Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsTesla loyalty and market share soar, but dominance of EV segment could wane

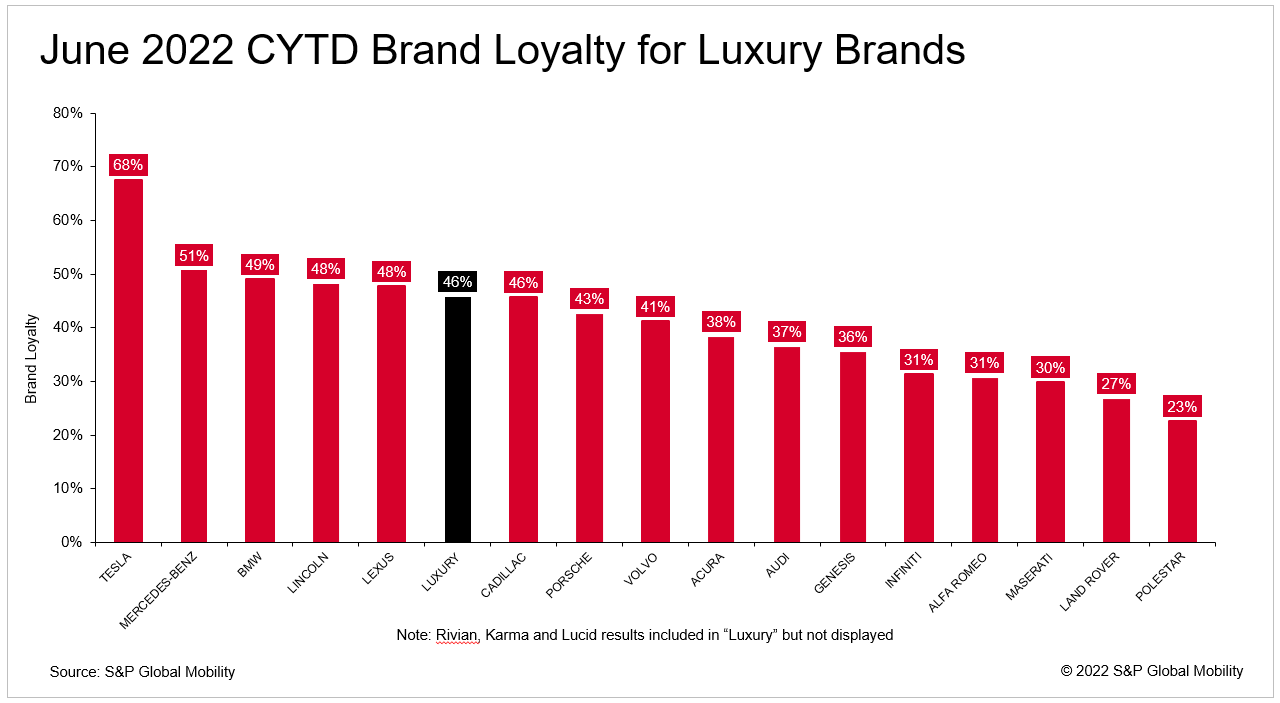

Tesla Motors has not just thrived in the first six months of 2022; it has reached new levels of success based on two metrics - record-high brand loyalty rates and significant brand loyalty among Model 3 owners. Tesla brand loyalty (the propensity of return-to-market Tesla households to acquire another Tesla) has climbed to 67.5% in the first half of 2022, more than 12 percentage points higher than its brand loyalty in any preceding year (its next highest result was 55.2% in 2020). Driving these results is the Model 3, with a first half 2022 brand loyalty rate of 70.7% - higher than any other model on the U.S. market. In two of the first six months of 2022, Tesla's brand loyalty exceeded 70% (March - 73.1% and June - 72.8%). How does this compare to its luxury rivals? Tesla's June loyalty of 67.5% was almost 17 percentage points ahead of luxury runner-up Mercedes-Benz at 50.7%.

