle Market Grew 14 percent in 2023, according to S&P Global Mobility

US Commercial Vehicle Market Grew 14 percent in 2023, according to S&P Global Mobility

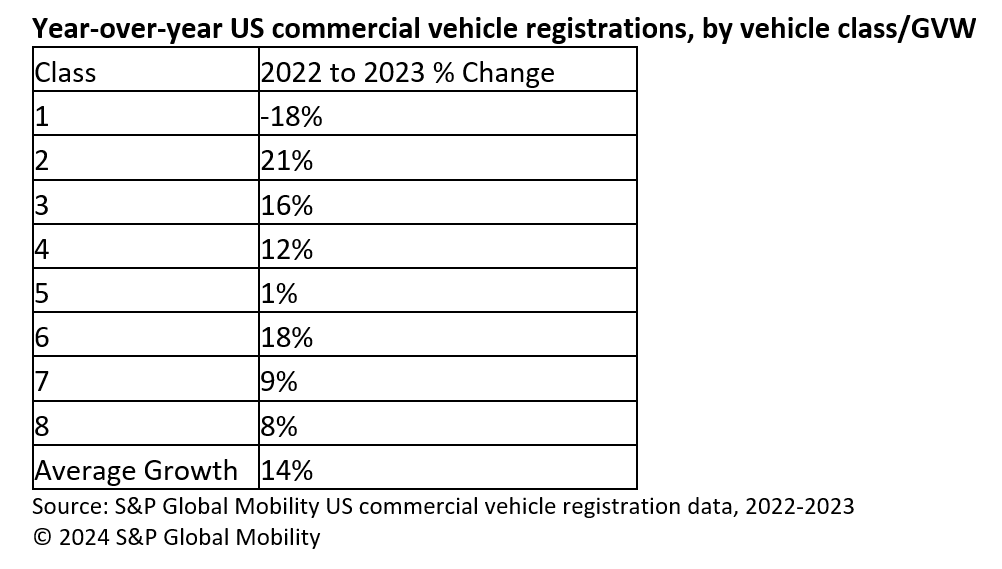

Fueled by the resurgence of the rental and leasing industry,

commercial vehicle registrations (GVW 1-8) rose 14% in 2023

compared to 2022, with more than 1.6 million commercial vehicles

registered in 2023, according to the latest analysis of new

commercial vehicle registration data from S&P Global Mobility.

US commercial registrations are also approaching pre-pandemic

levels, as 2023 was just 196,000 units shy of 2019

registrations.

US fleet industry trends in 2023

The lease/rental industry was the fastest-growing vocation in 2023. Some of the largest fleets experienced 40-60% decreases in new registrations during the pandemic and have since recovered to registration levels not seen since 2019. Class 2 saw a 21% increase in registrations due to continued growth in construction and last-mile delivery vehicles, with increases in pickup and cargo van registrations.

Class 1 provided the only decrease in 2023, which is attributed to almost all cargo vans now being registered as class 2 vehicles.

