Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsBriefCASE: OEMs’ balancing act - The resurgence of hybrids as BEVs hit brakes

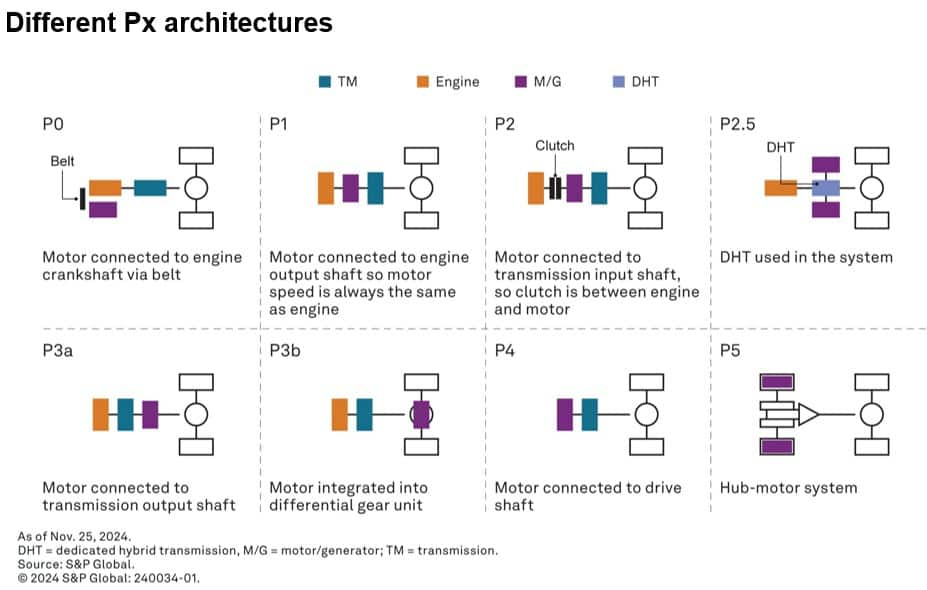

The new car registrations data from the European Automobile Manufacturers' Association (ACEA) indicates that hybrid electric vehicles (HEVs) will remain prevalent longer than the industry anticipated. In January-October 2024, battery-electric vehicle (BEV) registrations in the EU dropped by 4.9% year over year. Their market share also fell from 14% last year to 13.2%. Interestingly, HEV registrations increased 17.5% in October, with their market share rising to 33.3% from 28.6% last October. The demand trends are similar in the United States. Although BEV demand continues to grow, more growth is seen in the traditional HEV segment in 2024. The lower-than-expected growth rate in BEV demand has disrupted the investment and product strategies of original equipment manufacturers globally. Many are scaling back their EV investments and reviving focus on hybrid technology. During the 2024 CEO Investor Day in Seoul, Hyundai announced plans to double its hybrid lineup from 7 to 14 models. This expansion will include hybrid technology across various vehicle categories, including small, large and luxury cars. Additionally, Hyundai revealed it is developing the next-generation TMED-II system, a parallel full hybrid system, which is expected to be integrated into production vehicles starting January 2025. Hyundai is also working on a new range extender electric vehicle (REEV) technology. Volvo Cars has also revised its strategy, moving away from its initial goal of exclusively selling BEVs by 2030. The company now plans to allow for up to 10% of sales to be mild hybrids. Meanwhile, Ford is reducing capital expenditure meant for pure EVs from 40% to 30% of its annual capital expenditure budget. The challenging transition to pure EVs is also driving General Motors and Volkswagen to beef up their plug-in hybrid lineup in the near future. At the recently concluded Paris Motor Show, many OEMs showcased hybrid versions of their vehicles. The Alfa Romeo Junior Speciale Ibrida by Stellantis featured a 136-hp 48-V Hybrid VGT architecture and 156-hp electric motor. The hybrid system includes a 48-volt lithium-ion battery, and a 21-kW electric motor integrated into a 6-speed dual-clutch gearbox. The automaker also showcased a 280-hp plug-in hybrid version of the model year 2025 Alfa Romeo Tonale. Dacia unveiled an all-new C-segment SUV Bigster in two versions: a mild-hybrid version featuring a 0.8-KWh battery, 48V belt stator generator (BSG) and a new Hybrid 155 version featuring a 1.4-kWH battery and 12V BSG and transmission mounted motor. Mainland Chinese automakers BYD and GAC also unveiled hybrid models, alongside their EV offerings, as well as Ford. Positive outlook for electric motor marketThe resurgence of hybrid technology bodes well for non-P4 motors industry. According to S&P Global Mobility, demand for non-P4 motors (used in hybrid vehicles) is projected to increase at a compound annual growth rate (CAGR) of around 11% between 2023 and 2030. Throughout the forecast period Greater China is expected to lead the non-P4 motor market. The demand for these motors is expected to continue increasing in North America and Europe until 2028. Japan and Korea will also see the increase in demand for non-P4 motors until 2032. This increase in demand for non-P4 motors can be attributed to automakers such as Toyota and Hyundai, which are betting big on hybrid vehicles.

While the hybrid propulsion systems are expected to record growth in the near to medium term, pure BEVs will outsell hybrids in the long term as they are a better answer to the world's energy transition and sustainability goals. Michael Southcott, manager, technical research, S&P Global Mobility, says, "With consumer sentiment around electric vehicle pricing, range and charging capabilities remaining stagnant, and policymakers globally reassessing ambitious targets, it's understandable that OEMs are shifting their focus to hybrid solutions. While this doesn't change the ultimate goal of achieving 100% zero-emission vehicles, hybrids offer a viable short to midterm strategy for reducing vehicle emissions, giving the industry time to plan for widespread battery-electric vehicle adoption." Authored By: Priyanka Mohapatra, Senior Research Analyst, Supply Chain & Technology, S&P Global Mobility By subscribing to AutoTechInsight, you can quickly gain intel on market developments and technology trends, dive into granular forecasts, and seamlessly drive analytics to support challenging decision-making. |

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.