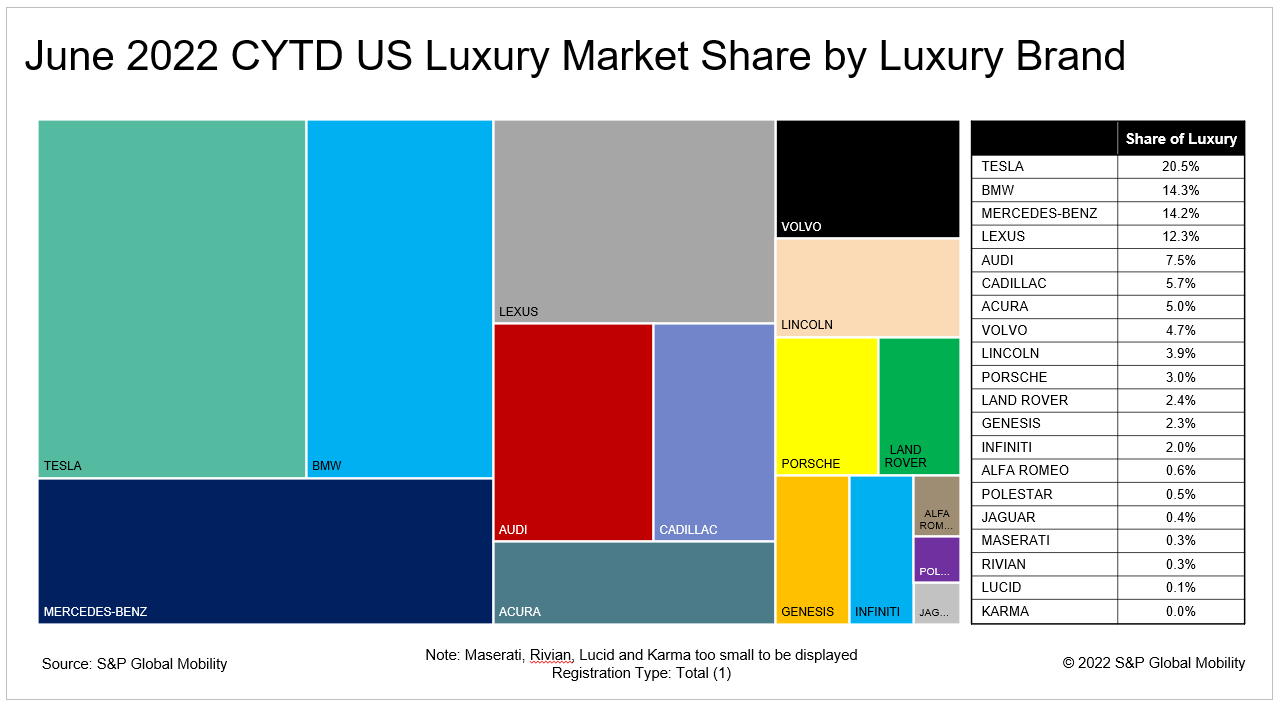

Tesla's market share results in the first half of 2022 are equally strong. With 20.5% share of the luxury market, Tesla share is more than 6 percentage points above that of runner-up BMW. Tesla's June 2022 new registration volume of just over 50,000 units represents the first time in (at least) the last 10 years that a luxury brand has registered more than 50,000 new vehicles in one month. In fact, the 40,000 threshold per month has only been surpassed four times in 10 years - three times by Tesla and once by BMW.

Tesla's high loyalty and share results demonstrate a challenging situation for the rest of the industry. Not only are an unprecedented number of households acquiring a Tesla, but a high proportion of these owners are sufficiently happy with their vehicles to acquire another one.

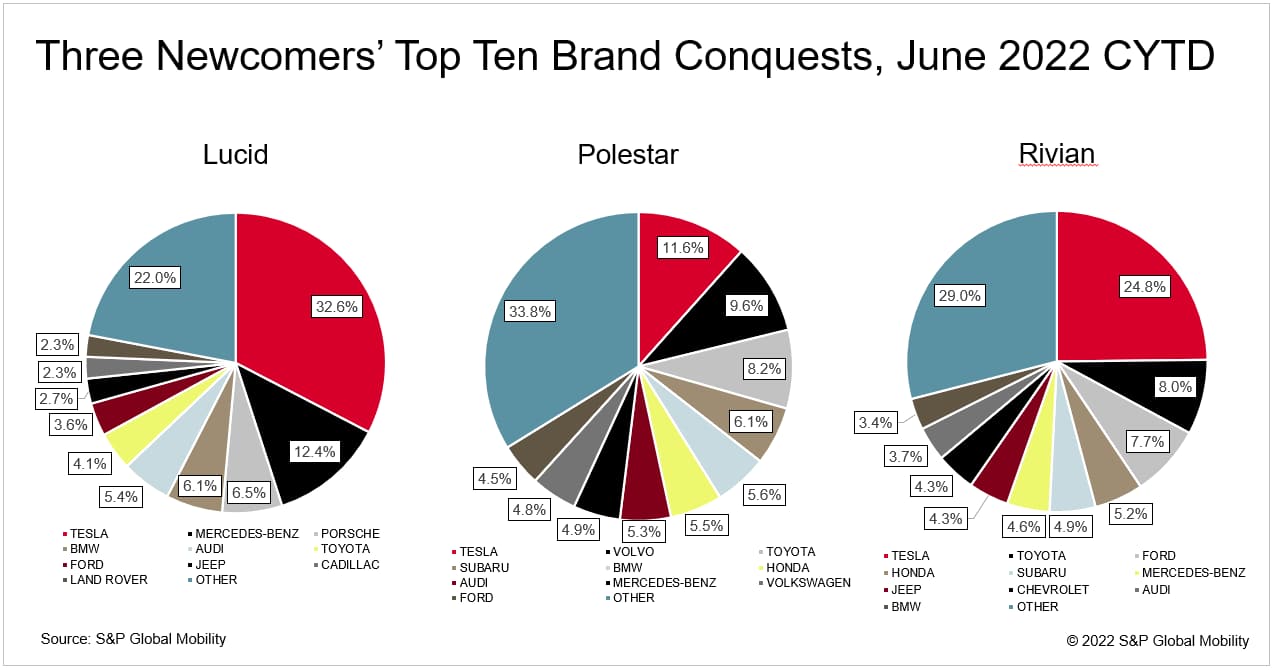

However, the U.S. luxury landscape is changing, and three newcomers have shown, in their early days, their ability to conquest Tesla owners. As the three charts below indicate, the number one brand conquested by each of Lucid, Polestar, and Rivian in the first six months of 2022 is Tesla. Moreover, one-third of Lucid's conquests, and one-quarter of Rivian's, are coming from Tesla owner families, according to the S&P Global Mobility Household Loyalty Methodology (the newly acquired vehicle may be an addition to the household fleet.) One key indicator to Lucid and Rivian conquests: They are competing against the older-sheet metal vehicles in the Tesla lineup - the Model X and S - at premium price levels where consumers having the latest trendy item is seen as essential. Conversely, Polestar is competing against the newer Model 3 and Y. If these trends continue, these three EV luxury brands and other newcomers may offer a viable alternative to Tesla.

--------------------------------------------------------------------

This automotive insight is part of our monthly Top

10 Trends Industry Report.The Report findings are

taken from new and used registration and loyalty data.

The August report is now available. To download the report, please

click below.

Feature your exclusive automotive industry insights on our Mobility News and Assets Community page, a platform that is designated for automotive and mobility industry thought leaders and the community.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.