Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsTesla's enviable minority group loyalty continues to climb

Despite an uncertain market and its fluctuating prices, Tesla continues to be the lead choice among US minority buyers returning to market

Loyalty is among the best indicators of customer satisfaction with a given vehicle or brand. And for newer automotive brands, establishing a cadence of repeat buyers can take decades.

Tesla, though, is already well on its way, establishing itself as the leader in segment model loyalty for both the Luxury Small Utility category with the Model Y, and Luxury Small Car category with the Model 3 in 2022.

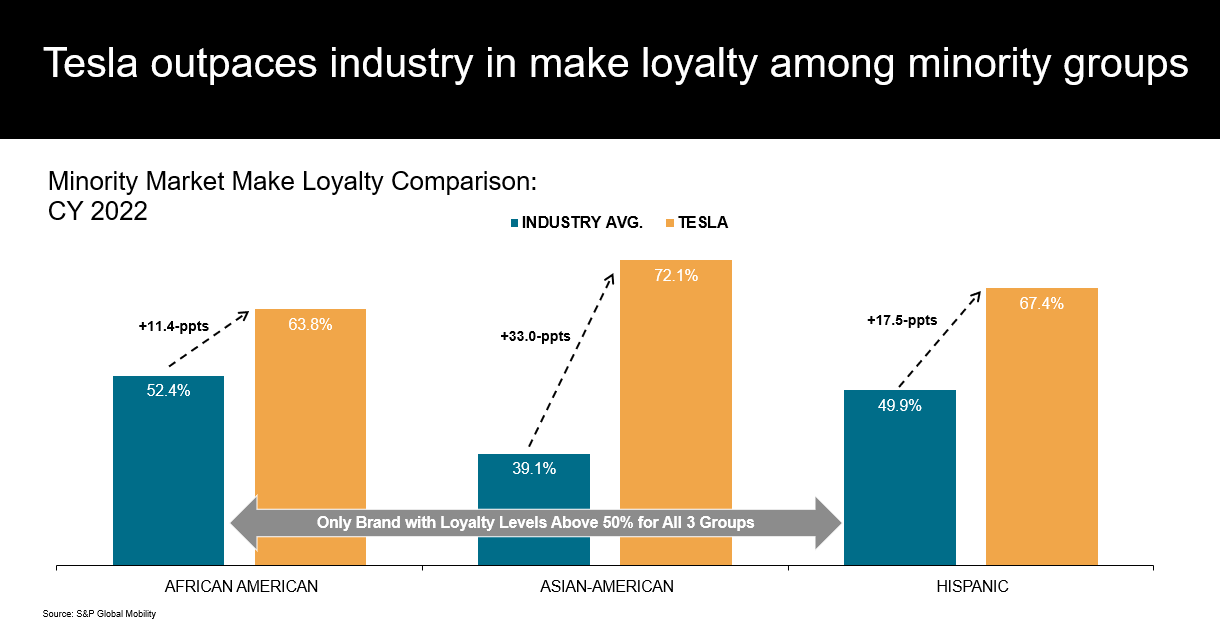

Tesla's loyalty is particularly strong among the diverse consumer base of minority buyers in 2022, especially among Asian-American buyers. Among African-American buyers, S&P Global Mobility data shows that Tesla's loyalty is 63.8% - more than 11 percentage points higher than the industry average. Tesla's loyalty among Hispanic buyers is 67.4%, beating the industry average by 17.5 points, while its 72.1% loyalty among Asian-American buyers is a stunning 33 points higher than industry average.

Those numbers have been increasing sharply - and within a very short time by industry standards. In 2017, Tesla's loyalty among overall minority buyers was 33.7%, lower than the industry average of 52.5%. By 2022, that had climbed to 70.0% against an industry average of 48.1% according to S&P Global Mobility analysis.

