Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsHyundai Market Share Rises to #3 in US for New Vehicle Retail

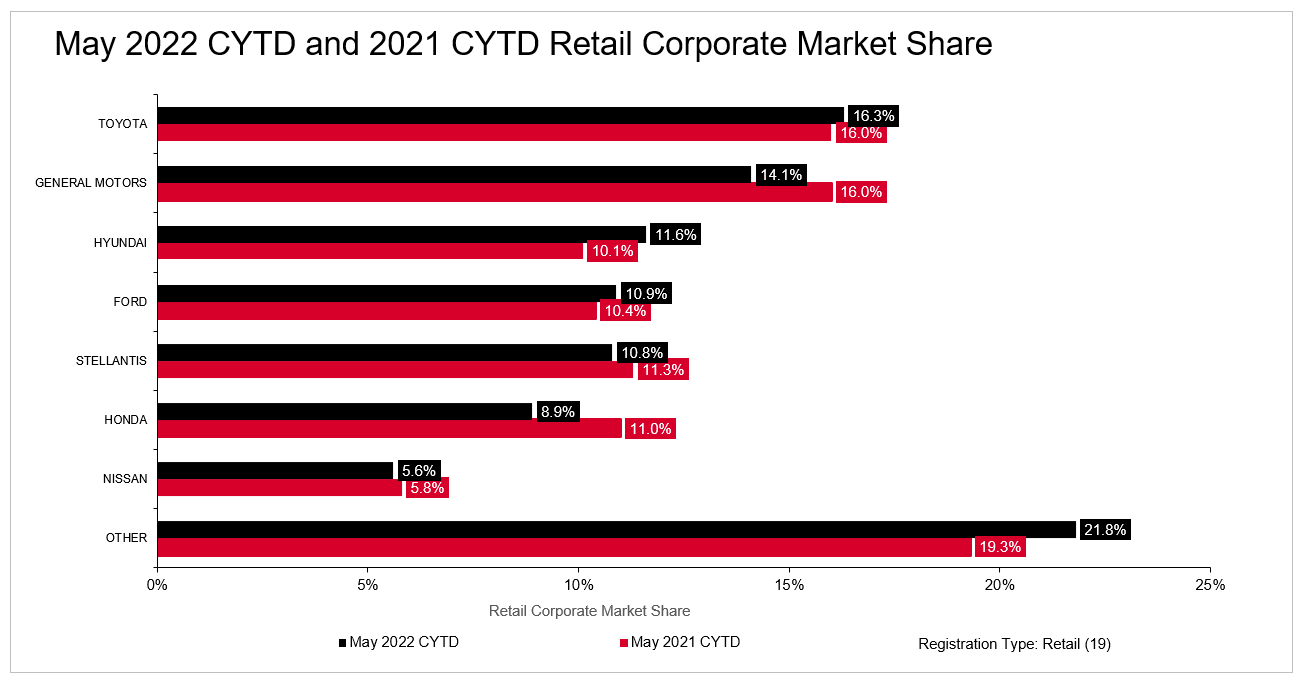

Through the first five months of 2022, Hyundai market share in the US retail market ranks third, up from sixth a year ago, based on new vehicle registration data compiled by S&P Global Mobility. With 12% of the retail market, Hyundai market share in the US now trails Toyota and GM, but outpaces Ford, Stellantis, and American Honda. Hyundai Motor Group consists of the Hyundai, Kia, and Genesis brands.