Alternative Fuel Vehicles Starting to Take

Hold

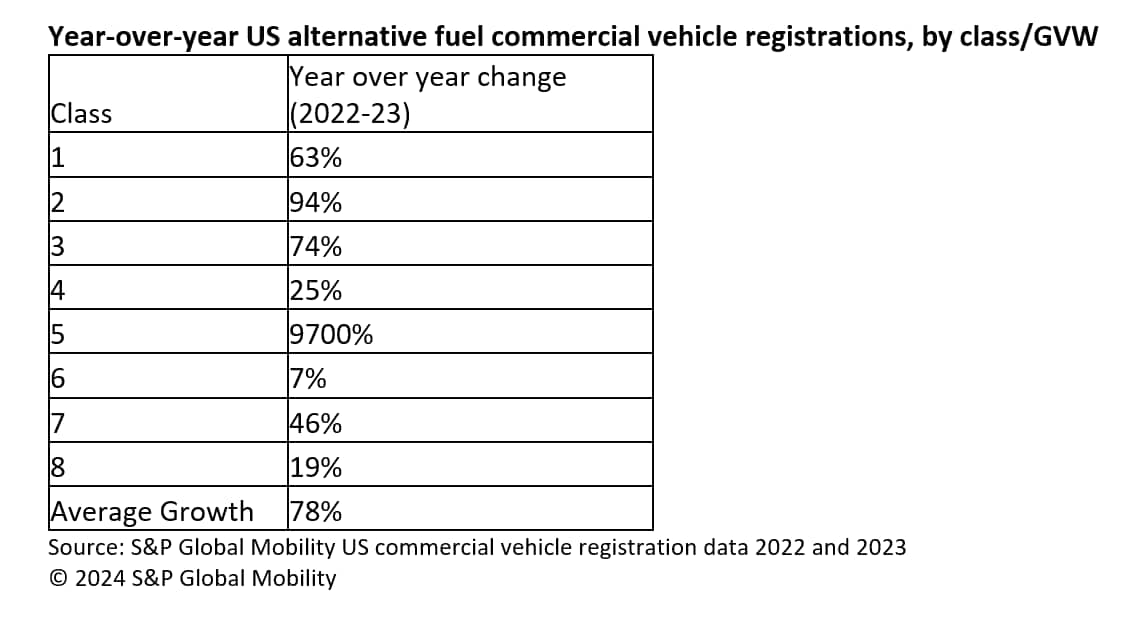

Alternative fuel vehicles, electric and hybrid powertrains are popular options for light-duty commercial vehicles while compressed natural gas (CNG) and electric are becoming popular alternative options for heavy-duty commercial vehicles. Electric cargo vans continue to trend in last-mile delivery applications, especially with fleets such as Amazon, Walmart, Penske, and FedEx. There were more than 14,000 EV cargo vans registered in 2023, according to the analysis, led by substantial growth from Rivian. In addition, hybrid pickup trucks are becoming a popular alternative to EV pickups in fleet applications due to price and availability. The Ford Maverick continues to show substantial growth for fleets, especially in the construction industry. In addition, electric pickup launches expected from Chevrolet and Ram should contribute to the EV and electrified vehicle sales boom.

Compressed natural gas (CNG) and electric fuels in heavy-duty vehicles (GVW 6-8) accounted for 6,800 registrations in 2023. CNG is becoming a popular option for the sanitation and refuse industry, with options from Peterbilt, Autocar, and Mack. General freight short-haul tractor trucks have been the primary adopters of EV for heavy-duty with launches from Freightliner, Volvo, BYD, Orange EV, and Nikola leading the way.

Commercial Vehicle Forecasts Nearly Flat for

2024

For 2024, S&P Global Mobility forecasts sales of class 4-8 commercial vehicles to grow just slightly, with expected gains of just 0.3% year-over-year (y/y). However, S&P Global Mobility expects a single-digit percentage climb in Class 4-7 medium-duty trucks and vans, which will offset an expected y/y slide in demand for new Class 8 trucks. Class 8 truck tractors alone are expected to be down by 5-10% y/y, even as straight trucks' demand is anticipated to remain strong with some growth.

Even as the overall market pauses growth, new registrations of zero-emissions and alternative fuel vehicles are expected to accelerate markedly. Demand for natural-gas trucks and buses in Class 4-8 is projected to repeat 2023 volumes, after a jump compared to 2022. Additionally, US demand for electric trucks and buses is forecast to more than double in 2024, as OEMs position to meet CARB state requirements and early adopter fleets continue to onboard the new technology. New registrations of hydrogen-powered trucks and buses are to rise even faster, albeit from a much lower 2023 base in unit terms.

LEARN MORE ABOUT COMMERCIAL VEHICLE

INSIGHTS AND INTELLIGENCE

THE COMMERCIAL VEHICLE FLEET ACCELERATES TOWARD ZEV ADOPTION

COMMERCIAL VEHICLE FORECAST: MDHD TRUCK MARKET COASTS THROUGH 2024

LEARN MORE ABOUT MEDIUM & HEAVY COMMERCIAL VEHICLE INDUSTRY FORECAST

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.