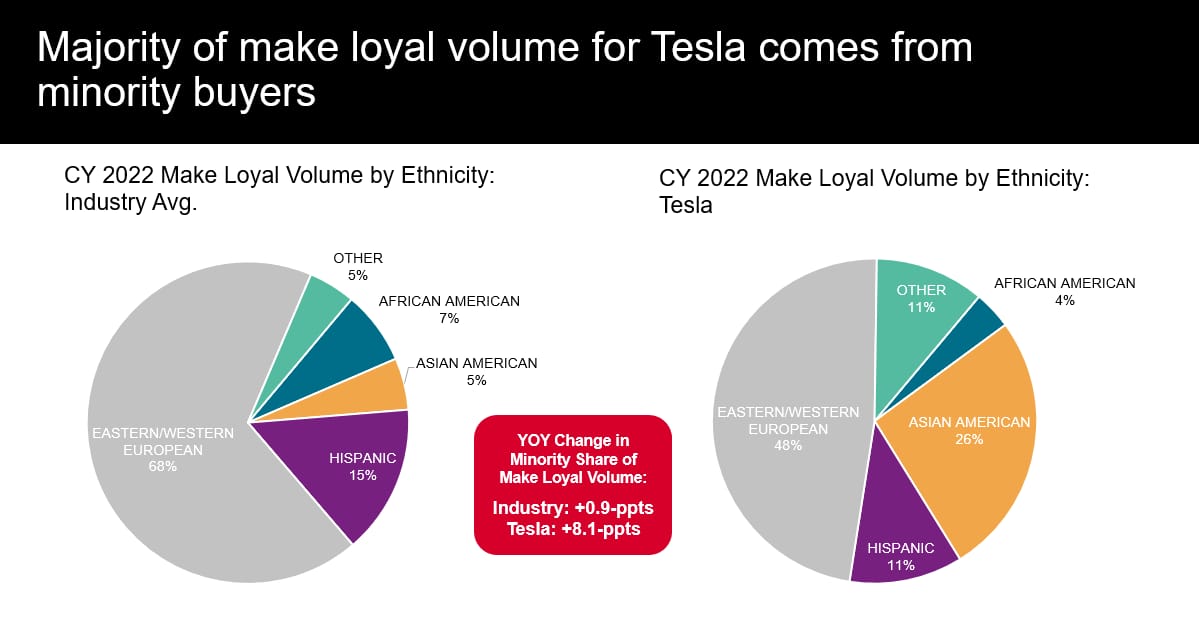

Some of that loyalty breaks down not just to minority groups but to

geography as well. "We see a lot of Tesla's market share coming

from California, the most ethnically diverse state in the US. So

it's natural, and a good thing they've been able to attract diverse

consumers to the brand," said Vince Palomarez, product management

associate director for Market Reporting for S&P Global

Mobility.

For those who might question if California's minority community is more brand-loyal - thus bolstering Tesla's overall percentages because of its strong buyer base there - actually the opposite is true. Compared to the national minority loyalty average of 48%, the California minority buyer average is just 43% loyal. Only Tesla, Rivian, Polestar, and Aston Martin have higher-than-average minority loyalties in California, Palomarez stated.

How has Tesla achieved this loyalty so quickly? It's due in part to

how quickly its customers come back for more. Tesla

leaseholders/lessees returned to market within 25 months on

average, five months quicker than the industry average.

For purchases, Tesla customers came back in just 23 months, a whopping 18 months faster than average, according to the S&P Global Mobility analysis.

"It's very similar to Apple. When you own the iPhone and you have an Apple Watch and you have a MacBook you're very tied together, a seamless transition moving from one device to another. If you bought a Tesla and you purchase the charging unit for your home, odds are you're probably going to purchase another Tesla because you have that infrastructure already built in," Palomarez said.

Going forward, however, Tesla's once-leading-edge portfolio is at risk of turning stale. Combine aging looks with droves of new BEV competitors entering the scene, and Tesla could face obstacles to maintaining loyal customers.

"Tesla does a lot of over-the-air updates, but in terms of sheet metal redesign, they've had nothing new since the Model Y came out in January of 2020," said Tom Libby, associate director of loyalty solutions and industry analysis for S&P Global Mobility. "And the Model S sheet metal is nearly identical to the car that came out almost 10 years ago. In this industry, that poses a bit of a challenge."

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.