Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFord and Chevrolet brand loyalty depends on pickups

Without F-Series and Silverado, big Detroit brands see customer-return percentages drop

It's been a long history of dueling pickups between the Ford

F-series and Chevrolet Silverado pickups to determine America's

best-selling truck. And a big part of that continued success for

both brands lies with brand loyalty - sometimes over generations of

owners.

But what happens to Ford and Chevrolet brand loyalty when those models are removed from the equation? The picture becomes quite different.

Brand loyalty measures how often a household with a particular brand's vehicle returns to the same brand when they make their next new-vehicle purchase, which could be a replacement vehicle or an addition to the garage.

Ford brand loyalty for the 2022 calendar year was 58.6%. When the F-series models - the F-150, F-250 and F-350 - were stripped out, brand loyalty fell to 49.5%.

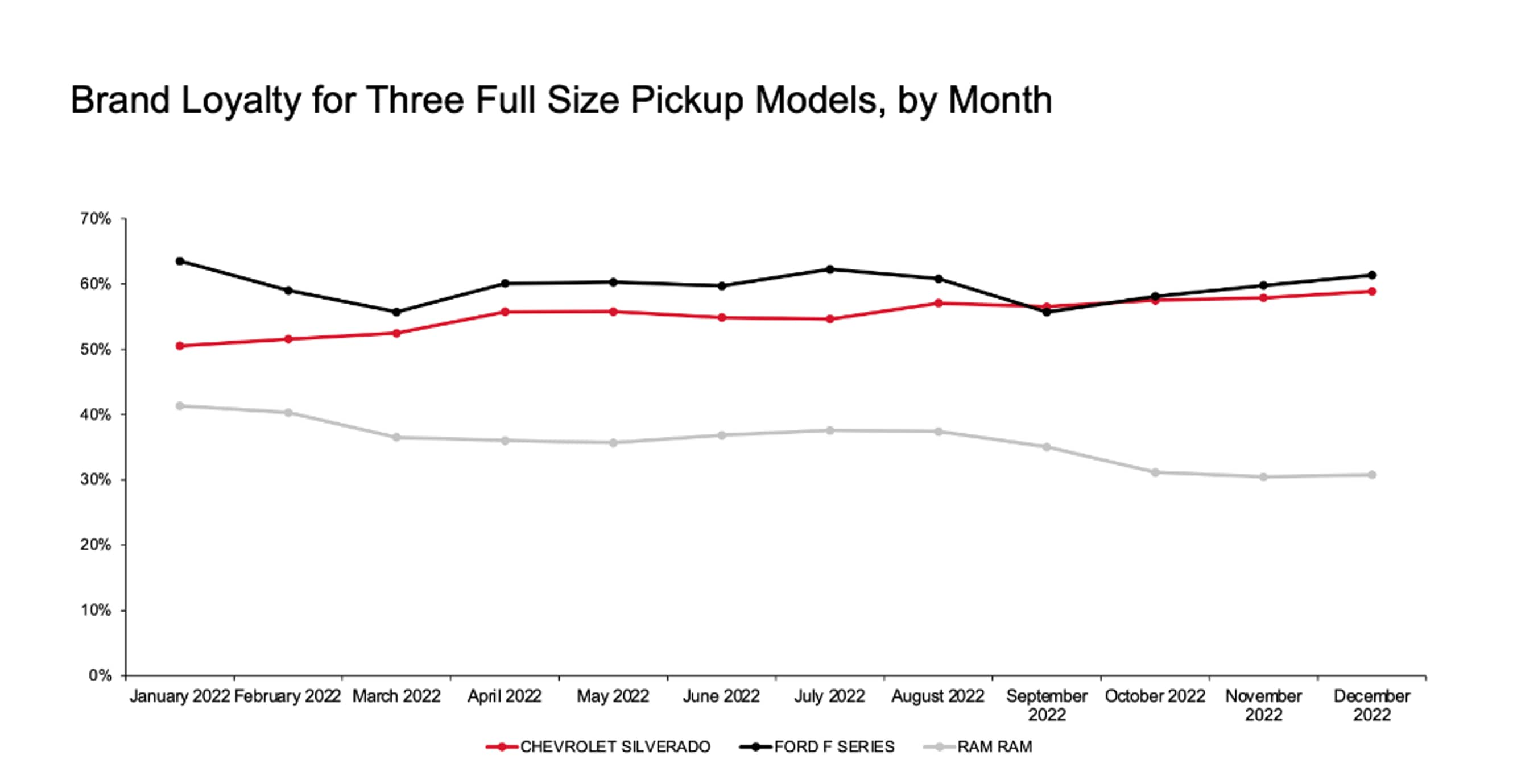

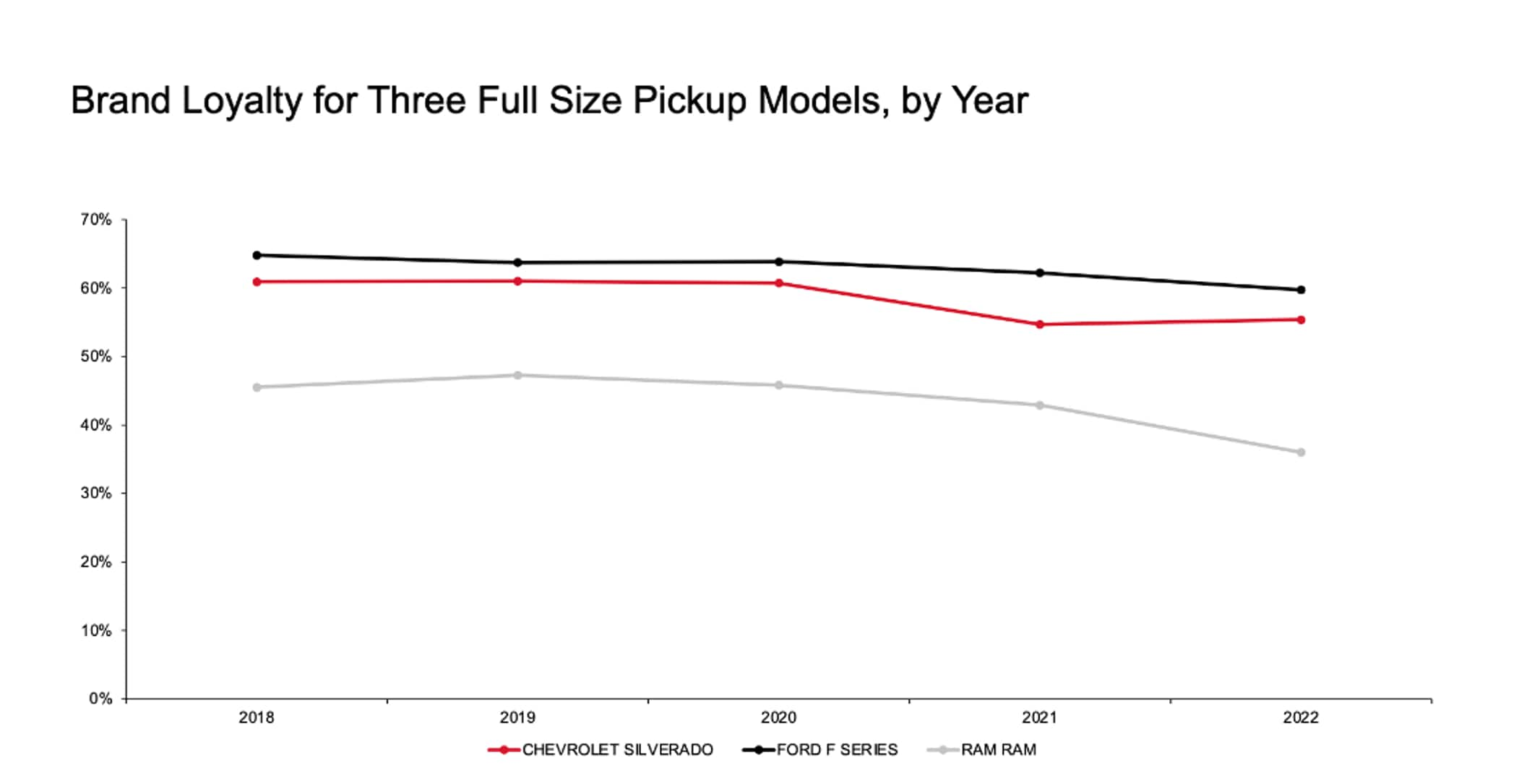

At the model level, owners of a Ford F-series showed 62.2% brand loyalty in 2021 and 59.7% in 2022. As the F-series is Ford's best-selling nameplate, it pulled the overall brand loyalty figure upward by a whopping 9.1 percentage points in 2022.

Similarly, Chevrolet brand loyalty in 2022 was 56.3%. When the Silverado was removed, it fell to 47.9%. Silverado owners, while loyal, aren't quite at the level of Ford owners. Make loyalty for all Silverado models in 2021 was 54.7%; in 2022, it rose to 55.4%.

(Meanwhile, loyalty to the Ram light-duty pickup has slipped from a pre-pandemic 47.3% loyalty in 2019 to 36% in 2022.)

Source: S&P Global Mobility

Might the Chevrolet figures be somewhat affected because General

