Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAverage age of vehicles hits new record in 2024

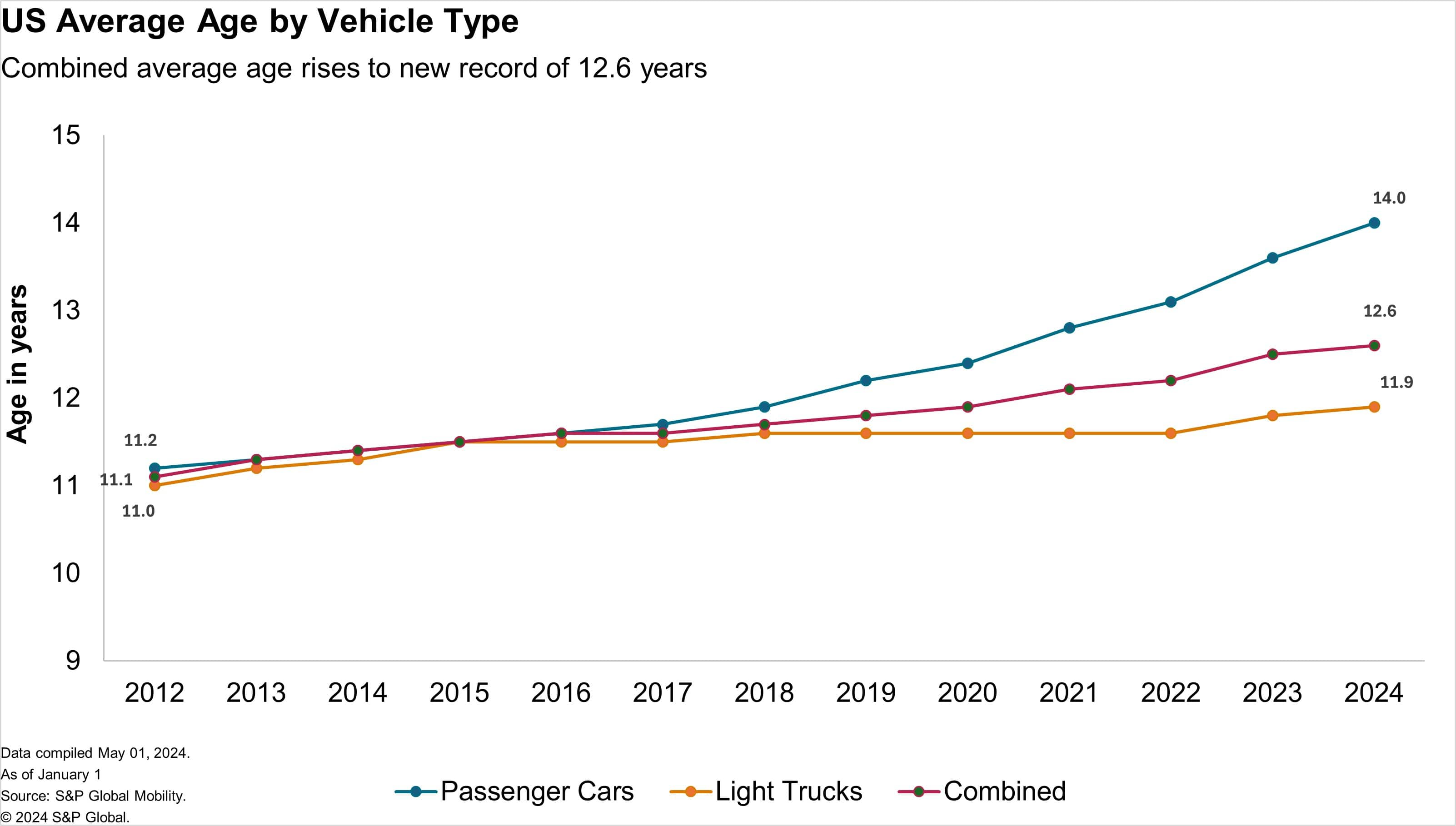

Vehicles in the US are now 12.6 years old on average, up two months from 2023.

Vehicles on the road are getting even older, according to S&P Global Mobility. The average age of cars and light trucks in the United States has risen again to a new record of 12.6 years in 2024, up by two months over 2023, according to new analysis. Increase in average age is showing signs of slowing as new registrations normalize.

This continues to improve business opportunities for companies in the aftermarket and vehicle service sector in the US, as repair opportunities are expected to grow alongside vehicle age.

"With average age growth, more vehicles are entering the prime range for aftermarket service, typically from 6 to 14 years of age," said Todd Campau, aftermarket practice lead at S&P Global Mobility. "With more than 110 million vehicles in that sweet spot — reflecting nearly 38 percent of the fleet on the road — we expect continued growth in the volume of vehicles in that age range to rise to an estimated 40 percent through 2028."

Two passenger cars scrapped for every new passenger car registration

Vehicle scrappage rates — the measure of vehicles exiting the active population — continue to hold steady. As of January 2024, the scrappage rate was 4.6%, largely unchanged from 4.5% in January 2023.

Looking at the mix of the fleet, since 2020, more than 27 million passenger cars exited the US vehicle population, while just over 13 million new passenger cars were registered. At the same time, over 26 million light trucks (including utilities) were scrapped and nearly 45 million were registered.

"Consumers have continued to demonstrate a preference for utility vehicles and manufacturers have adjusted their portfolio accordingly, which continues to reshape the composition of the fleet of vehicles in operation in the market," said Campau.

Vehicles in operation grows to 286M, while EV VIO exceeds 3M

The US vehicle fleet surged to 286 million vehicles in operation (VIO) in January, up 2 million over 2023, but the distribution of vehicles by age is changing. Vehicles under the age of six accounted for 98M vehicles in 2019, or about 35 percent of VIO. Today they represent less than 90M vehicles and are not expected to reach that threshold again until 2028 when they will represent about 30% of VIO, according to S&P Global Mobility estimates. This is driven by the impact of COVID and subsequent supply chain shortages that disrupted vehicle supply and registrations - and following historically high volumes in 2015-2019.

As a result, the primary driver of VIO growth will be vehicles in the aftermarket 'sweet spot' — vehicles 6-14 years of age, and even older vehicles, that are expected to represent about 70% or more of VIO for the next five years, which will serve as a tailwind to aftermarket service opportunities.

Electric vehicles (EVs) on the road also continued to increase, with 3.2 million EVs in operation in January. 2023 EV registrations surpassed one million units for the first time and increased about 52% compared with 2022. The rate of EV growth was slower than some automakers had anticipated, and there is potential for the average age of EVs to rise in the short term as consumer adoption slows. The average age of EVs in the US is 3.5 years and has been holding largely steady since 2019 with new registrations representing a large share of overall EV VIO.

"We started to see headwinds in EV sales growth in late 2023, and though there will be some challenges on the road to EV adoption that could drive EV average age up, we still expect significant growth in share of electric vehicles in operation over the next decade," said Campau.

Our Mobility News and Assets Community page features the latest automotive insights, visit the page to learn more.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.