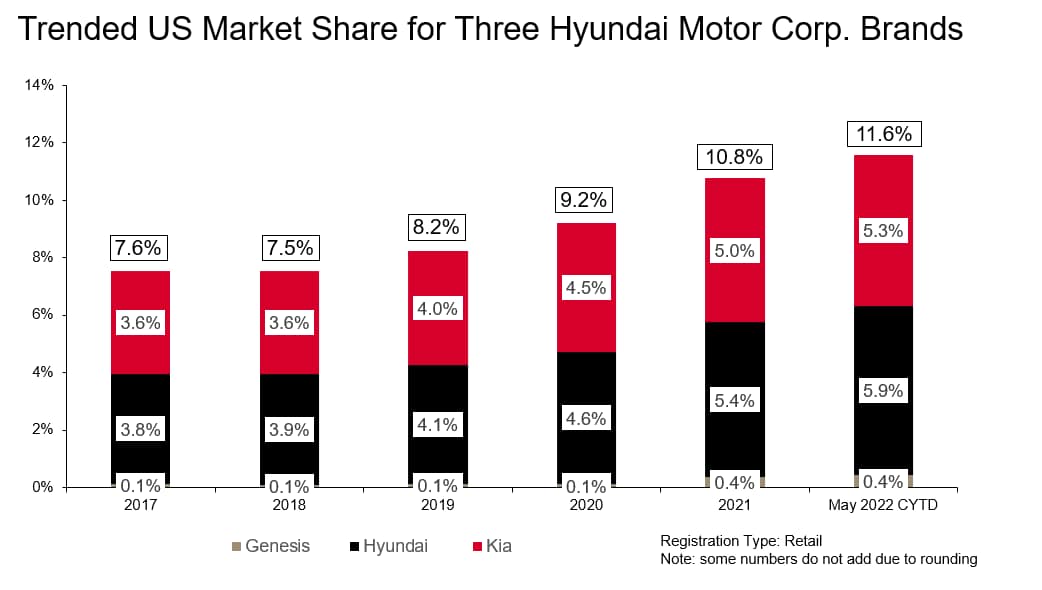

Brand-level new registration data indicates that all three Hyundai Motor brands contributed to Hyundai's market share growth. As the table below illustrates, since 2017 Hyundai market share in the US retail market -- broken out by Kia, Hyundai, and Genesis -- has grown by 1.7, 2.1 and .3 percentage points, respectively. While Genesis's increase is small in absolute terms, it has quadrupled from .1 five years ago.

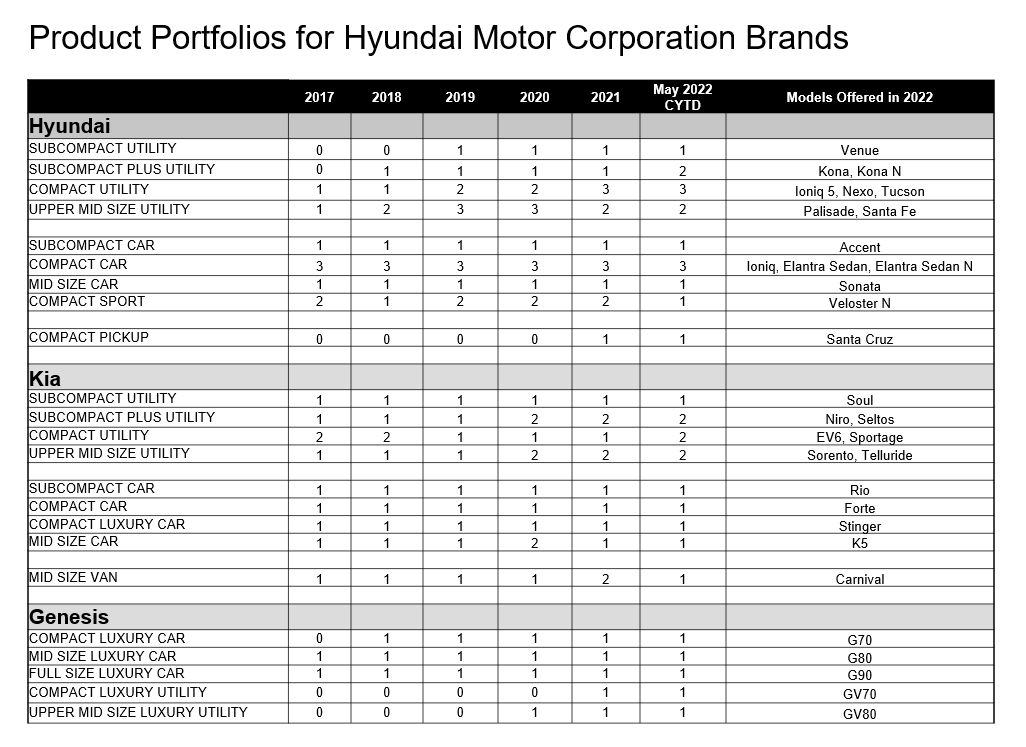

The expansion of the product portfolios for all three brands has played a central role in the corporation's share growth. Now the corporation has entries in all major car segments, and, more importantly, all the key utility segments. While the lower midsize utility segment is not covered, it could be argued that the Sorento should be in this segment.

None of the brands competes in the two full size utility segments, but together these two categories account for just 3.2% of new retail registrations (May 2022 CYTD). It is also noteworthy that the growth in Hyundai market share in the US has taken place without an offering in the traditional body-on-frame pickup segments.