Motors also owns the GMC truck brand? Not necessarily. GMC's 2022

loyalty rate was 45.1%.

Detroit's auto manufacturers are cognizant of the loyalty of their full-size pickup customers.

"The Ford, Chevy, Ram and GMC Sierra dominate the segment. They know the value of their entries in this segment, and they will go to extensive lengths to protect their position," said Tom Libby, associate director of loyalty solutions and industry analysis at S&P Global Mobility.

Limiting defections to rival brands is key, and here the F-Series and Silverado do well, given that roughly 2 million full-size pickups are sold every year. For the year ending in February, the Ford F-Series had a net outflow - in other words, defections minus conquests - to the Chevrolet brand of a mere 5,914 households. In the same period, 2,315 more F-Series households migrated to Ram than vice versa. Meanwhile, the Silverado had a net inflow of 1,915 households from the Ford brand. Silverado also gained 688 previous Ram owners.

The F-series topped retail registrations in the US for 21 months during the 36-month period between January 2020 and February 2023; however, the Silverado topped the list for 10 months in that period. Longer-term, when including retail and fleet sales, the F-Series has been the best-selling truck in the US for 46 consecutive years, according to Ford-reported sales data.

Source: S&P Global Mobility

Brand loyalty for mainstream brands including Ford and Chevrolet

declined from 56.6% in February 2020 to 50.6% in 2023. Luxury brand

loyalty dropped from 52% to 48.1%.

"The industry brand loyalty hasn't come back," said Libby. "Part of that is the inventory is nowhere near where it used to be."

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.