Recent additions to all three brands' portfolios have added substantial share to each brand. Hyundai launched the three-row Palisade and Venue utilities in 2019 (which have contributed 13% and 4%, respectively, to Hyundai Motor's May 2022 retail registration volume). These were followed by the launch of the Santa Cruz lifestyle pickup (5% of 2022 retail registrations) in 2021 and the Ioniq 5 EV at the start of this year(4% of 2022 registrations).

Kia launched the three-row Telluride in 2019 (15% of May 2022 CYTD Kia retail registrations), the Seltos in 2020 (7%), the Carnival midsize van in 2021 (3%), and the EV6 electric vehicle this year (4%).

Lastly, Genesis has greatly benefited from the addition of the GV70 and GV80 crossovers to its lineup in 2021. Those two models now account for almost two thirds of all Genesis retail registrations, and, importantly, provide Genesis car households with a crossover alternative so the household can remain brand and manufacturer loyal.

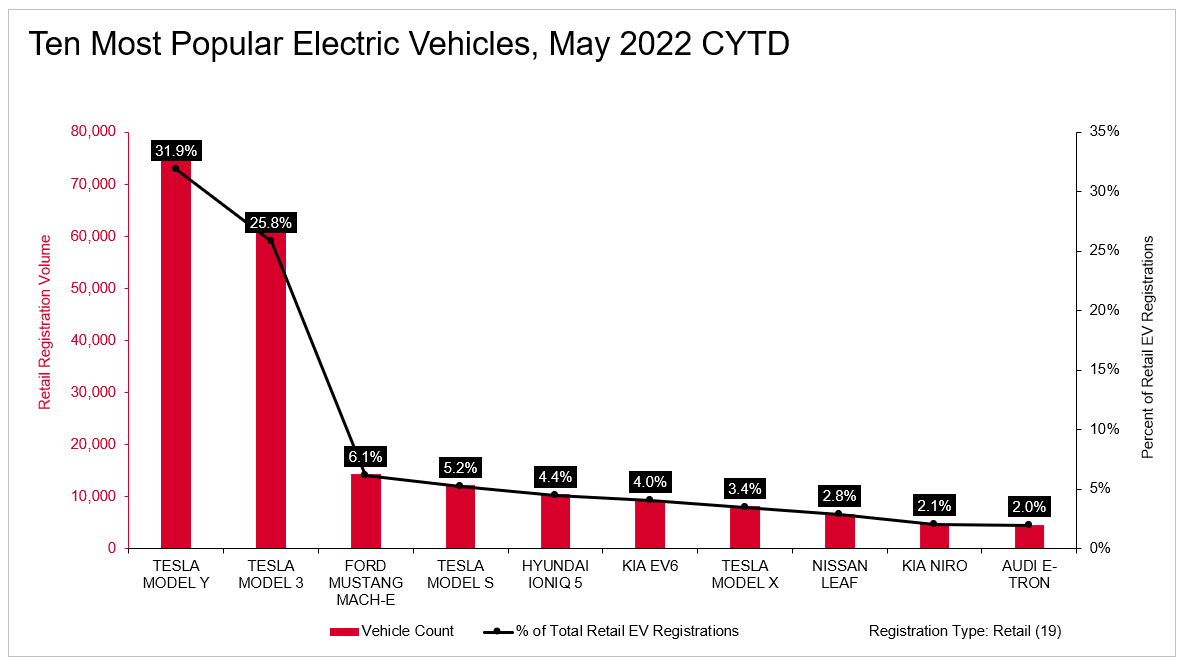

Hyundai Motor also has demonstrated its ability to compete in the growing and all-important EV space. Through the first five months of this year, the Ioniq 5, EV6, and Niro rank fifth, sixth, and ninth, respectively, among all EVs on the U.S. market, based on new retail registrations. Together these three models now account for 11% of all retail EV registrations. Hyundai Motor is the only corporation other than Tesla to place two or more EVs in the top ten, and, if Tesla is removed, the Ioniq 5 and EV6 rank second and third, trailing only the Mustang Mach-E.

This automotive insight is part of our monthly Top 10 Trends Industry Report. The report findings are taken from new and used registration and loyalty data. To download the full report, please click below.

Our Mobility News and Assets Community page features the latest automotive insights, visit the page to learn more.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.